When you’re drowning in debt, the idea of calling your creditors might feel like walking into a lion’s den. But here’s what most people don’t realize: creditors often want to settle just as much as you do. They’re dealing with their own internal pressures, reporting deadlines, and cost calculations that can work in your favor if you know how to approach them strategically. When negotiating with creditors, it’s essential to remember that they often want to settle just as much as you do. Effective negotiating with creditors requires understanding their motivations and pressures. Understanding the psychology behind negotiating with creditors can provide you with leverage. When negotiating with creditors, knowing their financial pressures can help improve your settlement offers. Debt age is crucial in negotiating with creditors, influencing their willingness to settle. Timing your negotiations with creditors can lead to more favorable terms.

Advanced settlement structuring can enhance your negotiating with creditors outcomes. While negotiating with creditors, consider alternative structures for payments. Pay-for-delete strategies can enhance your chances while negotiating with creditors. When negotiating with creditors, consider the tax implications of settlements. Settlement timing strategies are important when negotiating with creditors. Confidentiality clauses can enhance your negotiating with creditors strategy. The key to negotiating with creditors lies in understanding their business pressures. In negotiating with creditors, clarity in settlement agreements is essential.

The difference between a successful settlement and a rejected offer often comes down to timing, preparation, and understanding what motivates the person on the other end of the phone. Why do some people secure settlements for 30 cents on the dollar while others get stuck paying full amounts? What makes a creditor more willing to negotiate in March versus September? And how can you structure an agreement that not only saves you money today but actually helps rebuild your credit for tomorrow? The answers lie in understanding the psychology behind creditor decision-making and knowing exactly when and how to present your case.

The Psychology Behind Creditor Decision-Making: Understanding What Motivates Acceptance

Settlement terms should support your long-term recovery while negotiating with creditors. Attention to detail during negotiations with creditors can significantly impact outcomes. Improving credit scores while negotiating with creditors can create leverage. Building a positive credit history during negotiating with creditors is advantageous. Preventing resold accounts is crucial when negotiating with creditors for settlements. Understanding long-term implications is key during negotiations with creditors. Recognizing when to seek professional help is important while negotiating with creditors. Professional strategies can enhance your negotiating with creditors experience.

Creditors operate under financial pressures that most debtors never consider when approaching negotiations. Collection departments face monthly quotas, quarterly performance reviews, and annual budget constraints that directly influence their willingness to accept settlement offers. Understanding these internal dynamics transforms your approach from desperate pleading to strategic positioning.

The age of your debt plays a crucial role in creditor psychology. Accounts that are 90 days delinquent receive significantly different treatment than those approaching 180 days. During the first 90 days, creditors typically maintain hope for full recovery and may resist settlement offers below 70-80% of the original balance. However, as accounts age beyond 180 days, statistical recovery rates drop dramatically, making creditors more receptive to settlements in the 30-50% range.

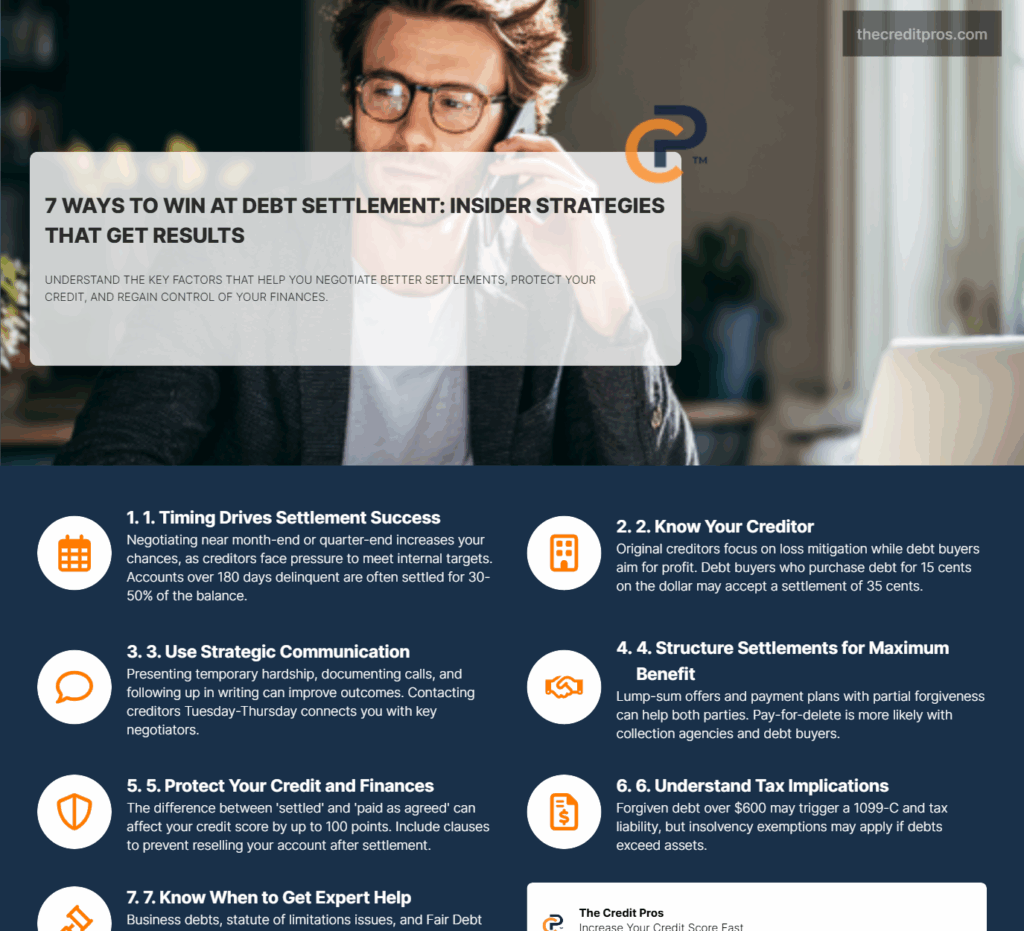

Collection department key performance indicators create predictable negotiation windows. Most collection agencies operate on monthly reporting cycles, with end-of-month pressure to close deals and meet targets. The final week of each month often presents optimal negotiation opportunities, as collectors may have more flexibility to accept lower offers rather than report zero recovery on aged accounts. Similarly, quarter-end periods intensify this pressure, particularly in September and December when annual performance evaluations approach.

The fundamental difference between original creditors and debt buyers dramatically affects settlement strategies. Original creditors like credit card companies or medical providers often view settlements as loss mitigation, focusing on minimizing write-offs while maintaining customer relationships. Debt buyers, conversely, purchase portfolios at steep discounts and operate purely on profit margins. A debt buyer who acquired your account for 15 cents on the dollar may readily accept a 35-cent settlement, while the original creditor might have rejected the same offer.

Internal cost calculations drive creditor decision-making more than emotional factors. Creditors constantly evaluate the expense of continued collection efforts against potential recovery amounts. Legal fees, staff time, and administrative costs accumulate rapidly, making settlements attractive when projected collection costs exceed potential recoveries. This reality explains why creditors often become more flexible as accounts approach legal action, where attorney fees can quickly consume any additional recovery.

Strategic Communication Techniques That Preserve Relationships While Securing Favorable Terms

The language you use during initial creditor contact sets the tone for the entire negotiation process. Presenting your situation as a temporary financial hardship rather than permanent inability to pay preserves creditor confidence in your eventual recovery. This distinction matters because creditors view hardship as a solvable problem, while inability to pay suggests futility in continued collection efforts.

Timing your initial contact strategically prevents automatic escalation to legal departments. Calling during regular business hours on Tuesday through Thursday typically connects you with primary collection staff who have more negotiation authority. Monday calls often encounter weekend backlog stress, while Friday conversations may be rushed due to weekly reporting deadlines. Avoiding these peak pressure periods increases your chances of reaching cooperative personnel.

Documentation strategies protect your interests while building creditor trust. Recording call dates, representative names, and conversation details demonstrates professionalism and creates accountability. However, avoid mentioning recording unless legally required, as this can trigger defensive responses. Instead, confirm key points in writing through follow-up emails, creating a paper trail that benefits both parties.

Knowing the type of creditor you are negotiating with can greatly impact your success. In negotiating with creditors, internal cost factors often outweigh emotional considerations. Effective communication during negotiating with creditors helps maintain relationships. When negotiating with creditors, language matters; frame your situation positively. Strategic timing in negotiating with creditors can prevent escalation to legal actions. Documentation is essential when negotiating with creditors to protect your interests. When negotiating with creditors, presenting lump-sum offers requires strategic framing. Managing multiple negotiations with creditors can prevent conflicts and maintain credibility.

The art of presenting lump-sum offers requires understanding creditor cash flow preferences. Rather than opening with your maximum offer, present a range that allows room for negotiation while emphasizing immediate payment capability. Creditors often prefer certain payment over uncertain future collections, making lump-sum offers attractive even at reduced amounts. Frame your offer as a business decision that benefits both parties rather than a personal plea for mercy.

Managing multiple creditor negotiations simultaneously requires careful coordination to prevent conflicts. Staggering your contact schedule prevents creditors from comparing notes or feeling pressured by competing negotiations. Focus on one primary negotiation at a time while maintaining minimal contact with others to preserve relationships. This approach prevents creditors from feeling manipulated and maintains your credibility across all accounts.

Advanced Settlement Structuring: Beyond Simple Percentage Reductions

Settlement agreements extend far beyond simple percentage discounts, offering opportunities to structure deals that benefit both parties while protecting your long-term financial interests. Payment plans with partial forgiveness create win-win scenarios where creditors receive steady cash flow while you gain manageable payment terms. These structures often prove more attractive to creditors than lump-sum offers, particularly when their internal metrics favor consistent monthly recoveries.

Pay-for-delete negotiations represent the most valuable settlement enhancement, though success rates vary significantly by creditor type. Original creditors typically resist credit report modifications, viewing them as separate from debt collection activities. Debt buyers and collection agencies show more flexibility, particularly when faced with lump-sum offers that exceed their acquisition costs. The key lies in positioning credit report removal as a standard business practice rather than a special favor.

Tax implications from forgiven debt require careful consideration during settlement structuring. Debt forgiveness exceeding $600 typically generates 1099-C forms, creating potential tax liability on the forgiven amount. However, insolvency exceptions may apply if your total debts exceed assets at the time of settlement. Structuring settlements to fall below reporting thresholds or timing them to coincide with qualifying financial circumstances can minimize tax exposure.

Settlement timing affects credit score recovery patterns in ways most people never consider. Settling multiple accounts simultaneously can create a concentrated negative impact followed by steady recovery, while spreading settlements across several months may provide more gradual score improvement. The optimal approach depends on your specific credit profile and future borrowing timeline. Accounts approaching the seven-year credit reporting limit may warrant delayed settlement to avoid resetting negative reporting periods.

Confidentiality clauses prevent information sharing between creditors, protecting your negotiation strategy across multiple accounts. Without these provisions, creditors may share settlement details with other collection agencies, potentially undermining your position in ongoing negotiations. Including non-disclosure language in settlement agreements maintains your strategic advantage while preventing coordinated collection efforts.

“The key to successful debt negotiation lies not in desperation but in understanding the business pressures that drive creditor decision-making, allowing you to position your offer as a mutually beneficial solution rather than a desperate plea.”

The following elements should be included in comprehensive settlement agreements:

- Specific payment amounts and due dates • Language confirming full satisfaction of the debt • Credit reporting modifications or removal commitments • Prohibitions against reselling the account to other collectors • Confidentiality provisions preventing information sharing • Clear statements that no additional amounts are owed • Signatures from authorized creditor representatives

Protecting Your Financial Future: Settlement Terms That Support Long-Term Recovery

Settlement agreement language directly impacts your credit report and future borrowing ability, making careful attention to specific wording essential. The difference between “settled” and “paid as agreed” reporting can affect your credit score by 50-100 points and influence lender decisions for years. While achieving “paid as agreed” status requires full payment, negotiating for “paid in full for less than the full balance” provides better credit impact than standard “settled” reporting.

Credit utilization calculations continue during the settlement process, offering opportunities to improve your score even before final resolution. Paying down other revolving accounts while negotiating settlements can boost your credit score, creating a stronger negotiating position and demonstrating financial responsibility to creditors. This strategy proves particularly effective when settlements involve payment plans, as improved credit metrics support your ability to honor the agreement.

Building positive credit history during settlement negotiations requires strategic planning but offers significant long-term benefits. Secured credit cards, credit-builder loans, and authorized user arrangements can begin improving your credit profile immediately, rather than waiting for settlement completion. This proactive approach demonstrates financial responsibility to creditors and creates positive momentum for post-settlement recovery.

Preventing settled accounts from being resold requires specific contractual language that many people overlook. Without explicit prohibitions, creditors may sell “settled” accounts to other collection agencies, creating future collection attempts despite your payment. Including language that transfers full ownership rights and prohibits further sale protects you from ongoing collection activity and ensures permanent resolution.

The long-term implications of settlement structures extend beyond immediate financial relief. Settlements that include monitoring periods or conditional forgiveness create ongoing obligations that may complicate future financial planning. Understanding these commitments helps you evaluate whether settlement terms truly serve your long-term interests or simply defer problems to a later date.

When Professional Help Becomes Essential: Recognizing Complex Scenarios

Certain debt situations require professional intervention to avoid costly mistakes that could worsen your financial position. Business debts, in particular, demand specialized knowledge of commercial collection practices and potential personal guarantee implications. Unlike consumer debts, business obligations often involve complex contractual terms, UCC filings, and potential asset seizure rights that require legal expertise to navigate safely.

Debt validation disputes differ fundamentally from settlement negotiations and require different strategies and timelines. Mixing these approaches can waive important legal rights and complicate your position. When debt ownership or validity remains questionable, addressing these issues before entering settlement discussions protects your interests and may eliminate the debt entirely without payment.

Different strategies apply when negotiating with creditors versus disputing debts. Understanding statute limitations is essential in negotiating with creditors. Leverage legal violations during negotiations with creditors for better outcomes. Professional assistance can provide advantages when negotiating with creditors. Mastering negotiating with creditors is key to achieving successful settlements.

Statute of limitations considerations create both opportunities and risks in debt negotiations. While expired limitations may provide complete defense against collection lawsuits, acknowledging the debt or making payments can restart the limitations period. Understanding these implications requires legal knowledge that most consumers lack, making professional consultation essential when dealing with aged debts.

Fair Debt Collection Practices Act violations during negotiations can provide significant leverage but require proper documentation and legal knowledge to pursue effectively. Creditor behavior that crosses legal boundaries may not only stop collection efforts but also create monetary damages in your favor. Recognizing these violations and understanding how to preserve evidence requires expertise that justifies professional assistance.

The complexity of modern debt collection, combined with the long-term implications of settlement decisions, often makes professional help a worthwhile investment. Attorneys specializing in debt defense understand creditor psychology, legal requirements, and negotiation strategies that can secure better outcomes than individual efforts. When the potential savings exceed professional fees, expert assistance becomes not just helpful but financially prudent.

Conclusion: Mastering the Art of Strategic Debt Settlement

The difference between those who secure 30-cent settlements and those who pay full amounts isn’t luck—it’s understanding that creditors operate as businesses with predictable pressures, deadlines, and motivations. By timing your approach strategically, presenting yourself as a solution rather than a problem, and structuring agreements that protect your future credit recovery, you transform debt negotiation from desperate pleading into professional business dealings.

The questions posed at the beginning reveal their answers through creditor psychology: March negotiations succeed because of quarterly pressures, while September brings year-end urgency. Settlement structures work when they address both parties’ needs, not just your immediate financial relief. Most importantly, protecting your financial future requires understanding that today’s settlement terms become tomorrow’s credit foundation. Your creditors aren’t your enemies—they’re potential partners in a business transaction that, when handled correctly, can benefit everyone involved while setting you on a path toward genuine financial recovery.