Most people think they understand credit card rewards – earn points, redeem for travel or cash back, repeat. But what if the difference between casual rewards earning and strategic optimization could mean thousands of dollars in additional value each year? The reality is that credit card companies design their programs with sophisticated mathematical models that most cardholders never fully grasp, leaving significant money on the table. This guide is about mastering credit card rewards programs and how to leverage them for maximum benefit. By mastering credit card rewards programs, you can significantly enhance your financial strategy and unlock valuable benefits. In this guide, we will focus on the art of mastering credit card rewards programs to ensure you get the most out of every dollar spent.

This comprehensive guide moves beyond basic program mechanics to reveal the hidden economics behind reward structures, from why certain categories offer higher multipliers to how interchange fees actually fund your benefits. You’ll discover advanced techniques for category stacking, transfer partner sweet spots, and portfolio construction that treats rewards programs as the sophisticated financial tools they truly are. Whether you’re wondering why your grocery store purchase didn’t earn bonus points or questioning if that annual fee is actually worth it, the strategies ahead will equip you with the analytical framework to maximize every dollar you spend while mastering credit card rewards programs.

Understanding the secret strategies of mastering credit card rewards programs can lead to significant savings in your overall expenses. Our goal is to provide you with insights into mastering credit card rewards programs to help you navigate the complexities of these financial tools. By focusing on mastering credit card rewards programs, you can turn points into real-world value, like travel or cash back. Many cardholders miss out on maximizing their potential by not mastering credit card rewards programs effectively. Successful financial planning includes mastering credit card rewards programs, allowing for better budgeting and spending strategies. Staying informed about the latest trends in mastering credit card rewards programs can give you an edge over other cardholders. Mastering credit card rewards programs involves knowing the nuances and leveraging them for maximum benefits. Strategically mastering credit card rewards programs can yield benefits beyond your expectations when done correctly.

Decoding Reward Program Architecture: Beyond Points and Miles

Your ability to navigate through mastering credit card rewards programs directly correlates with the rewards you can earn. We will explore how mastering credit card rewards programs can help you make the most out of your spending. Identifying the best opportunities by mastering credit card rewards programs will enhance your overall financial well-being. Individuals serious about optimizing their finances should focus on mastering credit card rewards programs to maximize returns. One strategy involves mastering credit card rewards programs to pivot during market changes. By mastering credit card rewards programs, you can uniquely position yourself for future financial successes.

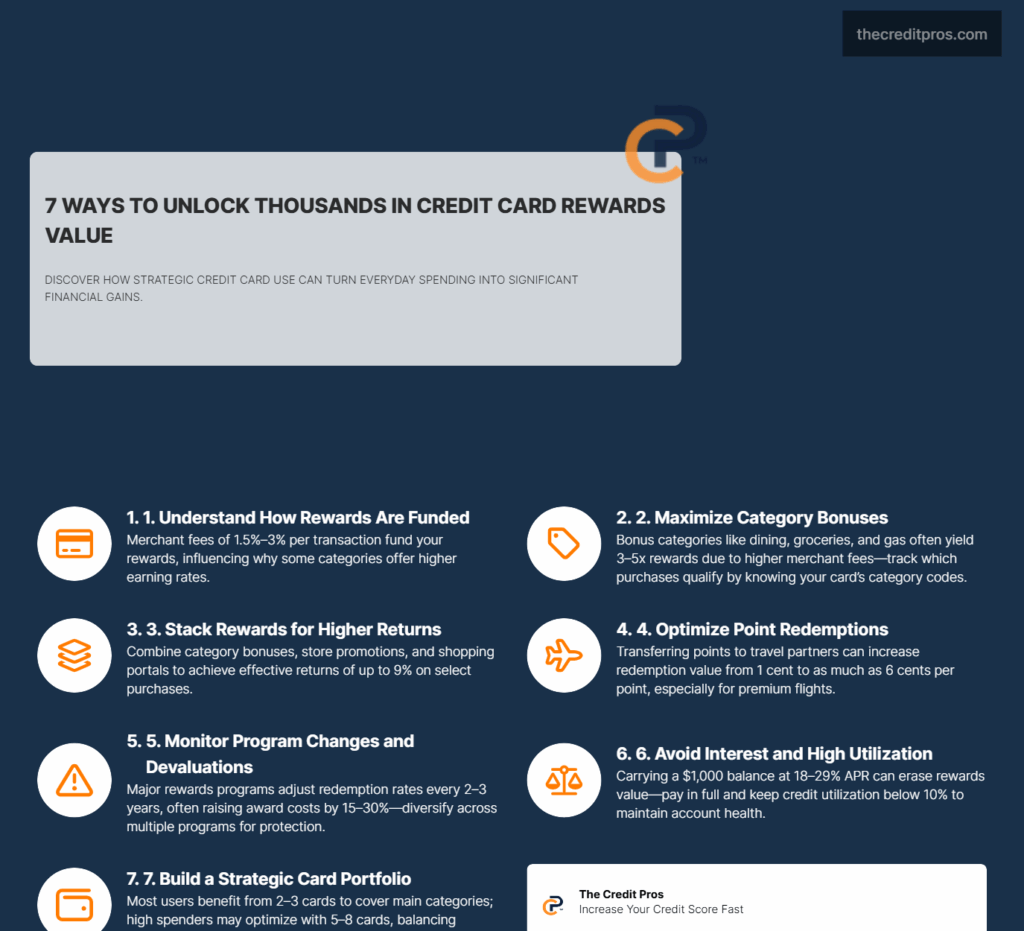

Credit card rewards programs operate on sophisticated mathematical models that most cardholders never fully understand. Card issuers construct these programs using interchange fees as their primary funding mechanism, where merchants pay approximately 1.5% to 3% of each transaction to process payments. This merchant-funded system explains why certain categories like dining and gas stations often offer higher reward multipliers – these merchants typically pay higher interchange rates, creating more revenue for issuers to share with cardholders. Investing time in mastering credit card rewards programs is crucial for those looking to optimize their financial strategies.

The psychology behind reward program design extends far beyond simple point accumulation. Issuers employ behavioral economics principles to encourage specific spending patterns, using techniques like quarterly rotating categories to create urgency and engagement. These rotations serve dual purposes: they prevent cardholders from maximizing rewards indefinitely in high-interchange categories while maintaining program excitement through variety. The 5% cash back offer on groceries for three months isn’t generous – it’s calculated to drive spending behavior while managing the issuer’s cost structure.

Understanding the true cost basis of rewards reveals why “free” redemptions aren’t always optimal. When you redeem 25,000 points for a $250 statement credit, you’re typically receiving the full face value. However, that same 25,000 points might transfer to an airline partner where strategic redemptions could yield $400-600 in travel value. This disparity exists because card issuers purchase airline miles at wholesale rates, often 1-2 cents per mile, while retail redemption values can reach 4-6 cents per mile for premium cabin awards.

Program partnerships create value arbitrage opportunities that sophisticated cardholders exploit. Credit card companies negotiate bulk purchase agreements with airlines and hotels, securing miles and points at significant discounts to retail rates. These partnerships explain why transfer ratios vary dramatically between programs – a 1:1 transfer to one airline might represent exceptional value while the same ratio to another partner could be suboptimal based on the underlying wholesale costs and redemption possibilities.

Strategic Category Management and Spending Orchestration

Merchant category codes (MCCs) form the backbone of category bonus systems, yet most cardholders remain unaware of how these four-digit codes determine their earning rates. Each business receives an MCC based on their primary revenue source, but the system contains numerous exceptions and edge cases. Warehouse clubs like Costco carry a “Discount Stores” MCC rather than “Grocery Stores,” which explains why grocery category cards don’t earn bonus points on these purchases. Understanding these nuances allows you to predict categorization and adjust spending accordingly.

Category stacking represents the most sophisticated approach to maximizing rewards, combining multiple earning mechanisms for amplified returns. This technique involves layering merchant-specific promotions, category bonuses, and shopping portal earnings on the same purchase. For example, purchasing a gift card at a grocery store using a card with 4x grocery points, then using that gift card through a shopping portal offering 5% cash back, effectively creates a 9% return on the underlying purchase.

Timing purchases around quarterly category activations requires careful calendar management and spending discipline. Most rotating category programs activate on specific dates – typically January 1, April 1, July 1, and October 1 – with registration required within the first few weeks. Strategic cardholders prepare shopping lists in advance, timing major purchases like electronics or home improvement projects to coincide with relevant category periods. This approach can transform routine spending into significant rewards accumulation.

Annual spending caps on category bonuses demand strategic allocation across multiple cards. When Chase Freedom offers 5% cash back on up to $1,500 in quarterly spending, reaching that cap requires $6,000 in annual category purchases across all four quarters. Cardholders with higher spending volumes often maintain multiple rotating category cards to exceed these limits, effectively extending their high-earning capacity throughout the year.

Business expenses and family spending coordination create opportunities for accelerated earning without manufactured spending. Legitimate business purchases, from office supplies to client entertainment, can be strategically routed through personal rewards cards (with proper expense tracking for tax purposes). Similarly, coordinating family member spending through authorized user cards allows households to concentrate purchases on optimal earning categories while maintaining separate financial management.

Redemption Optimization: The Science of Value Extraction

Ultimately, mastering credit card rewards programs is about understanding your spending behaviors and adapting to maximize rewards. Successful outcomes hinge on mastering credit card rewards programs for every significant expense you incur. Adopting a mindset focused on mastering credit card rewards programs will help you achieve your financial goals. Mastering credit card rewards programs should be seen as a vital component of any financial strategy.

Transfer partner sweet spots exist within every major rewards program, representing redemption opportunities where points provide outsized value compared to cash alternatives. These opportunities arise from pricing discrepancies between cash fares and award tickets, particularly in premium cabins on international routes. A business class flight to Europe might cost $4,000 in cash but only 60,000 transferable points, creating a redemption value of 6.7 cents per point – significantly higher than the 1-1.25 cents per point available through cash redemptions.

The mathematics of cash back versus travel redemptions involves complex break-even analysis that varies by individual spending patterns and travel preferences. Cash back provides guaranteed value with immediate liquidity, while travel redemptions offer potentially higher returns with added complexity and restrictions. For cardholders who travel frequently and can navigate award booking intricacies, travel redemptions typically provide superior value. However, those with limited travel needs or preference for simplicity often benefit more from straightforward cash back programs.

Dynamic pricing in airline award programs has fundamentally altered redemption strategies, moving away from fixed award charts toward demand-based pricing models. This shift means award prices fluctuate based on cash fare costs, route popularity, and seasonal demand. Strategic redeemers monitor these patterns, booking awards during off-peak periods or on less popular routes where dynamic pricing algorithms offer better value propositions.

Award chart devaluations represent one of the most significant risks in rewards programs, as issuers regularly adjust redemption rates to manage program costs. Historical analysis reveals that most major programs implement devaluations every 2-3 years, typically increasing award costs by 15-30% while introducing new restrictions. Protecting against these changes requires diversification across multiple programs and strategic timing of major redemptions before announced devaluations take effect.

“When shopping for rewards programs, consider your own purchasing habits—if you don’t travel much, a reward program that offers airline miles probably won’t be too useful. If you do a lot of online shopping, a card that offers deep retail discounts may be more useful than one that offers discounted gasoline.”

Ultimately, your success in financial strategies hinges on mastering credit card rewards programs effectively.

The following redemption strategies maximize value extraction:

- Book awards immediately upon earning sufficient points for planned trips

- Monitor award availability 330+ days in advance for popular routes

- Utilize stopover and open-jaw routing rules for additional destinations

- Consider positioning flights to access better award availability

- Leverage partner award charts when they offer better value than the earning program

Risk Management and Program Sustainability

Interest rate arbitrage represents the most critical risk factor in rewards optimization, where carried balances can quickly negate years of rewards accumulation. Credit cards typically charge annual percentage rates between 18-29%, meaning a $1,000 balance carried for one year could cost $180-290 in interest charges. This cost far exceeds the rewards earned on that same $1,000 in spending, even with premium cards offering 2-3% returns. Successful rewards optimization requires treating credit cards as payment tools rather than lending instruments.

Credit utilization impact extends beyond basic credit score considerations to affect rewards earning potential. High utilization ratios signal financial stress to card issuers, potentially triggering credit line reductions or account closures that eliminate future earning opportunities. Maintaining utilization below 10% across all accounts preserves both credit score health and issuer relationships, ensuring continued access to premium rewards programs and sign-up bonuses.

Account closure risks increase with aggressive rewards optimization behavior, particularly when combined with minimal organic spending or frequent churning activities. Card issuers monitor account profitability through sophisticated algorithms that track spending patterns, payment behavior, and overall relationship value. Accounts that generate minimal interchange revenue while extracting maximum rewards face higher closure risk, emphasizing the importance of maintaining genuine spending relationships with key issuers.

Diversification strategies protect against single program devaluations by spreading rewards accumulation across multiple ecosystems. Rather than concentrating all spending on one premium card, sophisticated cardholders maintain earning relationships with 3-4 different programs, ensuring that devaluations in one system don’t eliminate their entire rewards strategy. This approach requires more complex management but provides crucial protection against program changes.

Tax implications of rewards earning and redemption create additional complexity for high-volume rewards earners. While most personal spending rewards remain tax-free, certain activities like business credit card sign-up bonuses or manufactured spending techniques may trigger 1099-MISC reporting requirements. The threshold for reporting varies by issuer but typically begins around $600 in annual rewards value, requiring careful record-keeping and potential tax planning consultation.

Advanced Portfolio Construction and Future-Proofing

The optimal number of credit cards varies significantly based on individual spending profiles and credit management capabilities. Research suggests that cardholders with annual spending below $30,000 typically benefit from 2-3 specialized cards covering their primary spending categories. Those with higher spending volumes or complex category needs may justify 5-8 cards, while extreme optimizers sometimes maintain 15+ active accounts. The key lies in balancing earning potential against management complexity and annual fee costs.

Annual fee justification models require sophisticated calculations that extend beyond simple earning comparisons. A card with a $500 annual fee needs to generate more than $500 in additional value compared to no-fee alternatives. This calculation includes direct rewards differences, valuable perks like airport lounge access or travel credits, and opportunity costs of alternative card choices. Many premium cards justify their fees through ancillary benefits rather than pure earning rates, making the analysis more complex but potentially more valuable.

Adapting strategies for major life changes ensures rewards optimization remains relevant as circumstances evolve. Marriage often doubles household spending power while creating opportunities for coordinated earning strategies and shared benefits. Business ownership introduces new spending categories and potentially higher volumes, justifying business credit cards with different reward structures. Retirement typically reduces spending while increasing travel time, shifting optimal strategies toward travel-focused programs with flexible redemption options.

Emerging trends in rewards programs reflect broader technological and consumer preference shifts. Cryptocurrency rewards programs have gained traction among tech-savvy consumers, offering Bitcoin or other digital currencies instead of traditional points. Subscription-based benefits, like streaming service credits or delivery fee waivers, appeal to younger demographics while creating ongoing engagement with card programs. These innovations suggest that future rewards programs will become more personalized and lifestyle-integrated.

Exit strategies become crucial when programs undergo unfavorable changes or personal circumstances shift. Effective exit planning involves monitoring program communications for advance notice of devaluations, maintaining minimum spending requirements to preserve accounts until major redemptions are complete, and having alternative earning strategies ready for implementation. The most successful rewards optimizers treat their card portfolio as a dynamic system requiring continuous evaluation and adjustment rather than a static set of financial tools.

Conclusion: Transforming Your Financial Strategy Through Rewards Mastery

The sophisticated mathematics behind mastering credit card rewards programs reveal opportunities worth thousands of dollars annually for those who understand the underlying mechanics. From interchange fee structures that fund your benefits to transfer partner sweet spots that multiply redemption values, these programs operate as complex financial instruments designed to reward strategic behavior. The difference between casual participation and optimization lies in recognizing that rewards programs aren’t just about earning points – they’re about understanding the economic incentives that drive program design and positioning yourself to benefit from these carefully constructed systems.

Your success in rewards optimization depends on treating these programs as the analytical challenges they truly are, requiring careful portfolio construction, risk management, and continuous adaptation to program changes. The cardholders who extract maximum value don’t just chase sign-up bonuses or high earning rates; they build comprehensive strategies that account for category management, redemption timing, and long-term program sustainability. The question isn’t whether you can afford to optimize your rewards strategy – it’s whether you can afford to leave thousands of dollars on the table by treating these sophisticated financial tools as simple cashback programs.