Personal loans occupy a unique position in the credit scoring ecosystem that many people don’t fully understand. While most borrowers think of them simply as a way to access quick cash, these financial tools can actually serve as powerful credit-building instruments when used strategically. The relationship between personal loans and credit scores isn’t straightforward – the same loan that devastates one person’s credit profile might significantly improve another’s, depending on timing, existing credit mix, and management approach. Understanding the role of personal loans in credit score management is essential for borrowers aiming to enhance their financial health. Utilizing personal loans in credit score management can help to strategically improve your credit profile. Engaging with personal loans in credit score management can lead to better financial health.

What makes personal loans particularly interesting is their ability to address multiple credit score factors simultaneously. They can instantly diversify your credit portfolio, reduce dangerous credit card utilization rates, and create new opportunities for positive payment history. But here’s what most people miss: the impact isn’t immediate, and the benefits only materialize under specific conditions. The difference between a credit score boost and a credit score disaster often comes down to understanding these nuanced timing strategies and avoiding common management mistakes that can quickly turn a helpful tool into a financial liability.

Many individuals overlook how personal loans in credit score management provide a means to establish and diversify their credit mix. This is why personal loans in credit score management can be beneficial if managed properly. Incorporating personal loans in credit score management allows borrowers to assess their financial standing without penalties. By carefully timing personal loans in credit score management, borrowers can optimize their financial portfolios. Utilizing personal loans in credit score management effectively can lead to lasting credit improvements.

The Timing Strategy: When Personal Loans Become Credit Score Catalysts

Strategic timing transforms personal loans from simple financial products into sophisticated credit score enhancement tools. The most effective approach involves understanding the intricate relationship between application timing and existing credit account aging patterns. Credit scoring algorithms evaluate account age as a stability indicator, with older accounts contributing more significantly to your overall credit profile strength. Understanding the nuances of personal loans in credit score management can unlock new opportunities.

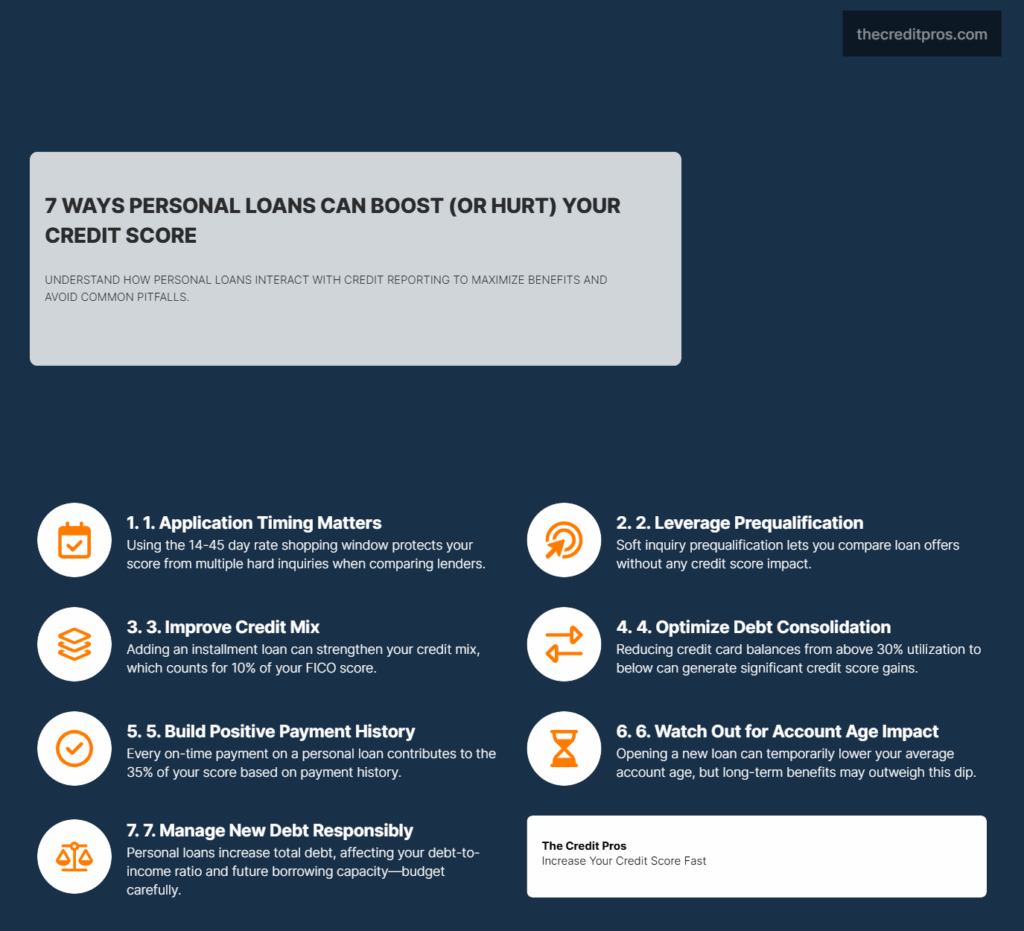

The 14-45 day rate shopping window represents one of the most underutilized protective mechanisms in credit management. During this period, multiple hard inquiries for the same type of installment loan consolidate into a single inquiry impact on your credit score. This protection allows you to compare offers from numerous lenders without accumulating multiple credit score penalties that would otherwise compound over time. Personal loans in credit score management empower borrowers to take charge of their finances.

Prequalification processes using soft inquiries provide superior strategic advantages over traditional hard inquiry approaches. These preliminary assessments allow you to evaluate potential loan terms and approval likelihood without triggering any credit score impact. The ability to shop extensively through soft inquiries means you can identify the most favorable terms before committing to a hard inquiry, maximizing your chances of approval while minimizing credit score disruption. Personal loans in credit score management can help create a solid foundation for future credit applications. Applying personal loans in credit score management can also assist in reducing overall credit utilization ratios.

The compound effect of timing personal loans with existing account aging patterns requires careful consideration of your current credit portfolio’s maturity. Introducing a new account when your existing accounts are approaching significant age milestones can dilute the average account age calculation. However, when timed strategically during periods of credit utilization stress or when your credit mix lacks installment loan diversity, the benefits often outweigh the temporary age dilution effects. Consequently, personal loans in credit score management serve as pivotal financial instruments.

The Credit Mix Optimization: Beyond Simple Diversification

Credit mix optimization extends far beyond simple account diversification to encompass strategic portfolio construction that demonstrates comprehensive credit management capabilities. The 10% credit mix factor carries amplified importance for individuals with limited credit histories, where each account type represents a larger percentage of the overall credit evaluation. This factor becomes particularly crucial when your credit profile consists primarily of revolving credit accounts like credit cards.

The fundamental distinction between revolving credit and installment loans lies in their repayment structures and risk assessment profiles. Revolving credit allows variable monthly payments and ongoing borrowing against available limits, while installment loans require fixed monthly payments toward a predetermined balance. Credit scoring algorithms evaluate these payment patterns differently, with installment loans demonstrating your ability to manage structured, long-term financial commitments. To fully harness the benefits of personal loans in credit score management, one must follow consistent practices.

Credit mix improvements typically show delayed but sustained score benefits, often taking 30-60 days to fully manifest in your credit reports. This delayed response occurs because credit scoring models require time to evaluate the new account’s payment behavior and its integration with your existing credit management patterns. The sustained nature of these benefits means that once established, a well-diversified credit mix continues contributing positively to your score over time. Overall, the integration of personal loans in credit score management is crucial for long-term financial stability.

Lenders evaluate installment loan experience as evidence of your ability to manage different types of financial obligations successfully. This evaluation extends beyond simple payment history to encompass your capacity for financial planning, budgeting discipline, and long-term commitment adherence. The psychological and algorithmic differences between secured and unsecured debt management reflect varying risk levels, with unsecured personal loans demonstrating higher creditworthiness due to the absence of collateral backing.

The Debt Consolidation Paradox: Strategic Balance Sheet Restructuring

Ultimately, mastering personal loans in credit score management leads to better financial outcomes for individuals. The mathematical relationship between credit utilization reduction and score improvement follows a non-linear progression that creates exponential benefits at specific thresholds. When credit card balances exceed 30% of available limits, each percentage point reduction generates increasingly significant score improvements. This threshold effect means that using a personal loan to reduce utilization from 80% to 25% produces dramatically more score enhancement than a reduction from 40% to 35%.

Consolidating high-interest credit card debt through personal loans creates a payment history advantage by establishing a new positive payment stream while simultaneously reducing the risk of missed credit card payments due to high minimum payment requirements. The fixed payment structure of personal loans provides predictable monthly obligations that facilitate better budgeting and payment consistency compared to variable minimum payments on high-balance credit cards. The ongoing evaluation of personal loans in credit score management can lead to enhanced financial outcomes.

“Using a personal loan for debt consolidation—specifically, applying funds borrowed at a relatively low interest rate to pay down higher-interest credit card debt—could improve your credit scores.”

The temporary score dip following personal loan origination typically lasts 30-90 days before the long-term improvement trajectory begins. This initial decline results from the hard inquiry impact and the reduction in average account age. However, the subsequent improvement phase often produces score gains that exceed the initial temporary reduction, particularly when the loan successfully reduces credit utilization below critical thresholds. Incorporating personal loans in credit score management into your financial strategies is essential.

Strategic approaches to maintaining low utilization after consolidation require disciplined spending management and systematic credit card balance monitoring. The most effective strategy involves:

Ultimately, personal loans in credit score management can facilitate significant improvements if used wisely.

- Setting up automatic payments for both the personal loan and any remaining credit card balances

- Implementing spending alerts to prevent credit card balance accumulation

- Establishing a monthly credit utilization review process

- Creating emergency fund reserves to prevent future high-balance situations

The 1-2 month reporting lag between debt consolidation actions and credit score improvements requires careful expectation management during the transition period. Credit card companies typically report balance updates to credit bureaus at different times throughout the month, meaning the full utilization reduction impact may not appear immediately in your credit reports.

Payment History Amplification: Building Momentum Through Consistency

Success in personal loans in credit score management is often a reflection of informed decision-making. Payment history amplification through personal loans leverages the 35% payment history factor by creating additional opportunities for positive payment reporting. Each on-time personal loan payment contributes to the cumulative positive payment history that credit scoring algorithms use to evaluate your creditworthiness. This amplification effect becomes particularly powerful when combined with existing positive payment streams from credit cards and other accounts. For those looking to improve their scores, personal loans in credit score management can be a key component.

The compounding effect of multiple positive payment streams creates momentum that strengthens your overall credit profile resilience. When you maintain consistent payments across various account types, the positive payment history becomes more robust and less susceptible to the negative impact of occasional missed payments on individual accounts. This diversification of payment sources provides a buffer that protects your overall payment history score component. Employing personal loans in credit score management can help mitigate risks associated with high debts.

Installment loan payment patterns receive different algorithmic weighting compared to revolving credit payments due to their fixed nature and predetermined terms. Credit scoring models recognize that installment loans require sustained commitment over extended periods, often viewing consistent installment payments as stronger indicators of financial responsibility than variable revolving credit payments. This differential weighting means that personal loan payments can carry enhanced positive impact compared to equivalent credit card payments.

The autopay advantage extends beyond simple convenience to provide critical protection against payment history damage. Automated payments eliminate the risk of human error, scheduling conflicts, and temporary cash flow disruptions that could result in missed payments. The consistent payment timing that autopay provides also demonstrates financial organization and planning capabilities that credit scoring algorithms evaluate favorably.

Recovery strategies for credit profiles with previous payment issues benefit significantly from the addition of consistent personal loan payments. The positive payment history generated by reliable personal loan payments can help offset the negative impact of previous missed payments, particularly as older negative items lose influence over time. This recovery acceleration occurs because recent positive payment patterns receive greater weight in credit scoring calculations than older negative incidents.

Risk Mitigation: Avoiding the Credit Score Pitfalls

Borrowers should understand how personal loans in credit score management can affect their overall debt strategies. Risk mitigation strategies must address the fundamental challenge that personal loans create additional payment obligations requiring enhanced budgeting discipline. The introduction of a new fixed monthly payment into your financial obligations increases the complexity of cash flow management and elevates the consequences of budgeting errors. This increased complexity demands more sophisticated financial planning and monitoring systems to prevent payment disruptions. Understanding personal loans in credit score management is vital for effective financial planning.

The cascading effect of missed personal loan payments extends beyond the immediate payment history damage to impact your overall credit health through multiple channels. A single missed payment can trigger late fees, penalty interest rates, and potentially accelerate the entire loan balance. More significantly, the missed payment reporting can damage your credit score for up to seven years, while also signaling increased risk to other lenders who may respond by reducing credit limits or increasing interest rates on existing accounts. In summary, personal loans in credit score management represent key opportunities for financial growth.

Mastering personal loans in credit score management requires understanding their strategic uses. Emergency fund structuring becomes critical when managing personal loan obligations because the fixed payment nature provides less flexibility than revolving credit during financial emergencies. Unlike credit cards where you can reduce payments by paying only minimums, personal loans require consistent full payments regardless of temporary financial stress. This inflexibility necessitates maintaining emergency reserves specifically designated for loan payment protection.

Loan term selection plays a crucial role in maintaining manageable payment schedules that align with your income stability and cash flow patterns. Longer terms reduce monthly payment amounts but increase total interest costs, while shorter terms minimize interest expenses but require higher monthly payments. The optimal term balances payment affordability with total cost minimization, ensuring that the monthly obligation remains sustainable throughout the loan’s duration even during periods of reduced income or increased expenses.

The debt load increase paradox requires careful navigation because while personal loans can improve credit utilization ratios, they simultaneously increase your total debt obligations. This increase affects your debt-to-income ratio calculations that future lenders use for approval decisions, potentially limiting your access to additional credit despite improved credit scores. Managing this paradox requires strategic timing of credit applications and careful consideration of your overall debt capacity relative to income levels.

Conclusion: Mastering the Personal Loan Credit Strategy

Personal loans represent a sophisticated credit management tool that can either accelerate your credit score improvement or create lasting financial damage, depending entirely on your strategic approach and timing. The difference between success and failure isn’t found in the loan itself, but in understanding how payment history amplification, credit mix optimization, and utilization reduction work together to create compound benefits. When executed properly, these loans transform from simple borrowing instruments into powerful credit-building catalysts that address multiple scoring factors simultaneously.

The nuanced relationship between personal loans and credit scores demands respect for both the opportunities and risks involved. Strategic timing, disciplined payment management, and careful risk mitigation separate those who experience lasting credit score improvements from those who face extended financial consequences. Your credit score’s future doesn’t depend on whether you use personal loans—it depends on whether you master the sophisticated strategies that turn these financial tools into credit score accelerators rather than credit score destroyers.