Getting approved for your first credit card often feels impossible when you don’t already have credit history. Banks want to see proof you can handle credit responsibly, but how can you prove that without being given the chance? This common frustration leaves many people feeling stuck, watching their financial goals slip further away while they wait for someone to take a chance on them. Building credit without credit card is possible for many individuals who feel restricted by traditional methods.

Understanding how to build credit without credit card opens doors for financial independence. What many people don’t realize is that credit cards aren’t your only path to building a solid credit foundation. You can establish creditworthiness through several proven methods that don’t require traditional plastic in your wallet. From strategic loan arrangements that help you save money while building credit, to leveraging existing relationships and even turning your monthly rent payments into credit-building opportunities. The key is understanding which approaches work best for your situation and how to execute them properly to maximize your credit score growth over time. Many people are unaware of the advantages of building credit without credit card.

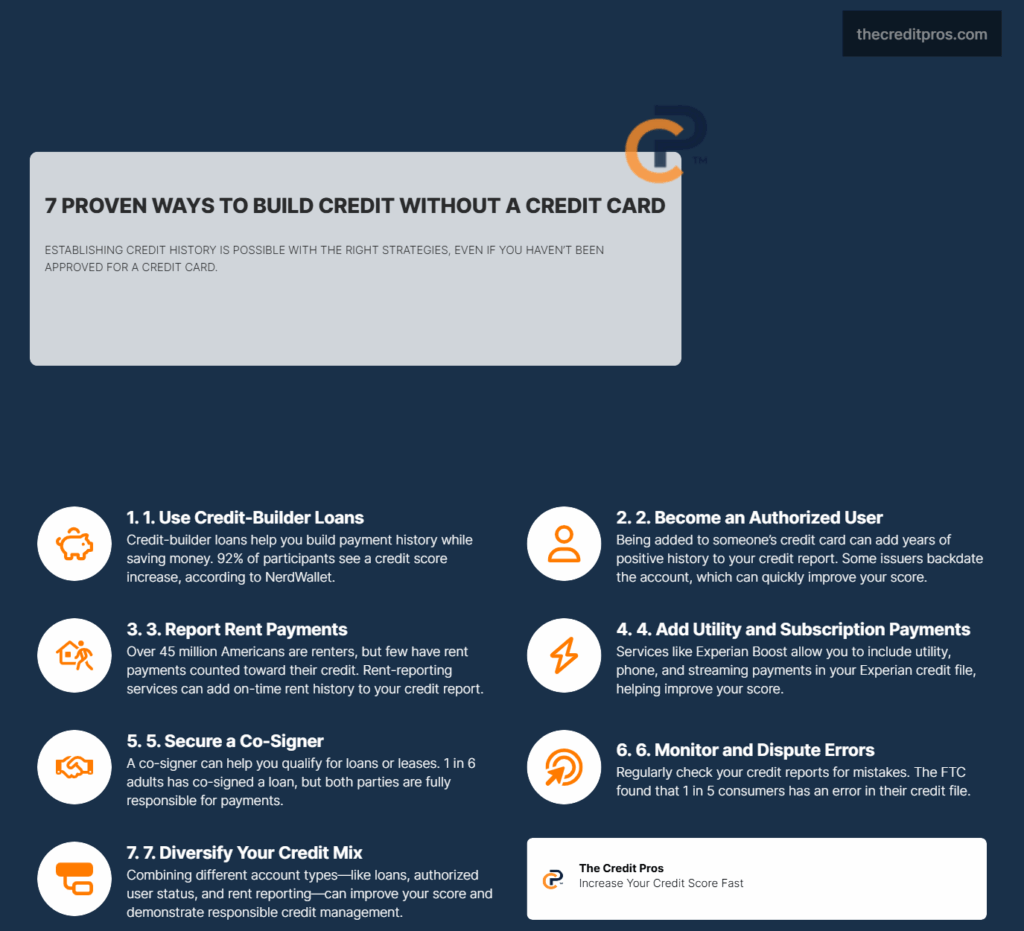

The Strategic Power of Credit-Builder Loans

Credit-builder loans operate on a fundamentally different principle than traditional lending products, creating a unique opportunity for individuals to establish creditworthiness while simultaneously building savings. Unlike conventional loans where you receive funds upfront, credit-builder loans require you to make monthly payments into a secured account before accessing the money. This structure eliminates risk for lenders while providing them with consistent payment data to report to credit bureaus. It’s crucial to explore options for building credit without credit card to create a robust financial future.

The mechanics of these loans center around forced savings combined with credit reporting. When you obtain a credit-builder loan, the lender typically deposits the loan amount into a certificate of deposit or savings account that you cannot access until the loan term concludes. Your monthly payments go toward paying off this “loan,” and each payment gets reported to the major credit bureaus as positive payment history. This creates a dual benefit where you build credit while accumulating savings that you receive upon completion of the loan term. Adopting new strategies for building credit without credit card can significantly improve your credit score.

Financial institutions report credit-builder loans differently than traditional credit products because the risk profile differs significantly. Since the loan amount remains secured throughout the term, lenders can report consistent, positive payment history without concern about default risk. This reporting pattern often results in more favorable credit score impacts compared to other secured credit products, as the payment history demonstrates reliability over an extended period. Many resources are available for those interested in building credit without credit card.

Timing strategies play a crucial role in maximizing credit-builder loan effectiveness. Loan terms typically range from six months to 24 months, with longer terms generally providing more substantial credit score improvements due to extended payment history. However, shorter terms allow you to access your funds sooner and potentially qualify for traditional credit products more quickly. The optimal approach involves balancing your immediate financial needs with long-term credit building goals. Building credit without credit card is a viable option for various financial situations.

Credit unions frequently offer more favorable credit-builder loan terms compared to online lenders, including lower fees and more flexible payment options. Many credit unions also provide financial counseling services alongside their credit-builder programs, helping you understand how to maximize the credit benefits. Online lenders, while potentially more convenient, often charge higher fees and may have less personalized customer service, though they typically offer faster approval processes and digital account management tools. Exploring authorized user dynamics can be a way of building credit without credit card.

Authorized User Relationships: Beyond Family Connections

The science behind authorized user reporting reveals significant variations in how different card issuers handle credit bureau notifications. Major credit card companies like American Express, Chase, and Capital One report authorized user accounts to all three credit bureaus, while some smaller issuers may only report to one or two bureaus. Understanding these reporting patterns helps you select the most beneficial authorized user arrangements for your credit building goals. It’s essential to know how to use your financial resources for building credit without credit card effectively.

Card issuers also differ in how they report account opening dates for authorized users. Some report the date when you were added as an authorized user, while others backdate the account to the original opening date. This distinction significantly impacts your credit history length, as backdated accounts can instantly add years to your credit profile. Before entering an authorized user arrangement, verify the issuer’s reporting practices to ensure you receive maximum credit benefits. Understanding the reporting implications is key when building credit without credit card.

Negotiating authorized user agreements requires clear communication about expectations and boundaries with the primary account holder. Essential discussion points include spending limits, payment responsibilities, and account monitoring procedures. Many successful arrangements involve the authorized user having no spending privileges while still receiving credit benefits, eliminating potential conflicts over purchases or payment obligations. Establishing written agreements, even informal ones, helps prevent misunderstandings that could damage both the relationship and your credit profile. Many individuals successfully navigate building credit without credit card through informed decisions.

The age of account advantages from authorized user status can dramatically accelerate your credit building timeline. When you become an authorized user on an account with several years of positive payment history, that entire history typically appears on your credit report. This immediate boost to your average account age can improve your credit score within 30 to 60 days, providing a foundation for qualifying for your own credit products much sooner than building credit from scratch. Establishing credit through various methods can lead to building credit without credit card.

Credit utilization inheritance represents both an opportunity and a risk in authorized user relationships. Your credit score benefits when the primary cardholder maintains low utilization rates across their accounts, but high utilization can negatively impact your score even if you make no purchases. This dynamic makes it crucial to partner with financially responsible primary cardholders who consistently manage their credit utilization effectively. Finding ways of building credit without credit card is empowering for all consumers.

Perseverance is key when pursuing methods for building credit without credit card. Exit strategies from authorized user status require careful timing to maintain your credit progress. The optimal transition point typically occurs after you’ve established your own credit accounts and built sufficient independent credit history. Removing yourself too early can cause your credit score to drop due to reduced account age and credit history, while staying too long may limit your ability to develop independent credit management skills.

Alternative Payment Reporting Services and Their Credit Impact

Rent-reporting services have emerged as one of the most impactful alternative credit building tools, transforming housing payments into credit-building opportunities. These services work by collecting rent payment data directly from tenants or property management companies and reporting this information to credit bureaus. The impact varies significantly depending on which credit bureaus receive the data and how credit scoring models weight rental payment history. Utilizing responsible financial habits is vital for building credit without credit card.

Most rent reporting services focus on reporting to Experian and TransUnion, as Equifax has been slower to incorporate rental payment data into credit reports. This selective reporting means your credit scores may improve with some lenders while remaining unchanged with others, depending on which credit bureau they use for decision-making. Understanding these limitations helps set realistic expectations for rent reporting benefits. Building credit without credit card allows for more flexibility in your financial planning.

The mechanics of rent reporting require consistent, on-time payments to generate positive credit impact. Late rent payments can harm your credit score just as much as timely payments help it, making rent reporting a double-edged tool. Many services offer payment reminders and automatic payment options to help ensure consistency, recognizing that irregular reporting can undermine the credit building benefits. Focusing on alternative methods is encouraged for building credit without credit card.

Utility and subscription reporting services extend credit building opportunities to additional monthly expenses like phone bills, streaming services, and insurance payments. However, the credit impact from these services varies considerably based on the specific utility companies and service providers involved. Major telecommunications companies often have established relationships with credit bureaus, making their payment data more likely to appear on credit reports compared to smaller local utilities. Rent payments can be a significant factor when considering building credit without credit card.

Experian Boost represents a self-reported data platform that allows you to connect bank accounts and add positive payment history for utilities, phone bills, and streaming services. While this service can provide immediate credit score improvements, the benefits typically only apply to Experian-based credit scores and may not influence lending decisions that rely on other credit bureaus or proprietary scoring models. Building credit without credit card through alternative means is both smart and achievable.

Strategic payment timing optimization involves understanding credit bureau reporting cycles to maximize the impact of alternative payments. Most alternative payment reporting services update credit bureaus monthly, typically within the first two weeks of each month. Ensuring your alternative payments are processed and reported before these update cycles can accelerate credit score improvements and help you qualify for traditional credit products sooner. There are numerous strategies to consider when building credit without credit card.

Co-signer Arrangements and Shared Financial Responsibility

Co-signer arrangements create shared financial responsibility that extends far beyond the initial credit application, establishing legal obligations that can last for years. When you enter a co-signed credit agreement, both parties become equally responsible for the entire debt, regardless of who makes purchases or payments. This joint liability means the co-signer’s credit report will reflect all account activity, including late payments, high balances, and account closures. Understanding the process is essential for anyone interested in building credit without credit card.

The legal implications of co-signing include potential wage garnishment, asset seizure, and credit damage for both parties if payments become delinquent. Many co-signers underestimate these risks, focusing primarily on helping the primary borrower establish credit without fully understanding their ongoing financial exposure. State laws vary regarding co-signer protections, with some states requiring specific disclosures about co-signer rights and responsibilities. Building credit without credit card can lead to a healthier financial future.

Co-signer release programs offer pathways to independent credit by allowing the primary borrower to remove the co-signer after meeting specific criteria. These programs typically require a certain number of consecutive on-time payments, often 12 to 24 months, plus proof of sufficient income to support the debt independently. Not all lenders offer co-signer release options, making it crucial to identify these programs before entering co-signed agreements. Many people discover that building credit without credit card is a feasible path to financial security.

Building independent creditworthiness while maintaining co-signed accounts requires strategic planning to demonstrate individual financial responsibility. This process often involves establishing additional credit accounts in your name only, maintaining separate savings accounts, and documenting income stability. The goal is creating a credit profile that can stand alone when you eventually remove the co-signer from existing accounts. The ability to build credit without credit card gives individuals more control over their finances.

Communication protocols between co-signers and primary borrowers help maintain healthy relationships while building credit. Essential elements include:

- Regular account monitoring and balance updates

- Agreed-upon spending limits and payment responsibilities

- Notification procedures for any account changes or issues

- Clear timelines for transitioning to independent credit

- Documentation of all agreements and expectations

Risk mitigation strategies protect both parties in co-signed credit arrangements by establishing safeguards against potential problems. These strategies include setting up automatic payments to prevent missed payments, maintaining separate emergency funds to cover payments if needed, and regularly monitoring credit reports for both parties to identify issues early. Many successful co-signing relationships also involve periodic reviews of the arrangement to assess progress toward independent credit goals. Investing time in learning about building credit without credit card can yield great long-term rewards.

Credit Monitoring and Strategic Score Optimization

Understanding credit report nuances across different bureaus reveals how alternative credit data receives varying treatment in credit scoring calculations. Experian tends to incorporate alternative credit data most readily, including rental payments and utility reporting, while Equifax and TransUnion have been more conservative in adopting these data sources. This disparity means your credit scores may vary significantly between bureaus when using alternative credit building methods. It’s wise to explore all options, including building credit without credit card, for financial health.

Credit scoring models also weight alternative credit data differently than traditional credit accounts. FICO scores typically give less weight to alternative payment data compared to credit card or loan payments, while VantageScore models tend to be more inclusive of non-traditional credit information. Understanding these differences helps you focus your credit building efforts on the data sources most likely to improve the credit scores used by your target lenders.

The 30-day reporting cycle governs when credit changes appear on your credit reports and affect your credit scores. Most creditors and alternative credit reporting services update credit bureaus monthly, typically between the statement closing date and the first week of the following month. Timing your credit-building activities around these cycles can optimize score improvements and help you qualify for credit products more quickly. Ultimately, building credit without credit card shows that there are different paths to creditworthiness.

Strategic timing also involves understanding when lenders pull credit reports during their decision-making processes. Many lenders update their systems with new credit bureau data weekly, meaning recent positive changes may not immediately influence lending decisions. Planning credit applications 30 to 45 days after implementing credit building strategies allows sufficient time for improvements to appear and influence lending decisions.

Credit mix optimization using alternative credit building methods requires balancing different types of accounts to demonstrate varied credit management skills. A well-rounded alternative credit profile might include a credit-builder loan for installment credit history, authorized user status for revolving credit experience, and rent reporting for consistent payment demonstration. This diversification shows lenders your ability to manage multiple types of credit responsibilities.

Error identification and dispute processes for alternative credit data require vigilance and persistence, as these newer reporting systems may have more frequent inaccuracies than traditional credit reporting. Common errors include incorrect payment dates, duplicate reporting of the same payments, and failure to report positive payment history. Disputing these errors through both the credit bureaus and the original reporting services often yields faster resolution than relying on credit bureau disputes alone.

Graduation strategies for transitioning from alternative credit building to traditional credit products require careful timing and preparation. The optimal transition typically occurs after establishing six to twelve months of positive alternative credit history and achieving a credit score above 600. This foundation provides sufficient creditworthiness to qualify for secured credit cards or starter credit cards, beginning the transition to traditional credit building while maintaining the benefits of alternative credit reporting. With the right tools, building credit without credit card can be a straightforward process.

Ultimately, the path to establishing creditworthiness doesn’t have to rely on traditional credit cards. Many people are finding success in building credit without a credit card using various strategies such as credit-builder loans, authorized user relationships, and alternative payment reporting. Many have successfully found ways of building credit without credit card through diligent effort.

Remember, building credit without a credit card can lead to greater financial independence and open up new opportunities for you in the future.

Your financial journey includes many avenues; building credit without a credit card is just one of them. Explore your options and take charge of your financial future today!