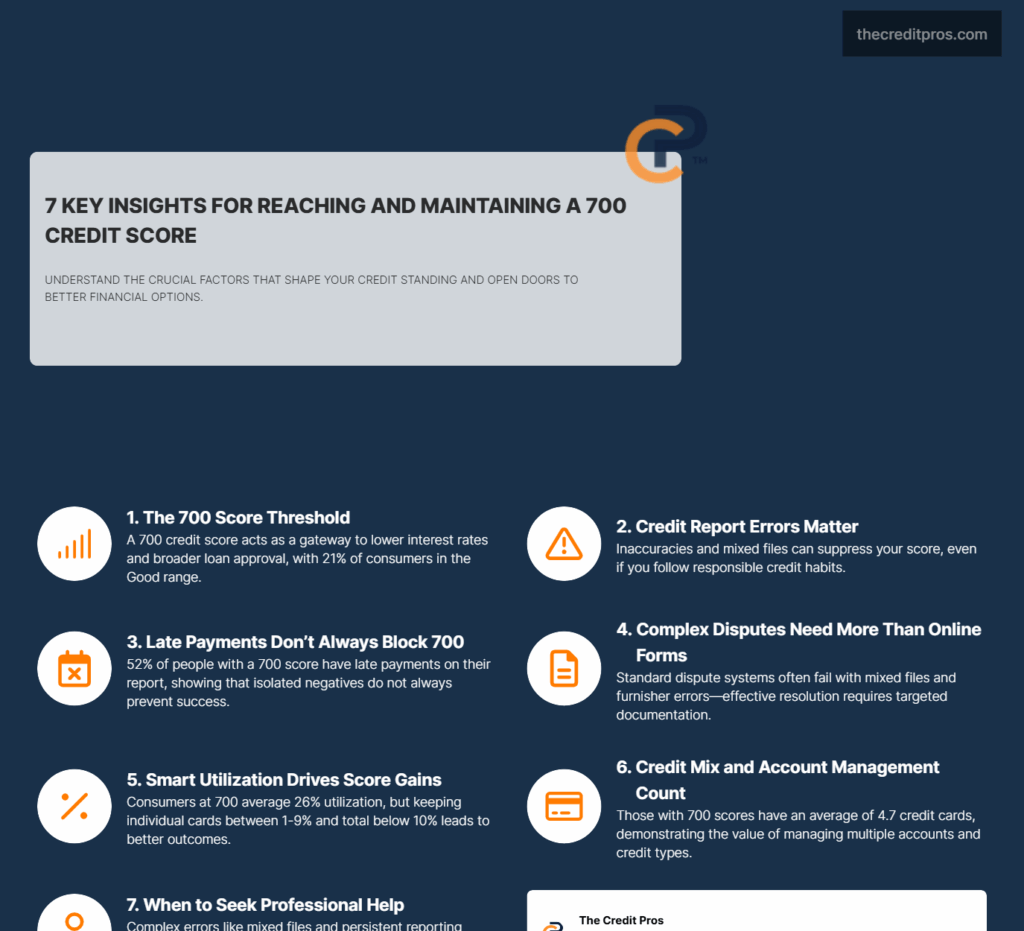

A 700 credit score sits right in the middle of the “Good” credit range, but here’s what most people don’t realize: it’s not just another number on your credit report. This specific threshold acts as a gateway that separates acceptable borrowers from those who face higher interest rates and limited loan options. While 21% of consumers fall into the Good credit range, reaching that magical 700 mark can mean the difference between approval and rejection, between a 6% interest rate and a 12% one. Understanding the 700 credit score benefits further highlights its importance in financial decision-making.

What makes this journey particularly challenging is that 52% of people who achieve a 700 score actually have late payment records on their credit reports. This raises an important question: how many people struggling to break through the 670-699 range are being held back not by their actual credit behavior, but by reporting errors that look like legitimate negative marks? The path to 700 isn’t just about paying bills on time and keeping balances low—it often requires understanding the complex world of credit reporting systems and knowing when your DIY efforts have reached their limits.

The Hidden Impact of Credit Report Errors on Your Path to 700

Credit report inaccuracies create invisible barriers that prevent countless consumers from achieving their target credit score, despite maintaining responsible financial habits. These errors don’t exist in isolation—they compound over time, creating a cascade effect that can trap borrowers in lower score ranges for months or even years. The automated systems used by credit bureaus to process millions of data points monthly lack the nuanced understanding required to distinguish between legitimate negative marks and reporting mistakes.

Those who achieve a 700 credit score can enjoy numerous advantages, such as lower interest rates on loans and mortgages, higher credit limits, and better chances of approval for credit applications. These 700 credit score benefits empower consumers to make significant financial moves with confidence.

Ultimately, the 700 credit score benefits serve as a motivation for many to reach their credit goals. Understanding the 700 credit score benefits will empower you to take control of your financial destiny. Many consumers realize that the 700 credit score benefits can transform their financial situations. Therefore, focusing on the 700 credit score benefits can lead to better financial outcomes. Achieving a 700 credit score comes with numerous benefits that can greatly influence your financial future. The 700 credit score benefits extend to all areas of financial life, making it a pivotal goal for many.

By understanding the 700 credit score benefits, you can leverage your credit to its fullest potential. Exploring the 700 credit score benefits can help individuals make informed choices about credit management. Many financial experts emphasize the importance of the 700 credit score benefits in their advice. Understanding the full spectrum of the 700 credit score benefits can provide a roadmap for financial success. To maximize the advantages, one must acknowledge the 700 credit score benefits as an essential part of their strategy.

The sense of achievement that comes with reaching a 700 credit score is amplified by its many benefits. The journey to a 700 credit score is filled with opportunities, especially when you understand the 700 credit score benefits. Knowing the 700 credit score benefits can also help you negotiate better terms with lenders. When you recognize the 700 credit score benefits, you can make informed financial decisions. Many people are motivated by the 700 credit score benefits to improve their credit habits. Understanding the breadth of the 700 credit score benefits can guide consumers in their financial planning. As you dive deeper into your credit journey, the 700 credit score benefits will become more apparent.

Families often prioritize the 700 credit score benefits when considering home financing options. Many individuals seek to understand the 700 credit score benefits as they plan for major purchases. A firm grasp of the 700 credit score benefits can assist you in navigating financial decisions more effectively. Recognizing the 700 credit score benefits also aids in strategic planning for future financial goals. By achieving a 700 credit score, individuals unlock numerous 700 credit score benefits that enhance their financial landscape. The more you learn about the 700 credit score benefits, the greater your financial options become. Exploring the 700 credit score benefits can reveal opportunities for better financial products.

Those aiming for higher credit limits should consider the 700 credit score benefits that await them. Many consumers find that understanding the 700 credit score benefits encourages them to take action. Being aware of the 700 credit score benefits can motivate you to maintain good credit habits. When you reach a 700 credit score, these 700 credit score benefits help you secure favorable terms. Another one of the notable 700 credit score benefits is the access to premium loan products. Understanding the 700 credit score benefits is essential for anyone looking to improve their financial standing.

Mixed credit files represent one of the most insidious forms of credit report errors affecting score progression. When credit bureaus merge information from consumers with similar names, addresses, or Social Security numbers, the resulting confusion can introduce foreign accounts, payment histories, and credit inquiries onto your report. This identity confusion creates a particularly challenging scenario because the negative information appears legitimate within the bureau’s system, making standard dispute processes less effective.

The statistical reality that 52% of people with 700 credit scores have late payment records on their reports reveals a crucial insight about credit scoring algorithms. These systems are designed to evaluate overall credit risk patterns rather than punish isolated incidents, which means that single reporting errors can have disproportionate impacts on consumers who otherwise maintain excellent credit habits. A misreported late payment from three years ago can continue to suppress your score even as you demonstrate consistent on-time payments across all other accounts.

Furnisher reporting inconsistencies create another layer of complexity in the path to 700. Different creditors use varying reporting schedules, data formats, and interpretation standards when submitting information to credit bureaus. A credit card company might report your payment as late due to a processing delay on their end, while your bank records show the payment was submitted on time. These discrepancies become embedded in your credit history and require specific documentation and escalation procedures to resolve effectively.

Decoding the 700 Score Threshold: What Lenders Actually See

The transition from a 699 to a 700 credit score represents more than a single-point increase—it signals to lenders that you’ve crossed into a fundamentally different risk category. Lending institutions use sophisticated risk assessment models that create distinct approval tiers, and the 700 threshold serves as a critical decision point in their automated underwriting systems. This classification shift affects everything from initial application approvals to the specific terms and interest rates offered.

Within the Good credit range of 670-739, lenders apply additional stratification that creates meaningful differences in lending outcomes. While 21% of consumers fall into this overall range, those scoring between 700-739 receive preferential treatment compared to borrowers in the 670-699 segment. The difference translates into measurably better loan terms, with interest rate spreads often varying by 1-3 percentage points depending on the credit product.

The average consumer with a 700 credit score maintains 4.7 credit card accounts, a figure that reflects the credit mix component of scoring algorithms. This diversification demonstrates to lenders that you can successfully manage multiple credit relationships simultaneously, a key indicator of creditworthiness that automated systems weight heavily. However, the utilization patterns across these accounts matter significantly more than the raw number of accounts.

Industry-specific lending standards create additional nuances around the 700 benchmark. Mortgage lenders typically require scores of 620 or higher for conventional loans, but the 700 threshold often determines whether you’ll qualify for the most competitive interest rates without additional risk-based pricing adjustments. Auto lenders may approve borrowers with lower scores, but reaching 700 frequently eliminates the need for larger down payments or co-signers.

The 700 threshold often determines whether you’ll qualify for the most competitive interest rates without additional risk-based pricing adjustments.

Credit card companies demonstrate the most dramatic shifts in available products at the 700 mark. Premium rewards cards, balance transfer offers with extended 0% APR periods, and higher credit limits become accessible options that weren’t available just a few points lower. This expanded access creates opportunities for further credit optimization through strategic account management and utilization reduction.

Strategic Error Correction: Beyond Basic Dispute Letters

Standard online dispute systems fail to address complex credit report errors because they’re designed to handle straightforward cases like incorrect account balances or outdated personal information. When dealing with mixed files, identity confusion, or furnisher reporting errors, these automated systems lack the sophistication to investigate and resolve the underlying issues. Successful error correction for complex cases requires a more strategic approach that leverages specific provisions within the Fair Credit Reporting Act.

The 30-day investigation requirement under FCRA creates both opportunities and limitations for dispute resolution. Credit bureaus must complete their investigation within this timeframe, but they’re not required to conduct extensive research if the furnisher confirms the disputed information. Understanding this dynamic allows you to structure your disputes more effectively by providing specific documentation that contradicts the furnisher’s records and forces a more thorough investigation.

Documentation strategies for complex disputes require careful preparation and organization. Mixed file situations demand proof of identity separation, including utility bills, employment records, and financial statements that establish distinct residential and financial histories. When disputing furnisher errors, you need copies of payment confirmations, account statements, and correspondence that demonstrate the discrepancy between your records and the reported information.

Direct communication with furnishers often produces faster results than working exclusively through credit bureaus. The FCRA requires creditors to investigate disputes forwarded by bureaus, but it also allows consumers to dispute information directly with the company that reported it. This approach can be particularly effective when you have clear documentation of the error and can demonstrate the specific mistake in their reporting process.

Escalation procedures become necessary when initial disputes fail to resolve reporting errors. This process involves submitting detailed complaints to the Consumer Financial Protection Bureau, state attorney general offices, and potentially pursuing legal action under FCRA provisions. These escalated approaches carry more weight because they create regulatory scrutiny and potential liability for credit bureaus and furnishers who fail to correct legitimate errors.

The Credit Utilization Optimization Strategy for 700+ Scores

The conventional wisdom about keeping credit utilization below 30% represents just the starting point for credit score optimization. Consumers with 700 credit scores maintain an average utilization rate of 26%, but this figure masks the more sophisticated strategies required to maximize scoring potential. The relationship between individual account utilization and aggregate utilization creates opportunities for strategic balance management that can yield significant score improvements.

Scoring algorithms evaluate utilization at both the individual account level and across your entire credit portfolio. Having one card with high utilization can negatively impact your score even if your overall utilization remains low, while maintaining small balances across multiple accounts often produces better results than having zero balances on all cards. This nuanced approach requires careful timing of payments and strategic distribution of balances.

Statement date timing creates opportunities for utilization optimization that many consumers overlook. Credit card companies typically report your statement balance to credit bureaus, regardless of whether you pay the full balance before the due date. By making payments before your statement closes, you can control the exact balance that gets reported and optimize your utilization ratios across all accounts simultaneously.

The impact of zero-balance reporting versus low-balance reporting varies by scoring model, but maintaining small balances on some accounts while keeping others at zero often produces optimal results. This strategy demonstrates active credit usage while maintaining low overall utilization, satisfying both components of the utilization calculation. The key lies in distributing these small balances strategically across accounts with different credit limits and payment schedules.

- Monitor statement closing dates across all accounts to coordinate payment timing

- Maintain utilization between 1-9% on your highest-limit cards for optimal scoring

- Keep total utilization below 10% while showing activity on multiple accounts

- Request credit limit increases on existing accounts to improve utilization ratios

- Avoid closing older accounts that contribute to your overall available credit

Credit limit management represents another critical component of utilization optimization. Regular requests for credit limit increases on existing accounts improve your utilization ratios without requiring new credit inquiries, assuming you maintain the same spending patterns. This strategy proves particularly effective for consumers who have demonstrated consistent payment history and income growth since opening their accounts.

Professional Credit Repair: When DIY Efforts Reach Their Limits

Recognizing when individual dispute efforts have reached their effectiveness ceiling requires honest assessment of both the complexity of your credit issues and the time investment required for resolution. Complex cases involving mixed files, multiple furnisher errors, or identity theft recovery often exceed the scope of what consumers can reasonably handle while maintaining their other responsibilities. The opportunity cost of spending dozens of hours navigating credit bureau procedures may exceed the value of professional assistance.

Professional credit repair services maintain established relationships with credit bureaus and furnishers that can expedite dispute resolution in ways that individual consumers cannot replicate. These relationships don’t guarantee outcomes, but they do provide access to specialized departments and escalation procedures that aren’t available through standard consumer channels. The systematic approach used by experienced professionals often identifies error patterns and resolution strategies that individual consumers might miss.

The prioritization of dispute strategies represents a critical advantage of professional services over DIY approaches. Experienced credit repair professionals understand which types of errors to address first for maximum score impact and how to sequence disputes to avoid triggering defensive responses from creditors. This strategic sequencing can mean the difference between resolving issues in months versus years.

Realistic timelines for professional credit repair vary significantly based on the specific types of errors and the responsiveness of involved parties. Simple reporting errors might resolve within 30-60 days, while complex mixed file situations or furnisher disputes can take 6-12 months or longer. Professional services provide more accurate timeline estimates because they understand the typical resolution patterns for different types of cases and can adjust expectations accordingly.

The evaluation criteria for selecting credit repair services should focus on transparency, experience with your specific type of credit issues, and realistic promises about outcomes and timelines. Services that guarantee specific score increases or promise to remove all negative information regardless of accuracy should be avoided, as these claims violate both FTC regulations and the realistic limitations of the dispute process.

Breaking Through the 700 Barrier: Your Path Forward

Reaching a 700 credit score isn’t just about following basic credit advice—it’s about understanding that this threshold represents a fundamental shift in how lenders view your creditworthiness. The reality that 52% of consumers with 700 scores have late payment records proves that credit scoring is more nuanced than perfect payment history alone. Complex reporting errors, mixed files, and furnisher inconsistencies often create invisible barriers that prevent responsible borrowers from crossing this critical line, despite maintaining excellent financial habits.

Your journey to 700 requires strategic thinking beyond the conventional wisdom of paying bills on time and keeping balances low. Whether through sophisticated utilization optimization, targeted error correction, or professional assistance when DIY efforts reach their limits, success depends on recognizing that credit scoring systems are complex algorithms that reward strategic understanding over simple compliance. The question isn’t whether you deserve a 700 credit score—it’s whether you’re equipped with the right knowledge and tools to overcome the system’s inherent complexities and claim the financial opportunities that await on the other side.