Most borrowers think they understand APR – after all, it’s just the interest rate, right? Wrong. That common misconception costs people thousands of dollars every year because APR calculations involve complex mathematics that most lenders don’t fully explain. When you see a 6% APR mortgage and a 6% APR personal loan, you might assume they’re equivalent, but the reality is far more complicated. Understanding APR is essential for making informed financial decisions. Understanding APR can prevent financial pitfalls and enhance your overall financial literacy. By mastering the concept of understanding APR, you can save significant amounts over the life of a loan.

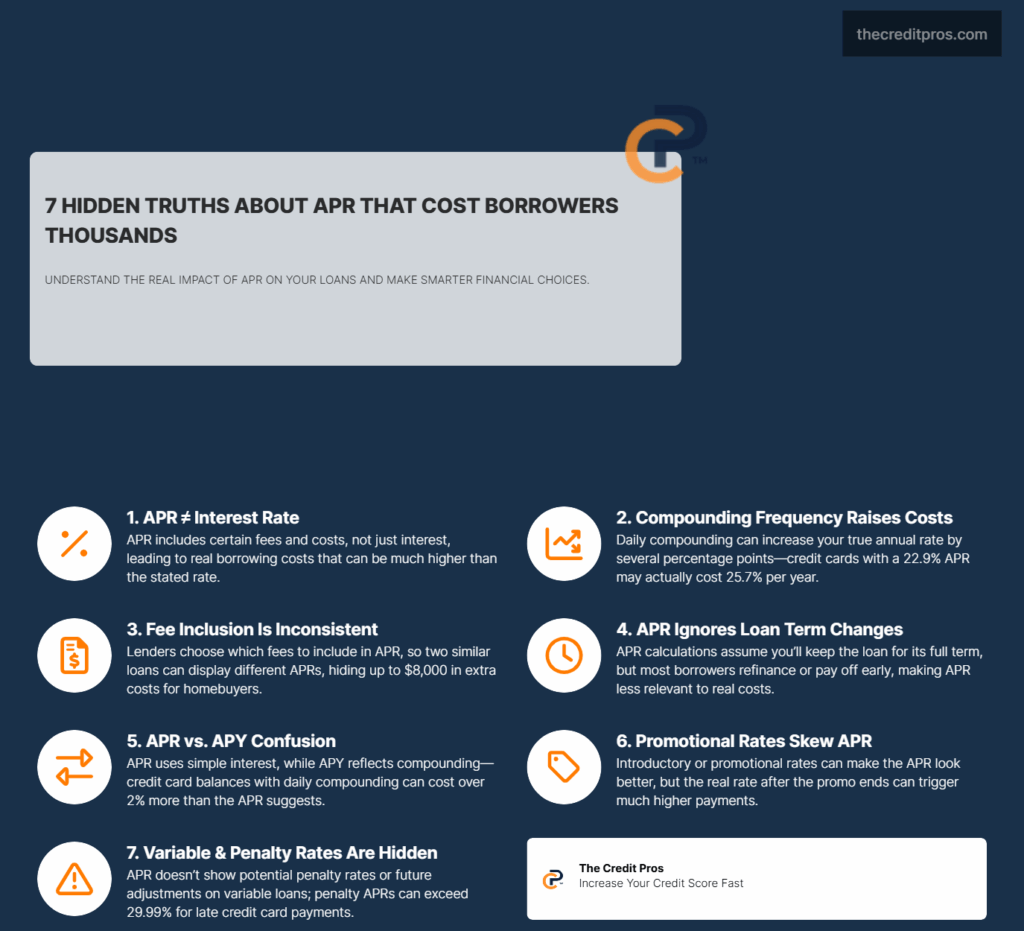

The truth is, APR serves as a standardized comparison tool, but it has significant limitations that can mislead even careful borrowers. Some fees get included while others don’t, compounding frequencies vary dramatically between loan types, and the calculations assume you’ll keep the loan for its entire term – something most people never do. Understanding APR and these hidden mechanics isn’t just academic knowledge; it’s the difference between choosing a loan that truly serves your financial interests and one that quietly drains your wealth through overlooked costs and misleading presentations.

Understanding APR is crucial when comparing different loan offers to ensure you choose the right option. Understanding APR helps borrowers identify potentially misleading terms presented by lenders. For many borrowers, understanding APR can clarify their financial obligations and expectations. Deepening your understanding of APR can empower you during negotiations with lenders. Understanding APR also plays a vital role in determining the overall cost of your loan. For borrowers, understanding APR is essential to avoid paying more than necessary. Understanding APR can guide you through the intricacies of loan agreements. Knowledge is power, and understanding APR gives you that power in financial decisions. The more you focus on understanding APR, the better financial choices you can make. Your ability to make informed decisions improves as your understanding APR deepens. Understanding APR can help you identify the right loan for your unique financial situation.

The Hidden Mathematics: How APR Calculations Actually Work Behind the Scenes

The mathematical foundation of APR extends far beyond simple interest calculations, incorporating a complex web of fees, timing, and regulatory interpretations that most borrowers never fully grasp. While lenders present APR as a straightforward annual percentage, the underlying formula involves dividing all loan costs by the principal amount, then dividing by the loan term in years, and multiplying by 365 days. This approach creates the illusion of precision while masking significant variations in how different institutions calculate and present their rates.

The periodic interest rate multiplication method reveals why advertised rates often differ from your actual borrowing costs. Credit card companies, for instance, multiply daily periodic rates by 365 days to arrive at their APR, but this calculation assumes simple interest without compounding. When you carry a balance, however, the daily compounding effect means your effective interest rate exceeds the advertised APR. A credit card with a 22.9% APR that compounds daily actually costs you 25.7% annually when you maintain a balance throughout the year.

Compounding frequency creates substantial variations across loan products, even when base interest rates appear similar. Mortgages typically compound monthly, personal loans may compound daily, and some business loans compound quarterly. These differences represent real money that flows from your pocket to the lender’s bottom line. The regulatory framework allows lenders considerable flexibility in how they present these calculations, creating opportunities for strategic rate presentation that favors their marketing objectives over borrower clarity.

Lenders exploit regulatory gray areas by selectively including or excluding fees from their APR calculations. Mortgage lenders might include origination fees but exclude appraisal costs, while personal loan providers could incorporate processing fees but omit late payment penalties. This selective inclusion creates artificially attractive APRs that don’t reflect your total borrowing costs. The Truth in Lending Act requires APR disclosure but provides enough flexibility that two identical loans can legally display different APRs based on which fees each lender chooses to include.

APR vs. APY: The Compounding Confusion That Costs Borrowers Money

The fundamental distinction between APR and APY lies in their treatment of compounding, yet this difference creates one of the most expensive misunderstandings in personal finance. APR calculates costs using simple interest, while APY incorporates the compounding effect that occurs when interest charges are added to your principal balance. This mathematical difference becomes particularly significant with credit cards and revolving credit facilities, where daily compounding can increase your effective rate by several percentage points above the advertised APR.

Taking the time to comprehend understanding APR is an investment in your financial health. Understanding APR is not just beneficial; it’s essential for every potential borrower. With a solid grasp of understanding APR, you’ll navigate loan options with confidence.

Marketing tactics deliberately exploit this confusion by emphasizing whichever metric appears more favorable to their product positioning. Credit card companies prominently display APR because it appears lower than the equivalent APY, while banks advertising savings accounts highlight APY because compound interest makes their rates appear more attractive. This strategic presentation means you’re comparing different calculation methods when evaluating financial products, often without realizing the fundamental differences.

Daily compounding on credit card balances creates a particularly costly scenario for borrowers who don’t understand the APR-APY relationship. When you carry a $10,000 balance on a card with a 20% APR, daily compounding means you’ll actually pay approximately 22.13% annually. This difference of more than two percentage points translates to hundreds of dollars in additional interest charges over the course of a year. The compounding effect becomes even more pronounced with higher balances and longer repayment periods.

“The APR isn’t always an accurate reflection of the total cost of borrowing. In fact, it may understate the actual cost of a loan.”

Adjustable-rate mortgages present unique challenges in APR accuracy because the calculation must estimate future rate changes over the loan’s entire term. Lenders typically use current rates plus historical averages to project future costs, but these estimates often prove wildly inaccurate. During periods of rising interest rates, initial APR calculations can underestimate actual borrowing costs by significant margins, leaving borrowers unprepared for payment increases that exceed their original expectations.

The importance of understanding APR cannot be overstated in today’s financial landscape. Ultimately, your financial wisdom hinges on understanding APR and its implications.

The Fee Structure Maze: What’s Really Included in Your APR

Consider each loan’s understanding APR carefully to avoid costly mistakes. Enhancing your understanding APR is a proactive step in achieving financial freedom. Prioritize understanding APR to ensure financial decisions benefit your long-term goals. The inconsistent inclusion of fees across different lenders creates a complex landscape where identical loan products can display dramatically different APRs based solely on accounting methodology. Mortgage lenders face particular complexity because home loans involve numerous third-party fees that may or may not be included in APR calculations. Some lenders include attorney fees, title insurance, and property taxes in their APR, while others exclude these costs entirely, creating APR differences of one percentage point or more between otherwise identical loan offers.

Origination fees, processing charges, and closing costs represent the most common fee categories that impact APR calculations, but their treatment varies significantly across institutions. A lender charging a 2% origination fee might spread this cost across the loan term for APR purposes, making their rate appear competitive with a no-fee competitor. However, the upfront cash requirement and the actual cost of borrowing remain higher despite the favorable APR presentation. This mathematical manipulation particularly affects borrowers who plan to refinance or sell before the loan’s maturity date.

The strategic exclusion of certain fees from APR calculations creates additional complexity in loan comparisons. Mortgage APRs typically exclude:

- Appraisal fees and property inspection costs • Title insurance and attorney fees • Property taxes and homeowner’s insurance • Private mortgage insurance premiums • Application and credit report fees • Notary and document preparation charges

These exclusions mean that mortgage APRs often understate actual borrowing costs by $3,000 to $8,000 for typical home purchases. The regulatory justification for these exclusions centers on the argument that these costs aren’t directly related to the credit extension, but this distinction provides little comfort to borrowers who must pay these fees regardless of their technical classification.

Penalty APRs and variable rate changes represent another category of costs that don’t appear in initial APR disclosures but can dramatically impact your actual borrowing expenses. Credit card companies can increase your interest rate to penalty levels exceeding 29.99% for late payments or other violations, while variable-rate loans can experience rate increases that bear no relationship to your original APR. These potential cost increases remain invisible in standard APR presentations, creating a false sense of rate stability that doesn’t reflect the dynamic nature of modern lending products.

APR Limitations: When This Standard Metric Misleads Borrowers

The assumption that borrowers will maintain their loans for the full term represents one of APR’s most significant limitations, particularly given that most mortgages are refinanced or paid off within seven years. This assumption creates distorted cost calculations because fees that are amortized over 30 years for APR purposes are actually paid over much shorter periods. A mortgage with $5,000 in closing costs shows a modest APR impact when spread over three decades, but these costs represent a substantial expense when you refinance after five years.

Introductory rates and promotional periods create additional APR calculation challenges that often mislead borrowers about long-term costs. Credit card companies offering 0% introductory APR for 12 months must calculate their ongoing APR based on the regular rate that takes effect after the promotional period. However, the initial APR calculation doesn’t reflect the payment shock that occurs when promotional rates expire, leaving borrowers unprepared for significant payment increases.

The inadequacy of APR for comparing different loan structures becomes particularly apparent when evaluating fixed-rate versus variable-rate products. Fixed-rate loans provide APR certainty, while variable-rate products can only estimate future costs based on current market conditions and historical trends. During periods of interest rate volatility, these estimates can prove dramatically inaccurate, with actual borrowing costs varying significantly from initial APR projections.

Adjustable-rate mortgages illustrate this limitation most clearly, as their APR calculations must estimate rate changes over the loan’s entire term. Lenders typically use current rates for the initial fixed period, then apply rate caps and historical averages to project future adjustments. However, these projections often underestimate actual costs during periods of rising rates, while overestimating costs during declining rate environments. The result is an APR that provides little guidance for long-term financial planning.

Strategic APR Analysis: Making Informed Decisions Beyond the Numbers

Developing a comprehensive evaluation framework requires balancing APR considerations with loan flexibility, prepayment options, and lender reputation factors that don’t appear in standard rate comparisons. Your personal borrowing profile significantly affects APR relevance, particularly regarding your likelihood of early repayment, refinancing plans, and tolerance for rate uncertainty. Borrowers planning to relocate within five years should weight upfront costs more heavily than APR, while those seeking long-term stability might prioritize rate predictability over initial cost savings.

Break-even analysis provides a more accurate comparison method when evaluating loans with different fee structures and APR presentations. This analysis calculates the point at which higher upfront costs are offset by lower ongoing rates, providing clearer guidance for borrowers with specific timeline expectations. A loan with higher closing costs but lower interest rates might offer better value for long-term borrowers, while no-fee options could benefit those planning early repayment.

Promotional rates require particular scrutiny because their impact on calculated APR often doesn’t reflect the payment shock that occurs when special rates expire. Credit card balance transfers offering 0% introductory rates for 18 months create artificially low initial APRs that don’t prepare borrowers for the substantial payment increases that follow. Evaluating these offers requires calculating costs based on the regular APR that takes effect after the promotional period, rather than relying on the blended rate used for APR calculations.

Your intended loan usage pattern should fundamentally influence how much weight you place on APR in your decision-making process. Borrowers who consistently pay credit card balances in full should prioritize rewards and benefits over APR, while those who carry balances need to focus on the actual cost of borrowing. Similarly, mortgage borrowers planning to stay in their homes for decades should emphasize long-term rate stability, while those expecting to move or refinance within a few years should minimize upfront costs even if it means accepting higher APRs.

The Bottom Line: APR’s Hidden Complexities Demand Your Attention

The misconception that APR simply equals interest rate costs borrowers thousands annually because the reality involves complex fee structures, compounding variations, and calculation methods that favor lenders over transparency. While APR serves as a standardized comparison tool, its limitations become apparent when you consider that most loans aren’t held to term, promotional rates distort calculations, and selective fee inclusion creates misleading presentations. The mathematical foundation reveals how daily compounding can increase your effective rate by several percentage points above advertised APR, while strategic fee exclusions hide thousands in additional costs.

Understanding these hidden mechanics transforms you from a passive borrower accepting surface-level presentations to an informed decision-maker who can navigate the complex landscape of modern lending. The difference between a 6% mortgage APR and a 6% personal loan APR isn’t just academic—it’s the distinction between loans that serve your financial interests and those that quietly drain your wealth through overlooked costs and misleading mathematics. Your financial future depends not on understanding APR as the complete picture, but on recognizing it as just one piece of a much larger puzzle that requires your active engagement to solve.