Most borrowers think resuming student loan payments will automatically hurt their credit score, but recent research reveals something surprising: some people actually see their scores increase by up to 8 points. The difference comes down to understanding your specific borrower profile and how credit reporting cycles work with your payment timing. What determines whether you’ll be in the group that benefits or the group that sees temporary setbacks? Effective credit score loan management can make a significant impact. Effective credit score loan management is essential for maximizing your financial health. Through diligent credit score loan management, you can significantly improve your creditworthiness.

The answer lies in strategic loan management that goes beyond simply making payments on time. Your credit score responds to specific patterns in how you handle different types of loans, when those payments get reported to credit bureaus, and how you balance your overall loan portfolio. Once you understand these mechanics, you can turn credit score loan management into a powerful tool for building better credit – even if you’ve faced challenges in the past.

Understanding the nuances of credit score loan management can ultimately lead to better loan terms. A strong grasp of credit score loan management can differentiate you from other borrowers. Effective credit score loan management involves knowing when to make payments to maximize benefits. Developing a strategy for credit score loan management can enhance your overall financial profile. Timing your payments skillfully is a crucial aspect of credit score loan management. This can lead to a better understanding of credit score loan management and its impact. Implementing smart strategies for credit score loan management is essential for maintaining a solid score. Consistent credit score loan management practices can yield positive results over time.

Applying effective credit score loan management techniques will reinforce your financial discipline. Being aware of the importance of credit score loan management can enhance your financial strategy. This knowledge allows borrowers to engage in better credit score loan management practices. Strategic credit score loan management decisions can optimize your overall credit profile. Effective credit score loan management contributes to a well-rounded credit portfolio.

The Credit Score Paradox: Why Resuming Student Loan Payments Can Both Help and Hurt

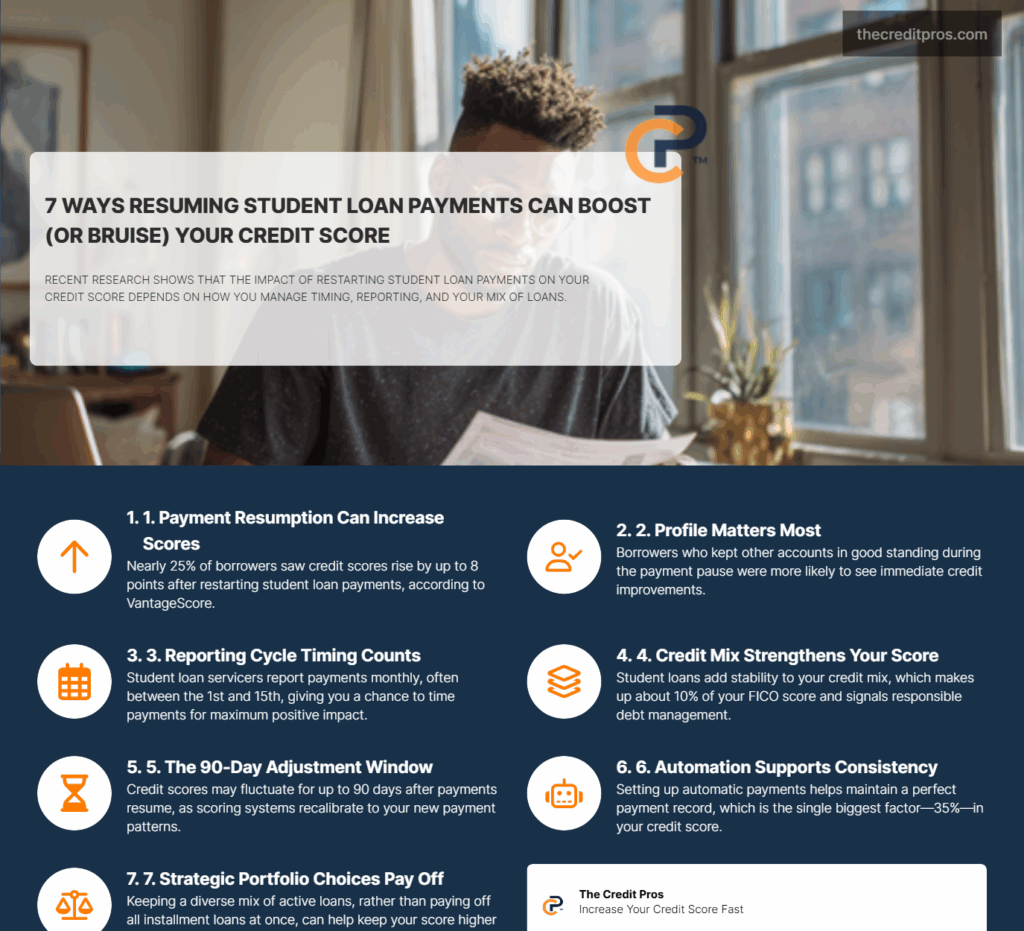

The VantageScore study reveals a counterintuitive reality that challenges conventional wisdom about student loan payments and credit scores. Borrowers resuming repayment may see scores increase by up to 8 points, while many others experience decreases during the initial payment period. This dual outcome stems from fundamental differences in borrower profiles and how credit scoring algorithms interpret payment resumption after extended periods of non-payment.

Your borrower profile determines whether you fall into the beneficiary category or face temporary score reductions. Borrowers who maintained strong credit management across other accounts during payment suspension often see immediate score improvements when resuming student loan payments. These individuals benefit from the positive payment history addition to their credit reports, which strengthens their overall credit mix and demonstrates renewed financial responsibility. Conversely, borrowers who experienced credit challenges during the suspension period may initially see score decreases as the resumed payments highlight existing credit management issues.

The timing mechanics behind these divergent outcomes relate to how credit bureaus process and weight different types of payment information. When student loan payments resume after extended suspension, credit scoring algorithms must recalibrate your risk profile based on new payment data. For borrowers with strong underlying credit foundations, this recalibration enhances their scores by adding positive installment loan payment history. However, borrowers with weakened credit profiles may experience score volatility as algorithms adjust to the new payment patterns while considering existing credit challenges.

Payment history gaps create unique scoring opportunities that many borrowers fail to recognize. During loan suspension periods, your credit report lacks recent installment loan payment data, which can actually benefit your score if you maintain excellent management of other credit accounts. When you resume payments strategically, you’re essentially adding a new positive credit element to your profile, potentially triggering score improvements that compound with your existing positive credit behaviors.

With a focus on credit score loan management, you can tackle financial challenges head-on. Utilizing credit score loan management strategies can help transform financial obstacles into opportunities. Each step in the credit score loan management process leads to better outcomes. Through understanding credit score loan management, borrowers can achieve their financial objectives. Integrating solid credit score loan management into your financial plans is vital for long-term success. Ultimately, credit score loan management is about making informed choices for your financial future.

Strategic Payment Timing: Leveraging Credit Reporting Cycles for Maximum Impact

Credit reporting cycles operate on specific schedules that most borrowers never consider when managing loan payments. Each lender reports to credit bureaus on predetermined dates, typically monthly, but the exact timing varies significantly between servicers. Understanding these reporting schedules allows you to synchronize your loan payments with other credit activities to maximize positive impact on your credit score.

The 30-day reporting lag creates strategic opportunities for borrowers who understand how to leverage this timing. When you make a loan payment, it doesn’t immediately appear on your credit report. Instead, most lenders report account information once monthly, often around the same date each month. This delay means you can strategically time payments to coincide with other positive credit activities, creating a compounding effect that amplifies your score improvements. With dedicated credit score loan management, you can enhance your financial standing.

Mapping your specific lenders’ reporting schedules requires direct communication with each servicer to determine their exact reporting dates. Most student loan servicers report between the 1st and 15th of each month, but some report on different cycles. Once you identify these dates, you can schedule your payments to arrive just before reporting periods, ensuring maximum positive impact. This strategy becomes particularly powerful when combined with credit utilization management, as you can coordinate low utilization reporting with positive loan payment reporting.

The strategic advantage of making payments just before statement closing dates extends beyond simple on-time payment benefits. When payments are reported immediately after being processed, they demonstrate current financial responsibility and active account management. This timing strategy proves especially valuable for borrowers resuming payments after suspension, as it establishes a pattern of proactive credit management that scoring algorithms recognize and reward with improved scores.

The Loan Portfolio Effect: Balancing Multiple Loan Types for Optimal Credit Mix

Credit scoring algorithms assign different weights to various loan types, creating opportunities for strategic portfolio management that most borrowers overlook. Student loans, auto loans, personal loans, and mortgages each contribute uniquely to your credit mix, with installment loans providing stability that balances the volatility of revolving credit accounts. Understanding these individual contributions allows you to optimize your overall credit profile through strategic loan management decisions.

The credit mix component represents approximately 10% of your FICO score, but its impact extends beyond this percentage when managed strategically. Maintaining active installment loans demonstrates your ability to manage diverse credit types, which scoring algorithms interpret as lower risk behavior. This diversity becomes particularly valuable when you’re managing high credit utilization on revolving accounts, as active installment loans provide stability that can offset potential negative impacts from credit card balances.

Strategic considerations for loan payoff sequencing require careful analysis of how each loan contributes to your overall credit profile. Paying off loans in order of interest rates makes financial sense, but may not optimize your credit score if it eliminates beneficial loan types from your credit mix. For example, maintaining a low-balance student loan with excellent payment history can provide ongoing credit mix benefits that outweigh the minimal interest costs, especially if eliminating it would leave you with only revolving credit accounts.

The specific weight each loan type carries varies based on your overall credit profile and the scoring model being used. Consider these factors when managing your loan portfolio:

- Student loans: Provide long-term installment credit history and demonstrate educational investment

- Auto loans: Show secured debt management and typically feature predictable payment pattern

- Personal loans: Demonstrate unsecured installment credit management and financial planning

- Mortgages: Represent the highest-value installment credit and long-term financial commitment

Loan diversity creates scoring advantages that compound over time, particularly when you maintain excellent payment histories across multiple loan types. This diversity signals to lenders that you can successfully manage various credit obligations simultaneously, reducing your perceived risk and potentially qualifying you for better terms on future credit products.

Recovery Strategies: Transforming Loan Challenges into Credit Opportunities

Converting past loan difficulties into positive credit narratives requires strategic thinking about how credit scoring algorithms interpret payment pattern changes. Borrowers who experienced challenges during loan suspension periods can use resumption as an opportunity to demonstrate renewed financial responsibility. The key lies in understanding how scoring algorithms weight recent payment history more heavily than older negative information, creating pathways for rapid score recovery.

The 90-day window represents a critical period for borrowers experiencing initial score decreases after resuming payments. During this timeframe, credit scoring algorithms are essentially learning your new payment patterns and adjusting your risk assessment accordingly. Borrowers who maintain perfect payment timing and consistency during this period often see accelerated score improvements that exceed their pre-resumption baselines. This phenomenon occurs because the algorithms recognize the positive behavior change and adjust scoring accordingly.

Loan modification and forbearance strategies can be used proactively without credit damage when implemented correctly. Many borrowers avoid these options due to misconceptions about their credit impact, but strategic use of these programs can actually support credit score optimization. For example, obtaining a temporary payment reduction through income-driven repayment plans can help you maintain perfect payment history while managing other credit obligations more effectively.

Building positive payment patterns that accelerate recovery requires consistency across all credit accounts, not just loan payments. The compound effect of excellent payment history on loans combined with optimized credit card management creates momentum that drives sustained score growth. This holistic approach to credit management transforms individual loan challenges into comprehensive credit improvement strategies that benefit your entire financial profile.

Advanced Loan Management: Micro-Strategies for Sustained Credit Growth

Automated payment strategies provide benefits beyond convenience that many borrowers fail to recognize. When you establish automatic payments for loans, you’re creating a consistent positive payment pattern that credit scoring algorithms reward with sustained score improvements. This consistency becomes particularly valuable during periods of financial stress, as automated payments ensure your loan management doesn’t suffer even when other areas of your finances require attention.

The compound effect of consistent loan management extends throughout your entire credit lifecycle, creating momentum that supports long-term financial goals. Each on-time payment strengthens your payment history, which represents 35% of your credit score. Over time, this consistent positive history creates a foundation that supports higher credit limits, better interest rates, and improved access to credit products that can further enhance your financial position.

Loan payoff strategies can be leveraged to create credit score momentum when executed strategically. Rather than simply paying loans off as quickly as possible, consider how the timing of payoffs impacts your credit mix and utilization ratios. For example, paying off a loan just before applying for a mortgage can improve your debt-to-income ratio while maintaining beneficial credit mix elements through other active loans.

Managing multiple loan servicers requires understanding how each servicer’s reporting practices impact your credit reports. Different servicers may report on different dates, use varying payment processing timelines, and have distinct policies for handling payment allocation. Mastering these nuances allows you to optimize your payment strategies across all loans simultaneously, creating coordinated positive impacts on your credit score that compound over time.

Conclusion: Turning Loan Management Into Your Credit Advantage and Embracing Credit Score Loan Management

Your credit score can be significantly improved with effective credit score loan management and precise strategies.

In conclusion, the significance of credit score loan management cannot be overstated for achieving financial success.