Credit card rewards can feel like free money – until you realize your credit score has taken a hit from chasing those points and cashback percentages. You’re not alone if you’ve wondered whether that 5% cashback is worth it when your credit utilization jumps to 40% or if applying for that new travel card will hurt your score more than the signup bonus helps your wallet. The challenge isn’t just earning rewards; it’s doing so without accidentally sabotaging the very credit health that makes those premium cards accessible in the first place. Understanding smart credit card usage can help you maximize the benefits of credit cards while maintaining a healthy credit score. Effective smart credit card usage requires knowledge of various reward strategies and their impact on credit health.

What if you could maximize your rewards while actually improving your credit score? The key lies in understanding how reward strategies interact with credit scoring factors – and why conventional wisdom about credit card rewards often misses crucial details about utilization timing, payment strategies, and card selection. When you know which redemption methods can boost your credit utilization ratio and how to time your spending across multiple cards, you can build a system that serves both your rewards goals and your credit health simultaneously. Prioritizing smart credit card usage can lead to significant financial benefits down the line.

The Strategic Card Selection Framework: Beyond Rewards Rates

Selecting the right credit card requires analyzing how different reward structures impact your credit utilization calculations and overall credit health. Cashback cards typically offer more straightforward spending patterns that align better with maintaining low credit utilization ratios, while travel rewards cards often encourage concentrated spending that can spike your utilization percentages. The mathematical relationship between your credit limits and spending patterns becomes crucial when you’re trying to maximize rewards without triggering credit score penalties.

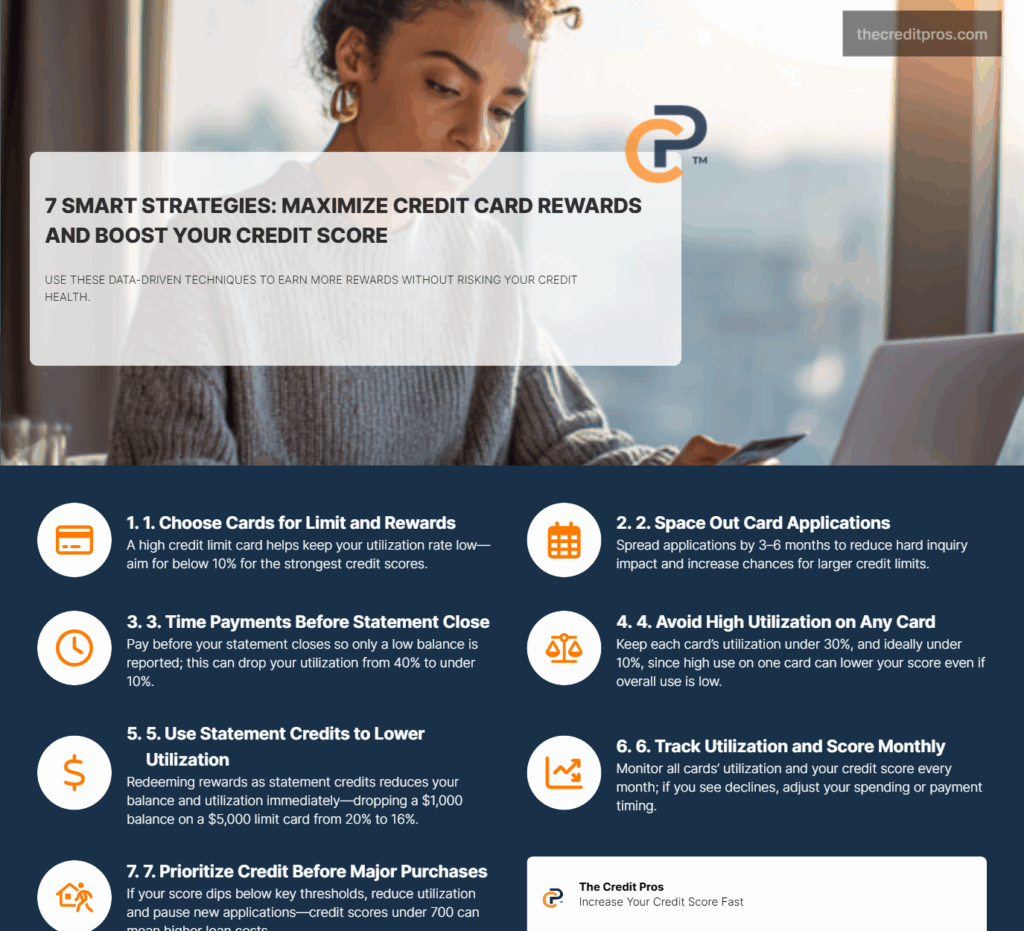

The timing of your card applications directly affects your ability to maintain optimal credit utilization across multiple cards. Hard inquiries from new applications temporarily lower your credit score, but the strategic acquisition of higher credit limits can actually improve your utilization ratio over time. You should space applications at least three to six months apart to minimize the cumulative impact on your credit score while building a portfolio of cards that complement each other’s reward structures.

When evaluating cards with different reward structures, consider how each card’s credit limit will integrate with your existing credit profile. A card with a $2,000 limit might offer excellent rewards rates, but if you typically spend $1,500 monthly on that card’s bonus categories, you’ll consistently maintain a 75% utilization ratio on that specific card. This high individual card utilization can negatively impact your credit score even if your overall utilization remains low across all cards. Smart credit card usage also involves knowing when to take advantage of promotional offers. By focusing on smart credit card usage, you can navigate the complexities of credit management effectively.

The approval odds for premium cards with higher credit limits often correlate with your existing credit utilization patterns. Card issuers evaluate your current utilization rates when determining credit limits, meaning that maintaining low utilization before applying can result in higher limits that provide more flexibility for reward optimization. This creates a strategic advantage where good credit habits directly enable better reward-earning potential. Effective financial management includes mastering smart credit card usage techniques.

Spending Consolidation Without Credit Utilization Penalties

The 30% credit utilization threshold represents a critical inflection point where credit scores begin to experience more significant negative impacts, but the optimal utilization rate for maximum credit scores typically falls below 10%. When consolidating spending to maximize rewards on a single card, you must calculate whether the increased utilization percentage will cost you more in credit score damage than you’ll gain in rewards value. This calculation becomes particularly complex when dealing with cards that have varying credit limits and reward structures. Incorporating smart credit card usage into your planning can lead to more effective financial outcomes.

Strategic payment timing allows you to maintain low reported utilization while maximizing your reward earnings through concentrated spending. Your statement balance determines what gets reported to credit bureaus, not your actual spending throughout the month. By making payments before your statement closing date, you can spend significantly more on rewards categories while maintaining a low reported utilization ratio. This technique requires careful tracking of statement closing dates across multiple cards to ensure optimal timing. With smart credit card usage, you can strategically manage your applications to improve your credit score.

The mathematics of optimal spending distribution across multiple cards involves calculating the marginal benefit of each additional dollar spent on rewards categories versus the credit score impact of increased utilization. For example, if you have three cards with limits of $5,000, $10,000, and $15,000, spending $1,000 on each card results in utilization rates of 20%, 10%, and 6.7% respectively. The card with the highest limit provides the most room for reward optimization without credit score penalties. Adopting smart credit card usage habits ensures your credit profile remains healthy while earning rewards.

Managing multiple cards while maintaining low individual utilization rates requires understanding that credit scoring models evaluate both overall utilization and individual card utilization. Even with a low overall utilization rate, having one card with high utilization can negatively impact your credit score. You should aim to keep individual card utilization below 30% and ideally below 10% for optimal credit score performance, which may require spreading rewards spending across multiple cards rather than concentrating on the highest-earning card. Smart credit card usage includes maintaining low utilization rates across all your cards.

Redemption Strategies That Protect Your Credit Profile

Statement credit redemptions directly reduce your card balance, which immediately improves your credit utilization ratio and can provide a measurable boost to your credit score. When you redeem $200 in cashback as a statement credit on a card with a $1,000 balance and $5,000 limit, your utilization on that card drops from 20% to 16%. This reduction in utilization can translate to credit score improvements that compound over time, making statement credits particularly valuable for credit-conscious reward earners. Utilizing smart credit card usage techniques can help you avoid penalties while maximizing rewards.

The timing of redemptions significantly impacts their credit benefits, with redemptions made before statement closing dates providing the maximum utilization improvement. If you redeem rewards after your statement closes but before your payment due date, the reduced balance won’t be reflected in your credit report until the following month. Strategic redemption timing allows you to maintain consistently low reported utilization while maximizing your reward earnings throughout each billing cycle. Ultimately, the goal of smart credit card usage is to earn while maintaining financial health.

Reward point transfers to airline and hotel partners don’t directly impact your credit utilization, but they can affect your relationship with card issuers and your ability to earn future rewards. Some issuers track redemption patterns and may view frequent transfers as less profitable customer behavior, potentially affecting future credit limit increases or retention offers. Additionally, transferred points typically can’t be recovered if you need to reduce card balances quickly, making them less flexible for credit management purposes. Embracing smart credit card usage means being proactive about your credit profile and rewards strategy.

Managing expired rewards without emergency spending requires proactive planning to avoid situations where you’re forced to make purchases that push your utilization above optimal levels. Many cardholders make the mistake of rushing to spend points before expiration, often resulting in unnecessary purchases that increase their credit utilization just to avoid losing rewards value. Instead, you should monitor expiration dates well in advance and plan redemptions that align with your normal spending patterns and credit utilization goals. Smart credit card usage is essential to balancing rewards with credit health.

Advanced Reward Optimization Techniques for Credit-Conscious Users

Bonus category spending can significantly impact your credit utilization calculations, particularly during quarters when rotating categories align with your largest expense categories. When a card offers 5% cashback on grocery stores and your monthly grocery spending is $800, concentrating this spending on a card with a $3,000 limit results in 26.7% utilization just from groceries. You must balance the reward earnings against the credit score impact, potentially spreading grocery spending across multiple cards or making mid-cycle payments to maintain optimal utilization. With a focus on smart credit card usage, you can build a stronger financial future.

Business credit cards offer a strategic advantage for reward optimization because most business cards don’t report to personal credit bureaus unless you default on payments. This separation allows you to maximize rewards on business spending without affecting your personal credit utilization ratios. However, you must qualify for business cards legitimately and maintain separate business and personal spending to maximize this strategy’s effectiveness. By practicing smart credit card usage, you can enhance your overall financial strategy.

The credit reporting differences between personal and business card usage create opportunities for advanced reward strategies that don’t impact personal credit scores. Business cards typically report only to business credit bureaus, meaning high utilization on business cards won’t affect your personal credit score. This allows you to pursue aggressive reward strategies on business cards while maintaining conservative utilization on personal cards for optimal credit score performance. Striving for smart credit card usage helps you keep your score in check while maximizing rewards.

Annual fee cards require careful management to maximize value without carrying balances that negate the fee’s worth. The key lies in calculating whether the additional rewards earned justify both the annual fee and any potential credit score impact from increased utilization. For cards with annual fees above $200, you typically need to earn significantly more in rewards to justify the cost, which often requires higher spending that can impact your credit utilization if not managed carefully. Incorporating smart credit card usage into your financial planning is a wise strategy for long-term success.

Strategic card retention and cancellation decisions affect both your reward earning potential and your credit score through their impact on your credit history length and available credit. Canceling a card reduces your total available credit, which can increase your overall utilization ratio even if your spending remains constant. However, keeping cards with high annual fees solely for credit score benefits may not be cost-effective if you’re not maximizing their reward potential. Ultimately, smart credit card usage enables you to earn rewards without compromising your credit health.

Long-Term Credit Health Monitoring While Maximizing Rewards

Creating comprehensive tracking systems requires monitoring both your reward earnings and credit score changes to identify when reward strategies begin negatively impacting your credit health. You should track monthly utilization rates across all cards, payment timing, and credit score fluctuations to establish baseline patterns. This data allows you to identify which reward strategies provide the best risk-adjusted returns and adjust your approach when credit scores begin declining. Effective smart credit card usage requires constant monitoring of both rewards and credit score changes.

Early warning signs that reward strategies are harming your credit include gradual credit score decreases over multiple months, despite maintaining good payment history. These decreases often result from creeping utilization increases as reward spending grows over time. You should also monitor for changes in credit limit increase approvals or retention offer values, as these can indicate that issuers view your account as higher risk due to utilization patterns. Smart credit card usage not only enhances your reward potential but also safeguards your credit score.

The relationship between reward card churning and credit score stability depends heavily on your existing credit profile and the frequency of applications. Each new card application results in a hard inquiry that temporarily lowers your credit score, but the long-term impact depends on how the new credit limits affect your overall utilization ratio. Churning strategies work best for individuals with established credit histories and low utilization rates who can absorb temporary score decreases. Implementing smart credit card usage strategies can lead to better redemption outcomes.

Building credit history while maximizing rewards from existing cards requires balancing account age with reward optimization. Keeping older cards active with small recurring charges helps maintain credit history length while allowing you to focus reward spending on newer cards with better earning rates. This approach maintains the credit score benefits of long account history while optimizing your reward earnings on current spending. To achieve smart credit card usage, track your spending and redemption patterns closely.

Recognizing when to prioritize credit building over reward maximization typically occurs when your credit score falls below thresholds needed for optimal lending rates or when you’re planning major purchases that require excellent credit. During these periods, you should focus on maintaining utilization below 10% and avoiding new credit applications, even if it means sacrificing some reward earnings. The long-term financial benefits of better lending rates often outweigh short-term reward losses. Engaging in smart credit card usage will help you develop a sustainable financial strategy.

Conclusion: Building Your Rewards Strategy for Long-Term Success

The essence of smart credit card usage is understanding how rewards and credit health are intertwined. The path to maximizing credit card rewards without sacrificing your credit score isn’t about choosing between financial benefits – it’s about understanding how they work together. Strategic card selection, optimal utilization management, and smart redemption timing create a framework where your reward earnings actually support your credit health rather than undermining it. Embracing smart credit card usage empowers you to achieve your financial goals efficiently. By maintaining utilization below 10%, timing payments strategically, and choosing cards that complement your spending patterns, you can build a sustainable system that serves both your immediate reward goals and your long-term credit objectives. Planning for smart credit card usage can help you avoid unnecessary spending and maximize your benefits.

Smart credit card usage is key to achieving a balance between earning rewards and maintaining a good credit score. The conventional wisdom that treats credit card rewards as separate from credit health misses the fundamental truth: your credit score is the foundation that makes premium rewards accessible in the first place. Ultimately, smart credit card usage is about making informed choices for financial success. When you approach rewards with a credit-conscious mindset, you’re not just earning points and cashback – you’re building the financial credibility that unlocks better cards, higher limits, and more lucrative opportunities. The question isn’t whether that 5% cashback is worth a credit score hit; it’s whether you’re sophisticated enough to earn the rewards while making your credit score stronger. In conclusion, effective smart credit card usage can lead to a more rewarding financial journey.