When relationships end, your shared financial accounts don’t automatically disappear with the relationship. Joint bank accounts, credit cards, and loans remain legally binding obligations that can seriously damage your credit score and financial future if mishandled. The timing of when you close these accounts, how you coordinate with your ex-partner, and the specific steps you take can mean the difference between protecting your financial health and facing years of credit damage. Managing joint accounts post-divorce is crucial for ensuring financial stability.

When managing joint accounts post-divorce, it’s important to communicate effectively with your ex-partner. But what happens when your ex won’t cooperate with closing accounts, or worse, starts draining shared funds? How do you balance protecting yourself while maintaining the credit history benefits that some joint accounts provide? The process involves more than simply calling your bank – it requires strategic timing, proper documentation, and understanding complex creditor policies that most people never consider until it’s too late. Your approach to managing these accounts during separation will impact your financial life long after the relationship ends.

The Strategic Timing of Account Closure: When to Act and When to Wait

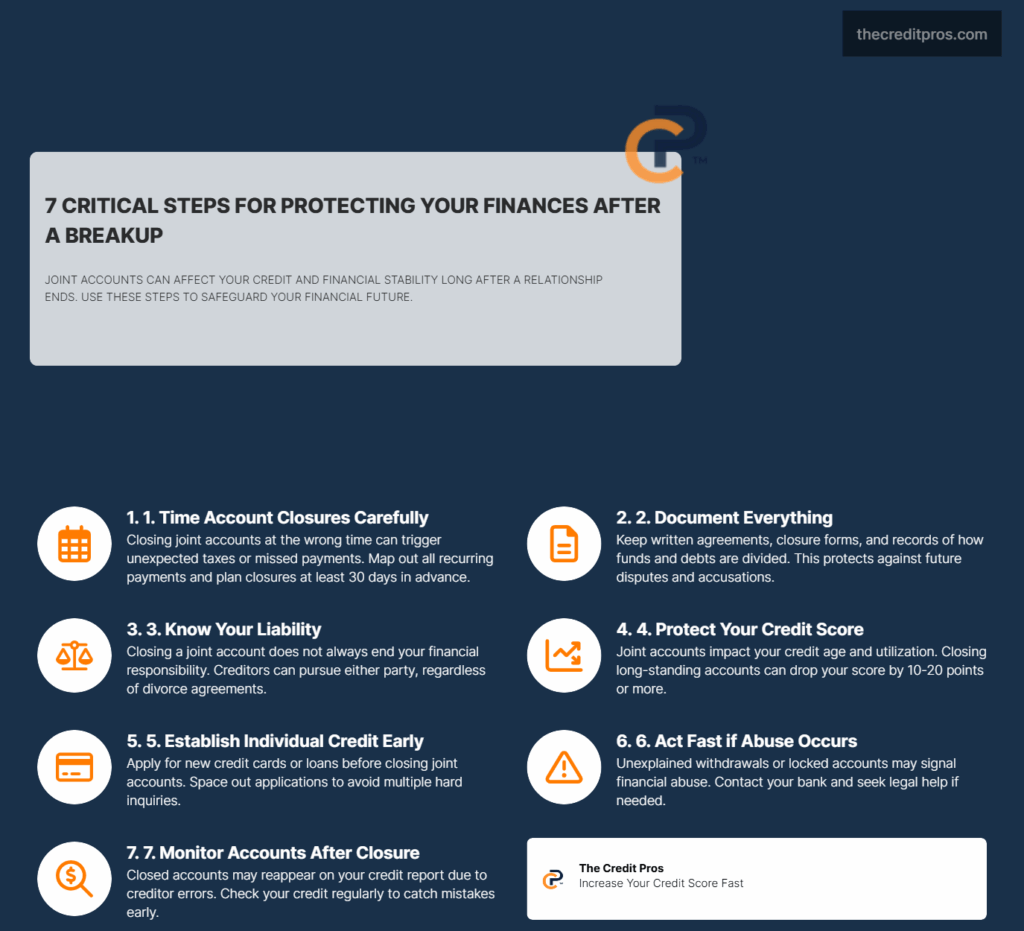

The timing of joint account closures can significantly impact your financial obligations and credit standing long after your relationship ends. Tax considerations alone can create substantial unexpected costs if you close accounts at the wrong time during the year. When you transfer large sums from joint accounts to individual accounts, these movements can push you into higher tax brackets or trigger capital gains obligations that careful timing could have avoided. In the context of managing joint accounts post-divorce, timing is key.

Automatic payment cycles present another critical timing consideration that many people overlook until it’s too late. Closing an account just days before your mortgage, car loan, or insurance payment processes can result in default notifications, late fees, and potential damage to your credit score. The safest approach involves mapping out all recurring payments at least 30 days before any planned closure, ensuring alternative payment methods are established and tested before cutting off the original funding source. Consider the long-term implications when managing joint accounts post-divorce.

The relationship between account closure timing and divorce proceedings requires careful coordination with legal counsel. Courts may issue temporary restraining orders that prevent either party from closing or depleting joint accounts during proceedings. Acting too quickly without understanding these legal constraints can result in contempt of court charges or accusations of hiding assets. Conversely, waiting too long to secure your financial interests can leave you vulnerable to your ex-partner’s financial decisions that could damage your credit or deplete shared resources. Understanding policies is vital for managing joint accounts post-divorce.

Strategic maintenance of certain joint accounts during the separation period can actually benefit your credit profile. Accounts with long payment histories and low utilization rates contribute positively to your credit age and mix factors. Closing these accounts immediately eliminates this benefit, potentially dropping your credit score at a time when you need it most for securing individual housing, credit cards, or loans. The key lies in identifying which accounts provide credit benefits worth the temporary risk of maintaining joint liability. Documentation is key when managing joint accounts post-divorce.

Cooperative Account Closure: Protecting Both Parties and Credit

Managing joint accounts post-divorce means understanding your obligations. Bank policies vary significantly regarding joint account closure requirements, with some institutions requiring both parties’ signatures while others allow single-party closure. Understanding your specific bank’s policies before initiating closure conversations prevents delays and reduces the potential for conflict. Most major banks maintain detailed documentation requirements for joint account closures, including proof of identity from both parties and clear instructions for fund distribution. Be proactive in managing joint accounts post-divorce to prevent future disputes.

Creating comprehensive documentation during the closure process protects both parties from future accusations of financial impropriety. This documentation should include written agreements about fund distribution, copies of all closure paperwork, and records of any outstanding obligations tied to the accounts. The documentation serves as evidence that both parties participated willingly in the closure process and agreed to the final distribution of assets and liabilities. In the process of managing joint accounts post-divorce, emotions can run high.

The emotional dynamics of cooperative closure meetings can undermine even the most well-intentioned financial planning. Scheduling these meetings in neutral locations, such as bank branches, helps maintain professional boundaries and reduces the likelihood of personal conflicts derailing the process. Bringing a neutral third party, such as a mediator or financial advisor, can help facilitate productive discussions and ensure all necessary details are addressed systematically. Managing joint accounts post-divorce necessitates addressing power imbalances.

“If you close accounts and cards together, it can prevent accusations of the closing party trying to hide assets from the other or starve them of cash. Both of these have been known to occur in divorces.”

Power imbalances often emerge when one party has historically managed most financial relationships. The less financially involved party may feel pressured to agree to terms they don’t fully understand or that disadvantage them. Addressing these imbalances requires ensuring both parties have independent access to account information, understand all obligations and benefits associated with each account, and have adequate time to review closure terms before signing agreements. Effective monitoring is crucial when managing joint accounts post-divorce.

Accounts with complex fee structures, automatic investments, or recurring transfers require special attention during closure. Investment accounts may have early withdrawal penalties, while savings accounts might have minimum balance requirements that trigger fees if violated during closure. Understanding these nuances prevents unexpected costs from appearing weeks or months after you believe the closure process is complete. Managing joint accounts post-divorce can involve navigating complex liabilities.

Managing Joint Account Liability After Separation

The distinction between closing joint accounts and terminating joint liability creates confusion that can haunt your financial future for years. Simply closing a joint credit card account doesn’t automatically remove your liability for future charges if your ex-partner retains access to the account or if the account can be reopened. True liability termination requires specific steps with each creditor, often involving written requests and confirmation that your obligation has been legally severed. Coordinate with creditors when managing joint accounts post-divorce.

Divorce decrees create a common misconception about creditor obligations that can prove financially devastating. While a court may order your ex-spouse to assume responsibility for certain joint debts, creditors are not bound by these court orders and can still pursue you for payment if the primary debtor defaults. Your divorce decree provides grounds for seeking reimbursement from your ex-spouse, but it doesn’t protect you from creditor collection efforts or credit damage in the meantime. Recognizing financial abuse is critical when managing joint accounts post-divorce.

Managing shared credit cards where one party retains the account requires careful coordination with the card issuer. Simply removing yourself as an authorized user doesn’t eliminate joint liability if you were a co-applicant on the original account. The remaining party must typically qualify for the account independently, and the creditor must agree to release the departing party from future obligations. This process can take several weeks and may require the remaining party to undergo new credit approval. Implement protective measures when managing joint accounts post-divorce.

Monitoring closed joint accounts becomes essential because creditor errors can cause these accounts to reappear on your credit report months or years later. Credit reporting systems sometimes fail to properly update account closures, especially when accounts are transferred between different departments within large financial institutions. Regular credit report monitoring helps identify these errors before they impact your credit score or create confusion during future credit applications. Balance protective actions with legal considerations when managing joint accounts post-divorce.

The long-term implications of accounts that remain open under your ex-partner’s control extend far beyond the immediate separation period. Late payments, overlimit fees, or defaults on these accounts can continue damaging your credit score for years if proper liability termination wasn’t achieved. Understanding which accounts carry ongoing risk helps prioritize your monitoring efforts and guides decisions about credit repair strategies.

Preserving Your Credit Score During Joint Account Transitions

Joint account closures impact multiple components of your credit score calculation, with credit age and account mix being the most significantly affected factors. Closing long-standing joint accounts immediately reduces your average account age, potentially dropping your credit score by 10-20 points or more depending on your overall credit profile. The impact becomes more severe if the joint accounts represent a significant portion of your total credit history.

Counterintuitive strategies sometimes favor temporarily maintaining certain joint accounts despite the relationship ending. High-limit, low-balance joint credit cards with perfect payment histories can provide substantial credit score benefits that outweigh the risk of temporary joint liability. The key lies in establishing clear agreements with your ex-partner about account usage and monitoring during this transition period. Emergency financial safety nets can aid in managing joint accounts post-divorce.

Credit utilization ratios often suffer dramatically when joint account credit limits disappear from your credit profile. If joint credit cards provided significant available credit that kept your utilization ratios low, losing this credit can immediately spike your utilization percentages and damage your credit score. Preparing for this impact involves either paying down existing balances or securing new individual credit lines before closing joint accounts. Understand the impact of restraining orders on managing joint accounts post-divorce.

Strategic timing for new account openings: • Apply for individual credit cards 2-3 months before closing joint accounts • Space out applications to avoid multiple hard inquiries in short timeframes:

- Focus on cards from institutions where you already have relationships • Consider secured cards if your independent credit history is limited • Request credit limit increases on existing individual accounts before closures

The timing of new individual account openings requires balancing immediate needs with long-term credit health. Opening multiple new accounts simultaneously triggers numerous hard inquiries that can temporarily lower your credit score. However, waiting too long to establish individual credit can leave you without adequate credit access when joint accounts close. The optimal approach involves strategic spacing of applications over several months leading up to joint account closures.

“Closing accounts together is the safest” approach according to family law experts, as it prevents one party from being accused of financial misconduct during divorce proceedings.

Future behavior by your ex-partner on shared accounts continues affecting your credit profile until proper liability termination occurs. Late payments, charge-offs, or collection activities on joint accounts impact both parties’ credit reports regardless of who actually incurred the charges. This ongoing vulnerability emphasizes the importance of achieving complete liability separation rather than simply removing yourself from account access. It’s important to remember that managing joint accounts post-divorce affects future financial health.

Emergency Protocols for Uncooperative Partners and Financial Abuse

Financial abuse during relationship dissolution often escalates when the abusive partner recognizes their control is ending. Warning signs include sudden changes in account passwords, unexpected large withdrawals from joint accounts, or new charges on joint credit cards without discussion. Recognizing these patterns early allows for protective action before significant financial damage occurs.

Immediate protection options vary depending on your jurisdiction and the specific nature of the financial abuse. Many states allow victims of domestic violence to place security freezes on joint accounts or request court intervention to prevent asset dissipation. These protections typically require documentation of the abusive behavior and may involve temporary restraining orders that affect both parties’ access to joint resources.

Working with creditors to freeze accounts when cooperation isn’t possible requires understanding each institution’s specific policies and procedures. Most major banks and credit card companies have protocols for handling domestic violence situations, but these procedures aren’t always well-publicized or consistently applied. Documenting your situation clearly and requesting supervisory involvement often improves your chances of obtaining protective measures. Identify fee structures when managing joint accounts post-divorce.

The legal distinction between protective actions and potentially illegal account manipulation becomes critical when cooperation breaks down. Actions taken to protect yourself from financial abuse are generally legally defensible, while actions that could be construed as hiding assets or depriving your ex-partner of legitimate access may create legal vulnerabilities. Consulting with legal counsel before taking unilateral action helps ensure your protective measures don’t create new legal problems.

Creating emergency financial safety nets becomes essential when you can’t immediately close compromised accounts. This involves establishing individual accounts at different financial institutions, securing independent credit sources, and building cash reserves that your ex-partner can’t access. These safety nets provide financial stability while you work through the complex process of separating joint financial obligations.

Restraining orders create additional complexity for joint financial obligations because they may prevent direct communication necessary for account closure coordination. Courts sometimes appoint mediators or require communication through attorneys to facilitate necessary financial transactions while maintaining protective boundaries. Understanding how restraining orders affect your ability to manage joint accounts helps you plan alternative approaches for achieving financial separation while maintaining legal compliance.

Conclusion: Protecting Your Financial Future Through Strategic Account Management

Managing joint accounts after relationship dissolution requires careful balance between protecting your immediate financial interests and preserving your long-term credit health. The strategic timing of closures, proper documentation of agreements, and understanding creditor policies can mean the difference between maintaining financial stability and facing years of credit damage. Your approach to these accounts impacts everything from your credit score to your ability to secure future housing and loans. When managing joint accounts post-divorce, strategic planning is essential.

The complexity of joint financial obligations doesn’t disappear when relationships end – it often intensifies. Whether you’re dealing with cooperative closure processes or navigating financial abuse situations, the decisions you make in these crucial months will echo through your financial life for years to come. The most important realization is that your financial independence isn’t just about closing accounts; it’s about understanding that every joint financial tie you maintain represents both an opportunity and a vulnerability that could reshape your economic future without warning. Ultimately, managing joint accounts post-divorce requires careful consideration of all factors.