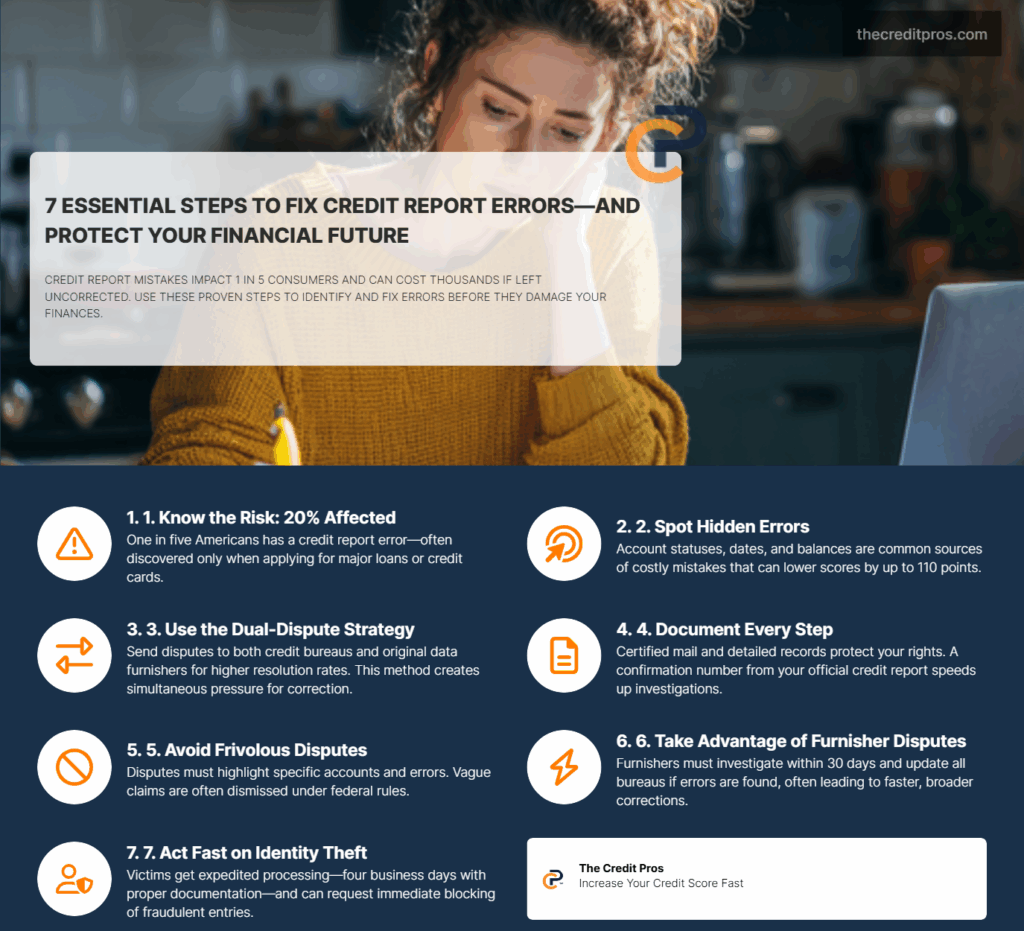

Credit report errors affect roughly 20% of consumers, yet most people discover these costly mistakes only when applying for major loans or credit cards. These inaccuracies can artificially lower your credit scores, increase interest rates, and even result in loan denials – potentially costing thousands of dollars over time. What many don’t realize is that the standard dispute process through credit bureaus represents just half of your available options. To successfully dispute credit report errors, it is crucial to understand the various types of inaccuracies that can appear on your report, and how to effectively address them.

When you dispute credit report errors, you have the right to expect a thorough investigation into the discrepancies that might affect your credit score. The Consumer Financial Protection Bureau recommends a dual-dispute strategy that targets both credit reporting companies and the original data furnishers simultaneously. This approach significantly increases your chances of successful resolution, but timing and documentation become critical factors. While disputing obvious errors like wrong account numbers seems straightforward, the most impactful disputes often involve subtle discrepancies in dates, balances, or account statuses that require a trained eye to identify. Understanding when disputes might be deemed frivolous – and how to avoid that designation – can mean the difference between swift resolution and months of frustration. Each time you dispute credit report errors, keep a record of your communications and any changes made as a result of your disputes.

Strategic Error Identification: Beyond the Obvious Mistakes

The most damaging credit report errors often hide in plain sight, masquerading as legitimate entries that casual reviewers overlook entirely. Account status discrepancies represent one of the most financially consequential yet frequently missed error categories. When your records show an account as “paid as agreed” but the credit report displays “30 days late,” this single discrepancy can reduce your credit scores by 60-110 points depending on your overall credit profile. These status mismatches frequently occur during account transfers between servicers or when automated reporting systems fail to update after payment processing delays. Disputing credit report errors can lead to significant improvements in your credit score, making it essential to stay vigilant.

Date inconsistencies create another layer of hidden damage that compounds over time. Credit age calculations rely heavily on account opening dates and payment history timestamps. A mortgage account incorrectly showing an opening date six months later than actual can reduce your average account age significantly, particularly impactful for consumers with limited credit history. Knowing how to dispute credit report errors effectively can save you money in interest rates and fees on future loans. Payment date errors prove equally problematic when they push legitimate on-time payments into late categories due to processing delays or system synchronization failures between your bank and the furnisher’s reporting system.

Balance reporting errors affecting utilization ratios demand immediate attention, as credit utilization comprises 30% of your FICO score calculation. Credit cards showing balances from previous billing cycles rather than current amounts can artificially inflate your utilization percentage. A card with a $500 balance reported instead of the actual $50 balance transforms a healthy 5% utilization into a concerning 50% utilization on a $1,000 credit limit. These errors frequently stem from timing mismatches between when furnishers pull balance data and when they submit reports to credit bureaus.

Understanding the distinction between errors and unfavorable but accurate information prevents wasted effort on futile disputes. Legitimate negative marks that reflect actual payment delays or defaults cannot be disputed successfully, regardless of how they impact your credit scores. The key lies in verifying the accuracy of dates, amounts, and account statuses rather than challenging the existence of negative information itself. A bankruptcy filing that occurred and was properly processed cannot be disputed, but incorrect dates or included accounts that were actually discharged can be challenged effectively. Do not hesitate to dispute credit report errors, as timely action can prevent long-term financial damage.

Your credit report confirmation number provides significant leverage in dispute proceedings by demonstrating you obtained your report through official channels. This number, typically found at the top of reports from annualcreditreport.com, establishes the legitimacy of your dispute request and helps credit bureaus locate your file efficiently. Including this number in correspondence signals to investigators that you followed proper procedures and obtained your report through authorized means, potentially expediting the review process. Efficiently dispute credit report errors by following a clear process and maintaining detailed records of your efforts.

Mastering the Dual-Dispute Strategy: Credit Bureaus vs. Furnishers

The sequence of your dispute approach directly impacts success rates, with strategic timing creating pressure from multiple directions simultaneously. Beginning with credit reporting companies triggers the mandatory 30-day investigation timeline while establishing your dispute on record. This initial step forces credit bureaus to forward your dispute to the relevant furnishers, creating the first layer of pressure for resolution. However, the most effective approach involves dispatching disputes to both credit bureaus and furnishers within days of each other, preventing either party from claiming they were unaware of the dispute. It’s essential to dispute credit report errors quickly to mitigate any negative impact on your creditworthiness.

Credit reporting companies can determine disputes as frivolous or irrelevant, but strict federal requirements govern this designation. The Fair Credit Reporting Act mandates that bureaus provide written notice within five business days explaining their frivolous determination, including specific reasons for the decision. Disputes lacking sufficient information for investigation, such as vague claims about “incorrect information” without specifying accounts or error types, commonly receive frivolous designations. Your correspondence must include specific account numbers, clear explanations of the disputed information, and detailed reasoning for why the information appears incorrect. Consider seeking professional help if you encounter challenges when you dispute credit report errors.

Certified mail with return receipt requested creates an unbreakable documentation trail that proves delivery and receipt dates. This documentation becomes crucial evidence if disputes require escalation to regulatory agencies or legal proceedings. The return receipt provides legal proof that credit bureaus and furnishers received your dispute within required timeframes, preventing them from claiming non-receipt or delayed processing. Regular mail offers no such protection and allows recipients to claim they never received your correspondence.

The dual-dispute strategy exploits the interconnected nature of credit reporting by creating simultaneous pressure on both data collectors and data providers. When credit bureaus receive disputes, they must forward relevant information to furnishers and await their investigation results. Simultaneously disputing with furnishers creates independent investigation pressure and often produces faster results since furnishers have direct access to account records without requiring inter-company communication delays. To effectively dispute credit report errors, familiarize yourself with the rights granted to you under the Fair Credit Reporting Act.

Essential dispute documentation includes:

- Complete contact information and credit report confirmation number

- Specific account numbers and disputed information details

- Clear explanations of why information appears incorrect

- Copies of supporting documents (bank statements, payment records, correspondence)

- Highlighted or circled disputed items on credit report copies

- Certified mail tracking numbers and return receipt documentation

The Furnisher Dispute Advantage: Targeting the Source

Furnisher disputes frequently succeed where credit bureau disputes fail because furnishers maintain direct control over the data they report and face specific legal obligations under the Fair Credit Reporting Act. When furnishers receive disputes, they must conduct reasonable investigations within 30 days and report their findings to all credit bureaus where they provide information. This direct relationship eliminates the communication delays and potential information loss that can occur when credit bureaus act as intermediaries between consumers and furnishers. When you dispute credit report errors, make sure to provide all relevant documentation to support your claims.

The 30-day furnisher investigation timeline operates independently from credit bureau investigation periods, creating parallel pressure for resolution. Many individuals overlook the importance of documentation when they dispute credit report errors, which can jeopardize the process. Furnishers must review their internal records, account notes, and payment histories to verify disputed information accuracy. Unlike credit bureaus that rely on furnisher responses, furnishers can access original documentation, customer service records, and transaction histories that provide definitive answers about account status and payment history accuracy.

Identifying the correct furnisher dispute address requires careful attention to credit report details and furnisher websites. Many companies maintain separate addresses specifically for credit reporting disputes, distinct from general customer service correspondence. Using incorrect addresses can delay processing and potentially void your dispute timeline protections. The Consumer Financial Protection Bureau’s sample letter template provides standardized formatting that furnishers recognize and process efficiently, but customization with specific account details and error explanations remains essential. Utilizing templates can simplify the task whenever you dispute credit report errors and ensure you include necessary information.

When furnisher investigations confirm errors, they must notify all credit reporting companies where they provide data about the corrections. This automatic notification system means successful furnisher disputes typically result in corrections across all three major credit bureaus without requiring separate bureau disputes. The furnisher bears responsibility for ensuring all credit bureaus receive updated information within the required timeframes, shifting the burden of correction from you to the data provider. When you dispute credit report errors, verify that the issues are not only factual but also materially important to your credit score.

Furnishers face potential legal liability for reporting inaccurate information after receiving dispute notices, creating strong incentives for thorough investigations and prompt corrections. The Fair Credit Reporting Act imposes specific duties on furnishers to investigate disputes and update inaccurate information, with potential damages for violations including actual damages, attorney fees, and punitive damages in cases of willful non-compliance. You may need to dispute credit report errors multiple times if the initial attempts do not yield the desired results.

Advanced Dispute Tactics: When Standard Approaches Fall Short

Consumer statement requests provide a valuable option when disputes cannot resolve underlying disagreements about account information accuracy. These 100-word statements become part of your credit file and appear on future credit reports, allowing you to provide context about disputed information without admitting fault or liability. Effective consumer statements focus on factual circumstances rather than emotional appeals, such as explaining payment processing delays that resulted in late payment reports or identity theft incidents that affected account management. Effective communication is key when you dispute credit report errors; clarity in your requests can accelerate the process.

Credit bureau investigation limitations become apparent when dealing with complex disputes involving multiple account changes, servicer transfers, or documentation gaps. Bureaus typically conduct automated investigations that compare your dispute claims against furnisher responses without examining underlying documentation or conducting detailed account reviews. When investigations rely solely on furnisher verification without independent document review, legitimate disputes may be dismissed despite valid error claims. Consider reaching out for credit counseling if you feel overwhelmed by the process to dispute credit report errors.

Re-investigation requests become appropriate when initial investigations appear inadequate or when you can provide additional supporting documentation that wasn’t available during the original dispute. The Fair Credit Reporting Act requires credit bureaus to conduct reasonable investigations, and you can challenge the adequacy of their investigation methods if they appear superficial or incomplete. New evidence, such as recently discovered payment records or correspondence with the original creditor, justifies re-investigation requests and often produces different outcomes.

The Consumer Financial Protection Bureau complaint process creates additional pressure for dispute resolution when standard approaches fail to produce satisfactory results. CFPB complaints require companies to respond within 15 days and provide detailed explanations of their investigation findings and resolution efforts. Companies track CFPB complaint volumes and resolution rates, creating institutional pressure to resolve disputes that reach this level to avoid regulatory scrutiny. Many consumers underestimate the necessity to dispute credit report errors promptly to avoid long-term repercussions.

CFPB complaints also create permanent records of company dispute handling practices, contributing to regulatory oversight and potential enforcement actions against companies with patterns of inadequate dispute resolution. This regulatory pressure often motivates companies to conduct more thorough investigations and provide more favorable resolutions for complaints that reach the CFPB level. Utilizing all available resources can enhance your ability to dispute credit report errors effectively.

Identity Theft Disputes: The Specialized Protocol

Identity theft disputes receive enhanced protections and expedited processing under federal law, making IdentityTheft.gov reports crucial documentation for fraud-related credit errors. Federal Trade Commission identity theft reports provide official documentation that strengthens your dispute position and triggers special investigation procedures at credit bureaus and furnishers. These reports create presumptions of fraud that shift the burden of proof to companies claiming the disputed information is accurate. To dispute credit report errors, remember to keep copies of all correspondence sent to credit reporting agencies.

The specialized identity theft dispute process allows victims to request immediate blocking of fraudulent information from credit reports while investigations proceed. This blocking prevents fraudulent accounts from continuing to damage credit scores during the investigation period, unlike standard disputes where disputed information remains on reports until investigations conclude. Identity theft victims can also request extended fraud alerts that remain active for seven years, compared to standard 90-day fraud alerts. It’s crucial to dispute credit report errors with a clear strategy and understanding of the process involved.

Fraud alerts and credit freezes serve different strategic purposes during identity theft disputes and require careful timing to maximize protection. Fraud alerts require creditors to verify your identity before opening new accounts, while credit freezes prevent access to your credit reports entirely. Implementing credit freezes before disputing identity theft prevents criminals from opening additional fraudulent accounts while your disputes are pending, but may complicate the dispute process by limiting credit bureau access to your files. Being proactive can make a substantial difference when you dispute credit report errors that could harm your credit profile.

Documentation requirements for identity theft disputes extend beyond standard dispute materials to include police reports, identity theft affidavits, and detailed timelines of fraudulent activity. Police reports provide official documentation of criminal activity that supports your dispute claims and may be required by some furnishers before they remove fraudulent accounts. Identity theft affidavits, available through IdentityTheft.gov, provide standardized formats that credit bureaus and furnishers recognize and process efficiently.

Priority treatment for identity theft disputes reflects the serious nature of fraud and the potential for ongoing harm to victims. Credit bureaus must complete identity theft investigations within four business days when victims provide proper documentation, compared to 30 days for standard disputes. This expedited timeline recognizes that delayed resolution of identity theft disputes can prevent victims from accessing credit for essential needs like housing or transportation while fraudulent information remains on their reports. Remember, persistence is essential when you dispute credit report errors that may affect your financial future.

Conclusion: Taking Control of Your Credit Report Accuracy

Successfully disputing credit report errors requires more than simply identifying obvious mistakes – it demands a strategic understanding of how to dispute credit report errors and where their vulnerabilities lie. Understanding your legal rights is vital as you dispute credit report errors to ensure they are upheld.

Your credit report isn’t just a financial document – it’s a reflection of your economic opportunities and future possibilities. The 20% of consumers affected by credit report errors face a choice: accept the financial penalties imposed by inaccurate information, or invest the time and effort required to dispute credit report errors for accuracy. Ultimately, knowing how to dispute credit report errors can empower you to take control of your credit health.