Collections accounts can drop your credit score by 50 to 100 points overnight, yet most people handle them in ways that actually make the damage worse. The conventional wisdom of “just pay it off” often backfires, while the real strategies that work require understanding timing, legal loopholes, and the business model that drives collection agencies. Understanding how to handle collections accounts effectively can save you money and stress.

Learning how to handle collections accounts is essential for maintaining a strong credit score. What many don’t realize is that collections accounts operate under a complex web of federal regulations and credit reporting rules that create opportunities for removal – even when the debt is legitimate. The key lies in knowing when to dispute, when to negotiate, and when paying could actually hurt your score more than help it. With the right approach, you can minimize the long-term impact on your credit while protecting yourself from aggressive collection tactics that violate your rights. In this guide, we will explore how to handle collections accounts effectively.

Understanding the Collections Process and Your Rights Under Federal Law

The transition from original creditor to collection agency fundamentally alters your legal position and available options for resolution. When an account becomes delinquent, creditors typically attempt internal collections for 90 to 180 days before either charging off the debt or transferring it to a third-party collector. This transfer creates a critical distinction in your rights and negotiation leverage, as third-party collectors operate under stricter federal regulations than original creditors.

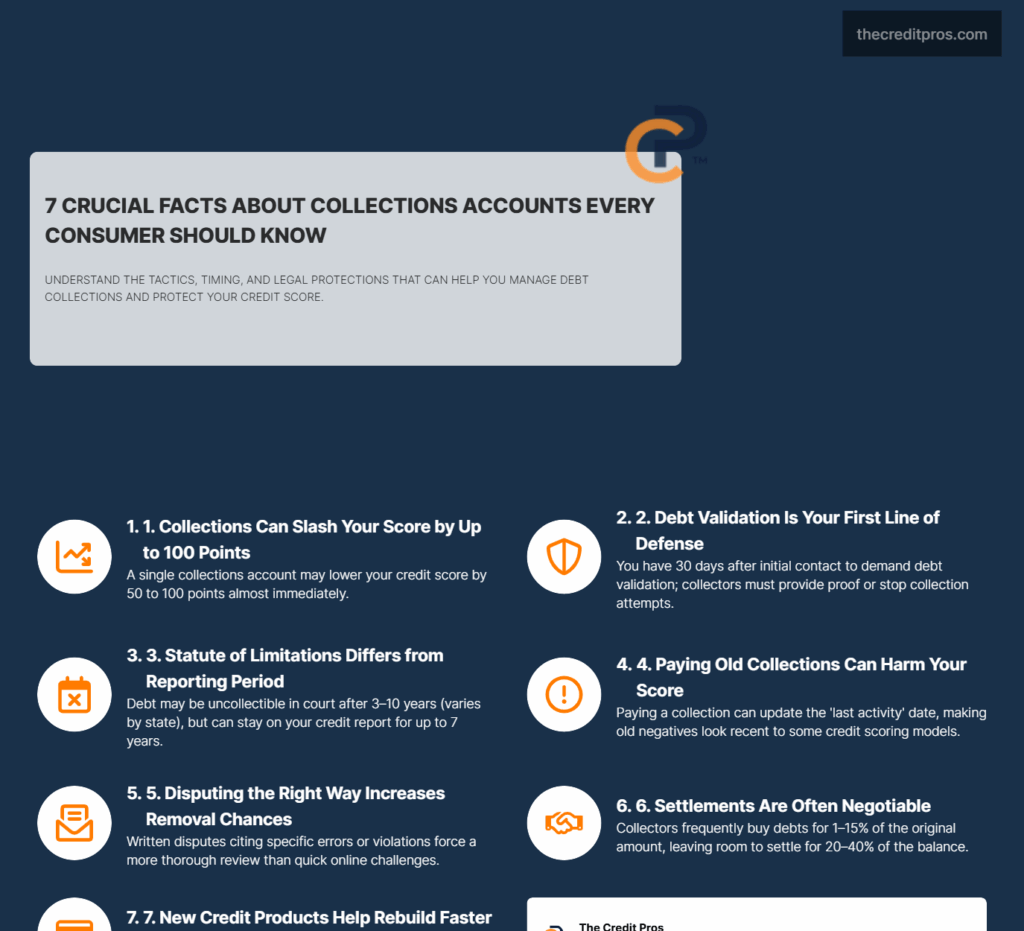

The Fair Debt Collection Practices Act (FDCPA) provides comprehensive protection against abusive collection practices, but only applies to third-party debt collectors, not original creditors collecting their own debts. Under FDCPA provisions, collectors cannot contact you before 8 AM or after 9 PM, cannot use profane language, and must cease communication if you request it in writing. More importantly for credit management, collectors must provide debt validation within five days of initial contact, including the amount owed, the name of the original creditor, and a statement of your right to dispute the debt within 30 days.

State-by-state variations in collections laws create additional layers of protection that many consumers overlook. Statute of limitations periods range from three years in some states to ten years in others, and these timeframes determine how long collectors can legally pursue court action. However, the statute of limitations for collections differs from the seven-year credit reporting period, creating scenarios where old debts can still appear on credit reports even when they’re no longer legally collectible.

The 30-day validation period represents the most critical window in the collections process, yet most consumers fail to utilize this protection effectively. During this period, you have the right to request debt verification, which requires the collector to provide documentation proving they own the debt and the amount is accurate. If you fail to dispute within 30 days, the collector can assume the debt is valid and proceed with collection efforts. Requesting validation doesn’t restart the statute of limitations or acknowledge the debt, making it a powerful tool for consumers who understand proper timing. Implementing strategies on how to handle collections accounts can protect your credit score.

The legal distinction between “charged off” and “collections” status creates significant implications for credit scoring and debt resolution. A charge-off indicates the original creditor has written off the debt as a business loss, but the debt remains collectible. When subsequently sold or assigned to a collection agency, the same debt can appear twice on your credit report – once as a charge-off and again as a collections account. This double reporting can severely impact credit scores, and understanding how to address both entries strategically becomes crucial for score recovery. Understanding how to handle collections accounts can also help in negotiating better outcomes.

Strategic Timing: When and How to Engage with Collection Agencies

The optimal timing for engaging with collectors depends heavily on the account’s age, reporting status, and your long-term credit goals. Fresh collections accounts typically offer the greatest negotiation leverage because collectors haven’t yet invested significant resources in collection efforts. However, engaging too early can inadvertently restart statute of limitations periods or create new legal vulnerabilities if not handled properly. Knowing how to handle collections accounts can leverage your position during negotiations.

Collection agencies operate on a business model that heavily favors quick resolution over prolonged collection efforts. Most agencies purchase debt portfolios for pennies on the dollar – often paying between 1% to 15% of the original debt amount. This economic reality means collectors are often willing to accept settlements for 20% to 40% of the balance, particularly when accounts approach the end of their profitable collection lifecycle. Understanding these economic incentives allows you to time settlement offers when collectors are most motivated to accept reduced payments. For many, learning how to handle collections accounts is key to financial recovery.

The critical difference between acknowledging debt and restarting statute of limitations cannot be overstated. Simply discussing the debt with a collector doesn’t restart the limitations period, but making a payment, entering a payment plan, or providing a written acknowledgment of the debt can reset the clock entirely. This distinction becomes particularly important with older debts where the statute of limitations may have already expired, making them legally uncollectible through court action. Effective strategies on how to handle collections accounts require attention to detail.

Paying old collections can paradoxically hurt your credit score more than leaving them unpaid, particularly with newer scoring models that ignore paid collections entirely. When you pay a collection account, it updates the “last activity” date on your credit report, potentially making an old negative item appear fresh to some scoring algorithms. This “re-aging” effect can drop your score significantly, making it crucial to negotiate deletion as part of any payment agreement. As you learn how to handle collections accounts, keep in mind the importance of persistence. Understanding how to handle collections accounts can ultimately lead to better credit opportunities.

Seasonal patterns in collection agency operations create strategic opportunities for favorable settlements. Collection agencies typically experience budget pressures at quarter-end and year-end, making them more willing to accept reduced settlements to meet revenue targets. Additionally, portfolio sales often occur during specific times of the year, and accounts approaching sale dates may be settled for significantly less than their face value. Grasping how to handle collections accounts can greatly influence your financial trajectory.

Advanced Dispute Strategies Beyond Basic Credit Report Challenges

Being proactive about how to handle collections accounts can yield significant benefits. Online dispute systems provided by credit bureaus are designed for efficiency rather than thoroughness, making them inadequate for complex collections disputes. These automated systems typically result in superficial investigations that favor data furnishers over consumers. Written correspondence directly to credit bureaus creates a paper trail and forces more detailed investigations, particularly when disputes target specific violations of the Fair Credit Reporting Act (FCRA). To successfully navigate how to handle collections accounts, one must be informed.

Effective disputes must target specific data furnishing violations rather than general inaccuracies. Under FCRA Section 623, data furnishers have ongoing obligations to investigate disputes and report information accurately. Common violations include reporting accounts with incorrect dates, amounts, or ownership information. By identifying and documenting these specific violations, you can craft disputes that require substantive investigation rather than automated verification. Employing the right tactics on how to handle collections accounts is crucial.

The difference between “soft” and “hard” deletions from credit bureaus affects the permanence of collections removal. Soft deletions typically occur when bureaus cannot verify information within the 30-day investigation period, but these items can reappear if the furnisher provides verification later. Hard deletions result from proven FCRA violations or furnisher agreements to remove information permanently, making them the preferred outcome for long-term credit repair. Learning how to handle collections accounts can help you achieve financial peace of mind.

Key dispute timing strategies:

- Submit disputes early in the month to maximize investigation time

- Avoid disputing multiple items simultaneously on the same report

- Allow 45 days between dispute rounds to avoid frivolous dispute flags

- Document all correspondence with certified mail return receipts

Finally, mastering how to handle collections accounts can lead to a brighter financial future. The “method of verification” loophole exploits inadequate bureau investigation procedures by demanding specific details about how information was verified. Credit bureaus must provide the method of verification upon request, and their failure to conduct reasonable investigations can constitute FCRA violations. This strategy proves particularly effective when collectors lack original documentation or when accounts have been sold multiple times between collection agencies. With knowledge on how to handle collections accounts, you can avoid common pitfalls.

Every individual should understand how to handle collections accounts for a solid credit foundation. FCRA Section 623 allows you to dispute directly with data furnishers rather than credit bureaus, creating an alternative pathway when bureau disputes fail. Furnisher disputes often prove more effective because they bypass bureau investigation procedures and require the collection agency to investigate internally. This approach works particularly well when you have documentation that contradicts the reported information or when the collector cannot provide adequate debt verification. Mastering how to handle collections accounts can significantly affect your credit journey.

Negotiation Tactics: Pay-for-Delete vs. Settlement Strategies

Pay-for-delete agreements exist in a regulatory gray area that makes them unofficial but not illegal. While credit bureaus and collection agencies publicly discourage these arrangements, they remain a common practice in debt resolution. The key challenge lies in getting collectors to honor deletion agreements after payment, as they have little legal incentive to follow through once they receive payment. As you navigate how to handle collections accounts, focus on strategic timing.

Settlement negotiations must account for tax implications that many consumers overlook. Forgiven debt exceeding $600 typically generates a 1099-C tax form, creating potential tax liability on the forgiven amount. This means a $10,000 debt settled for $3,000 could result in $7,000 of taxable income, significantly impacting the true cost of settlement. Strategic settlement timing around year-end can help manage these tax consequences more effectively.

Partial payments can prove more damaging than no payment at all when they restart statute of limitations periods or create new legal vulnerabilities. Collection agencies often encourage small “good faith” payments to restart limitations periods and strengthen their legal position. Before making any payment, ensure you understand the full implications for both credit reporting and legal collectibility. Ultimately, your success in how to handle collections accounts hinges on informed decisions.

Goodwill letters to original creditors prove most effective when you have an established positive history with the company and can demonstrate that the collections account resulted from extraordinary circumstances. These letters work best with original creditors rather than collection agencies because creditors have more flexibility in credit reporting decisions and greater incentive to maintain customer relationships.

“Collection agencies typically purchase debt portfolios for pennies on the dollar, which creates significant negotiation opportunities for consumers who understand the economic realities of the collections industry.”

The timing strategy for lump-sum versus payment plan settlements significantly affects both negotiation leverage and credit impact. Lump-sum offers typically result in better settlement terms because they provide immediate cash flow to collectors. However, payment plans may offer better cash flow management for consumers while still achieving deletion agreements if properly negotiated upfront. Ultimately, understanding how to handle collections accounts is a skill worth acquiring.

Strategies on how to handle collections accounts will empower your financial decisions. Collection agency commission structures heavily influence their willingness to negotiate, with individual collectors often earning 20% to 50% of collected amounts. Understanding these incentives helps you identify when collectors have personal motivation to accept your settlement terms versus when they might prefer to transfer accounts to legal departments or other agencies.

Long-term Credit Recovery: Minimizing Ongoing Impact While Building Positive History

Collections accounts continue affecting credit scores even as they age, though their impact diminishes over time under newer scoring models. FICO 9 and VantageScore 3.0 ignore paid collections entirely, while older models continue factoring them into score calculations. This scoring model variation means that paying collections may improve scores with some lenders while having no effect with others who use newer models. Furthermore, knowing how to handle collections accounts can prevent future issues.

The interplay between collections removal and overall credit utilization optimization requires strategic coordination of credit repair efforts. Removing collections accounts can improve your credit mix and reduce negative account ratios, but these improvements may be offset if you simultaneously increase credit utilization or close positive accounts. Maintaining low utilization across all accounts while pursuing collections removal maximizes the positive impact of your credit repair efforts.

Strategic use of secured credit products accelerates score recovery by adding positive payment history while collections disputes proceed. Secured credit cards and credit-builder loans provide immediate opportunities for positive reporting, helping offset collections damage while you work toward removal. The key lies in choosing products that report to all three bureaus and maintaining perfect payment history throughout the recovery process.

Different scoring models treat paid versus unpaid collections with varying degrees of severity, making it crucial to understand which models your target lenders use. Mortgage lenders typically use older FICO models that penalize both paid and unpaid collections, while credit card companies increasingly use newer models that ignore paid collections. This knowledge helps you prioritize which collections to address first based on your immediate credit needs.

Building a comprehensive credit monitoring system alerts you to new collection activity before it reports to credit bureaus. Many collection agencies report to bureaus before sending initial contact letters, making early detection crucial for exercising your validation rights. Professional monitoring services can identify new collections within days of reporting, providing maximum time for dispute and negotiation strategies. Learning how to handle collections accounts is the first step towards your credit recovery journey.

Conclusion: Mastering how to handle collections accounts for Long-Term Credit Success

With the right knowledge on how to handle collections accounts, you can take control of your financial health, reduce stress, and avoid further damage to your credit. Understanding your rights, communicating effectively with collectors, and planning repayment strategies can help you regain stability and move toward a stronger financial future.