Economic downturns don’t just threaten your income—they create a web of hidden credit risks that most people never see coming. While you’re focused on making ends meet, lenders are quietly reducing credit limits, closing accounts, and tightening their approval standards, often catching responsible borrowers completely off guard. Your perfect payment history might not protect you from these behind-the-scenes changes that can damage your credit score through no fault of your own. To effectively protect credit during economic downturns, it’s crucial to stay informed and proactive. To successfully protect credit during economic downturns, consider reviewing your credit report regularly for any discrepancies. Learning how to protect credit during economic downturns also requires understanding the changes in credit scoring models.

What makes this situation particularly challenging is that traditional credit advice falls short during economic stress. The standard “pay your bills on time” guidance doesn’t account for the complex decisions you face when resources are limited, or the sophisticated fraud schemes that emerge during financial uncertainty. Understanding how to navigate these unique pressures—from strategic payment timing to recognizing early warning signs in your credit reports—can mean the difference between financial recovery and long-term credit damage. The key lies in knowing which protective measures actually work when the economy shifts against you. Many consumers overlook the importance of strategies to protect credit during economic downturns.

The Hidden Credit Vulnerabilities That Surface During Economic Stress

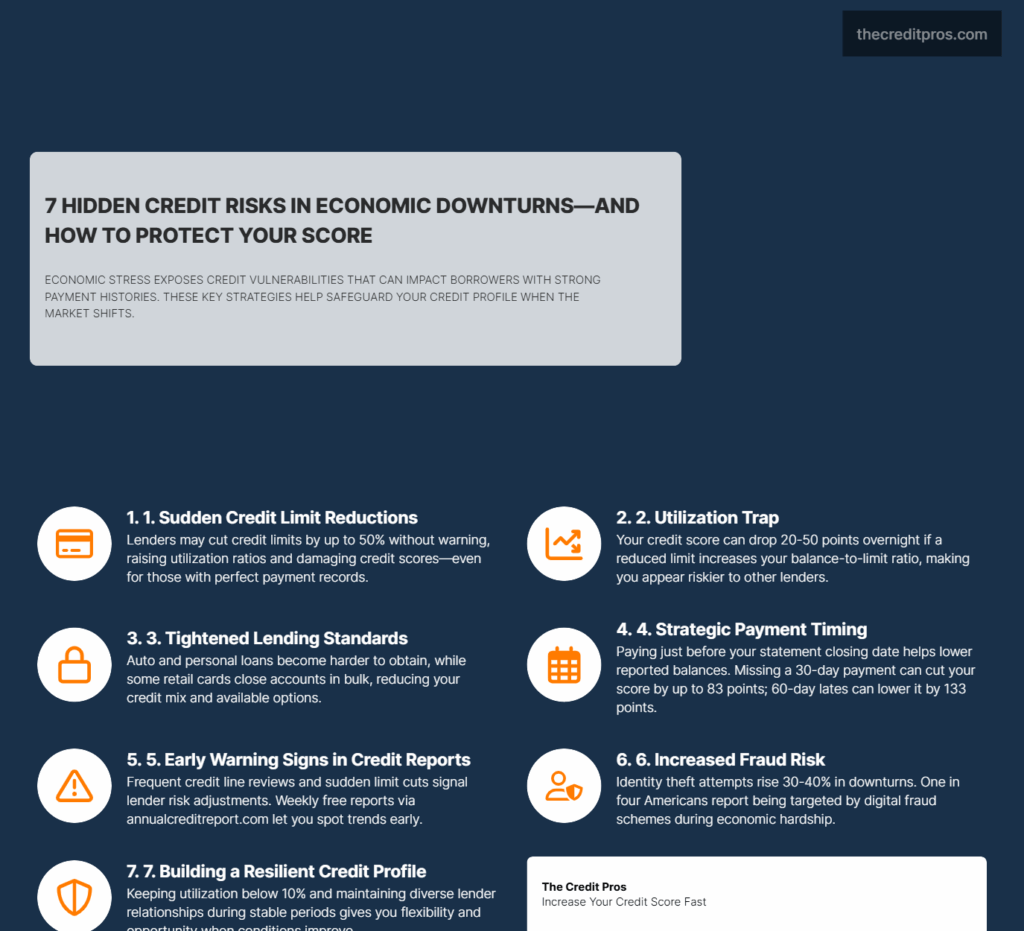

Therefore, it is essential to plan how to protect credit during economic downturns. Understanding these vulnerabilities can help you to better protect credit during economic downturns. Economic downturns expose credit weaknesses that remain invisible during stable financial periods. Lenders systematically reduce credit limits across their portfolios as risk management protocols activate, often targeting accounts based on geographic regions, employment sectors, or spending patterns rather than individual payment history. This practice, known as “defensive lending,” can slash available credit by 30-50% without warning, immediately increasing utilization ratios for cardholders who previously maintained healthy credit profiles.

It’s wise to implement a proactive approach to protect credit during economic downturns. Utilizing the correct strategies can significantly help to protect credit during economic downturns. Paying close attention to your credit utilization will help you to protect credit during economic downturns. By taking specific actions to protect credit during economic downturns, you can mitigate the risks that come with financial instability and ensure your credit remains intact. These guidelines can help you to protect credit during economic downturns effectively.

The cascading effects of reduced credit availability create a utilization trap that catches even the most disciplined borrowers. When your credit limit drops from $10,000 to $6,000 while your balance remains at $2,000, your utilization jumps from 20% to 33% overnight. This sudden spike can trigger credit score drops of 20-50 points, creating a downward spiral where other lenders view you as higher risk and implement their own defensive measures. The interconnected nature of credit reporting means that one lender’s risk adjustment becomes every lender’s concern.

Credit mix deterioration compounds these challenges as certain types of credit become unavailable during economic stress. Auto loans tighten qualification standards, personal loans disappear for all but the highest-tier borrowers, and retail credit cards close accounts en masse. This reduction in credit diversity signals to scoring models that your credit profile has become less stable, even when your payment behavior remains consistent. The psychological weight of financial uncertainty often leads to decision-making patterns that prioritize immediate relief over long-term credit health, creating behavioral changes that credit algorithms interpret as increased risk indicators.

Strategic Payment Prioritization: Beyond the Minimum Payment Mindset

It’s vital to remember how to protect credit during economic downturns to avoid long-term issues. Payment timing strategies become crucial when cash flow constraints force difficult choices between creditors. The credit reporting calendar operates on specific cycles that create windows of opportunity for strategic payment allocation. Most lenders report to credit bureaus once monthly, typically on the same date each month, creating a predictable pattern you can leverage. Making payments just before your statement closing date ensures lower reported balances, while payments made immediately after reporting have minimal immediate impact on your credit profile.

Another strategy to protect credit during economic downturns involves maintaining low debt-to-income ratios. Addressing credit issues promptly can help to protect credit during economic downturns. Being proactive can go a long way in helping to protect credit during economic downturns. The severity gradient of late payment reporting creates a strategic framework for payment prioritization during resource constraints. A 30-day late payment typically reduces credit scores by 17-83 points depending on your starting score, while 60-day lates can drop scores by 27-133 points. The 90-day threshold often triggers automatic account reviews and potential closures, making this the critical line to avoid crossing. Understanding these thresholds allows you to allocate limited resources toward preventing the most damaging reporting scenarios.

Taking action now can also help you protect credit during economic downturns. In addition to monitoring, you should also know how to protect credit during economic downturns. Understanding these risks can enhance your ability to protect credit during economic downturns effectively. Forbearance and deferment programs carry hidden credit implications that vary significantly between lenders and loan types. Federal student loan forbearance typically reports as current during the accommodation period, while private lender programs may report as “paying under partial payment agreement” or similar designations that can impact your credit profile. Mortgage forbearance under government programs generally maintains positive reporting status, but private mortgage servicers may use different reporting codes that signal distress to other lenders.

Moreover, knowing how to protect credit during economic downturns can provide you with peace of mind. Finally, remember to continuously seek ways to protect credit during economic downturns. Your knowledge of how to protect credit during economic downturns can empower your financial decisions. Actively working to protect credit during economic downturns is essential for your financial stability.

- Payment Strategy Hierarchy During Financial Stress:

- Mortgage payments (highest impact on overall financial stability)

- Secured debt payments (auto loans, secured credit cards)

- Unsecured revolving credit (credit cards with lowest utilization impact)

- Personal loans and unsecured installment debt

- Medical debt and collection accounts (lowest immediate credit impact)

Proactive Credit Monitoring as Economic Intelligence

Credit report analysis reveals economic trends before they appear in traditional financial news. Increased inquiry activity from employers conducting background checks often precedes layoff announcements, while sudden credit limit reductions across multiple accounts signal broader industry tightening. The expanded weekly credit report access through annualcreditreport.com during economic uncertainty provides unprecedented visibility into these patterns, allowing you to anticipate and prepare for changes before they impact your financial planning.

Lender behavior modifications appear in credit reports through subtle changes in account management practices. Credit line reviews increase in frequency, promotional rate periods shorten, and new account approvals shift toward more conservative terms. These changes reflect internal risk assessment adjustments that precede public announcements of tightened lending standards. Monitoring these shifts across your credit profile provides early warning signals about broader market conditions affecting your access to credit.

“With nearly two-thirds of Americans feeling financial strain due to the COVID-19 pandemic, it’s an important time to take an active role in our finances,” according to TransUnion’s Consumer Financial Hardship Study. The correlation between credit score fluctuations and economic recovery phases creates predictable patterns that informed consumers can leverage. Credit scores typically lag economic indicators by 3-6 months, meaning that recovery preparations should begin before traditional economic metrics show improvement. Understanding this timing allows you to position yourself for post-recession opportunities by maintaining credit health during the downturn and preparing applications for when lending standards begin to relax.

Identity theft attempts increase by 30-40% during economic downturns as fraudsters exploit the chaos and desperation that accompany financial stress. Credit monitoring becomes your first line of defense against these opportunistic attacks, with unusual inquiry patterns, new account openings, or address changes serving as immediate red flags. The intersection of legitimate financial assistance programs and fraudulent schemes creates a complex landscape where vigilant monitoring becomes essential for distinguishing between authorized and unauthorized activity.

Advanced Fraud Protection During Economic Vulnerability

Economic downturns create optimal conditions for synthetic identity fraud, where criminals combine real and fabricated information to create new identities that can pass initial verification processes. These schemes particularly target individuals experiencing financial stress, using their legitimate personal information as the foundation for fraudulent credit applications. The desperation accompanying economic hardship makes consumers more susceptible to sharing personal information in exchange for promised financial relief, creating opportunities for sophisticated fraud operations.

Strategic deployment of credit protection tools requires understanding the specific threat landscape during economic stress. Credit freezes provide maximum protection but can impede legitimate financial assistance applications, while fraud alerts offer notification without blocking access entirely. The decision between these tools depends on your immediate credit needs and risk tolerance. Active job seekers may choose fraud alerts to avoid delays in employment background checks, while those not seeking new credit can implement comprehensive freezes across all three credit bureaus.

Government assistance programs create new vulnerabilities as fraudsters develop schemes around stimulus payments, unemployment benefits, and small business loans. These programs often require personal information that criminals can exploit for identity theft, while the urgency surrounding financial relief can override normal caution. The legitimate need for financial assistance must be balanced against the increased fraud risk, requiring careful verification of program authenticity and secure handling of required documentation.

“A quarter of Americans know they’ve been targets of digital fraud schemes related to COVID-19” according to the TransUnion Consumer Financial Hardship study.

Layered security approaches provide comprehensive protection without impeding legitimate financial recovery efforts. This strategy combines credit monitoring, fraud alerts, and selective credit freezes based on immediate needs and risk assessment. The key lies in maintaining enough flexibility to access legitimate opportunities while creating sufficient barriers to prevent unauthorized access. Regular review and adjustment of these protective measures ensures they remain aligned with changing circumstances and threat levels.

Building Credit Resilience for Future Economic Cycles

Credit utilization buffer creation requires strategic planning during stable economic periods to provide flexibility when income disruptions occur. Maintaining utilization below 10% during normal times creates a safety margin that allows for temporary balance increases without triggering significant credit score damage. This approach recognizes that economic stress often forces increased reliance on credit for basic expenses, making low baseline utilization a critical protective factor.

Positive payment history accumulation during stable periods creates credit score momentum that provides resilience during temporary difficulties. Credit scoring models weight recent payment history more heavily, but long-term patterns create a foundation of creditworthiness that can withstand short-term disruptions. The strategic timing of major purchases and credit applications during stable periods maximizes the protective value of positive payment history when economic conditions deteriorate.

Post-recession lending opportunities often favor borrowers who maintained credit health during economic stress, creating competitive advantages for those who successfully navigated the downturn. Lenders typically emerge from economic stress with pent-up demand for qualified borrowers, leading to improved terms and increased availability for consumers with strong credit profiles. Understanding these cycles allows you to position your credit profile to capitalize on improved lending conditions as they emerge.

Relationship diversification across multiple lenders provides insurance against individual institution policy changes during market stress. Banks, credit unions, and online lenders each respond differently to economic pressure, with some tightening standards while others maintain or even expand lending to gain market share. Maintaining active relationships with various lender types ensures continued access to credit when individual institutions implement defensive strategies. This diversification strategy requires ongoing account management but provides crucial flexibility during periods of market uncertainty.

Turning Credit Protection Into Financial Advantage

Economic downturns don’t just test your financial resilience—they reveal the fundamental difference between reactive crisis management and proactive credit strategy. The hidden vulnerabilities that surface during market stress, from defensive lending practices to sophisticated fraud schemes, create a complex landscape where traditional advice falls short. Your ability to navigate these challenges depends on understanding the interconnected nature of credit systems and implementing strategic protections before they’re needed.

The key to financial success during challenging times is to protect credit during economic downturns.