The gig economy has created a massive shift in how millions of people earn their living, but there’s a crucial aspect most workers don’t fully understand: how their irregular income patterns are quietly affecting their credit scores. Traditional credit scoring models were built around the predictable world of W-2 employees with steady paychecks, leaving gig workers at a significant disadvantage when it comes to building and maintaining good credit. Understanding the gig economy and credit score is essential for workers navigating this landscape. In the gig economy and credit score realm, it is important to know how income variability affects your financial health.

What makes this particularly challenging is that the very nature of gig work – income fluctuations, payment timing mismatches, and lack of traditional employment documentation – can trigger red flags in credit algorithms that weren’t designed to recognize the legitimacy of this work style. But here’s what’s encouraging: new financial tools and strategies are emerging specifically for gig workers, and understanding how to navigate these credit challenges can actually position you for stronger financial health than traditional employees. The question isn’t whether gig work affects your credit – it’s how you can work with these unique circumstances to build the credit profile you need. Many gig workers are unaware of the gig economy and credit score implications of their income streams.

The Hidden Credit Vulnerabilities of Gig Work

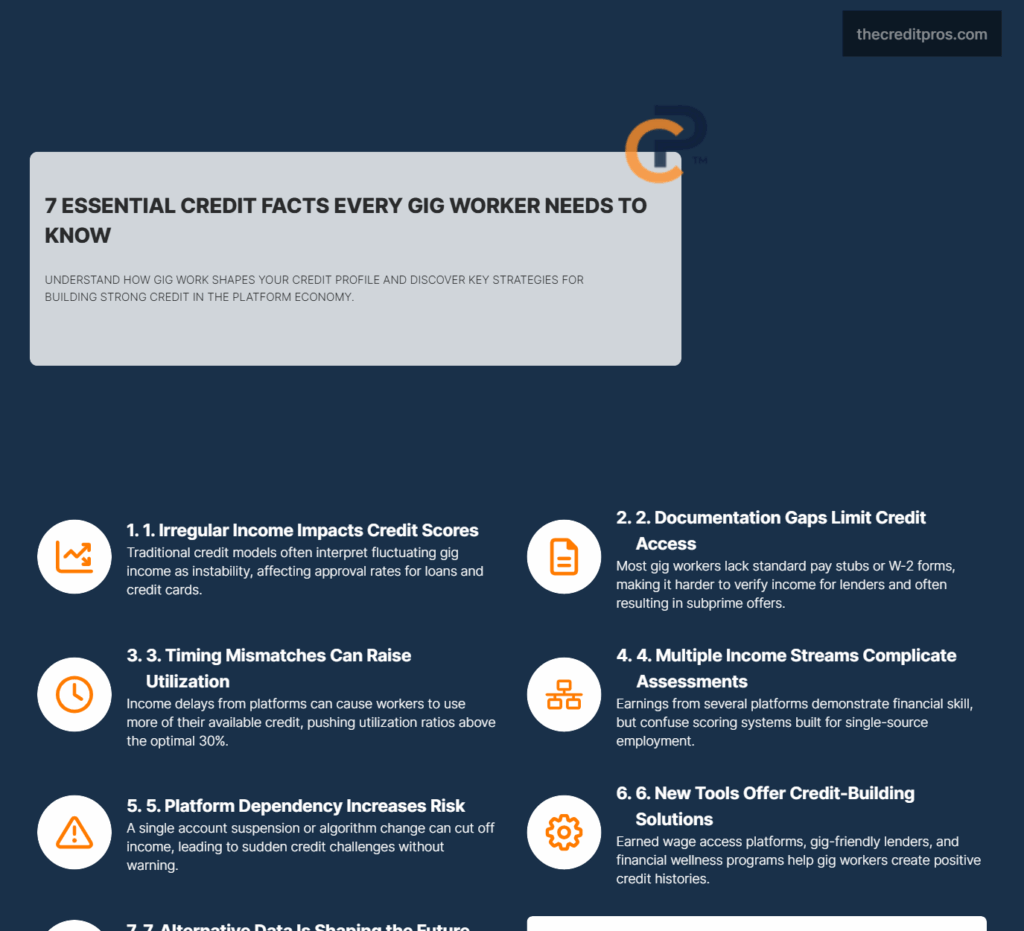

The fundamental architecture of credit scoring systems creates systematic barriers for gig workers that extend far beyond simple income verification. Credit bureaus rely on algorithms designed around the predictable financial patterns of traditional employment, where consistent monthly deposits signal stability and reliability. When these systems encounter the irregular payment cycles typical of gig work, they interpret this variability as financial instability rather than the normal rhythm of platform-based earnings. Understanding how the gig economy and credit score interact can help mitigate financial challenges.

The documentation challenge represents perhaps the most immediate obstacle gig workers face when applying for credit. Traditional employment verification relies on pay stubs, W-2 forms, and employer confirmation letters that simply don’t exist in the gig economy. Instead, gig workers must piece together bank statements, platform earnings reports, and tax documents that often fail to paint a complete picture of their financial capacity. This documentation gap forces many gig workers into subprime lending categories despite having substantial earning potential.

The gig economy and credit score relationship is complex, affecting how workers are perceived by lenders. Seasonal income fluctuations compound these challenges in ways that traditional credit models fail to account for. A delivery driver who earns significantly more during holiday seasons or a rideshare driver whose income peaks during special events experiences natural business cycles that credit algorithms may misinterpret as financial distress. These fluctuations can trigger concerning patterns in credit utilization ratios, where a worker might use more available credit during slower periods and pay it down during peak earning times, creating a credit profile that appears unstable to traditional scoring models. It is crucial for gig workers to understand the gig economy and credit score dynamics.

The psychological dimension of financial uncertainty creates additional credit vulnerabilities that extend beyond mechanical scoring issues. Gig workers often develop heightened financial anxiety due to income unpredictability, leading to conservative credit behaviors that paradoxically harm their credit scores. Some workers avoid using credit altogether during uncertain periods, reducing their credit activity and potentially lowering their scores due to inactivity.

Platform dependency introduces a unique vulnerability that traditional employment rarely faces. A single policy change, algorithm update, or account suspension can instantly eliminate a gig worker’s primary income source, creating credit emergencies that develop without warning. This dependency risk makes gig workers particularly vulnerable to sudden credit deterioration when platform relationships change unexpectedly. Insight into the gig economy and credit score is becoming increasingly important. Changes in the gig economy and credit score assessment will impact many workers.

The Credit Score Calculation Paradox for Gig Workers

Understanding the gig economy and credit score can transform your financial outlook. The standard recommendation to maintain credit utilization below 30% becomes problematic when income arrives in irregular chunks rather than steady monthly deposits. Gig workers often face timing mismatches where their highest expenses occur before their peak earning periods, forcing them to rely more heavily on available credit during specific windows. This pattern can push utilization ratios above recommended thresholds during certain periods, even when workers have sufficient earning capacity to manage their obligations. It’s vital to comprehend the gig economy and credit score factors to prevent financial pitfalls.

Payment timing mismatches create cascading effects throughout gig workers’ credit profiles. Platform payments may arrive several days after completion of work, while credit card bills maintain fixed due dates regardless of when earnings materialize. Another aspect of the gig economy and credit score is the impact of irregular payment schedules. This disconnect forces many gig workers into a constant juggling act, where they must anticipate income timing to avoid late payments that could damage their credit scores.

Multiple income streams, while providing diversification benefits, can complicate credit mix calculations in unexpected ways. Credit scoring models evaluate the variety of credit types consumers manage, but they struggle to interpret the financial complexity of workers who might have revenue from three different platforms, seasonal work, and occasional traditional employment. This complexity can either enhance credit profiles by demonstrating financial sophistication or confuse algorithms that expect simpler financial patterns. Monitoring the gig economy and credit score can lead to better financial decisions.

The emergence of alternative data sources presents both opportunities and challenges for gig worker credit assessment. Delivery completion rates, customer satisfaction scores, and platform tenure could theoretically provide valuable insights into creditworthiness, but current scoring models lack the infrastructure to incorporate these metrics meaningfully. Some forward-thinking lenders are beginning to experiment with platform-specific data, but widespread adoption remains limited.

- Platform performance metrics (completion rates, customer ratings)

- Earnings consistency patterns across multiple platforms

- Geographic coverage and market adaptability

- Technology adoption and digital financial behaviors

- Customer interaction quality and dispute resolution

Traditional credit scoring models miss crucial financial behaviors specific to platform work that could actually indicate strong creditworthiness. The ability to maintain high performance ratings across multiple platforms, adapt quickly to changing market conditions, and manage complex multi-stream income sources demonstrates financial sophistication that current algorithms cannot recognize or value appropriately. The implications of the gig economy and credit score can be significant for workers.

Strategic Credit Building in the Gig Economy Ecosystem

Earned Wage Access services represent a significant opportunity for gig workers to establish credit-building patterns without taking on traditional debt obligations. Platforms like KarmaLife allow workers to access earned wages before standard pay cycles complete, creating opportunities to demonstrate consistent repayment behavior while managing cash flow challenges. These services can serve as stepping stones toward traditional credit products by establishing documented patterns of responsible financial behavior.

The strategic timing of credit applications becomes crucial for gig workers who must work within the constraints of irregular income patterns. Understanding the gig economy and credit score will empower workers to make informed choices. Applying for credit during peak earning periods, when bank statements show higher balances and platform earnings reports demonstrate strong performance, can significantly improve approval odds. This requires careful planning and understanding of personal earning cycles to optimize the timing of credit-seeking activities. The gig economy and credit score can influence your financial opportunities.

Building relationships with gig-friendly lenders who understand the nuances of platform-based income can provide significant advantages over traditional banking relationships. These specialized lenders have developed underwriting processes that account for income variability and platform-specific risk factors, often resulting in more favorable terms for qualified gig workers. Establishing these relationships during strong earning periods creates valuable financial partnerships for future credit needs. Awareness of the gig economy and credit score can enhance your financial literacy.

Small, frequent borrowing patterns can effectively establish credit history when managed strategically. Rather than avoiding credit altogether due to income uncertainty, gig workers can benefit from taking small loans or using credit cards for routine expenses, then paying them off quickly during peak earning periods. This approach builds positive payment history while avoiding the risks associated with carrying large balances during uncertain income periods. Strategies that address the gig economy and credit score are crucial for financial health.

Financial wellness programs offered by major gig platforms increasingly include credit-building components designed specifically for their worker populations. These programs often provide educational resources, credit monitoring services, and sometimes preferential lending relationships that can accelerate credit development. Workers who actively engage with these programs often see faster credit improvement than those who attempt to navigate credit building independently. Understanding the gig economy and credit score can provide a competitive edge.

Navigating Credit Challenges During Economic Uncertainty

Economic disruptions affect gig workers differently than traditional employees, requiring specialized approaches to credit protection and recovery. Platform algorithm changes, market saturation, or regulatory shifts can rapidly alter earning potential in ways that traditional job loss insurance doesn’t address. Building credit resilience requires understanding these unique risk factors and developing contingency plans that account for platform-specific vulnerabilities.

Maintaining credit health during seasonal income drops or economic downturns requires proactive communication strategies with creditors. Many lenders have developed specialized programs for gig workers that allow for temporary payment modifications during documented slow periods. However, accessing these programs requires establishing relationships and demonstrating the temporary nature of income reductions before credit damage occurs. The gig economy and credit score issues must be addressed by every gig worker.

Many professionals overlook the connection between the gig economy and credit score. Emergency fund building takes on heightened importance for gig workers whose income streams can disappear without traditional unemployment benefits or severance packages. The relationship between emergency savings and credit health becomes particularly critical when unexpected expenses coincide with reduced earning periods. Workers who maintain adequate emergency reserves can avoid credit damage during temporary income disruptions.

Recovery strategies for gig workers who have experienced credit setbacks must account for the unique challenges of rebuilding credit without traditional employment verification. This often involves working with specialized credit repair services that understand gig economy documentation challenges and can effectively communicate with creditors about the legitimate nature of platform-based income sources.

The importance of diversifying both income streams and credit relationships becomes apparent during economic uncertainty. Gig workers who rely on single platforms or single credit sources face concentrated risks that can quickly escalate during disruptions. Building multiple platform relationships and maintaining diverse credit options provides crucial flexibility during challenging periods. To succeed, understand the gig economy and credit score implications of your work.

The Future of Credit in the Gig Economy

Regulatory developments signal a growing recognition of gig workers’ unique financial needs and may influence how credit access evolves for this population. These legislative frameworks often include provisions for financial security and benefits that could provide the documentation and stability traditional lenders require for credit approval. As similar regulations develop globally, the credit landscape for gig workers may become more accommodating. Strategies for the gig economy and credit score adaptation are essential in today’s market.

The gig economy and credit score relationship is vital for long-term financial success. The evolution of credit scoring methodology increasingly incorporates gig-specific metrics as lenders recognize the limitations of traditional models. Forward-thinking credit bureaus are experimenting with alternative data sources that better reflect the financial capacity and reliability of platform-based workers. This evolution could fundamentally change how creditworthiness is assessed for the growing gig economy workforce.

Emerging partnerships between fintech companies and gig platforms create integrated financial service ecosystems that address credit needs alongside income generation. These partnerships often result in products specifically designed for gig worker financial patterns, including credit offerings that align with platform payment cycles and underwriting that considers platform performance metrics.

Blockchain technology and alternative verification methods present potential solutions to the documentation challenges that currently plague gig worker credit applications. Distributed ledger systems could provide tamper-proof records of earnings, performance metrics, and payment history that would give lenders confidence in gig worker creditworthiness without relying on traditional employment documentation. Workers must learn about the gig economy and credit score implications for their careers.

The future of work involves a clear understanding of the gig economy and credit score. Financial inclusion initiatives specifically targeting non-traditional workers are reshaping how the credit industry approaches gig economy participants. These initiatives often combine policy advocacy, technology development, and specialized lending programs to create more equitable access to credit for workers whose income patterns don’t fit traditional models. The success of these programs could accelerate broader industry adoption of gig-friendly credit practices. Legislation may clarify the gig economy and credit score standards in the coming years.

Wrapping Up: Your Credit Journey in the Gig Economy

The gig economy’s impact on your credit score isn’t a temporary challenge that will resolve itself – it’s a fundamental shift requiring new strategies and understanding. While traditional credit systems weren’t designed for irregular income patterns, the emergence of specialized financial tools and gig-friendly lenders demonstrates that the industry is adapting to serve this growing workforce. Your success depends on recognizing that building credit as a gig worker requires different tactics: strategic timing of applications, leveraging earned wage access services, and maintaining relationships with lenders who understand platform-based income. Understanding the gig economy and credit score will be vital for emerging workers.

The question posed at the beginning – how you can work with gig economy circumstances to build strong credit – has a clear answer rooted in proactive financial management and strategic planning. By understanding the unique vulnerabilities of gig work and implementing targeted credit-building strategies, you’re not just overcoming disadvantages; you’re positioning yourself to thrive in an evolving financial landscape. The workers who master these specialized approaches today won’t just survive the credit challenges of gig work – they’ll emerge as the financially sophisticated professionals of tomorrow’s economy. Finally, the gig economy and credit score will define future lending practices.