You probably check your credit score regularly, but did you know there’s another score working behind the scenes that could be costing you hundreds of dollars each year? Most people discover the connection between their credit and insurance premiums only after receiving a surprisingly high quote or renewal notice. While you might assume your driving record or home’s location determines your insurance costs, credit-based insurance scores often carry equal or greater weight in premium calculations. Understanding credit scores and insurance premiums is essential for managing your overall financial health.

In many cases, credit scores and insurance premiums can directly affect how much you pay for coverage. What makes this particularly challenging is that credit-based insurance scores operate differently from traditional FICO scores, using their own five-factor formula that can fluctuate independently of your regular credit rating. The rules governing these scores vary dramatically depending on where you live, creating a complex web of regulations that can either protect you or leave you vulnerable to higher premiums. Understanding how these scores work, when they can legally be used, and most importantly, how to optimize them for better insurance rates requires looking beyond basic credit advice to the specific strategies that insurance companies actually use in their underwriting decisions. The relationship between credit scores and insurance premiums is often overlooked by consumers.

The Hidden Algorithm: How Credit-Based Insurance Scores Really Work

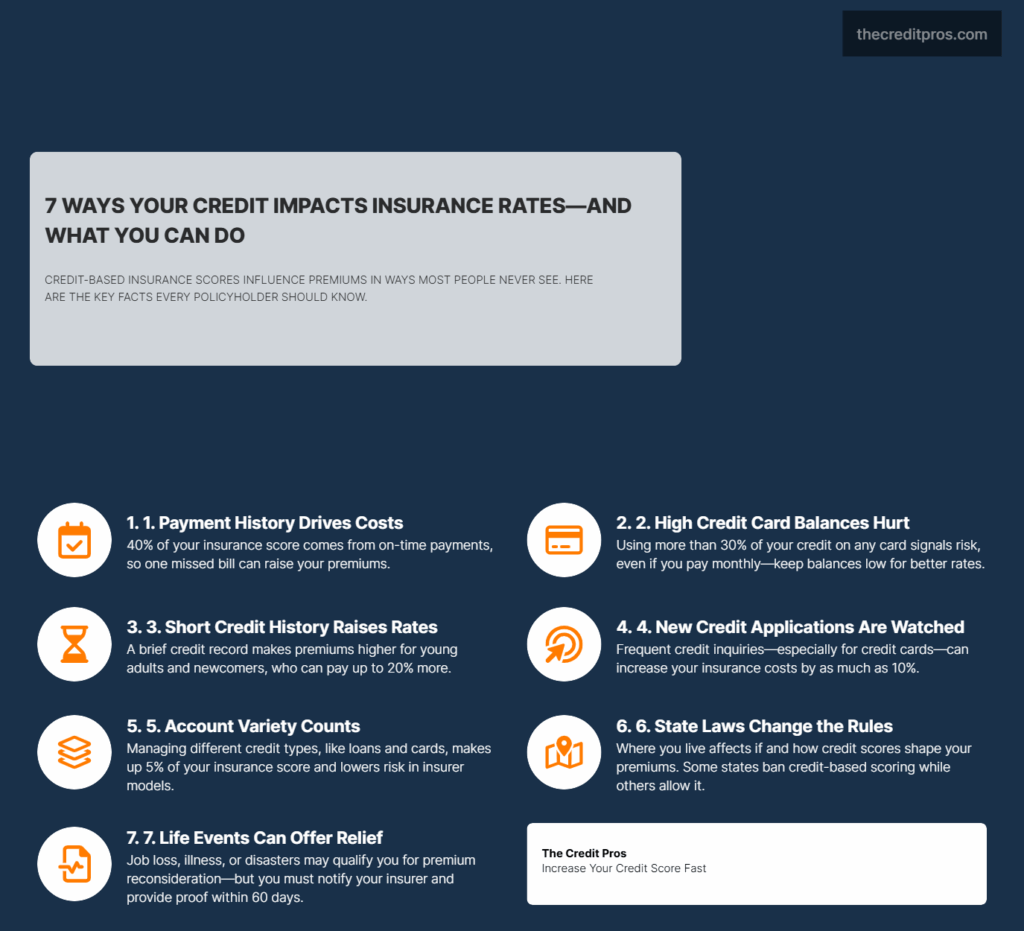

Understanding the factors that influence credit scores and insurance premiums is crucial for consumers. The mathematical foundation of credit-based insurance scores operates on a weighted system that prioritizes financial behaviors differently than traditional credit scoring models. Payment history commands the largest influence at 40% of your insurance score, reflecting insurers’ belief that consistent payment patterns predict claim-filing behaviors more accurately than absolute credit limits or account balances. This emphasis means a single late payment on a credit card can impact your insurance premiums more significantly than carrying high balances across multiple accounts. Insurance companies frequently analyze credit scores and insurance premiums when assessing risk.

Outstanding debt occupies the second-largest weight at 30%, but the calculation focuses on utilization ratios rather than total debt amounts. Insurance companies analyze how much of your available credit you’re using across all accounts, with optimal ratios typically falling below 30% per card and 10% overall. The scoring algorithm penalizes maxed-out credit cards more severely than high-balance loans with consistent payments, creating a counterintuitive scenario where someone with a large mortgage might score better than someone with smaller credit card balances at their limits. Improving your credit scores and insurance premiums can lead to significant savings on your policy.

Credit history length receives 15% weighting, creating systematic disadvantages for demographics with limited credit exposure. Young adults entering the workforce face higher insurance premiums not due to driving inexperience alone, but because their abbreviated credit histories signal higher risk to insurance algorithms. New immigrants with excellent international credit records encounter similar challenges, as domestic credit-based insurance scores cannot incorporate foreign financial histories, effectively penalizing geographic mobility and life transitions beyond individual control.

The pursuit of new credit accounts for 10% of your insurance score, but the algorithm distinguishes between different inquiry types in ways that often surprise consumers. Rate shopping for auto loans or mortgages within specific time windows typically counts as single inquiries, while multiple credit card applications spread across months trigger individual penalties. Insurance companies view frequent credit seeking as indicative of financial stress, even when consumers are comparison shopping for better terms or consolidating existing debt.

Credit mix comprises the smallest factor at 5%, yet its impact extends beyond simple account diversity. Insurance algorithms favor consumers who successfully manage different types of credit simultaneously – revolving accounts, installment loans, and mortgages – interpreting this variety as evidence of comprehensive financial management skills. The scoring system rewards consumers who maintain both secured and unsecured credit products, viewing this balance as predictive of responsible claim behavior and lower policy cancellation rates. Many people are surprised to learn how credit scores and insurance premiums are intertwined.

State Regulations: Where Geography Determines Your Financial Fate

The impact of credit scores and insurance premiums can vary greatly depending on your location. State-level regulations create dramatically different insurance landscapes for consumers with identical credit profiles, making your zip code as important as your credit score in determining premium costs. The District of Columbia’s specific allowance for credit-based scoring in homeowners insurance and auto insurance while excluding other coverage types reflects a compromise between consumer protection advocates and insurance industry interests. This selective application means DC residents face credit-based pricing for property risks while receiving protection from credit discrimination in health, life, and disability insurance markets.

The enforcement mechanisms behind prohibited personal information usage rely primarily on complaint-driven investigations rather than proactive monitoring systems. Insurance companies cannot legally access or consider race, gender, marital status, or income information when calculating credit-based insurance scores, but detecting violations requires consumers to recognize discriminatory patterns and file formal complaints. The regulatory framework places the burden of identifying credit score misuse on individuals who may lack the technical knowledge to distinguish between legitimate risk factors and prohibited characteristics. Awareness of credit scores and insurance premiums allows for smarter financial decisions.

Geographic variations in credit scoring permissions create interstate commerce complications for national insurance carriers, who must maintain separate underwriting systems for different regulatory environments. States like California, Hawaii, and Massachusetts prohibit or severely restrict credit-based insurance scoring, while others permit its use across all insurance lines. This patchwork forces insurers to develop location-specific pricing models, sometimes resulting in identical risk profiles receiving vastly different premium quotes based solely on state residence. Awareness about how credit scores and insurance premiums affect your bottom line is crucial.

Managing your credit scores and insurance premiums effectively is key to financial health. Extraordinary life circumstance provisions exist in most jurisdictions but require specific documentation and proactive consumer advocacy to trigger premium reconsideration. Events like job loss, serious illness, or natural disasters can temporarily suspend credit-based scoring penalties, but consumers must typically request these accommodations within specific timeframes and provide supporting evidence. The burden of proof remains with policyholders to demonstrate that credit score deterioration resulted from circumstances beyond their control rather than financial mismanagement. Consumers should be aware of how their credit scores and insurance premiums influence each other.

The Underwriting Ecosystem: Beyond Credit Scores in Premium Determination

Many factors contribute to the relationship between credit scores and insurance premiums. It’s essential to realize that credit scores and insurance premiums are interconnected in ways that affect your overall financial strategy. Insurance companies integrate credit-based scores with traditional underwriting factors through sophisticated actuarial models that assign different weights based on coverage type and risk categories. For auto insurance, credit scores often carry equal or greater weight than driving records in premium calculations, particularly for drivers with limited claims history or those seeking coverage with new insurers. The correlation between credit responsibility and claim frequency drives this emphasis, with insurers viewing payment patterns as predictive indicators of future risk-taking behaviors.

The actuarial science behind multi-factor risk modeling reveals why insurers prioritize credit information over seemingly more relevant factors like annual mileage or vehicle safety ratings. Statistical analysis demonstrates that consumers with higher credit-based insurance scores file fewer claims across all insurance categories, regardless of their demographic characteristics or coverage history. This correlation persists even when controlling for income levels, suggesting that financial responsibility behaviors extend beyond monetary capacity to risk management decision-making. Understanding the connection between credit scores and insurance premiums is essential for optimizing your costs.

Demographic factors legally influence premiums through location-based pricing, vehicle characteristics, and coverage history, creating a complex interplay with credit-based scoring systems. Young drivers in urban areas with poor credit scores face compounding premium penalties, as age, location, and credit factors multiply rather than simply add together. The mathematical models used by insurers create exponential rather than linear premium increases when multiple risk factors align, making credit improvement particularly valuable for consumers in already high-risk categories. The nuances of credit scores and insurance premiums can be complex but are worth understanding.

The timing of credit score evaluations varies significantly between insurance companies and policy types, with some insurers checking scores at application, renewal, and after major life events, while others conduct annual reviews regardless of policy changes. This variation means credit improvements may not immediately translate to lower premiums unless consumers actively shop for new coverage or request policy reviews. Understanding your insurer’s credit review schedule becomes crucial for maximizing the financial benefits of credit score improvements. By learning about credit scores and insurance premiums, consumers can make informed choices.

Key factors insurers consider alongside credit-based insurance scores:

- Claims history and frequency patterns

- Geographic risk factors including weather and crime statistics

- Vehicle make, model, year, and safety ratings

- Annual mileage and primary use classifications

- Coverage limits and deductible selections

- Multi-policy discounts and loyalty program participation

Strategic Credit Management for Insurance Optimization

Targeted credit improvement strategies require understanding the specific behaviors that influence insurance scoring algorithms differently than traditional credit scores. Paying down credit card balances produces more immediate insurance benefits than closing accounts, as utilization ratio improvements register quickly in credit-based insurance score calculations. The optimal approach involves reducing balances across all cards rather than concentrating payments on single accounts, as insurance algorithms analyze overall credit management rather than individual account performance. The link between credit scores and insurance premiums is increasingly recognized by consumers.

The timing of credit report monitoring aligns strategically with insurance renewal cycles to maximize premium reduction opportunities. Consumers benefit from checking credit reports 60-90 days before policy renewals, allowing sufficient time to dispute errors and implement improvement strategies before insurers conduct their reviews. The FACT Act’s provision for free annual credit reports from each bureau creates opportunities for quarterly monitoring without additional costs, enabling consumers to track progress and identify issues across different reporting agencies. Raising awareness about credit scores and insurance premiums can help consumers save money.

Documentation and communication processes for extraordinary life circumstance claims require specific evidence and timing to successfully trigger premium reconsiderations. Medical emergencies, job losses, or natural disasters must be reported to insurers within prescribed timeframes, typically 30-60 days after the event, with supporting documentation including medical records, termination letters, or disaster declarations. The success rate for these appeals increases significantly when consumers provide comprehensive documentation and clearly articulate the connection between their circumstances and credit score changes. It is crucial for consumers to understand how credit scores and insurance premiums impact their finances.

Maintaining older credit accounts benefits insurance scoring more than traditional credit scoring due to the 15% weight assigned to credit history length in insurance algorithms. Closing old credit cards or paying off long-standing loans can inadvertently reduce credit-based insurance scores even when improving traditional FICO scores. The strategic approach involves keeping older accounts active with minimal usage rather than closing them, preserving credit history length while maintaining low utilization ratios across all accounts. Being proactive about credit scores and insurance premiums can lead to better financial outcomes.

Conclusion: Mastering the Hidden Variables in Your Financial Equation

Ultimately, understanding credit scores and insurance premiums will empower you as a consumer. The intersection of credit scores and insurance premiums reveals a sophisticated financial ecosystem where your payment history and debt management patterns influence far more than loan approvals. Credit-based insurance scores operate through their own five-factor algorithm, weighted differently than traditional FICO scores, while state regulations create a geographic lottery that can dramatically impact your premiums regardless of your actual risk profile. Understanding these hidden connections empowers you to make strategic financial decisions that extend beyond basic credit improvement to comprehensive risk management. Credit scores and insurance premiums are the key to unlocking better financial outcomes.

Your credit report isn’t just a reflection of your borrowing history—it’s become a predictor of your insurance costs, claim behavior, and financial responsibility across multiple industries. The companies evaluating your applications have already connected dots between payment patterns and risk assessment that most consumers haven’t even realized exist. While you’ve been focused on improving your credit score for better loan terms, insurance companies have been using that same information to determine whether you’ll pay hundreds more each year for the same coverage your neighbor receives. In conclusion, the relationship between credit scores and insurance premiums is pivotal for all consumers.