When divorce papers are filed, most couples focus on dividing assets and determining custody arrangements. But there’s a financial minefield that often gets overlooked until it’s too late: your credit score. While you’re splitting up furniture and bank accounts, your joint credit obligations continue to bind you together in ways that can wreak havoc on your financial future long after the divorce is final. Understanding the impact of divorce and credit scores is essential to ensure financial health after a separation.

It’s important to consider how divorce and credit scores influence your ability to rebuild financially. The problem runs deeper than most people realize. Even when a judge assigns debt responsibility to your ex-spouse, creditors aren’t required to honor those decisions. Your name remains on joint accounts, co-signed loans, and even seemingly minor shared obligations like family cell phone plans. What happens when your former partner stops making payments on debts you’re still legally responsible for? The answer involves understanding the complex relationship between divorce law and credit reporting – and knowing exactly which steps to take before, during, and after your divorce to protect the credit score you’ll need to rebuild your independent life.

The Anatomy of Joint Credit Obligations: What Creditors Don’t Tell You

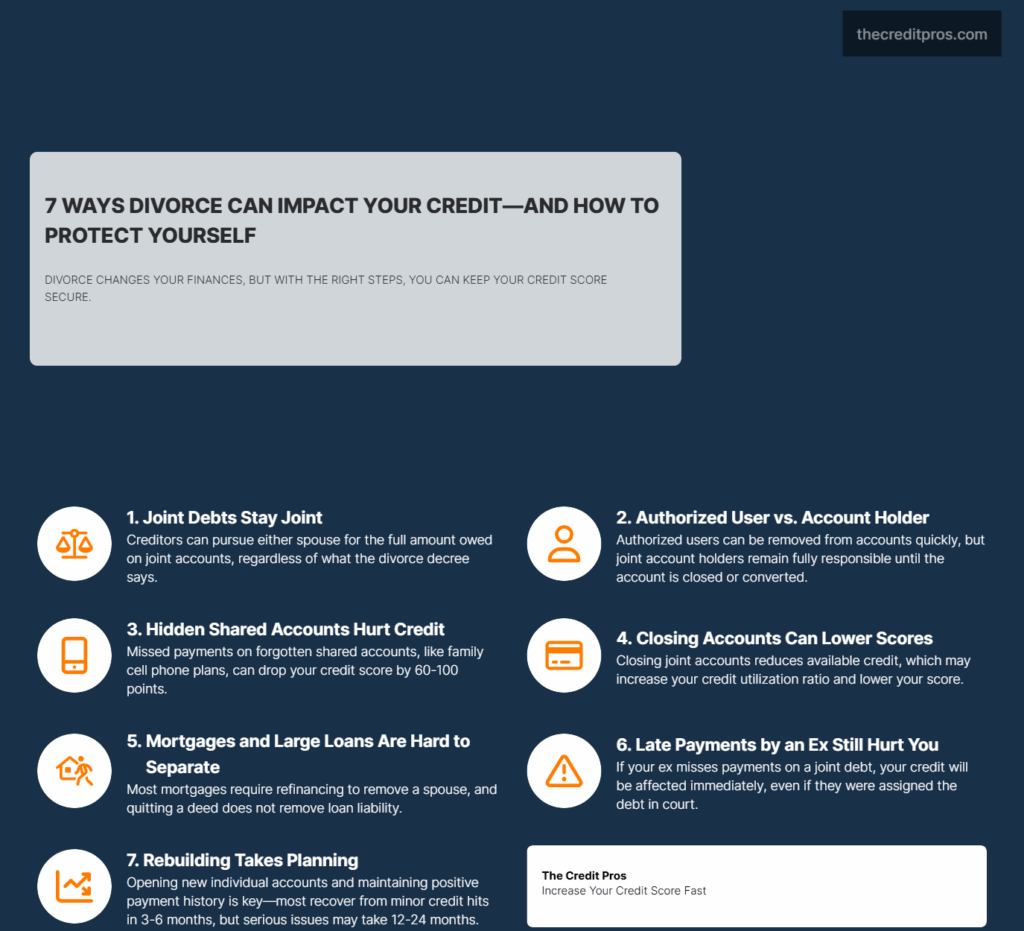

Your approach to divorce and credit scores can determine your future financial stability. Joint credit accounts create binding legal relationships that persist regardless of marital status changes. When you open a joint credit card or co-sign a loan with your spouse, both parties become equally responsible for the entire debt, not just their portion of spending. This joint and several liability means creditors can pursue either party for the full amount owed, making divorce decree assignments legally meaningless from the creditor’s perspective.

The distinction between primary account holders and authorized users fundamentally impacts your ability to separate from joint financial obligations. Primary account holders maintain full control over the account, including the power to add or remove authorized users, while authorized users can only request removal from the account. If you’re listed as an authorized user on your spouse’s credit card, you can contact the creditor directly to request removal, and your credit report should reflect this change within 30-45 days. However, if you’re a joint account holder, both parties must agree to changes, or the account must be closed entirely. Joint credit obligations can have lasting implications for your divorce and credit scores.

Creditors resist honoring divorce decrees because these legal documents don’t alter the original contract terms you signed. Banks and credit card companies view divorce settlements as agreements between spouses that don’t affect their right to collect from either debtor. When a judge assigns a specific debt to one spouse, the creditor remains legally entitled to pursue collection from both parties if payments cease. This creates a dangerous gap between legal responsibility as defined by the court and financial liability as enforced by creditors. The relationship between joint accounts and your divorce and credit scores is crucial to understand.

Hidden joint obligations extend beyond obvious credit cards and loans into seemingly minor shared accounts that can significantly impact your credit score. Utility accounts, family cell phone plans, streaming services, and even library cards can appear on credit reports when payments are missed. These accounts often remain forgotten during divorce proceedings because they seem insignificant compared to mortgages and major credit cards. However, a missed payment on a shared cell phone plan reports to credit bureaus the same way as a missed credit card payment, potentially dropping your credit score by 60-100 points. Divorce and credit scores are often overlooked, yet they significantly affect your financial future.

The timing of account closure and debt division creates critical vulnerabilities that many divorcing couples fail to recognize. Closing joint accounts immediately upon filing for divorce can actually harm your credit score if it significantly reduces your available credit or eliminates your oldest credit lines. Conversely, leaving accounts open while negotiating divorce terms exposes you to potential damage from your spouse’s spending or payment behaviors. The optimal approach involves freezing joint accounts to prevent new charges while maintaining them open to preserve credit history length and utilization ratios. Be proactive about managing your divorce and credit scores to avoid long-term issues.

Strategic Account Disentanglement: Beyond Simple Closure

Credit utilization ratios require careful management when separating joint financial accounts to prevent unnecessary credit score damage. Your credit utilization ratio, which compares your outstanding balances to available credit limits, accounts for approximately 30% of your credit score calculation. Closing joint accounts with high credit limits can dramatically increase your utilization ratio on remaining accounts, potentially causing significant score drops even when you maintain the same debt levels. Avoiding pitfalls related to divorce and credit scores can help you maintain a healthy financial profile.

The strategic approach involves calculating your total available credit across all accounts before making any closures. If joint accounts represent a substantial portion of your available credit, consider applying for individual replacement credit before closing joint accounts. This maintains your overall credit availability while eliminating joint liability exposure. However, new credit applications temporarily lower your credit score, so timing these applications strategically around your divorce proceedings minimizes cumulative negative impacts. Your understanding of divorce and credit scores can shape your recovery journey.

Account conversion offers an alternative to complete closure that preserves credit history while eliminating joint liability. Many major credit card issuers allow joint account holders to convert shared accounts into individual accounts, transferring the entire account history to one person while removing the other party’s liability. This process typically requires the remaining account holder to qualify individually for the existing credit limit and may involve a temporary credit check. The conversion preserves the account’s age and payment history, which benefits the remaining account holder’s credit profile. Strategic planning around divorce and credit scores is essential for protecting your finances.

Documentation trails become essential when separating joint accounts because credit bureau errors frequently occur during account modifications. Create detailed records of all communication with creditors, including dates, representative names, and confirmation numbers for account changes. Request written confirmation of any account modifications, including authorized user removals, account closures, or liability transfers. These documents serve as evidence if disputes arise with credit bureaus or if your ex-spouse later claims responsibility for accounts they agreed to assume. Your approach to divorce and credit scores can greatly influence your financial independence.

Mortgage and large asset considerations require specialized approaches because these debts typically cannot be easily transferred or closed. Mortgage lenders rarely allow simple liability transfers without full refinancing, which requires the remaining borrower to qualify individually for the entire loan amount. If refinancing isn’t feasible due to income limitations or market conditions, the departing spouse may need to remain on the mortgage while signing a quitclaim deed to transfer property ownership. This arrangement leaves the departing spouse liable for mortgage payments while holding no property interest, creating significant financial risk. Understanding divorce and credit scores is key to navigating the post-divorce landscape.

Home equity lines of credit and auto loans present similar challenges but offer more flexibility than traditional mortgages. Some lenders allow loan assumptions where one spouse takes full responsibility for the debt, though this typically requires demonstrating sufficient income and creditworthiness to handle the payments independently. Auto loans can sometimes be refinanced more easily than mortgages, especially if the vehicle’s value supports the loan amount and the remaining borrower has stable income. Documenting your journey regarding divorce and credit scores can provide you with necessary evidence.

Protecting Your Credit When Your Ex-Spouse Defaults

Addressing concerns around divorce and credit scores early can mitigate long-term damage. Court orders provide legal recourse between former spouses but offer no protection against creditor actions when joint debts become delinquent. When your ex-spouse fails to make payments on debts assigned to them in the divorce decree, creditors can still pursue collection against you as the joint debtor. Your legal remedy involves seeking contempt of court charges against your ex-spouse or pursuing civil litigation for damages, but these processes take months or years while credit damage occurs immediately upon missed payments.

The liability mitigation process requires proactive communication with creditors before payment problems arise. Contact each creditor holding joint debts to explain the divorce situation and request written confirmation of account status changes. Some creditors may agree to remove your name from accounts when presented with divorce documentation, though they’re not legally required to do so. Document these conversations and follow up with written requests that create paper trails for future disputes. Focusing on divorce and credit scores can help you make informed financial decisions.

Credit monitoring systems designed for divorce situations require specialized alerts beyond standard identity theft protection. Set up specific monitoring for all joint accounts, including those assigned to your ex-spouse in the divorce settlement. Many credit monitoring services allow you to create custom alerts for specific accounts, notifying you immediately when payment statuses change or when new derogatory information appears on your credit report. These early warnings provide opportunities to address problems before they cause significant credit damage. Managing obligations related to divorce and credit scores is vital for financial health.

Emergency response protocols become crucial when you discover missed payments on joint accounts assigned to your ex-spouse. Your immediate actions should include:

- Contacting the creditor to understand the payment status and minimum amount needed to bring the account current • Documenting the situation with screenshots or written statements from the creditor • Notifying your divorce attorney about the breach of the divorce decree • Considering making the minimum payment yourself to prevent further credit damage while pursuing legal remedies • Requesting the creditor remove late payment notations from your credit report once the account becomes current

The decision to make payments on your ex-spouse’s assigned debts requires careful consideration of both immediate credit protection and long-term legal implications. Making payments may prevent credit damage but could also establish a pattern that courts interpret as accepting responsibility for the debt. Consult with your attorney before making payments on debts assigned to your ex-spouse, and document any payments as emergency measures to protect your credit rather than acceptance of responsibility. The connection between divorce and credit scores should be a priority during your transition.

Rebuilding Individual Credit Architecture Post-Divorce

Single-income credit management presents unique challenges that require strategic adjustments to maintain healthy credit profiles after divorce. Your debt-to-income ratio becomes a critical factor in creditworthiness when transitioning from dual-income to single-income status. Even if your individual credit score remains high, lenders may view your reduced income capacity as increased risk, potentially limiting your access to new credit or resulting in higher interest rates on approved applications. Your focus on divorce and credit scores can help establish your financial goals.

Income documentation strategies become particularly important when applying for new credit accounts post-divorce. Lenders evaluate your ability to repay based on current income, not your historical earning capacity during marriage. If you receive alimony or child support, these payments may count toward your qualifying income, but you’ll need to provide court documentation and proof of consistent payment history. Some lenders require 12-24 months of documented support payments before considering them as qualifying income for credit applications. Being proactive about divorce and credit scores will provide peace of mind during financial transitions.

Strategic new account opening requires balancing the need for individual credit establishment with the temporary negative impact of credit inquiries. Opening too many new accounts simultaneously can significantly lower your credit score, while opening too few may leave you vulnerable if existing joint accounts are closed unexpectedly. A measured approach involves opening one or two new individual accounts within the first six months after divorce, allowing your credit score to stabilize before pursuing additional credit if needed.

Strategies for managing divorce and credit scores can lead to a smoother financial transition. The timing of new account applications should consider your divorce timeline and credit score stability. Avoid applying for new credit immediately before or during contentious divorce proceedings, as your credit score may fluctuate due to joint account changes and increased financial stress. Wait until joint accounts are properly separated and your credit reports reflect accurate individual status before pursuing new credit relationships.

Credit history preservation methods focus on maintaining the positive aspects of your marital credit history while establishing clear individual identity. Keep individual accounts that predate your marriage open to maintain credit history length, even if you rarely use them. These accounts demonstrate long-term credit management experience and contribute to your credit score’s age component. If you were primarily an authorized user during marriage, establishing individual credit history becomes essential for future financial independence. Understanding the intricacies of divorce and credit scores can empower your decisions.

Address and identity verification updates ensure credit bureaus properly reflect your post-divorce status and prevent confusion between your credit profile and your ex-spouse’s information. Update your address with all three major credit bureaus immediately after establishing separate residence, even if you’re temporarily staying with family or friends. This prevents mail forwarding issues and ensures you receive important credit-related communications directly.

Name change considerations require systematic updates across all financial institutions and credit reporting agencies. If you’re reverting to a previous name or adopting a new name, notify creditors in writing with supporting legal documentation. Request that credit bureaus link your credit history under both names to preserve your credit profile continuity. This process typically takes 30-60 days to complete fully across all systems. Embracing the relationship between divorce and credit scores allows for better planning.

Long-Term Financial Independence: Creating Credit Resilience

Emergency credit strategies provide financial safety nets that become particularly important for single-income households managing post-divorce financial responsibilities. Establishing backup credit sources before you need them ensures access to funds during unexpected situations like job loss, medical emergencies, or major home repairs. Consider maintaining at least one credit card with available credit equal to 2-3 months of essential expenses, keeping this account active with small, manageable purchases that you pay off monthly. Your knowledge of divorce and credit scores is a critical asset in financial recovery.

The diversification of credit types strengthens your overall credit profile while providing multiple financial tools for different situations. A well-rounded credit portfolio might include a rewards credit card for daily expenses, a low-interest card for larger purchases, a home equity line of credit for major expenses, and potentially a personal line of credit for emergency situations. This diversification demonstrates credit management sophistication to lenders while providing flexibility for various financial needs.

Income documentation and credit applications require ongoing attention to present your post-divorce financial picture accurately to lenders. Maintain organized records of all income sources, including employment, alimony, child support, investment income, and any business earnings. Create a financial portfolio that clearly demonstrates your income stability and debt management capabilities, including recent pay stubs, tax returns, bank statements, and documentation of consistent support payments. Maintain awareness of how divorce and credit scores impact your future financial opportunities.

Credit score recovery timelines vary significantly based on individual circumstances, but understanding realistic expectations helps maintain motivation during the rebuilding process. Minor credit score drops from account closures or new credit inquiries typically recover within 3-6 months with consistent positive payment behavior. More significant damage from missed payments or high balances may require 12-24 months of excellent credit management to fully recover. Establishing individual credit history when you were previously an authorized user can take 6-12 months to show meaningful improvement.

Future relationship financial boundaries become essential considerations as you rebuild your independent financial life and potentially enter new romantic relationships. Maintain separate credit accounts and financial identities even in committed relationships to preserve the financial independence you’ve worked to establish. Consider prenuptial agreements that clearly define financial responsibilities and protect individual credit profiles if you remarry. Avoid co-signing loans or opening joint accounts until you’re certain about long-term relationship stability and financial compatibility.

The psychological aspect of financial independence often requires adjustment after years of shared financial decision-making during marriage. Building confidence in individual financial management takes time and practice, but maintaining strict boundaries around your credit and financial accounts protects the progress you’ve made in establishing independent creditworthiness. Regular monitoring of your credit reports and scores helps maintain awareness of your financial health and provides early warning of any issues that require attention. Understanding how divorce and credit scores interact is essential for maintaining financial stability in the long run.

Conclusion: Your Credit Score Doesn’t Have to Become Another Casualty of Divorce

Divorce inevitably disrupts your financial landscape, but your credit score doesn’t have to become collateral damage in the process. Addressing the intersection of divorce and credit scores is critical in today’s financial landscape. The key lies in understanding that creditors operate independently of divorce courts – they’ll pursue whoever signed the original agreements regardless of what your divorce decree says. By proactively addressing joint accounts, monitoring your credit throughout the process, and establishing individual financial identity, you can protect the creditworthiness you’ll need to rebuild your independent life. Ultimately, managing divorce and credit scores is essential for protecting your financial health.