Most people assume that aggressively paying down student loans will automatically boost their credit score, but this approach can actually backfire in unexpected ways. The reality is that student loan debt management involves a complex web of credit reporting mechanics that can either strengthen or weaken your financial profile, depending on how you navigate them. To effectively tackle student loan debt, it’s important to understand the implications of your payment choices. Many people struggle to tackle student loan debt but don’t realize the impact of their payment timing.

What many borrowers don’t realize is that the timing of payments, the sequence of loan payoffs, and even the choice between consolidation and refinancing can create ripple effects across your entire credit report. Your payment history, credit mix, and account age all shift when you make strategic decisions about your student loans. The key lies in understanding how these moving parts work together, so you can tackle your debt while building the strong credit foundation you’ll need for future financial goals like buying a home or securing favorable interest rates. Understanding how to tackle student loan debt can significantly affect your financial future. If you are looking to tackle student loan debt, consider your options carefully. Many borrowers need guidance on how to tackle student loan debt effectively. Strategies to tackle student loan debt can include refinancing and payment planning.

Understanding the Credit Score Mechanics Behind Student Loan Payments

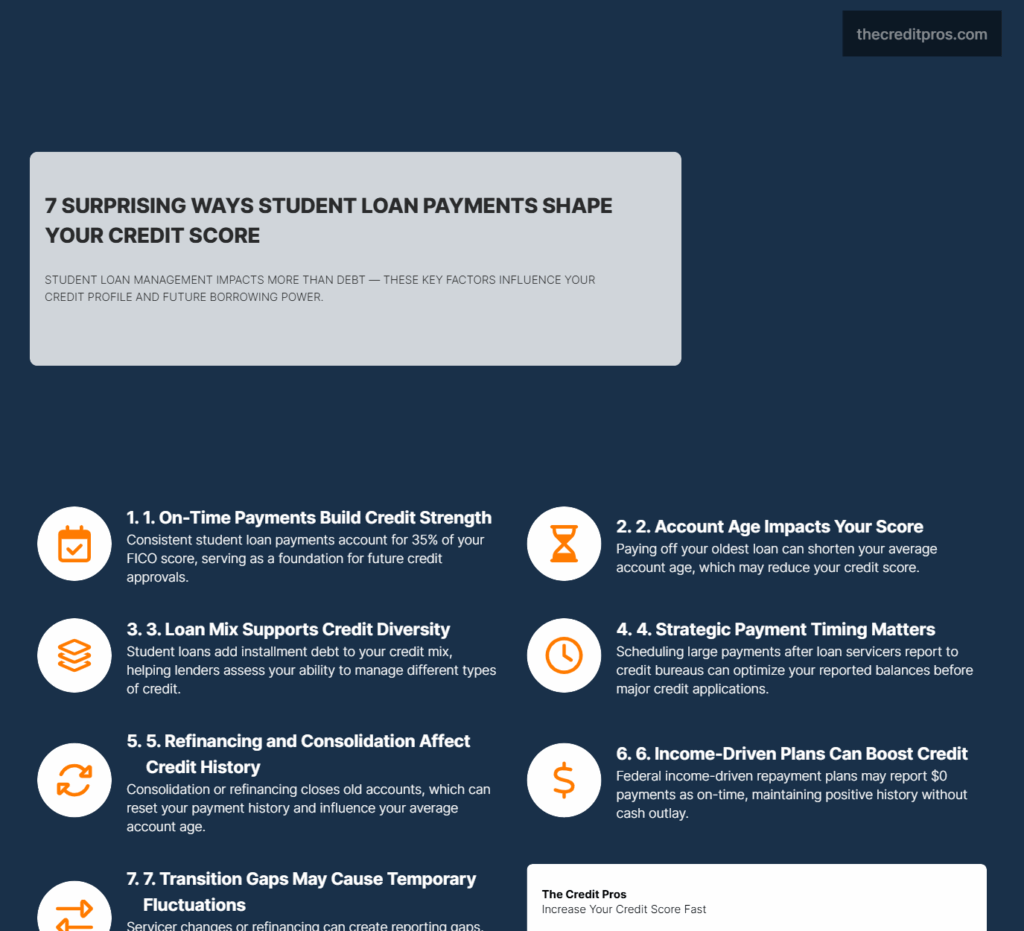

Student loan payment reporting operates on a complex system that directly influences your credit score calculations in ways most borrowers never consider. Credit bureaus receive payment information from loan servicers typically within 30 days of your payment due date, but the exact timing can vary significantly between federal and private loan servicers. This reporting schedule creates opportunities for strategic payment timing that can optimize your credit profile. It’s crucial to develop smart ways to tackle student loan debt while optimizing your credit. Taking steps to tackle student loan debt can improve your overall financial health.

The relationship between student loan payments and credit utilization extends beyond simple payment history. While student loans are installment debt rather than revolving credit, they contribute to your overall debt-to-income calculations that lenders evaluate. Your payment consistency on student loans establishes a foundation for creditworthiness that influences approval decisions for mortgages, auto loans, and credit cards. According to the Federal Reserve, total outstanding student loan debt in the United States exceeds $1.7 trillion, affecting many students’ ability to save, invest, and achieve other financial goals.

Understanding options to tackle student loan debt can provide peace of mind. Some strategies to tackle student loan debt may include income-driven repayment plans. By learning how to tackle student loan debt, you can avoid pitfalls. Moreover, knowing how to tackle student loan debt can prevent long-term financial issues. Finding effective ways to tackle student loan debt ensures a more secure financial future.

Ultimately, the goal is to tackle student loan debt while still maintaining credit health. It’s essential to have a plan to tackle student loan debt and use credit wisely. Developing a strategy to tackle student loan debt will empower you financially. To successfully tackle student loan debt, you may need to adjust your spending habits. Strategies to effectively tackle student loan debt should be tailored to your needs. Finding support to tackle student loan debt can also provide essential guidance.

Income-driven repayment plans create unique credit reporting scenarios that traditional repayment advice overlooks. When your calculated payment under an income-driven plan is $0, most federal loan servicers report this as a current, on-time payment to credit bureaus. This reporting can actually strengthen your credit profile by maintaining positive payment history without requiring actual cash outflow. However, the reduced payment amounts may not demonstrate the same debt management capability to future lenders who manually review your credit report.

As you learn to tackle student loan debt, remember to track your progress. Ultimately, tackling student loan debt requires a commitment to financial education. Furthermore, it’s important to understand that tackling student loan debt can take time. In summary, learning how to tackle student loan debt is a vital part of financial wellness.

The transition between loan servicers presents hidden credit risks that can temporarily impact your score. When federal loans transfer between servicers, there’s often a reporting gap where your payment history may appear inconsistent or incomplete. Private loan refinancing creates similar disruptions, as the original loan accounts close and new accounts open, potentially affecting your credit age calculations. Understanding these transition periods allows you to time major credit applications appropriately.

Strategic Payment Allocation to Maximize Credit Benefits

The sequence in which you pay off multiple student loans directly impacts your credit score through account closure and credit mix considerations. Paying off your oldest student loan first eliminates your longest-standing credit account, potentially reducing your average account age and lowering your credit score. Conversely, targeting newer loans or those with the highest interest rates may preserve your credit history length while reducing your overall interest burden.

Extra payment allocation requires careful consideration of credit reporting cycles to maximize score benefits. Most loan servicers report account balances to credit bureaus on a specific date each month, regardless of when you make payments. By timing large principal payments immediately after this reporting date, you can reduce your reported debt levels for the following month while maintaining positive payment history. This strategy becomes particularly valuable when you’re preparing for major credit applications like mortgages or auto loans.

The credit implications of maintaining small balances versus paying loans in full reveal counterintuitive optimization opportunities. Keeping a small balance on your oldest student loan preserves that account’s contribution to your credit history length and maintains your credit mix diversity. However, this approach must be balanced against the ongoing interest costs and the psychological burden of maintaining debt. The optimal strategy often involves maintaining one older loan with a minimal balance while aggressively paying down newer or higher-interest loans.

Automatic payment programs offer dual benefits that extend beyond the typical 0.25% interest rate reduction. These programs establish consistent, on-time payment history that strengthens your credit profile over time. More importantly, automatic payments reduce the risk of missed payments that could severely damage your credit score. However, you must maintain sufficient account balances to avoid overdraft fees, which can create additional financial stress and potentially impact your credit if bank fees go unpaid.

Navigating Refinancing and Consolidation Without Credit Damage

Student loan refinancing applications generate hard credit inquiries that can temporarily lower your credit score, but strategic inquiry management can minimize this impact. Credit scoring models typically treat multiple student loan inquiries within a 14-45 day window as a single inquiry, allowing you to shop rates aggressively without compounding credit damage. However, this protection only applies to inquiries for the same type of loan, so mixing student loan refinancing with other credit applications can multiply the negative impact.

The credit mix implications of consolidation extend beyond simple account closure considerations. Federal loan consolidation creates a new loan with a weighted average interest rate, but it also resets your payment history to zero on the new consolidated loan. This reset can temporarily reduce your credit score, particularly if your original loans had extensive positive payment histories. Private refinancing your student loans presents similar challenges, as you’re closing federal loan accounts and opening new private loan accounts, potentially altering your credit profile’s federal versus private debt composition.

Preserving credit history length during consolidation requires strategic planning around account closure timing. When you consolidate or refinance student loans, the original loan accounts typically close within 30-60 days of the new loan funding. This closure immediately impacts your credit utilization calculations and may affect your credit mix if student loans represent a significant portion of your credit accounts. The impact becomes more pronounced if you’re consolidating older loans that contribute significantly to your average account age.

The transition period between old and new loan servicers creates temporary credit reporting gaps that can confuse both automated credit scoring systems and manual underwriters. During this transition, your credit report may show both old and new loan accounts simultaneously, potentially inflating your apparent debt levels. Alternatively, there may be periods where no student loan accounts appear active, which can negatively impact your credit mix. Understanding these transition periods allows you to time major credit applications to avoid these temporary distortions.

Leveraging Forgiveness Programs While Building Credit Strength

Income-driven repayment plans create unique credit-building opportunities that traditional debt advice often overlooks. When your calculated payment under these plans is significantly lower than standard repayment amounts, you can allocate the difference toward building emergency savings or paying down higher-interest debt. This strategy improves your overall financial profile while maintaining positive student loan payment history at reduced cost.

Public Service Loan Forgiveness (PSLF) participation requires a 10-year commitment that spans critical credit-building years for many borrowers. During this period, maintaining consistent payment history on income-driven plans while building other aspects of your credit profile becomes essential. The relatively low payment amounts under income-driven plans can free up cash flow for building credit through other means, such as responsible credit card usage or establishing additional credit accounts.

Forbearance and deferment periods present both opportunities and risks for credit management. While these programs prevent negative payment history during financial hardship, they also pause the positive credit building that comes from consistent payments. Federal loan deferments typically report as current accounts in deferment status, which doesn’t hurt your credit but doesn’t help build positive payment history either. Private loan forbearance may report differently, potentially showing as missed payments if not properly documented.

The credit implications of $0 payments under income-driven plans extend beyond simple payment history considerations. These payments demonstrate debt management capability to some lenders while potentially raising questions about income stability for others. Manual underwriters may scrutinize income-driven payment plans more closely, particularly for mortgage applications where debt-to-income ratios are critical. Understanding how different lenders interpret these payment patterns helps you prepare appropriate documentation and explanations.

Building Credit Strength Through Strategic Debt Management

Student loan payment history serves as a foundation for broader credit improvement strategies that extend far beyond debt elimination. Consistent student loan payments demonstrate creditworthiness to lenders evaluating applications for mortgages, auto loans, and credit cards. This payment history becomes particularly valuable for borrowers with limited credit history, as student loans often represent their first major credit obligation and longest-standing credit account.

The debt-to-income ratio optimization process requires balancing aggressive student loan payments with maintaining healthy credit utilization across all accounts. While reducing student loan balances improves your debt-to-income ratio, maintaining some installment debt can actually benefit your credit mix. The optimal strategy often involves maintaining student loan payments while strategically managing credit card balances to optimize both debt-to-income ratios and credit utilization percentages.

Building additional credit accounts while managing student loan payments requires careful timing and strategic planning. Opening new credit accounts while carrying significant student loan debt can strain your debt-to-income ratio and potentially impact your ability to qualify for favorable terms. However, establishing a diverse credit mix through responsible credit card usage or other installment loans can strengthen your overall credit profile. The key lies in timing these additions to complement rather than compete with your student loan obligations.

The long-term credit benefits of maintaining student loans versus early payoff present a complex decision that depends on individual financial circumstances and goals. Keeping student loans active maintains credit mix diversity and preserves payment history length, both of which benefit your credit score. However, the psychological and financial benefits of debt elimination often outweigh these credit considerations. The decision ultimately depends on your broader financial goals, interest rates, and timeline for major credit applications like mortgages.

Strategic student loan management during the years leading up to major purchases like homes requires coordinating debt reduction with credit optimization. Mortgage lenders evaluate both debt-to-income ratios and credit scores, creating a complex optimization problem. Reducing student loan balances improves debt-to-income ratios but may impact credit scores if not managed carefully. The optimal approach often involves maintaining consistent payments while strategically reducing balances in the months leading up to mortgage applications.

The Bottom Line: Strategic Student Loan Management for Credit Success

The relationship between student loan payments and credit scores isn’t as straightforward as most borrowers assume. Strategic timing of payments, careful consideration of consolidation versus refinancing, and understanding how different repayment plans affect your credit profile can make the difference between building strong credit and inadvertently weakening it. Your payment history, credit mix, and account age all shift when you make decisions about your student loans, creating ripple effects that extend far beyond debt elimination.

The key to success lies in recognizing that aggressive debt payoff isn’t always the optimal strategy for your overall financial health. By understanding credit reporting mechanics, timing your payments strategically, and coordinating your student loan management with broader credit goals, you can tackle student loan debt while building the strong credit foundation you’ll need for future financial milestones. The most successful borrowers are those who view their student loans not just as debt to eliminate, but as powerful tools for building the creditworthiness that will serve them for decades to come.