Navigating the financial landscape of a new country can be daunting, especially when it comes to understanding and building a credit score in the United States. Why do credit score factors for immigrants carry so much weight, and what makes them a critical component of your financial identity in the U.S.? This guide will explore the intricacies of the U.S. credit system, tailored specifically for immigrants who are starting their journey toward financial integration. Whether you’re setting up your first bank account or aiming to secure a mortgage, knowing credit score factors for immigrants can help you establish a robust credit history.

For many immigrants, the concept of credit score factors for immigrants may be unfamiliar or vastly different from practices in their home countries. How can you effectively build your credit from scratch in a system that seems complex and unforgiving? We’ll break down the initial steps you need to take, from obtaining necessary identification numbers to choosing the right financial products that help build your credit. Our goal is to demystify the process and provide you with the tools you need to navigate this crucial aspect of your new life with confidence and clarity.

Starting from Scratch: Understanding the U.S. Credit System

In the U.S., credit scores are calculated by three major credit bureaus: Equifax, Experian, and TransUnion. These bureaus compile data reported by creditors to create your credit report, which in turn is used to calculate your credit score. Unlike some countries where credit scores might not be as central to financial identity, in the U.S., these credit score factors for immigrants can determine your ability to secure loans, the interest rates you pay, and even your housing options.

For immigrants, understanding these credit score factors for immigrants can be challenging, especially if you come from a country where such financial measures are not used. One common misconception is that your credit history from your home country will transfer to the U.S. Unfortunately, this is not the case; you’ll need to start building your credit history anew upon arrival. This fresh start can be seen as an opportunity to build a strong financial foundation with the right knowledge and tools.

The Initial Steps to Building Your U.S. Credit History

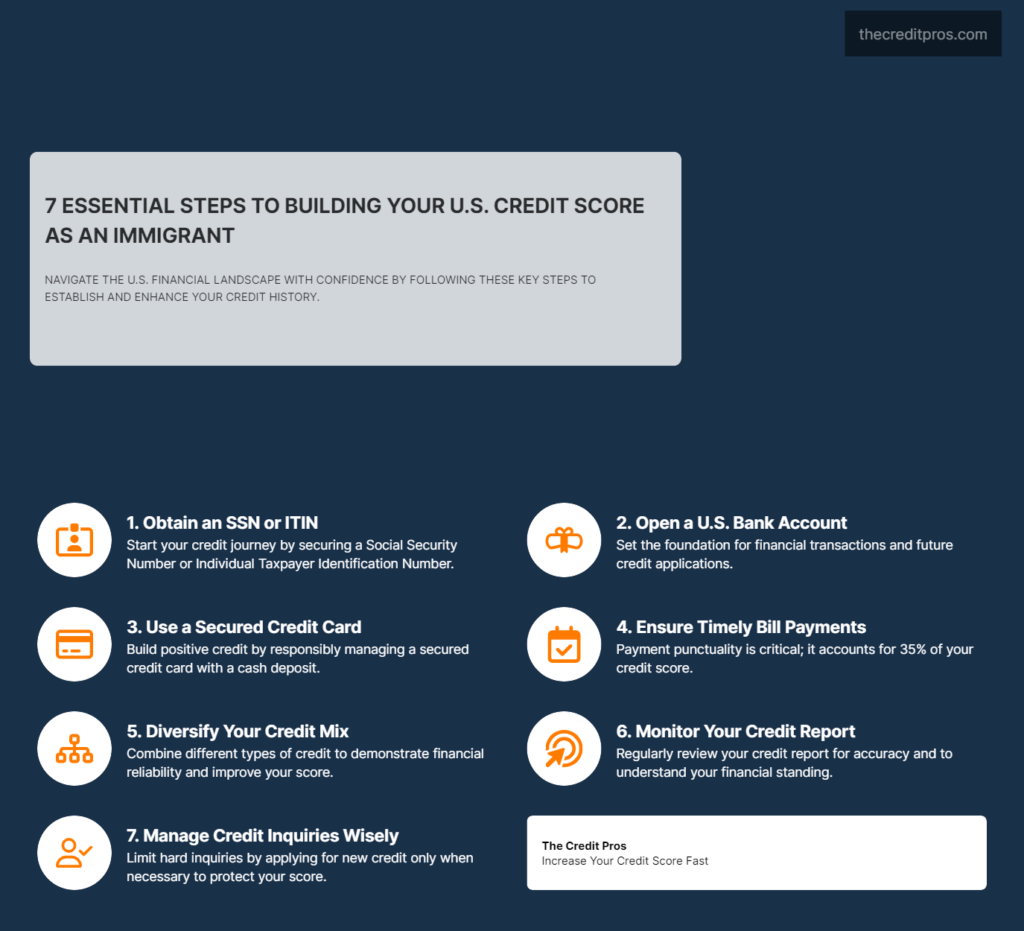

The first step in establishing your U.S. credit history is obtaining a Social Security Number (SSN) or, if ineligible, an Individual Taxpayer Identification Number (ITIN). These numbers are crucial as they are used by credit bureaus to track your financial transactions in the U.S.

Opening a U.S. bank account is equally foundational. It not only facilitates the management of your finances but also serves as a basic requirement for applying for most credit products. Start with a simple checking and savings account, which can later aid in applying for credit cards and loans.

For building credit, consider starting with a secured credit card. This type of card requires a cash deposit that serves as your credit limit. By using it responsibly and paying off your balance each month, you send positive signals to the credit bureaus. Alternatively, becoming an authorized user on a family member or friend’s credit card can also help you build credit, provided the primary cardholder has good credit habits.

Strategic Moves to Establish and Enhance Credit

Timely bill payments are crucial for building a good credit score. Payment history is the most significant factor affecting your score, making up 35% of it. Setting up automatic payments for utilities, rent, and credit cards can help ensure you never miss a due date.

Consider taking small, manageable loans and paying them back as agreed. This not only helps build your credit history but also improves your credit mix, which is another factor credit bureaus consider. A healthy credit mix might include a combination of revolving credit (like credit cards) and installment loans (like auto or student loans).

Credit Mix Importance:

Revolving credit: Shows you can handle credit that varies each month.

Installment loans: Demonstrates reliability in making consistent payments over time.

Monitoring and Understanding Your Credit Score

Regularly checking your credit report is essential for understanding your financial standing and ensuring accuracy. U.S. law allows you to get a free credit report from each of the three major credit bureaus once per year via AnnualCreditReport.com. This practice helps you catch errors or fraudulent activities early on.

Understanding what affects your credit score is key to managing it effectively. Factors include your payment history, amounts owed, length of credit history, new credit, and credit mix. Being aware of these can help you take smarter financial actions.

If you find discrepancies in your credit report, it’s important to dispute them promptly. Each credit bureau has its own process for handling disputes, but generally, you will need to submit a formal dispute form along with any supporting documents.

Long-Term Credit Management Strategies

Responsible credit use is crucial for maintaining a good credit score over the long term. This means not only paying bills on time but also keeping your credit utilization low (ideally under 30% of your total credit limit) and avoiding unnecessary debt.

As your financial situation stabilizes and your credit score improves, you might consider applying for more complex credit lines, such as a mortgage or auto loan. These credit forms not only further enhance your credit mix but also contribute to your financial growth and stability in the U.S.

Be mindful of the impact of credit inquiries, which can occur when lenders check your credit report during the application process. Too many hard inquiries in a short period can negatively affect your credit score. Therefore, it’s wise to apply for new credit accounts judiciously and only as needed.

Wrapping Up: Key Steps to Building Your U.S. Credit Score as an Immigrant

Understanding and establishing a credit score in the U.S. is a pivotal step for immigrants aiming to integrate financially into their new environment. Starting with obtaining an SSN or ITIN and opening a U.S. bank account, the journey progresses through strategic use of secured credit cards and responsible management of loans. Timely payments and maintaining a diverse credit mix are essential practices that significantly influence your credit score, which in turn affects your ability to secure favorable loans and housing options.

Regular monitoring of your credit report ensures accuracy and helps you understand the factors impacting your score. Remember, a well-managed credit profile opens doors to financial opportunities and stability in the U.S. As you navigate this complex terrain, consider each step as building a block towards a secure financial future. Let the knowledge of how each action affects your