Your FICO score calculation gives payment history a commanding 35% weight—more than any other factor. Yet most people think they understand payment history when they only see the surface level of “pay on time, avoid late payments.” This oversimplified view misses the intricate mechanics that actually drive your score up or down, including the role of payment history in credit scores. Understanding payment history in credit scores is essential for effective credit management.

What if the timing of your payments matters more than their consistency? What if certain types of late payments barely register while others crater your score for years? The reality is that payment history operates on multiple layers of complexity that most consumers never discover. From the mathematical differences between a 30-day late payment on your mortgage versus your credit card, to how the “recency effect” can make your last two years of payment behavior override decades of history, understanding these hidden dynamics, including the impact of payment history in credit scores, can mean the difference between rebuilding your credit in months versus years. Furthermore, the significance of payment history in credit scores cannot be overstated. It is crucial that consumers familiarize themselves with how payment history in credit scores affects their overall financial standing.

The Hidden Mechanics of Payment History Calculation

The nuances of payment history in credit scores play a vital role in determining your financial options. Each missed payment can severely impact the overall score, making it imperative to prioritize on-time payments. Additionally, the understanding of payment history in credit scores can empower consumers to make informed decisions and avoid pitfalls that could jeopardize their creditworthiness.

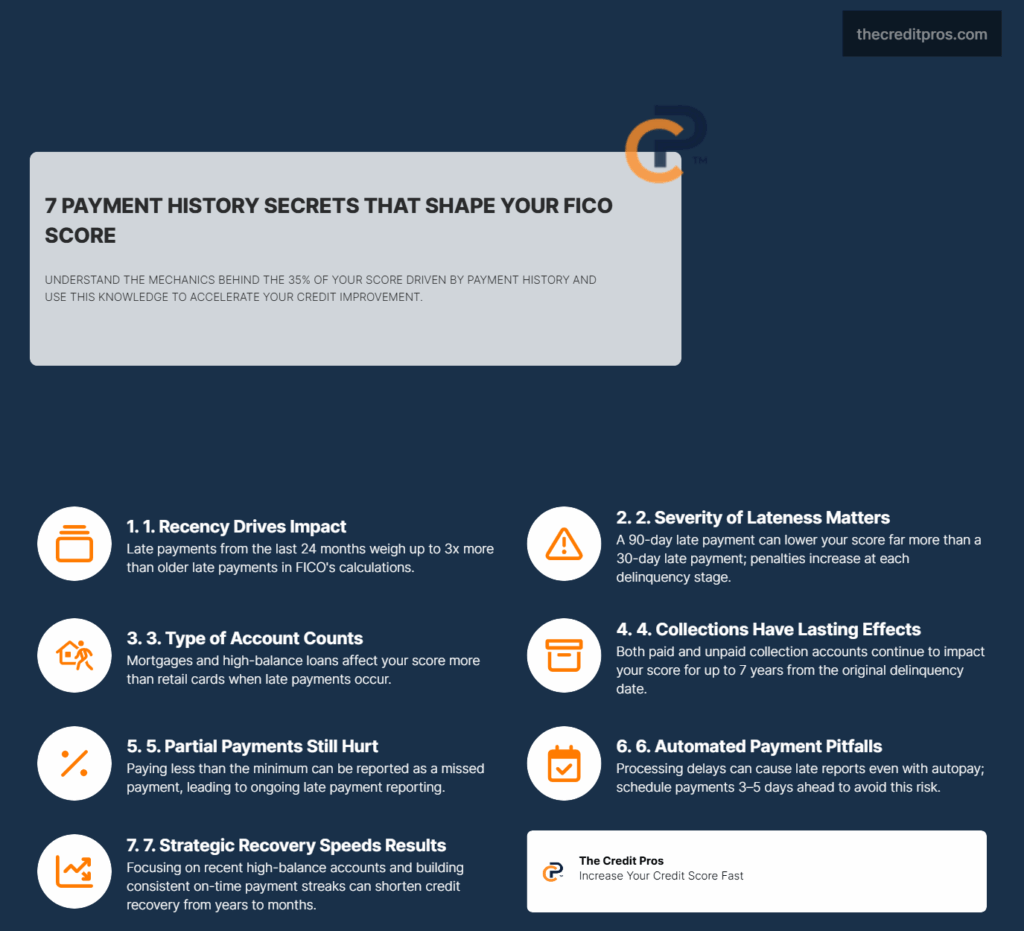

Payment history calculation operates through a sophisticated algorithmic framework that extends far beyond simple on-time versus late payment tracking. FICO scoring models employ a graduated penalty system where 30-day late payments trigger initial score reductions, 60-day delinquencies compound the damage, and 90-day or longer delinquencies create substantial score deterioration. The mathematical progression isn’t linear—each escalation in lateness severity creates disproportionately larger negative impacts on your credit score, underscoring the importance of payment history in credit scores.

The recency effect fundamentally reshapes how payment history influences your score calculation. Payment behavior from the most recent 24-month period carries approximately three times more weight than equivalent payment patterns from earlier years. This mathematical weighting means that consistent positive payment patterns over the past two years can effectively overshadow sporadic late payments from five or six years ago, creating opportunities for accelerated credit rehabilitation that most consumers never recognize.

Account-specific payment history weighting reveals another layer of complexity in score calculation. Mortgage loans carry enhanced significance in payment history calculations due to their secured nature and higher dollar amounts, while retail store credit cards often receive reduced weighting despite appearing identical on credit reports. Installment loans like auto financing occupy a middle ground, with their payment history impact varying based on the loan amount and your overall credit profile composition. It’s also important to recognize how payment history in credit scores shapes the financial landscape, influencing interest rates and loan approvals. With the right knowledge of payment history in credit scores, individuals can repair and improve their credit profiles over time.

Beyond Late Payments: The Subtle Payment History Factors

Collection accounts create persistent payment history complications that extend well beyond their initial placement. Even after full payment, collection accounts continue reporting their original delinquency status, maintaining negative payment history impacts for the full seven-year reporting period. The distinction between “paid collection” and “unpaid collection” status provides minimal score improvement, as the underlying payment failure remains the primary scoring factor rather than the resolution method.

The implications of payment history in credit scores extend beyond mere scoring; they can affect your access to various financial products and services. Moreover, understanding how payment history in credit scores is evaluated by lenders can help you navigate the borrowing process more effectively. This knowledge allows for better management of payment history in credit scores, ultimately leading to improved credit outcomes.

Partial payments generate unique reporting consequences that many consumers encounter without understanding their implications. When you make payments below the minimum required amount, creditors often report these as missed payments despite receiving some payment. This reporting practice can create situations where consistent partial payments result in continuous late payment reporting, compounding negative payment history impacts over multiple reporting cycles.

Medical collections operate under different payment history dynamics compared to traditional consumer debt collections. Recent FICO scoring model updates reduce the impact of paid medical collections, and many medical collections under $500 no longer influence credit scores. However, unpaid medical collections still create significant payment history damage, and the transition from medical provider to collection agency often occurs without clear consumer notification, creating unexpected credit score deterioration.

“Payment history shows how you’ve paid your accounts over the length of your credit. This evidence of repayment is the primary reason why payment history makes up 35% of your score and is a major factor in its calculation.”

The “zombie debt” phenomenon affects payment history through settled or charged-off accounts that continue reporting negative payment patterns. When creditors settle debts for less than the full amount, the original account typically receives a “settled for less than owed” designation while maintaining its historical late payment reporting. This dual negative impact—both the settlement notation and the underlying payment history—creates lasting score suppression that persists until the account ages off your credit report.

Strategic Payment History Recovery Timeline and Rehabilitation

The seven-year reporting lifecycle operates on a month-by-month basis rather than anniversary years, creating opportunities for strategic payment history rehabilitation timing. Negative payment history items begin their countdown from the original delinquency date, not from when the account was closed or sent to collections. Understanding this timeline allows you to predict when specific negative items will naturally fall off your credit report, enabling coordinated credit rebuilding strategies.

Consistent positive payment patterns create compounding benefits that accelerate beyond simple time-based score recovery. Each month of on-time payments strengthens your recent payment history while simultaneously pushing older negative items further into the historical weighting categories. This dual effect means that 18-24 months of perfect payment history can often restore credit scores to levels that would otherwise require 4-5 years of natural aging.

Managing multiple delinquent accounts requires strategic prioritization based on payment history impact potential. Focus your rehabilitation efforts on accounts with the highest balances and most recent activity first, as these provide the greatest score improvement potential per dollar invested. Smaller collection accounts or older delinquencies often provide minimal score benefits when addressed, making them lower priorities in comprehensive payment history rehabilitation strategies.

Strategic Payment History Rehabilitation Priorities:

- Current accounts with recent late payments (highest impact potential)

- High-balance installment loans or mortgages with delinquencies

- Credit cards with ongoing late payment reporting

- Recent collection accounts under 12 months old

- Older collection accounts or charged-off debts (lowest priority)

Goodwill letter strategies demonstrate varying effectiveness across different creditor types and organizational structures. Large national banks typically maintain rigid policies that prevent payment history adjustments regardless of circumstances, while smaller regional institutions and credit unions often retain discretionary authority to make goodwill adjustments. The key lies in understanding each creditor’s corporate structure and targeting your efforts toward institutions with decision-making flexibility at the customer service level.

Payment History Optimization in Modern Credit Systems

Automated payment systems create unexpected payment history complications despite their intended protective benefits. Payment processing delays, account closure timing, and weekend processing schedules can cause automated payments to post after due dates, generating late payment reports even when sufficient funds were available. The solution involves setting automated payments for amounts slightly above minimum requirements and scheduling them 3-5 days before actual due dates to accommodate processing variations.

The impact of payment history in credit scores is profound, influencing future borrowing capabilities and financial opportunities. Ultimately, mastering the intricacies of payment history in credit scores can be the key to financial success and stability. Credit utilization timing intersects with payment history in ways that affect how creditors perceive your financial responsibility. When you carry high balances that require minimum payments near your credit limits, even on-time payments can appear as financial stress indicators to sophisticated scoring algorithms. Optimal payment history reporting occurs when you maintain low utilization ratios while making payments that exceed minimum requirements, demonstrating both payment reliability and financial capacity.

The payment posting window varies significantly across creditor types and can impact your credit reporting cycles in unexpected ways. Credit card companies typically report account status to credit bureaus on your statement closing date rather than your payment due date, creating a potential disconnect between your payment timing and what appears on your credit report. Understanding each creditor’s reporting schedule allows you to optimize payment timing for maximum positive payment history impact.

Alternative payment data integration represents an emerging opportunity for payment history enhancement through previously unreported payment streams. Rent reporting services, utility payment tracking, and subscription service payments can now contribute to your payment history through specialized reporting agencies. However, these services typically only report positive payment patterns, meaning missed rent or utility payments won’t appear on your credit report through these channels.

Advanced Payment History Strategies for Long-Term Credit Health

Building redundancy in your payment history across different account types creates resilience against individual account problems while demonstrating comprehensive financial responsibility. Maintaining active payment histories across credit cards, installment loans, and potentially mortgage accounts provides multiple positive payment streams that can offset isolated payment difficulties. This diversification strategy proves particularly valuable during financial stress periods when you might struggle with specific payment categories.

The compound effect of payment history strength extends beyond direct score calculation into other credit factors through creditor behavior modifications. Consistent positive payment history often triggers automatic credit limit increases, which improve your credit utilization ratios without requiring new account applications. Additionally, strong payment history makes you eligible for promotional interest rates and enhanced account terms that can improve your overall financial position. A solid grasp of payment history in credit scores not only helps in score optimization but also enhances overall financial literacy.

Payment history consistency influences creditor risk assessment during credit applications and account reviews in ways that extend beyond credit score numbers alone. Underwriters specifically examine payment pattern regularity, looking for seasonal variations, payment amount consistency, and payment timing reliability. Demonstrating clockwork-like payment consistency often overcomes credit score deficiencies during manual underwriting processes, particularly for mortgage and auto loan applications.

Creating strategic payment dates across your various accounts can optimize your credit reporting cycles for maximum positive impact. By spacing payment due dates throughout the month, you ensure consistent positive payment reporting across multiple reporting cycles while avoiding the cash flow pressure of concentrated payment obligations. This approach also provides natural backup opportunities if you encounter temporary payment difficulties with specific accounts. Thus, make it a priority to educate yourself on payment history in credit scores; it’s a vital part of your financial journey.

The relationship between payment history strength and credit limit increases creates opportunities for accelerated credit profile improvement through positive feedback loops. Strong payment history typically leads to credit limit increases, which improve utilization ratios and create additional positive payment opportunities. These enhanced credit profiles then qualify for premium credit products with better terms, further strengthening your overall credit ecosystem and providing additional payment history diversification opportunities.

Conclusion: Mastering Payment History’s Hidden Complexity

Payment history in credit scores holds a 35% weight in your FICO score calculation, operating through intricate mechanisms that extend far beyond simple on-time payment tracking. The recency effect, account-specific weighting, and graduated penalty systems create opportunities for strategic credit rehabilitation that most consumers never discover. Understanding these hidden dynamics—from the mathematical differences between mortgage and credit card late payments to how consistent positive patterns can overshadow years of negative history—transforms payment history in credit scores from a passive credit factor into an active tool for score optimization.

The timing, consistency, and strategic coordination of your payments across different account types can accelerate your credit recovery from years to months. Whether you’re navigating collection accounts, optimizing automated payment systems, or building redundancy across multiple credit streams, the sophisticated algorithms governing payment history in credit scores reward those who understand their complexity. Payment history in credit scores isn’t just a record of past behavior—it’s a dynamic system that responds to strategic manipulation, and those who master its hidden mechanics hold the key to rapid credit transformation.