Building credit from scratch when you have no credit history feels like trying to get hired without work experience – everyone wants to see what you’ve done before, but how do you start when no one will give you that first chance? This credit-building paradox affects millions of Americans who find themselves locked out of financial opportunities simply because they haven’t borrowed money before. Whether you’re a recent graduate, new immigrant, or someone who has always paid cash, building credit from scratch can cost you thousands in higher interest rates, security deposits, and even job opportunities.

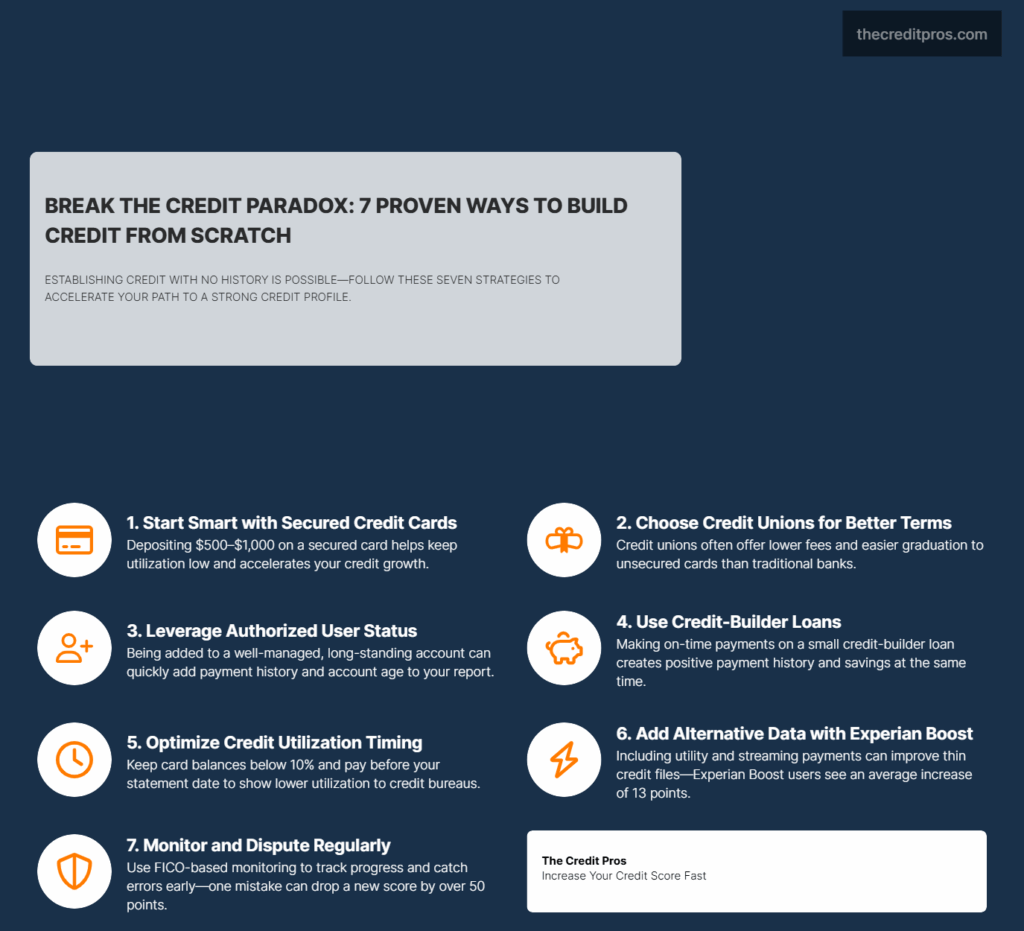

The good news is that there are proven strategies to break through this barrier, though not all approaches are created equal. While most people know about secured credit cards, few understand how to optimize their deposit amounts for maximum impact or why certain credit unions offer superior terms over traditional banks. What’s the difference between being an authorized user on your parent’s account versus your spouse’s, and how does payment timing affect your credit utilization beyond the basic 30% rule? The path from credit invisible to creditworthy involves strategic decisions that can accelerate your progress by months or even years. By implementing effective strategies for building credit from scratch, individuals can overcome barriers and access better financial opportunities.

Strategic Foundation Building: Beyond Basic Secured Cards

Starting with secured credit cards is a common approach for building credit from scratch, but understanding their optimal usage can further enhance outcomes. Establishing a solid foundation for building credit from scratch involves smart deposit decisions and effective utilization management. Understanding the graduation pathways can significantly expedite the process of building credit from scratch. Using multiple secured cards can speed up your journey in building credit from scratch when managed properly.

Secured credit cards represent the most accessible entry point for credit building, yet most newcomers approach them with a basic understanding that leaves significant opportunities untapped. The conventional wisdom of depositing the minimum amount and waiting for automatic improvements overlooks the strategic elements that can accelerate your credit development by months.

The authorized user strategy is another valuable method for building credit from scratch, depending on the primary cardholder’s habits. Leveraging the account age of the primary cardholder is essential when building credit from scratch as an authorized user. Recognizing the reporting policies can greatly influence your success in building credit from scratch as an authorized user. Planning your exit as an authorized user is crucial for your subsequent efforts in building credit from scratch independently.

Your deposit amount directly influences your credit utilization calculations and available credit growth potential. While many secured cards accept deposits as low as $200, depositing $500 to $1,000 creates a foundation that supports more sophisticated utilization management. This higher initial limit allows you to maintain lower utilization ratios even with regular spending, which becomes crucial as you establish payment patterns. Credit unions consistently offer superior secured card terms compared to traditional banks, with lower fees, better interest rates, and more flexible graduation policies. Exploring credit-builder loans is another effective way of building credit from scratch while developing a strong payment history. Choosing the right loan terms can maximize the benefits of building credit from scratch through structured payments. Utilizing alternative credit data is a modern approach to enhance building credit from scratch, especially for those with limited histories.

Banking relationships can also improve your chances when building credit from scratch by offering exclusive product access. The graduation pathway from secured to unsecured status varies dramatically between issuers, making your initial card selection critical for long-term success. Some issuers automatically review accounts for graduation after six months of on-time payments, while others require manual requests or specific criteria fulfillment. Understanding these policies upfront allows you to choose cards that align with your timeline expectations and avoid being locked into secured status longer than necessary.

Understanding credit utilization is key when building credit from scratch, as it significantly affects your score. Employing statement closing date strategies can help in building credit from scratch while keeping your utilization low. Maintaining multiple payment cycles is a practical approach for building credit from scratch without increasing debt levels.

Multiple secured cards can accelerate credit building when managed strategically, despite conventional advice suggesting otherwise. Opening two secured cards with different issuers within a short timeframe provides redundancy in your credit profile and increases your total available credit. This approach requires careful timing to minimize hard inquiries’ impact while maximizing the benefits of diverse credit relationships. The key lies in spacing applications appropriately and ensuring you can manage multiple payment schedules without compromising your on-time payment history. Effective utilization management is a crucial step in the overall process of building credit from scratch.

The Authorized User Advantage: Maximizing Piggyback Benefits

Becoming an authorized user offers the fastest path to credit score development, yet the effectiveness depends heavily on the primary cardholder’s credit management habits and the specific issuer’s reporting practices. Not all authorized user arrangements provide equal benefits, and understanding these nuances can mean the difference between rapid credit growth and minimal impact on your profile.

The primary cardholder’s account age significantly influences the benefit you receive as an authorized user. Accounts with longer histories contribute more substantially to your average account age, which comprises 15% of your FICO score calculation. Additionally, the primary cardholder’s utilization patterns directly affect your credit profile, making it essential to partner with someone who consistently maintains low balances relative to their credit limits.

Different credit card issuers employ varying policies for reporting authorized user activity to credit bureaus. Some issuers report authorized users immediately upon addition, while others may take 30 to 60 days to begin reporting. Major issuers like American Express and Chase typically report authorized user activity to all three credit bureaus, but smaller issuers may only report to one or two bureaus. Understanding these reporting patterns helps you select the most beneficial authorized user opportunity and set realistic expectations for when you’ll see credit score improvements.

The timing of your removal as an authorized user requires strategic consideration as you transition to independent credit building. Remaining an authorized user indefinitely can create dependency on another person’s credit management, while removing yourself too early may eliminate valuable credit history. The optimal timing typically occurs after you’ve established your own credit accounts and demonstrated six to twelve months of independent credit management. This approach preserves the positive history while ensuring your credit profile can stand independently.

Alternative Credit Building: Unconventional Paths to Credit History

Consistent monitoring is essential for individuals focused on building credit from scratch to track their progress accurately. Understanding your credit score models can empower your efforts in building credit from scratch effectively. Regular credit report monitoring is vital for anyone building credit from scratch to ensure accurate records. Simulation tools can provide insights into your journey of building credit from scratch by predicting score changes.

Credit-builder loans operate on a unique structure where you make payments before receiving the loan proceeds, creating a forced savings mechanism while establishing payment history. These loans typically range from $300 to $3,000 with terms between 12 to 24 months, but the strategic selection of loan terms can optimize their credit-building impact. Shorter loan terms create more frequent payment reporting, while longer terms provide extended payment history development. Breaking the credit paradox is achievable with the right strategies for building credit from scratch and informed decisions.

The loan structure variations among different lenders create opportunities for strategic selection based on your specific credit-building goals. Some credit-builder loans allow partial access to funds during the repayment period, providing flexibility for emergencies while maintaining the credit-building benefit. Others offer interest rate reductions for automatic payments or early completion, reducing the overall cost of credit building. Credit unions and community development financial institutions (CDFIs) often provide the most favorable terms, with lower interest rates and more flexible qualification requirements than traditional banks.

Alternative credit data sources have gained significant traction in recent years, with services like Experian Boost allowing consumers to add utility, cell phone, and streaming service payments to their credit profiles. These services can provide immediate score improvements for individuals with thin credit files, though the impact varies based on your existing credit profile and the specific scoring model used. The effectiveness of these services depends on consistent payment patterns and the types of accounts you choose to include.

Banking relationships can provide access to credit-building products with preferential terms through existing customer benefits. Many banks offer secured credit cards or credit-builder loans with reduced fees or better interest rates for existing checking account customers. Establishing a banking relationship before applying for credit products can improve your approval odds and potentially provide access to products not available to the general public. This relationship-based approach to credit building often yields better long-term results than pursuing products in isolation.

Credit Utilization Mastery: The 30% Rule and Beyond

Credit utilization extends far beyond the commonly cited 30% threshold, encompassing sophisticated strategies that can significantly impact your credit score development. Individual card utilization often carries more weight in scoring algorithms than overall utilization, making it essential to manage each card’s balance independently rather than focusing solely on aggregate utilization across all accounts.

Statement closing dates create opportunities for utilization manipulation that most credit builders overlook. Credit card issuers typically report your statement balance to credit bureaus, not your current balance, allowing you to strategically time payments to minimize reported utilization. Making payments before your statement closes can result in zero utilization reporting, while making partial payments can achieve specific utilization targets. This timing strategy becomes particularly valuable as you build credit, allowing you to demonstrate credit usage while maintaining optimal utilization ratios.

The relationship between credit limits and scoring algorithms reveals why secured card deposit amounts matter significantly in credit building. Higher credit limits provide more flexibility in utilization management and can contribute to better credit mix scores when combined with other credit types. As your credit profile develops, requesting credit limit increases on secured cards can provide additional utilization management benefits without requiring new credit inquiries.

Multiple payment cycles within a single statement period can help maintain consistently low utilization while still demonstrating credit usage. This approach involves making several smaller payments throughout the month rather than one large payment, keeping your balance low throughout the reporting period. Some credit builders use this strategy to maintain single-digit utilization ratios while still generating enough activity to demonstrate responsible credit usage.

Here are key utilization optimization strategies for credit builders:

- Per-card management: Keep individual card utilization below 10% rather than focusing only on overall utilization

- Statement date timing: Make payments 2-3 days before statement closing dates to control reported balances

- Strategic balance carrying: Maintain small balances (1-3% utilization) on one card while keeping others at zero

- Multiple payment scheduling: Use weekly or bi-weekly payments to maintain consistently low balances

- Credit limit optimization: Request increases every 6 months to improve utilization ratios without changing spending

Monitoring and Acceleration: Data-Driven Credit Development

Credit monitoring service selection requires understanding the different scoring models and their relevance to your credit-building goals. FICO scores remain the standard for most lending decisions, making FICO-based monitoring services more valuable for credit builders than VantageScore alternatives. However, VantageScore models often reflect credit changes more quickly, providing earlier indicators of your credit-building progress.

The frequency and detail of credit report updates vary significantly between monitoring services, affecting their usefulness for active credit builders. Some services update scores monthly, while others provide weekly or even daily updates during periods of significant credit activity. For credit builders, more frequent updates help identify the impact of specific actions and allow for rapid course corrections when strategies aren’t producing expected results.

Credit report accuracy becomes particularly crucial for new credit builders, as errors can have disproportionate impacts on thin credit files. A single incorrect late payment or inaccurate account can devastate a developing credit profile, making regular monitoring and prompt dispute resolution essential. Understanding the dispute process and maintaining documentation of your actual payment history provides protection against reporting errors that could derail your credit-building progress.

Score simulation tools available through many monitoring services allow credit builders to model the potential impact of different actions before implementation. These tools can predict how opening new accounts, paying down balances, or other credit actions might affect your score, enabling data-driven decision-making throughout your credit-building journey. The accuracy of these simulations improves as your credit file develops, making them increasingly valuable tools for planning your next credit-building steps.

Breaking the Credit Paradox: Your Path Forward

Building credit from scratch doesn’t have to be the impossible paradox it initially appears to be. The strategies outlined here – from optimizing secured card deposits and leveraging authorized user relationships to mastering utilization timing and exploring alternative credit-building tools – provide multiple pathways to establish your financial foundation. Success requires understanding that building credit from scratch is fundamentally about demonstrating reliability through strategic data points rather than simply waiting for time to pass.

Your journey from credit invisible to creditworthy depends on making informed decisions at each step, whether that’s selecting the right credit union for your secured card, timing your payments to optimize utilization reporting, or choosing monitoring services that provide actionable insights. The most successful credit builders don’t just follow basic advice – they understand the underlying mechanics of credit scoring and use that knowledge to accelerate their progress. The question isn’t whether you can build credit without existing credit history, but rather how quickly you’re willing to transform from someone locked out of financial opportunities into someone who commands the best terms available by building credit from scratch.