Credit card companies aren’t offering 0% APR balance transfers out of generosity – they’re making calculated bets on your financial behavior. While these promotional offers can genuinely help you save thousands in interest, the reality is that most people don’t use them effectively. The difference between those who succeed and those who end up deeper in debt often comes down to understanding what happens beyond that initial promotional period and having a clear strategy for the transition. In this guide on navigating credit card balance transfers, we will explore the strategies that can help you maximize the benefits of these offers.

Navigating credit card balance transfers effectively allows you to take advantage of promotional rates and avoid unnecessary interest costs. Understanding the specifics of navigating credit card balance transfers can significantly impact your financial situation. When navigating credit card balance transfers, knowing the approval criteria can make a big difference in your financial strategy. What makes some balance transfer applications get approved while others don’t, even with similar credit scores? Why do personal loans sometimes make more financial sense than 0% credit cards? The answers aren’t always obvious, and the stakes are high enough that getting it wrong can cost you years https://thecreditpros.com/get-started/of progress. We’ll walk through the complete picture – from the psychology behind these offers to building a sustainable plan that actually eliminates your debt rather than just moving it around.

For consumers, navigating credit card balance transfers often involves understanding their payment behaviors during the promotional period. Learning about navigating credit card balance transfers can help mitigate the risks associated with payment relief bias. By carefully navigating credit card balance transfers, you can avoid the hidden costs that often accompany balance transfers. Strategically navigating credit card balance transfers means timing your applications appropriately with your financial cycles.

The Psychology and Economics Behind 0% APR Offers

Consumers who excel at navigating credit card balance transfers understand the implications of interest rate changes. Calculating the costs associated with navigating credit card balance transfers can reveal potential savings. Understanding the terms of navigating credit card balance transfers will enable a smoother financial transition. The nuances of navigating credit card balance transfers are essential to maintaining healthy credit utilization ratios. As you consider your options, keep in mind the importance of navigating credit card balance transfers with a clear plan. Personal loans can sometimes be an alternative to navigating credit card balance transfers, but both options require careful consideration.

When evaluating your choices, understanding the differences between navigating credit card balance transfers and personal loans is crucial. Consumers often overlook that navigating credit card balance transfers can impact their credit scores positively. Staying disciplined while navigating credit card balance transfers is essential for long-term financial health. Key strategies for successfully navigating credit card balance transfers include creating a solid repayment plan.

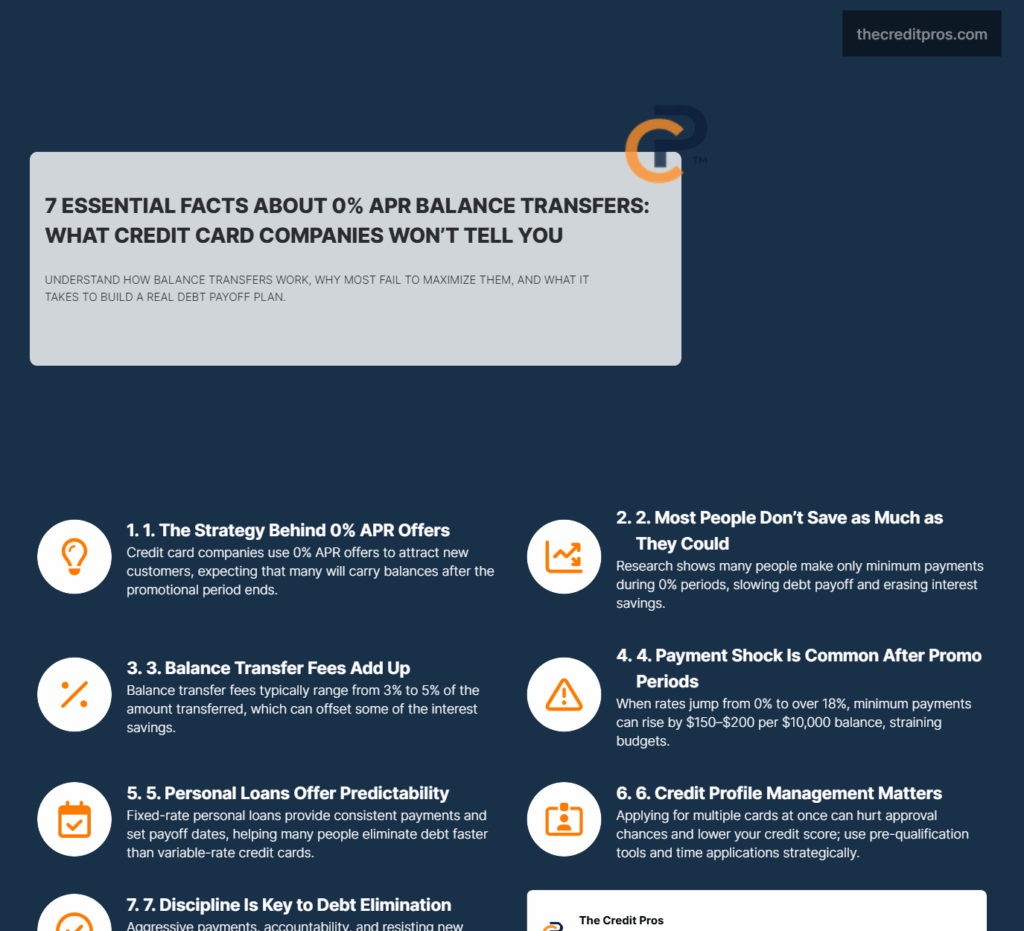

Credit card companies operate on a sophisticated understanding of consumer behavior that extends far beyond the obvious revenue streams. While the promotional 0% APR might seem like a loss leader, these offers represent carefully calculated investments in customer acquisition and long-term profitability. The companies bank on statistical models showing that most consumers will either carry balances beyond the promotional period or increase their overall spending once they feel relief from high-interest debt.

Fixed rates can provide stability when navigating credit card balance transfers. Many find that managing multiple accounts while navigating credit card balance transfers can simplify their financial situation. Understanding your credit profile is crucial when navigating credit card balance transfers. Effective budgeting plays a key role in successfully navigating credit card balance transfers. Ultimately, navigating credit card balance transfers requires thorough research and preparation. As you navigate credit card balance transfers, understanding the market and your financial position is essential.

Being informed about changes in credit scoring when navigating credit card balance transfers is fundamental. Planning and timing are essential aspects of navigating credit card balance transfers successfully. To enhance your outcomes, focus on the details while navigating credit card balance transfers. Effective communication with financial institutions can aid in navigating credit card balance transfers. Finally, remember that navigating credit card balance transfers is about leveraging opportunities responsibly. Ultimately, navigating credit card balance transfers can empower you to make informed financial decisions.

The behavioral economics at play reveal why many consumers struggle to maximize balance transfer benefits. Research demonstrates that people often treat the promotional period as a financial vacation rather than an aggressive debt reduction opportunity. This psychological phenomenon, known as “payment relief bias,” leads consumers to make minimum payments during 0% periods instead of maintaining or increasing their previous payment amounts. The result is that the debt reduction velocity slows dramatically, even though the interest burden has been eliminated.

Balance transfer fees, typically ranging from 3% to 5% of the transferred amount, represent the immediate revenue component for credit card companies. However, the true profitability lies in the transition period when promotional rates expire. Companies strategically time these offers during periods when consumer debt levels are elevated, knowing that a significant percentage of users will still carry balances when standard rates kick in. The promotional period length is also calculated based on average consumer payment patterns, ensuring that a substantial portion of users will face the rate increase while still carrying debt.

The strategic timing of promotional offers reveals another layer of sophistication in credit card marketing. Companies often launch aggressive balance transfer campaigns during tax refund season, back-to-school periods, and post-holiday months when consumers are most likely to be carrying elevated debt loads. This timing maximizes the pool of potential applicants while increasing the likelihood that transferred balances will persist beyond the promotional period.

Critical Factors When Promotional Rates Expire

Mastering the art of navigating credit card balance transfers is crucial for effective debt management. The transition from promotional to standard rates creates one of the most significant financial inflection points in debt management. When a 0% APR expires and jumps to a standard rate of 18% to 25%, the payment dynamics shift dramatically. A $10,000 balance that required only minimum payments during the promotional period suddenly demands an additional $150 to $200 monthly just to cover interest charges. This shock often catches consumers unprepared, leading to a cycle of minimum payments that can extend debt repayment by years.

Understanding the true break-even point for balance transfer effectiveness requires calculating more than just the promotional period benefits. The analysis must include the balance transfer fee, the standard rate that will apply after the promotion, and the realistic payment capacity during both periods. Many consumers discover too late that their savings during the promotional period are quickly eroded by higher interest charges once standard rates apply, particularly if they failed to aggressively pay down the principal balance.

The compounding effect of minimum payments during 0% periods creates a hidden trap. While no interest accrues during the promotional period, making only minimum payments means the vast majority of that payment goes toward fees and principal reduction is minimal. When the promotional rate expires, the remaining balance becomes subject to compound interest calculations that can quickly spiral out of control. This dynamic explains why some consumers find themselves in worse financial positions after balance transfers, despite initially lower interest rates.

Payment allocation changes represent another critical factor that affects debt reduction velocity. During promotional periods, payments are typically allocated first to promotional balances, then to purchases and other transactions. However, once promotional rates expire, the payment allocation hierarchy can shift, potentially leaving higher-rate balances untouched while payments service lower-rate debt. This regulatory requirement, designed to protect consumers, can paradoxically slow debt reduction if not properly understood and planned for.

Fixed-Rate Personal Loans vs. Balance Transfers: The Alternative Approach

Personal loans offer a fundamentally different approach to debt consolidation that addresses many of the structural weaknesses inherent in balance transfer strategies. Unlike credit cards, personal loans feature fixed interest rates and predetermined repayment schedules that eliminate the uncertainty of promotional rate expirations. This predictability provides a clear roadmap for debt elimination that many consumers find psychologically easier to follow than the variable landscape of credit card debt management.

The amortization structure of personal loans creates an immediate advantage in debt reduction velocity. From the first payment, a portion goes directly toward principal reduction, ensuring consistent progress toward debt elimination. This contrasts sharply with credit card minimum payments, which can result in years of payments with minimal principal reduction. The psychological benefit of seeing guaranteed progress each month cannot be overstated, as it reinforces positive financial behaviors and maintains motivation throughout the repayment period.

Credit utilization ratios are affected differently by personal loans versus balance transfers, with implications for credit score management. Balance transfers typically involve moving debt from one credit card to another, potentially creating high utilization ratios on the new card while leaving the original cards with available credit. Personal loans, conversely, are installment debt that doesn’t factor into credit utilization calculations, while simultaneously reducing credit card balances to zero. This dynamic often results in immediate credit score improvements that can compound over time.

The fixed payment structure of personal loans provides superior budgeting predictability compared to the variable minimum payments of credit cards. As credit card balances fluctuate, minimum payment requirements change, making it difficult to establish consistent budget allocations. Personal loans eliminate this variability, allowing for more precise financial planning and reducing the risk of payment shock when promotional rates expire. This stability proves particularly valuable for consumers who struggle with variable income or irregular expenses.

Key advantages of personal loans over balance transfers include:

- Fixed interest rates that eliminate promotional rate expiration risk

- Predetermined payoff dates that provide clear debt elimination timelines

- Consistent payment amounts that simplify budgeting and financial planning

- Immediate credit utilization improvement from paying off credit card balances

- No promotional rate restrictions on payment allocation or account usage

Managing Your Credit Profile During Multiple Transfer Applications

The credit inquiry landscape during balance transfer applications requires strategic navigation to minimize score impact while maximizing approval opportunities. Credit scoring models typically group similar inquiries within a 14 to 45-day window as a single inquiry, recognizing that consumers often shop for the best rates. However, this window applies primarily to mortgage and auto loans, with credit card applications receiving less favorable treatment in most scoring algorithms.

Strategic sequencing of balance transfer applications can significantly impact both approval odds and credit score preservation. Applying for multiple cards within a short timeframe can trigger fraud alerts and automated denials, even for applicants with strong credit profiles. The optimal approach involves researching pre-qualification tools that use soft credit pulls to assess likelihood of approval before submitting formal applications. This strategy allows consumers to identify the most promising opportunities while minimizing hard inquiries.

Existing relationships with financial institutions create approval advantages that extend beyond credit scores alone. Banks and credit unions often have internal scoring models that factor in deposit relationships, payment history, and overall account management when evaluating balance transfer applications. These relationship factors can result in approvals for consumers who might be denied by institutions where they have no existing relationship, even with identical credit profiles.

The impact of credit utilization changes during the transfer process creates a dynamic that many consumers overlook. As balances are transferred and accounts are paid off, credit utilization ratios can improve rapidly, potentially boosting credit scores within 30 to 60 days. This improvement can then be leveraged for additional balance transfer opportunities or better terms on subsequent applications. However, the timing of these utilization updates depends on when creditors report to credit bureaus, making the sequencing of applications critical for maximizing this benefit.

Building a Sustainable Debt Reduction Framework

Creating systems that prevent balance transfer dependency requires addressing the underlying spending and payment behaviors that created the debt initially. The most successful debt reduction strategies focus on creating sustainable lifestyle changes rather than relying on financial products to solve behavioral problems. This approach recognizes that balance transfers are tools for creating opportunity, not solutions for eliminating debt without corresponding behavioral modifications.

Structuring payments during promotional periods for maximum debt reduction requires a fundamental shift in mindset from minimum payment thinking to aggressive principal reduction. The optimal strategy involves maintaining or increasing previous payment amounts during the 0% period, directing all interest savings toward additional principal payments. This approach can reduce debt by 50% or more during typical promotional periods, creating substantial momentum for continued debt reduction even when standard rates apply.

The envelope method, traditionally used for cash budgeting, can be adapted for balance transfer payment management by creating dedicated accounts or budget categories specifically for debt reduction. This system involves allocating specific amounts to debt payments before other discretionary spending, ensuring that the promotional period benefits are maximized rather than absorbed into general spending increases. The psychological separation of debt payments from other expenses helps maintain focus on debt elimination goals.

Resisting the temptation of newly available credit limits represents one of the most challenging aspects of successful balance transfer execution. When existing credit card balances are transferred to new cards, the original cards often become available for new purchases. This available credit can create a false sense of improved financial position, leading to increased spending that ultimately worsens the overall debt situation. Successful debt reduction requires either closing the original accounts or implementing strict controls on their usage during the debt elimination period.

Accountability systems prove essential for ensuring promotional periods are maximized for debt reduction rather than payment relief. These systems can include automated payments that exceed minimum requirements, regular progress reviews with financial advisors or trusted friends, and milestone celebrations that reinforce positive behaviors. The most effective accountability systems combine external oversight with internal motivation, creating multiple layers of support for maintaining debt reduction discipline throughout the promotional period and beyond.

The Bottom Line: Strategic Debt Management Requires More Than Promotional Rates

Balance transfers aren’t inherently good or bad financial tools – their effectiveness depends entirely on your ability to use them strategically rather than as temporary payment relief. The credit card companies offering these promotions understand consumer psychology better than most consumers understand themselves, which explains why these offers remain profitable despite appearing generous. Success requires treating the promotional period as an aggressive debt elimination opportunity, not a financial vacation, while simultaneously addressing the spending behaviors that created the debt initially. Navigating credit card balance transfers can be the key to success.

The difference between those who emerge debt-free and those who find themselves deeper in trouble comes down to preparation, discipline, and realistic assessment of their payment capacity beyond the promotional period. Whether you choose balance transfers or personal loans, the underlying principle remains the same: debt elimination requires sustained behavioral change, not just better interest rates. The most sophisticated financial strategy in the world can’t overcome the fundamental reality that you can’t borrow your way out of debt – you can only create better conditions for paying it off. Therefore, mastering navigating credit card balance transfers is vital for financial health.