The transition to VantageScore 4.0 is a significant shift that homebuyers need to understand. This new scoring model brings changes that could impact your credit score, potentially influencing your ability to secure a mortgage. But what exactly are these changes, and how might they affect you? The Federal Housing Finance Agency (FHFA) has set a timeline for this transition, and it’s crucial to be prepared.

We will break down the key changes in VantageScore 4.0, comparing it with previous models to highlight what’s different. We’ll also explore how these changes could affect your credit profile, whether your score might increase or decrease, and what specific factors will play a role. With insights from industry experts and practical steps to adapt to the new scoring model, you’ll be equipped to navigate this transition smoothly and maintain or even improve your creditworthiness.

Understanding VantageScore 4.0

Key Changes in the Scoring Model

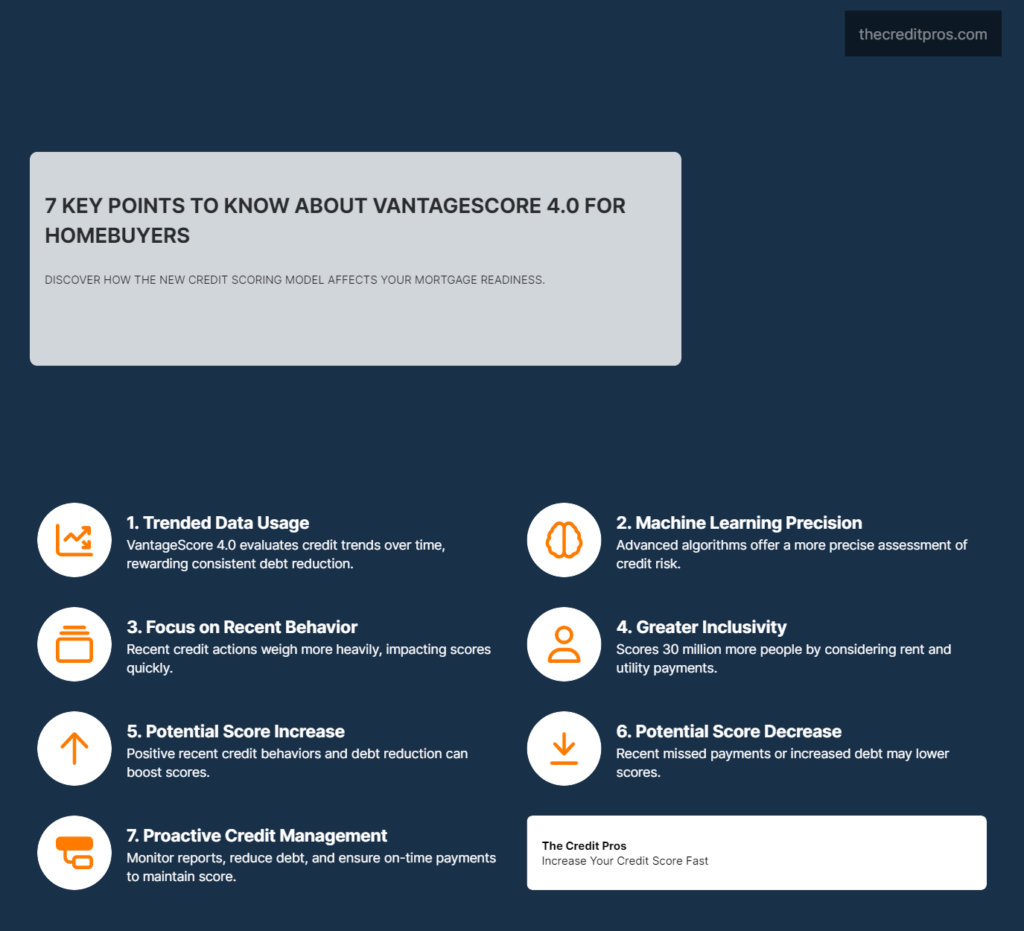

VantageScore 4.0 introduces several significant changes to the credit scoring model that homebuyers need to be aware of. One of the most notable updates is the incorporation of trended data, which looks at the trajectory of a consumer’s credit behavior over time rather than just a snapshot. This means the model will consider how you manage your credit over a period, such as whether you are consistently paying down debt or accumulating it.

Another key change is the enhanced use of machine learning techniques to better predict credit risk. This allows for a more nuanced understanding of consumer behavior and can potentially lead to more accurate credit scores. Additionally, VantageScore 4.0 places a greater emphasis on recent credit behaviors, which can be particularly beneficial for individuals who have made significant improvements in their credit management.

Comparing VantageScore 4.0 to previous models, the new version is designed to be more inclusive. For example, it can score approximately 30 million more consumers who previously had insufficient information to generate a credit score. This inclusivity is achieved by incorporating data from rent, utility, and telecom payments, which are often not included in traditional credit scoring models.

Insights from VantageScore and TransUnion highlight the rationale behind these changes. They emphasize that the goal is to create a more accurate and fair assessment of creditworthiness, particularly for consumers who may have been underserved by previous models. By considering a broader range of data and focusing on recent credit behaviors, VantageScore 4.0 aims to provide a more comprehensive view of a consumer’s financial health.

Implications for Homebuyers

Impact on Credit Scores

The transition to VantageScore 4.0 could have varying impacts on homebuyers’ credit scores, depending on their individual credit profiles. For some, the new model may result in higher scores, particularly if they have demonstrated positive credit behaviors in recent months. For instance, individuals who have been consistently paying down their credit card balances or have a history of on-time rent payments may see an improvement in their scores.

Conversely, the new model could lead to lower scores for those who have recently accumulated debt or missed payments. Since VantageScore 4.0 places a greater emphasis on recent credit behaviors, any negative actions taken in the past few months could have a more pronounced impact on your score.

Data points from HousingWire and Credit Karma indicate that the inclusion of trended data and alternative payment histories can significantly affect credit scores. For example, consumers who have been making steady progress in reducing their debt levels may benefit from a higher score, while those who have been increasing their debt may see a decrease.

Specific factors that may lead to score increases include:

- Consistent on-time payments for rent, utilities, and telecom bills.

- Reduction in overall debt levels.

- Positive trends in credit utilization rates.

On the other hand, factors that could lead to score decreases include:

- Recent missed payments or defaults.

- Increased credit card balances.

- High credit utilization rates over recent months.

Understanding these factors can help homebuyers anticipate how their credit scores might change with the new model and take proactive steps to mitigate any potential negative impacts.

Navigating the Transition Period

Timeline and Preparation

The transition to VantageScore 4.0 is set to take place over a defined timeline, with the Federal Housing Finance Agency (FHFA) planning to implement the new model by late 2025. This gives homebuyers ample time to prepare and adapt to the changes. However, it’s crucial to start taking steps now to ensure that your credit profile is in the best possible shape when the transition occurs.

During this transition period, homebuyers should focus on closely monitoring their credit reports and scores. Regularly checking your credit report can help you identify any inaccuracies or areas that need improvement. It is also advisable to review the specific factors that VantageScore 4.0 will consider and make adjustments to your credit management practices accordingly.

Steps homebuyers should take during the transition period include:

- Reviewing credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to ensure accuracy.

- Paying down high-interest debt to improve credit utilization rates.

- Making consistent, on-time payments for all bills, including rent, utilities, and telecom services.

- Avoiding opening new lines of credit unnecessarily, as this can impact your credit score.

By taking these steps, homebuyers can better position themselves to maintain or improve their credit scores under the new VantageScore 4.0 model.

Strategies to Maintain or Improve Creditworthiness

Practical Steps for Homebuyers

Adapting to the new VantageScore 4.0 model requires a proactive approach to managing your credit health. Here are some practical steps that homebuyers can take to maintain or improve their creditworthiness:

- Understand the New Scoring Criteria: Familiarize yourself with the factors that VantageScore 4.0 will consider, such as trended data and alternative payment histories. This knowledge will help you make informed decisions about your credit management practices.

- Focus on Recent Credit Behaviors: Since VantageScore 4.0 places a greater emphasis on recent credit activities, it is important to demonstrate positive credit behaviors consistently. This includes making on-time payments, reducing debt levels, and maintaining low credit utilization rates.

- Leverage Alternative Payment Histories: If you have a history of on-time payments for rent, utilities, or telecom bills, ensure that these are reported to the credit bureaus. This can help improve your credit score under the new model.

- Monitor Your Credit Regularly: Regularly checking your credit report and score can help you stay on top of any changes and address potential issues promptly. Utilize free credit monitoring services to keep track of your credit health.

- Seek Professional Advice: Consider consulting with a credit counselor or financial advisor to develop a personalized strategy for improving your credit score. They can provide expert guidance on managing your credit and navigating the transition to VantageScore 4.0.

By following these best practices, homebuyers can enhance their creditworthiness and be better prepared for the transition to VantageScore 4.0. Expert perspectives emphasize the importance of staying informed and proactive in managing your credit health, as this can significantly impact your ability to secure a mortgage and achieve your homebuying goals.

Wrapping Up: Navigating VantageScore 4.0 Transition

The shift to VantageScore 4.0 marks a pivotal change for homebuyers, with its emphasis on trended data and recent credit behaviors. This new model aims to provide a more accurate and inclusive assessment of creditworthiness, potentially benefiting those with positive credit management patterns. However, it also means that recent negative behaviors could have a more significant impact on your score.

As the Federal Housing Finance Agency sets the stage for this transition, it’s crucial to stay informed and proactive. By understanding the new scoring criteria and focusing on maintaining healthy credit habits, you can better navigate this change. The transition to VantageScore 4.0 represents a chance to redefine your financial health. Are you ready to embrace this opportunity and secure your path to homeownership?