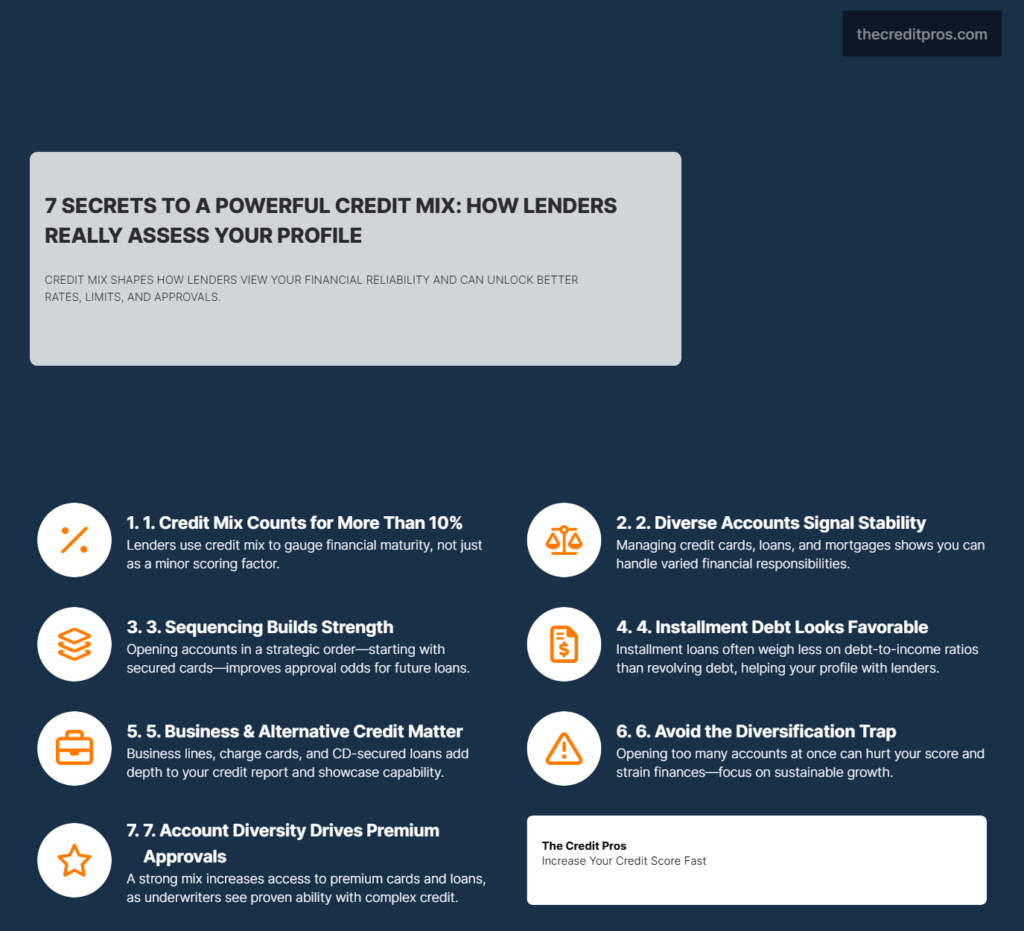

Most people know that credit mix accounts for 10% of their credit score, but what they don’t realize is how much more it influences behind the scenes. When lenders evaluate your application, they’re not just looking at numbers—they’re trying to understand what kind of borrower you are. Someone with only credit cards tells a different story than someone who’s successfully managed credit cards, an auto loan, and a mortgage. To truly improve your chances, you should diversify credit account mix.

The real power of credit mix isn’t just about hitting a scoring target. It’s about demonstrating financial maturity and showing lenders you can handle different types of credit responsibly. But here’s where it gets interesting: there’s actually a strategic sequence to building your credit mix that can amplify your results. The order matters, the timing matters, and understanding how lenders think about account diversity can open doors to better rates and terms you might not have qualified for otherwise.

By taking steps to diversify credit account mix, you can enhance your creditworthiness significantly. In essence, lenders appreciate borrowers who actively work to diversify credit account mix as it showcases financial responsibility. This can be achieved through various types of accounts, effectively allowing you to diversify credit account mix. Understanding how to diversify credit account mix will enable you to manage your finances better. Therefore, it’s essential to consider how you can diversify credit account mix in a way that aligns with your overall financial strategy. This is why having a plan to diversify credit account mix is critical for those seeking premium financial products. It’s also important to remember that diversifying credit account mix can help mitigate risks associated with any one type of credit.

As you work on your credit profile, make a conscious effort to diversify credit account mix accordingly. To optimize your financial potential, consistently look for ways to diversify credit account mix. Engaging different types of accounts is a key strategy to diversify credit account mix effectively. In various cases, individuals need to diversify credit account mix to adapt to their evolving financial landscapes. Strategically diversifying credit account mix aids in strengthening your overall credit profile.

The Psychology Behind Credit Mix: Why Lenders Value Account Diversity

Lenders evaluate credit mix through a sophisticated risk assessment lens that extends far beyond automated scoring algorithms. When underwriters review credit applications, they analyze account diversity patterns to distinguish between borrowers who merely accumulate credit and those who demonstrate genuine financial management capabilities. This psychological framework shapes lending decisions in ways that most consumers never realize.

The fundamental difference between “credit-dependent” and “credit-capable” borrower profiles lies in how individuals utilize various credit types. Credit-dependent borrowers typically maintain high balances across multiple revolving accounts, suggesting financial strain and potential overextension. In contrast, credit-capable borrowers strategically leverage different credit products for specific purposes while maintaining manageable debt levels. This distinction becomes particularly evident when lenders examine the relationship between account types and payment patterns.

Ultimately, the goal is to continually diversify credit account mix and monitor its impact on your credit score. As you progress in your financial journey, remember to consistently diversify credit account mix. Don’t overlook the importance of finding new ways to diversify credit account mix as you grow. Finding opportunities to diversify credit account mix can significantly influence your financial future. Ultimately, the aim should be to diversify credit account mix continuously to adapt to market conditions.

In the long run, those who diversify credit account mix tend to see better financial outcomes. Being proactive in your efforts to diversify credit account mix can pay off in significant ways. Investing time to learn how to diversify credit account mix will yield positive results over time. Creating strategies to diversify credit account mix is essential for financial growth and stability.

Having only revolving credit can signal financial instability to underwriters because it suggests limited financial planning and potential cash flow issues. Borrowers who rely exclusively on credit cards often appear to be managing month-to-month expenses rather than building long-term financial stability. This perception intensifies when credit utilization rates remain consistently high across multiple revolving accounts, indicating that the borrower may be using credit to bridge income gaps rather than for strategic financial purposes.

The concept of “credit sophistication” plays a crucial role in lending decisions, particularly for premium financial products. Lenders view borrowers who successfully manage diverse credit types as more financially mature and lower risk. This sophistication manifests in understanding when to use revolving credit versus installment loans, how to leverage secured credit products for financial advantage, and the ability to maintain multiple account types without compromising payment performance.

Manual underwriting processes place even greater emphasis on credit mix diversity than automated scoring systems. When loan officers review applications that fall outside standard approval criteria, they examine credit mix patterns to assess borrower reliability and financial acumen. A well-diversified credit profile can compensate for other weaknesses, such as limited credit history or recent credit challenges, because it demonstrates the borrower’s ability to manage complex financial obligations.

The relationship between credit mix and debt-to-income ratio perceptions creates additional advantages for borrowers with diverse credit profiles. Lenders often view installment debt more favorably than revolving debt when calculating debt-to-income ratios, even when the monthly payments are similar. This preference stems from the predictable nature of installment payments and the finite repayment terms, which reduce long-term risk exposure for lenders.

Strategic Account Sequencing: The Optimal Order for Building Credit Mix

Building an optimal credit mix requires strategic timing and careful sequencing to maximize both scoring impact and qualification opportunities. The foundation of effective credit mix development begins with establishing a solid revolving credit history, which serves as the cornerstone for accessing other credit types. This approach leverages the interconnected nature of credit products, where success with one type of credit creates opportunities for additional credit categories.

Secured credit cards represent the ideal starting point for credit mix development because they provide immediate access to revolving credit while minimizing lender risk. These accounts establish payment history and demonstrate responsible credit management, creating the foundation necessary for qualifying for unsecured credit products. The key advantage of starting with secured cards lies in their accessibility and the rapid establishment of positive credit history, which becomes essential for future credit applications. A well-rounded approach to finances requires you to diversify credit account mix actively. To enhance your credit position, make it a priority to diversify credit account mix.

The “credit ladder” approach involves using each successfully managed account type to qualify for the next level of credit products. After establishing positive payment history with secured or starter credit cards, borrowers can leverage this foundation to qualify for unsecured credit cards, which typically offer better terms and higher credit limits. This progression continues with installment loans, where established revolving credit history demonstrates the borrower’s ability to manage ongoing payment obligations.

Timing major credit applications requires careful consideration of inquiry impact and credit utilization patterns. The optimal strategy involves spacing applications to avoid multiple hard inquiries within short timeframes while ensuring that existing accounts show positive payment history and low utilization rates. This approach maximizes approval odds while minimizing negative scoring impacts from inquiry clustering.

Credit utilization timing becomes particularly crucial when applying for installment credit products. Lenders evaluate revolving credit utilization as part of the underwriting process, making it essential to optimize utilization rates before submitting installment loan applications. This strategy involves paying down revolving balances before applying for auto loans, personal loans, or mortgages to present the strongest possible credit profile.

Business credit accounts can accelerate personal credit mix development by providing additional credit history and demonstrating financial responsibility across multiple contexts. Successfully managing business credit lines or loans showcases advanced financial management skills while potentially improving personal credit qualification odds. This crossover benefit occurs because business credit management often appears on personal credit reports, particularly for sole proprietors and small business owners.

Finally, remember that your goal should always be to diversify credit account mix for optimal results. As you reflect on your credit journey, remember that diversifying credit account mix is crucial for success. To sum up, actively work to diversify credit account mix as part of your long-term financial strategy. In conclusion, prioritize efforts to diversify credit account mix to benefit from a diverse financial portfolio. Make it a point to continually diversify credit account mix to stay ahead in the ever-changing financial landscape. Ultimately, being intentional about how you diversify credit account mix can lead to lasting financial benefits.

By focusing on ways to diversify credit account mix, you can create a solid foundation for future financial growth. Regularly reassessing your approach to diversify credit account mix will help maintain a healthy credit profile. Lastly, ensure you take all necessary steps to effectively diversify credit account mix and maximize your opportunities. It is imperative to diversify credit account mix as part of a comprehensive financial plan.

The compounding effect of responsible credit mix management creates exponential benefits over time. Each successfully managed account type strengthens the overall credit profile, making qualification for additional credit products easier and more favorable. This progression allows borrowers to access premium credit products with better terms, lower interest rates, and enhanced benefits that were previously unavailable.

Beyond the Big Three: Exploring Alternative Credit Types for Portfolio Depth

Always evaluate and adjust your plan to diversify credit account mix according to your financial goals. Alternative credit types offer sophisticated opportunities for credit mix enhancement beyond traditional revolving credit, installment loans, and mortgages. These lesser-known credit products can provide strategic advantages for borrowers seeking to maximize their credit profile depth while accessing unique financial benefits. Understanding how these alternative credit types contribute to overall credit mix diversity requires examining their reporting characteristics and lender perception.

Store credit cards and general-purpose credit cards serve distinctly different strategic purposes within credit mix optimization. Store cards typically offer easier qualification criteria and can help establish initial credit history, but they also demonstrate spending patterns and retail relationships to lenders. General-purpose cards provide greater flexibility and often carry more weight in credit mix calculations due to their broader utility and typically higher credit limits. The strategic advantage lies in maintaining both types to showcase diverse credit management capabilities.

Charge cards differ fundamentally from traditional credit cards in credit mix calculations because they require full balance payment each month and typically don’t report credit limits. These accounts demonstrate cash flow management abilities and financial discipline, qualities that lenders value highly. American Express charge cards, for example, can enhance credit mix by showing the ability to manage high-balance accounts with strict payment requirements, even though they don’t contribute to credit utilization calculations.

The impact of authorized user accounts on credit mix diversity creates opportunities for both building and enhancing credit profiles. While authorized user status doesn’t carry the same weight as primary account ownership, it can contribute to credit mix by adding account variety and payment history. This strategy proves particularly valuable for individuals with limited credit history or those recovering from credit challenges, as it provides immediate access to diverse account types.

Buy-now-pay-later services represent an emerging category in credit reporting that may influence future credit mix considerations. Services like Affirm, Klarna, and Afterpay increasingly report payment history to credit bureaus, potentially adding installment account diversity to credit profiles. However, the long-term impact of these services on credit mix calculations remains evolving, making strategic use essential for borrowers seeking to optimize their credit profiles.

Professional credit accounts, including business lines of credit and commercial loans, offer crossover benefits for personal credit mix development. These accounts demonstrate advanced financial management capabilities and often appear on personal credit reports for business owners. The strategic advantage lies in showcasing the ability to manage both personal and professional credit obligations simultaneously, which can enhance overall creditworthiness perceptions.

CD-secured loans provide a unique opportunity for credit mix enhancement while building savings simultaneously. These products use certificate of deposit accounts as collateral for installment loans, creating a win-win scenario where borrowers build credit history while earning interest on their savings. This strategy proves particularly effective for individuals seeking to add installment credit to their mix without taking on significant financial risk.

Credit Mix Maintenance: Avoiding Common Diversification Pitfalls

Maintaining optimal credit mix requires ongoing attention to account management and financial balance to prevent diversification from becoming a liability. The most common pitfall involves opening too many accounts too quickly, which can overwhelm borrowers financially while creating negative scoring impacts from multiple inquiries and reduced average account age. Sustainable credit mix development prioritizes long-term financial health over rapid account accumulation.

The “credit mix trap” occurs when borrowers focus so heavily on account diversity that they neglect fundamental credit management principles. This trap manifests when individuals maintain accounts they cannot afford, struggle to make payments across multiple credit types, or accumulate debt across various account categories. The result often involves damaged payment history, increased debt levels, and overall credit profile deterioration despite having diverse account types.

Handling dormant accounts requires strategic decision-making to preserve credit mix benefits while avoiding unnecessary costs and complications. Closing accounts can negatively impact credit mix diversity, but maintaining unused accounts may involve annual fees or require periodic activity to prevent closure. The optimal approach involves selective account retention based on strategic value, cost considerations, and long-term credit goals.

Managing credit mix during major life transitions demands careful planning to maintain account diversity while adapting to changing financial circumstances. Marriage, divorce, job changes, and relocation can all impact credit mix strategy, requiring adjustments to account management approaches. These transitions often involve closing joint accounts, transferring account ownership, or modifying payment strategies to accommodate new financial realities.

Recovery strategies for credit mix after bankruptcy or major credit damage focus on rebuilding account diversity systematically while demonstrating renewed financial responsibility. This process typically begins with secured credit products and gradually progresses to unsecured revolving credit and installment loans. The key lies in patience and consistent payment performance rather than attempting to rebuild credit mix diversity too quickly.

The relationship between credit mix and credit age creates ongoing tension between maintaining established accounts and optimizing account diversity. Closing older accounts to streamline credit mix can negatively impact average account age, while maintaining unnecessary accounts may complicate financial management. The optimal balance involves preserving the oldest accounts in each credit category while strategically closing newer accounts that don’t contribute meaningful value.

Advanced Credit Mix Optimization: Maximizing Your Diversification Strategy

Advanced credit mix optimization involves tailoring account diversity strategies to specific financial goals and lender requirements. Mortgage qualification, for example, benefits from demonstrating successful management of installment debt alongside revolving credit, as mortgage underwriters specifically evaluate borrowers’ ability to handle long-term payment obligations. This targeted approach requires understanding how different lenders weight credit mix factors in their underwriting processes.

Different lenders place varying emphasis on credit mix diversity based on their risk assessment models and target customer profiles. Credit unions often prioritize relationship banking and may value diverse account types more heavily than large commercial banks that rely primarily on automated scoring. Understanding these preferences allows borrowers to strategically apply with lenders whose underwriting criteria align with their credit mix strengths.

Using credit mix to overcome other credit profile weaknesses requires strategic positioning of account diversity to compensate for limitations in other scoring factors. Borrowers with limited credit history can leverage diverse account types to demonstrate financial sophistication, while those with past credit challenges can use consistent payment performance across multiple credit categories to showcase rehabilitation efforts.

The role of credit mix in premium credit card and loan product qualification extends beyond basic approval criteria to include access to enhanced benefits and preferential terms. Premium products often require demonstrated ability to manage diverse credit types responsibly, making credit mix optimization essential for accessing high-value financial products with superior rewards, lower interest rates, and exclusive benefits.

Maintaining credit mix benefits while paying down debt aggressively requires careful balance between debt reduction goals and account diversity preservation. The optimal approach involves strategic debt paydown that maintains account variety while reducing overall debt levels. This strategy may involve keeping small balances on certain account types to preserve their active status while focusing major payments on high-interest debt.

Strategic account selection for maximizing rewards and benefits within credit mix goals creates opportunities for enhanced financial returns while building credit profile strength. This approach involves choosing credit products that serve dual purposes: contributing to credit mix diversity while providing valuable rewards, benefits, or financial advantages. The key lies in selecting accounts that align with spending patterns and financial goals while enhancing overall credit mix optimization.

The intersection of credit mix and estate planning considerations becomes relevant for high-net-worth individuals and those with complex financial situations. Certain credit accounts may transfer differently upon death, and maintaining diverse credit types can provide financial flexibility for surviving family members. This advanced consideration requires coordination between credit mix strategy and broader estate planning objectives to ensure optimal outcomes for all stakeholders.

Building Your Credit Mix: The Strategic Path Forward

Credit mix represents far more than a simple scoring component—it’s your financial autobiography told through account diversity. The strategic sequence of building from secured credit cards to installment loans to mortgages isn’t just about hitting scoring targets; it’s about demonstrating the kind of financial maturity that opens doors to premium products and preferential terms. Lenders don’t just see numbers when they evaluate your credit mix; they see a story of financial growth, responsibility, and sophistication that automated scoring systems can’t fully capture.

The psychology behind credit mix evaluation reveals why diversification matters beyond the 10% scoring weight. When you successfully manage revolving credit alongside installment loans, you’re proving you can handle different financial obligations with varying payment structures and risk profiles. This demonstration of financial versatility becomes your competitive advantage in a lending landscape where manual underwriting and relationship banking still influence the most important credit decisions. Your credit mix isn’t just about what you’ve borrowed—it’s about who you’ve become as a borrower, and that story determines not just whether you qualify, but what kind of financial future you can access.