Most people know that applying for credit triggers a hard inquiry, but what they don’t realize is how much the timing, frequency, and type of inquiry can dramatically alter the impact on their credit score. A single credit card application might drop your score by five points, while multiple applications within weeks could create a cascade effect that damages your creditworthiness for months. The difference often lies in understanding the hidden mechanics that credit scoring algorithms use to evaluate your financial behavior. Understanding how hard inquiries impact credit is essential for effective financial planning.

What makes this even more complex is that not all inquiries are created equal. Your mortgage shopping might be treated completely differently than your credit card applications, and certain professional credit checks operate under entirely separate rules that most consumers never learn about. The key isn’t avoiding credit applications altogether—it’s knowing how to strategically manage them so you can access the credit you need without unnecessarily damaging your score. Once you understand these patterns, you can make informed decisions that protect your credit health while still achieving your financial goals. Additionally, the way hard inquiries impact credit varies based on individual circumstances.

The Anatomy of Hard Inquiries: Beyond the Five-Point Drop

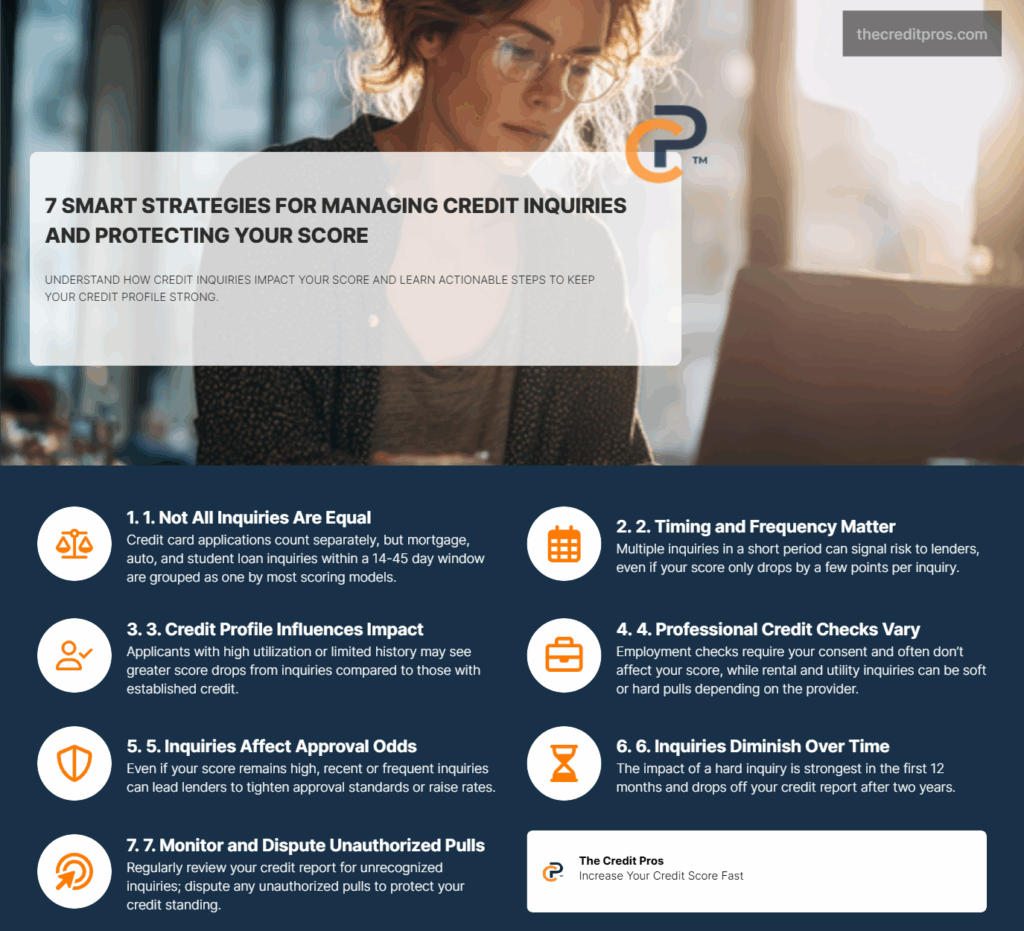

The conventional wisdom that hard inquiries universally decrease credit scores by five points oversimplifies a complex algorithmic process. Credit scoring models evaluate inquiry impact through multiple variables, including your existing credit profile, recent credit activity, and the specific type of credit being sought. Individuals with established credit histories and low utilization ratios often experience minimal score impact from a single hard inquiry, while those with limited credit history or recent negative marks may see more substantial decreases. It’s crucial to grasp how hard inquiries impact credit scores over time.

The timing of inquiries creates cascading effects that extend beyond immediate score changes. When lenders review credit reports, they analyze inquiry patterns to assess risk appetite and credit-seeking behavior. Multiple inquiries within short timeframes signal potential financial distress or overextension attempts, prompting lenders to apply stricter approval criteria even when scores remain within acceptable ranges. This secondary impact often proves more damaging than the direct scoring penalty, as it influences approval odds and terms offered. By understanding how hard inquiries impact credit, consumers can mitigate score drops.

Credit utilization ratios interact with inquiry frequency to amplify scoring impacts in ways most consumers never anticipate. High utilization combined with recent inquiries creates a compound risk signal that scoring algorithms interpret as aggressive credit expansion during financial stress. Conversely, maintaining low utilization can buffer inquiry impacts, sometimes reducing the typical five-point decrease to one or two points. The relationship between these factors explains why identical inquiry patterns produce different outcomes across various credit profiles. Thus, knowing how hard inquiries impact credit helps you make better borrowing choices.

Rate Shopping Windows: Maximizing Your Credit Shopping Strategy

The 30-day inquiry consolidation window represents one of credit scoring’s most misunderstood protective mechanisms. This feature treats multiple inquiries for the same loan type as a single hard pull, recognizing that responsible borrowers compare rates before committing to major purchases. However, the window applies exclusively to mortgage, auto, and student loan inquiries—credit card applications receive no such protection and accumulate individual scoring impacts regardless of timing. Ultimately, the focus on how hard inquiries impact credit should guide your credit strategy.

Strategic application timing within these windows requires precise coordination with your broader credit management timeline. The consolidation period begins with your first inquiry, not when you start shopping, meaning delayed applications can fall outside the protective window. Rate shopping effectiveness peaks when you complete all applications within a concentrated 14-day period, though the full 30-day window provides additional flexibility for complex loan scenarios or delayed lender responses. This section reviews how hard inquiries impact credit assessments by lenders.

Different credit scoring models handle inquiry windows with varying degrees of sophistication. FICO Score 8 employs a 45-day window for mortgage and auto loans, while older FICO versions use 14-day periods. VantageScore models implement their own consolidation logic, creating potential discrepancies when lenders use different scoring systems. Understanding which scoring model your target lenders prefer allows you to optimize your shopping strategy for maximum protection.

The distinction between pre-qualification and pre-approval inquiries creates opportunities for preliminary rate shopping without triggering hard pulls. Pre-qualification typically involves soft inquiries that don’t affect credit scores, allowing you to assess potential terms across multiple lenders. Pre-approval processes generally require hard inquiries but provide more accurate rate quotes and stronger negotiating positions. Sequencing these inquiry types strategically—beginning with soft pull pre-qualifications and concluding with clustered hard pull pre-approvals—maximizes your rate shopping efficiency while minimizing credit impact. Understanding the nuances of how hard inquiries impact credit can empower consumers.

Professional Credit Checks: When Others Access Your Credit

Employment credit screening operates under distinct regulatory frameworks that provide specific consumer protections often overlooked during job searches. The Fair Credit Reporting Act requires employers to obtain written consent before accessing credit reports and mandates adverse action notifications when credit information influences hiring decisions. These protections create opportunities for candidates to address credit concerns proactively, though many remain unaware of their rights during the employment screening process. Consequently, grasping how hard inquiries impact credit is vital for financial health.

Rental application inquiries occupy a unique position within the credit ecosystem, as property management companies may use either hard or soft pulls depending on their screening providers. Large apartment complexes typically employ soft inquiries through specialized tenant screening services, while individual landlords often trigger hard pulls through traditional credit monitoring platforms. Understanding your local rental market’s screening practices allows you to budget inquiry impacts when apartment hunting or negotiate screening fee arrangements that limit credit exposure. Every consumer should know how hard inquiries impact credit to enhance their applications.

Insurance and utility companies increasingly utilize credit information for risk assessment and deposit determination, though their inquiry practices vary significantly by industry and state regulations. Auto insurance providers primarily use specialized credit-based insurance scores derived from soft pulls, while utility companies may employ hard inquiries for new service establishment. These professional credit checks accumulate on your credit report regardless of their scoring impact, creating inquiry volume that future lenders evaluate when assessing your credit-seeking behavior. Moreover, knowing how hard inquiries impact credit helps prevent future pitfalls.

- Employment screening inquiries: Require written consent and provide adverse action protections

- Rental application pulls: Vary between hard and soft depending on screening service used

- Insurance credit checks: Typically use soft pulls for specialized insurance scoring models

- Utility service inquiries: May trigger hard pulls for new account establishment and deposit calculation

- Professional licensing checks: Often involve hard inquiries for financial services and healthcare positions

Account monitoring inquiries from existing creditors represent a frequently misunderstood category of professional credit access. These periodic reviews allow lenders to assess ongoing risk and adjust credit limits or terms accordingly. While classified as soft inquiries that don’t impact scores, they signal active account management and can precede automatic credit limit increases or promotional offers. Recognizing these inquiry patterns helps you anticipate and leverage potential credit expansion opportunities without initiating formal applications. The effects of how hard inquiries impact credit are often misunderstood.

Recovery Strategies: Minimizing Long-Term Inquiry Damage

Ultimately, being aware of how hard inquiries impact credit aids in managing financial goals. The recovery timeline for inquiry-related score impacts follows a predictable pattern that enables strategic credit planning around major financial decisions. Hard inquiries affect credit scores most significantly during their first 12 months on your credit report, with the impact gradually diminishing as the inquiry ages. After 12 months, older FICO scoring models ignore inquiries entirely, while newer versions may continue applying minimal impact until the inquiry reaches 24 months and falls off your report completely.

Proactive credit monitoring during the inquiry recovery period reveals subtle score fluctuations that influence application timing decisions. Score improvements often occur incrementally as inquiries age, creating windows of opportunity for new credit applications when your scores peak between inquiry impacts. Monthly monitoring allows you to identify these optimal application periods and avoid compounding inquiry damage during score recovery phases. Knowing the ins and outs of how hard inquiries impact credit can lead to better decisions.

Building inquiry-resistant credit profiles requires diversifying your credit portfolio while maintaining low utilization across all accounts. Established credit histories with multiple account types demonstrate responsible credit management and reduce the relative impact of new inquiries on your overall credit profile. This diversification strategy proves particularly effective for individuals planning major purchases that will require multiple credit applications within short timeframes. Every consumer should understand how hard inquiries impact credit for future planning.

“Credit literacy requires us to be diligent and forward thinking. It begins by educating our children and ourselves on sound credit and financial management principles,” explains Marco Carbajo, business credit expert and founder of the Business Credit Insiders Circle.

Disputing unauthorized inquiries demands specific documentation and persistence through the credit bureau investigation process. Successful inquiry removal requires proof that you never authorized the credit check or that the inquiry resulted from identity theft or clerical error. Credit bureaus must investigate dispute claims within 30 days and remove inquiries they cannot verify, though the process often requires multiple dispute rounds and detailed supporting documentation to achieve complete removal. Awareness of how hard inquiries impact credit can lead to proactive financial strategies.

Personal credit report monitoring serves dual purposes of inquiry tracking and application preparation. Regular report reviews reveal inquiry patterns that may concern future lenders and identify opportunities for strategic credit applications during low-inquiry periods. This monitoring also uncovers promotional soft pulls that may indicate pre-approved credit opportunities, allowing you to pursue new credit without triggering additional hard inquiries.

“All credit inquiries remain on your credit report for two years, making strategic timing essential for maintaining optimal credit health.”

Advanced Inquiry Management: Building a Sustainable Credit Strategy

Creating a personal inquiry calendar transforms reactive credit decisions into proactive financial planning that optimizes both timing and outcomes. This systematic approach involves mapping planned major purchases, tracking existing inquiry aging, and identifying optimal application windows that minimize cumulative credit impact. Since hard inquiries impact credit score most during clustered application periods, spacing them strategically helps protect your rating. The calendar should also account for seasonal lending patterns, promotional periods, and personal financial milestones—times when hard inquiries impact credit score the most in lender evaluations.

Credit mix diversification and account age management provide foundational stability that buffers inquiry impacts during active credit-seeking periods. Maintaining a combination of revolving credit, installment loans, and different account ages demonstrates credit management competency that scoring algorithms reward. Since hard inquiries impact credit score more noticeably when credit profiles lack depth, a well-diversified mix helps reduce their negative effect. This strong foundation ensures that even when hard inquiries impact credit score, your overall credit health remains resilient during expansion phases.

Business credit establishment offers sophisticated strategies for reducing personal credit inquiry frequency while expanding overall credit access. Developing business credit profiles through vendor trade lines, business credit cards, and commercial loans creates parallel credit capacity that doesn’t impact personal credit reports. This separation allows business owners and entrepreneurs to pursue growth financing without compromising personal credit scores or triggering excessive inquiry accumulation.

The strategic sequencing of credit applications requires understanding how different credit types interact within scoring algorithms and lender evaluation processes. Opening revolving credit accounts before installment loans typically produces better scoring outcomes, as does spacing applications across different credit categories rather than concentrating them within single product types. This sequencing approach minimizes the compounding effects of inquiry clustering while building comprehensive credit profiles that support long-term financial goals—especially when considering how hard inquiries impact credit score during periods of frequent credit activity.

Long-term credit planning integrates inquiry management with broader financial objectives, creating sustainable approaches to credit utilization and expansion. This comprehensive strategy considers major life events, career changes, and financial goals that will require credit access, allowing you to position your credit profile optimally for future needs. The planning process should anticipate inquiry-sensitive periods and build credit strength during stable phases, recognizing how hard inquiries impact credit score when applying for new credit during key financial milestones.

Mastering the Credit Inquiry Game: Your Path Forward

The strategic management of hard inquiries impact credit score isn’t just about avoiding a few points of credit score damage—it’s about understanding the sophisticated algorithms that determine your financial opportunities. By recognizing how inquiry timing, frequency, and type interact with your broader credit profile, you can navigate major purchases and credit expansion without sacrificing your creditworthiness. The protective windows for rate shopping, the hidden impacts of professional credit checks, and the recovery strategies we’ve explored all work together to address how hard inquiries impact credit score and to create a comprehensive approach to credit health.

Your credit journey doesn’t have to be a series of reactive decisions that leave you wondering why your score dropped or why you were denied. Instead, it can become a proactive strategy where you control the timing, understand the consequences, and position yourself for success. The difference between consumers who struggle with credit and those who leverage it effectively often comes down to this fundamental understanding: credit scoring isn’t just about what you owe—it’s about how intelligently you pursue the credit you need. The question isn’t whether you’ll need to apply for credit in the future, but whether you’ll be prepared to do it strategically when that moment arrives. In summary, an understanding of how hard inquiries impact credit can streamline borrowing.