For years, rent payments existed in a credit reporting blind spot. You could pay your rent faithfully for decades, but this consistent financial responsibility rarely showed up on your credit report or influenced your credit score. That’s changing rapidly as credit scoring models adapt to include rental payment data, creating new opportunities and risks for millions of renters. The inclusion of rent payments impact on credit score has become a crucial topic for renters today. Understanding how rent payments impact on credit score can empower renters to take control of their financial futures.

The shift toward including rent payments in credit scoring isn’t just about adding another line item to your credit report. Different credit scoring models handle rental data in surprisingly different ways, and the impact on your score depends on factors most renters don’t even know exist. Whether your rent payments help or hurt your credit score often comes down to details like which reporting service your landlord uses, how quickly data gets processed, and which credit scoring model a lender chooses to review. Understanding these mechanics can mean the difference between building credit through your housing payments or missing out on this opportunity entirely. Ultimately, how rent payments impact on credit score can be enhanced through smart strategies.

The Hidden Mechanics of Rent Payment Credit Reporting

The fundamental difference between traditional credit accounts and rental payment data lies in how information flows to credit bureaus. Traditional credit accounts like credit cards and loans operate through established automated reporting systems that have existed for decades. These systems automatically transmit payment information monthly, creating a seamless data pipeline that requires no additional action from consumers or creditors. This change is significant as it shows how rent payments impact on credit score for many individuals.

Rental payment data follows a more complex path to your credit report. Property management companies must make deliberate decisions about whether to report tenant payment information, unlike traditional creditors who report as part of standard industry practice. This decision-making process varies significantly across the rental industry, with some companies viewing credit reporting as an added service while others see it as an administrative burden. The decision to report rent payments can directly affect how rent payments impact on credit score.

The technical process of rent data integration involves specialized third-party services that act as intermediaries between property managers and credit bureaus. These services collect payment information from property management software, standardize the data format, and transmit it to credit reporting agencies. The integration requires property managers to establish accounts with reporting services, configure their systems to share payment data, and maintain ongoing compliance with credit reporting regulations. Understanding these processes is essential for grasping how rent payments impact on credit score.

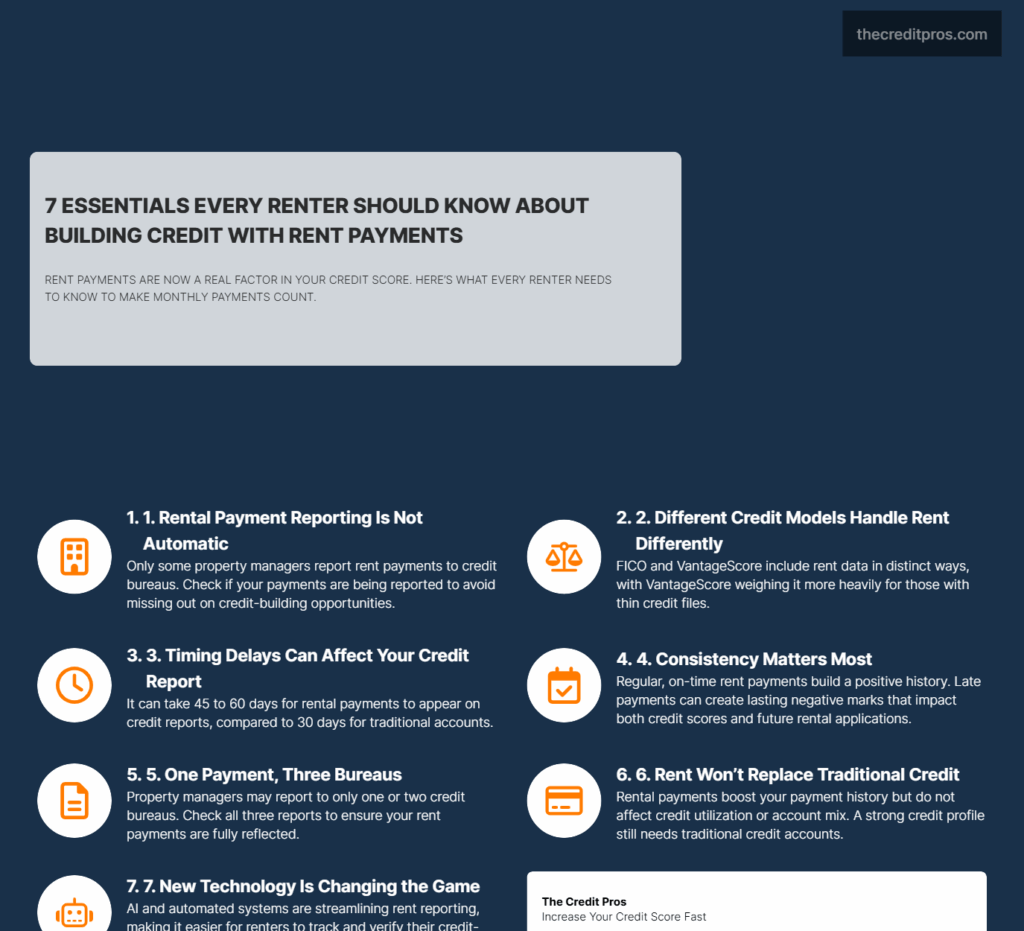

Timing delays between payment and credit report updates create significant variations in how quickly rental payment information appears on credit reports. While traditional credit accounts typically update within 30 days of statement closing dates, rental payment reporting can take 45 to 60 days to appear on credit reports. This delay occurs because rental payment data must pass through additional processing layers, including verification procedures and data formatting requirements that don’t apply to traditional credit accounts. The timing of updates can significantly influence how rent payments impact on credit score.

The distinction between voluntary and automatic reporting systems creates inconsistencies in rental payment credit reporting. Some property management companies opt for voluntary reporting, where they submit payment information periodically or upon request. Others utilize automatic reporting systems that transmit payment data monthly without manual intervention. These different approaches result in varying levels of completeness and consistency in rental payment credit histories. It is crucial to consider how different systems affect how rent payments impact on credit score.

Understanding Different Credit Scoring Models and Rental History

FICO and VantageScore models demonstrate markedly different approaches to incorporating rental payment data into credit calculations. FICO’s traditional models historically excluded rental payment information entirely, treating it as non-credit data that didn’t contribute to score calculations. Recent FICO versions have begun incorporating rental payment data, but with limited weight compared to traditional credit accounts. FICO and VantageScore models illustrate different ways in which rent payments impact on credit score.

VantageScore models have embraced rental payment data more comprehensively, integrating this information into their scoring algorithms from earlier versions. The mathematical weight assigned to rental payments in VantageScore calculations can represent up to 15% of the total score, particularly for consumers with limited traditional credit history. This difference means that the same rental payment history can produce different credit score impacts depending on which scoring model a lender uses. Understanding these differences is vital for knowing how rent payments impact on credit score.

The frequency of monthly rent payments provides scoring algorithms with consistent data points that can strengthen creditworthiness assessments. Unlike credit card payments that vary in amount and timing, rent payments typically occur monthly for fixed amounts, creating predictable payment patterns that scoring models can analyze. This consistency allows algorithms to identify payment reliability trends more effectively than with irregular payment schedules. Being aware of how rent payments impact on credit score can help renters make informed decisions.

Rental payment consistency affects credit utilization calculations indirectly by demonstrating payment capacity and financial management skills. While rent payments don’t directly impact credit utilization ratios, consistent rental payment history can influence how scoring models interpret existing credit utilization levels. Consumers with perfect rental payment records may receive more favorable treatment for higher credit utilization ratios than those without rental payment history. Rental payment history reveals how rent payments impact on credit score over time.

The role of rental payment amounts in creditworthiness assessment varies significantly between scoring models. Some algorithms consider the relationship between rental payment amounts and reported income levels, using this ratio to assess debt-to-income implications. Higher rental payments relative to income may indicate stronger creditworthiness if payments remain consistent, while lower rental payments might suggest conservative financial management or limited income capacity. Consistent records can demonstrate how rent payments impact on credit score positively.

How Rent Payments Create Both Positive and Negative Credit Impact

Positive credit building through consistent rent payments offers particular advantages for consumers with thin credit files or limited credit history. Traditional credit building requires opening credit accounts and managing debt, which can be challenging for young adults or individuals recovering from financial difficulties. Rental payment reporting provides an alternative path to credit building that doesn’t require taking on additional debt obligations. The effects of rent payments impact on credit score cannot be overlooked.

The cascading effects of rental payment delinquencies extend beyond immediate credit score impacts to influence future renting opportunities. Late rental payments reported to credit bureaus create negative marks that property managers review during tenant screening processes. These negative marks can result in rental application rejections, higher security deposits, or requirements for co-signers on future lease agreements. How rent payments impact on credit score is also determined by payment amounts relative to income.

Rental payment credit impact differs from traditional credit account effects in several key ways. Traditional credit accounts contribute to credit mix diversity, account age calculations, and available credit limits. Rental payments primarily influence payment history components without affecting credit utilization ratios or account diversity metrics. This limitation means that rental payment history alone cannot fully optimize credit scores without traditional credit accounts.

The relationship between rental payment patterns and creditworthiness predictions reveals important insights about consumer financial behavior. Consistent rental payment history demonstrates long-term financial stability and priority management skills that traditional credit accounts may not capture. Consumers who prioritize housing payments over other obligations often display different risk profiles than those who focus primarily on credit card or loan payments. Thus, how rent payments impact on credit score can vary based on multiple factors.

Rental payment delinquencies can create compounding negative effects that extend beyond credit score reductions. Property managers may report multiple months of late payments as separate delinquencies, creating cumulative negative impacts on credit reports. These multiple negative marks can remain on credit reports for up to seven years, significantly impacting creditworthiness assessments long after rental payment issues are resolved. For those with thin credit files, understanding how rent payments impact on credit score can be crucial.

Strategic Approaches to Maximizing Rent Payment Credit Benefits

Verifying whether your rent payments are being reported requires checking with all three major credit bureaus, as reporting practices vary between agencies. Property management companies may report to only one or two bureaus, creating incomplete rental payment histories across credit reports. Consumers should request free annual credit reports from each bureau to identify gaps in rental payment reporting and address inconsistencies. Future rental payment delinquencies can further highlight how rent payments impact on credit score.

The strategic timing of rental payment reporting enrollment can significantly impact credit building effectiveness. Enrolling in rental payment reporting services at the beginning of lease terms ensures complete payment history documentation from the start. Retroactive reporting may be available for some services, but historical payment data often requires additional verification procedures that can delay credit report updates.

Addressing rental payment discrepancies on credit reports requires understanding dispute procedures specific to rental payment data. Traditional credit dispute processes may not apply to rental payment information, as these disputes often require documentation from property management companies rather than financial institutions. Consumers should maintain detailed records of rental payments, including cancelled checks, electronic payment confirmations, and lease agreements. It’s important to recognize how rent payments impact on credit score differently than traditional credit.

Leveraging rental payment history during credit rebuilding phases requires coordinating rental payment reporting with other credit building activities. Consumers rebuilding credit should ensure rental payment reporting begins before opening new credit accounts, as positive rental payment history can strengthen applications for secured credit cards or small loans. This coordination creates a foundation of positive payment history that supports additional credit building efforts. The insights into how rent payments impact on credit score offer valuable guidance for consumers.

Verification Steps for Rental Payment Reporting:

- Contact your property management company to confirm reporting practices

- Check credit reports from all three bureaus for rental payment information

- Enroll in rental payment reporting services if not automatically included

- Monitor credit reports monthly for accurate rental payment recording

- Maintain documentation of all rental payments for dispute purposes

Future Implications and Emerging Trends in Rental Credit Integration

The movement toward standardized rental payment reporting across the industry reflects growing recognition of rental payment data’s value in credit assessments. Industry organizations are developing uniform reporting standards that would create consistency in how rental payment information appears on credit reports. These standards address current variations in reporting frequency, data formatting, and historical payment inclusion that create confusion for consumers and lenders. Understanding this relationship will clarify how rent payments impact on credit score.

Artificial intelligence and machine learning technologies are revolutionizing how rental payment credit analysis occurs within scoring algorithms. Advanced algorithms can identify patterns in rental payment behavior that traditional scoring methods might miss, such as seasonal payment variations or payment timing preferences. These technologies enable more nuanced assessments of creditworthiness that consider rental payment context rather than simply recording payment dates and amounts. However, consumers must know how rent payments impact on credit score when renting.

The potential for rental payment history to influence mortgage and loan approvals represents a significant shift in lending practices. Mortgage underwriters increasingly consider rental payment history as evidence of housing payment reliability, particularly for first-time homebuyers with limited traditional credit history. This trend may reduce barriers to homeownership for consumers who have demonstrated financial responsibility through consistent rental payments. Monitoring reports helps in ensuring how rent payments impact on credit score is reflected accurately.

Emerging tools and technologies are enhancing rental payment credit benefits through automated reporting systems and real-time credit monitoring. Property management software increasingly includes built-in credit reporting features that automatically transmit payment data to credit bureaus. These systems reduce administrative burdens for property managers while ensuring consistent rental payment reporting for tenants. Real-time credit monitoring services now specifically track rental payment reporting, alerting consumers to changes in their rental payment credit status and enabling rapid response to reporting errors or discrepancies. Addressing issues can clarify how rent payments impact on credit score effectively.

Conclusion: Navigating the New Landscape of Rental Credit Reporting

Understanding how rent payments impact on credit score is essential for renters. As rental payment integration becomes more standardized and AI-driven algorithms grow more sophisticated, the distinction between traditional credit accounts and rental payment history will continue to blur. The key lies in taking control of your rental payment reporting rather than hoping it happens automatically.

Your rent check represents more than just housing costs; it’s potentially your most consistent monthly opportunity to build creditworthiness—but only if you ensure it’s being counted. Integrating this awareness can shape how rent payments impact on credit score effectively.