Most people think they understand their credit report by glancing at their credit score and checking for obvious errors. But what if the real power lies in understanding the subtle patterns and hidden details that lenders actually examine when making decisions about your financial future? Your credit report contains layers of information that go far beyond basic payment history—from the strategic implications of inquiry timing to the complex ways different account types influence your creditworthiness. Having a solid grasp of credit report understanding is essential for navigating financial decisions. With credit report understanding, you can better interpret the information lenders have about you.

The difference between someone who simply monitors their credit and someone who truly understands it can mean the difference between approval and rejection, between premium rates and subprime terms. Each section of your credit report tells a specific part of your financial story, and knowing how to read between the lines gives you the ability to shape that narrative. When you understand what lenders see and how they interpret your credit data, you gain the knowledge to make informed decisions that strengthen your financial position over time.

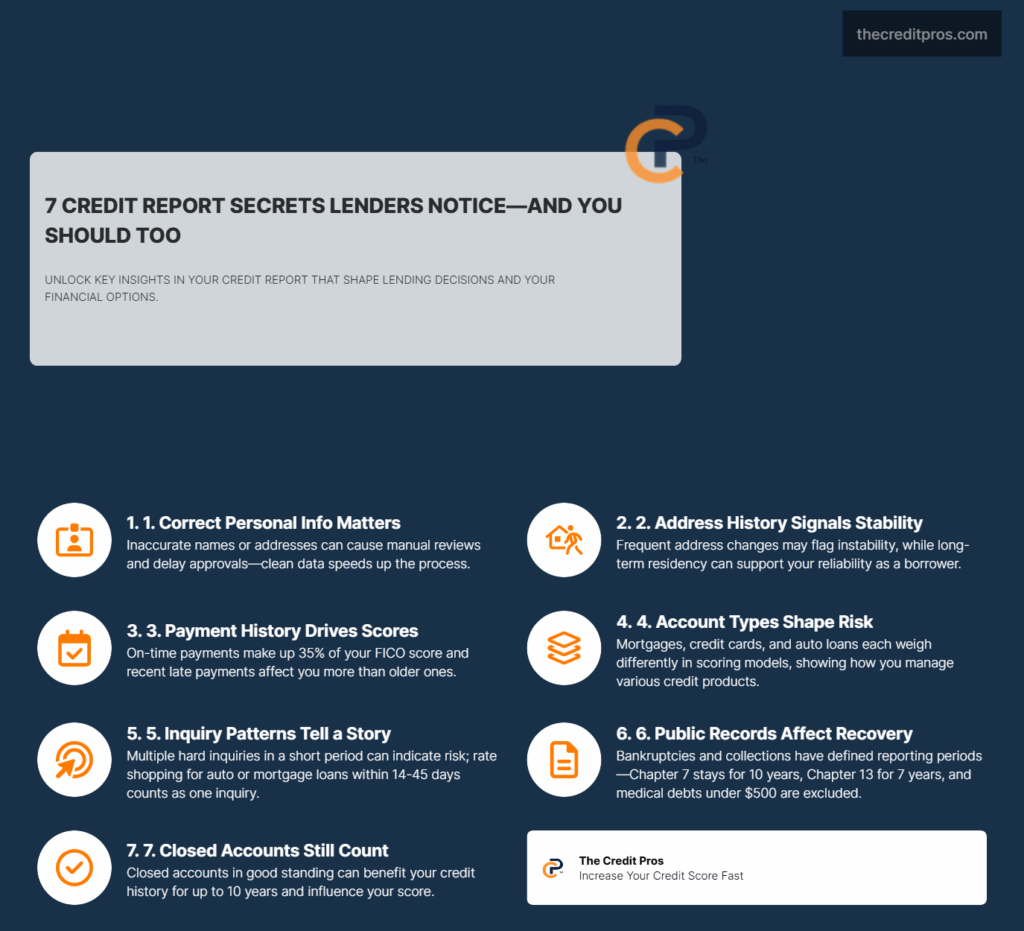

Accuracy in your personal information is vital for effective credit report understanding. Patterns in your address history are also important for credit report understanding. Employment data can significantly impact your credit report understanding.

Decoding the Personal Information Section: Your Financial Identity Verification System

A deep dive into payment history can enhance your credit report understanding. Recognizing the importance of timing is key to credit report understanding. This knowledge contributes to a complete credit report understanding. Strategically managing your payments is essential for credit report understanding.

Personal information accuracy serves as the foundation of your credit report’s reliability, directly influencing how lenders verify your identity during credit applications. When discrepancies exist between the information on your credit report and what you provide on applications, automated verification systems may flag your application for manual review, potentially delaying approval or requiring additional documentation. This verification process becomes particularly critical for high-value transactions like mortgages, where lenders must comply with strict identity verification requirements. Acknowledging different account types is vital for effective credit report understanding. Understanding your credit relationships enhances overall credit report understanding. Managing closed accounts is another aspect of credit report understanding. Understanding how BNPL affects your credit report understanding is crucial.

Multiple name variations on your credit report create a complex web that can either strengthen or complicate your credit profile. Lenders use sophisticated matching algorithms that attempt to connect various name formats, maiden names, and nicknames to build a comprehensive picture of your credit history. However, when these variations are inconsistent or contain errors, they can fragment your credit history across multiple profiles, potentially hiding positive payment history or creating confusion during underwriting processes. Knowing your rights in public records will enhance your credit report understanding.

Address history patterns reveal significant information about your stability and lifestyle to potential lenders, extending beyond simple contact verification. Frequent address changes within short timeframes may signal financial instability to lenders, while consistent long-term residency can indicate stability and responsibility. The reporting of previous addresses also plays a crucial role in fraud prevention, as lenders cross-reference application addresses with historical data to identify potential identity theft attempts.

Employment data reporting influences credit decisions through multiple pathways beyond traditional income verification. When employment information appears consistently across your credit report, it reinforces your identity verification and suggests career stability. However, outdated or missing employment information can raise questions about your current financial capacity, particularly for credit products that rely heavily on employment verification. The strategic maintenance of current employment information ensures that your credit report accurately reflects your professional stability and earning potential. Understanding inquiry types contributes to a comprehensive credit report understanding. Promotional inquiries add a layer to your credit report understanding. Understanding public records is crucial for your overall credit report understanding.

The Payment History Matrix: Beyond Simple On-Time Payments

Payment history reporting operates through a sophisticated rating system that captures nuanced differences in payment behavior beyond the binary concept of on-time versus late payments. Each rating code communicates specific information about your payment patterns, from accounts that are current with zero past-due amounts to those experiencing various stages of delinquency. Understanding these distinctions allows you to recognize how different payment scenarios affect your creditworthiness and how lenders interpret your payment reliability.

The compounding effect of payment timing patterns creates a complex scoring matrix that evaluates consistency over time rather than isolated incidents. Lenders analyze payment history trends to predict future payment behavior, giving more weight to recent payment patterns while still considering historical performance. A single late payment after years of perfect payment history carries less weight than sporadic late payments that suggest ongoing financial management challenges.

Understanding bankruptcy types is key for effective credit report understanding. Collection accounts can significantly affect your credit report understanding. Medical debt reporting changes impact your credit report understanding. Taking control of your financial narrative requires credit report understanding. Your credit report understanding shapes your financial future. Recognizing your credit report understanding is vital for financial success. Credit report understanding is the key to unlocking financial opportunities. Consumer statements can provide context for credit report understanding.

Different account types weight payment history differently within credit scoring models, reflecting the varying risk profiles associated with each credit product. Mortgage payments carry significant weight due to their secured nature and high dollar amounts, while credit card payments demonstrate revolving credit management skills. Installment loans like auto loans provide insights into your ability to manage fixed payment obligations, creating a comprehensive picture of your payment reliability across different credit scenarios.

Strategic payment timing for optimal credit report presentation involves understanding when creditors report payment information to credit bureaus. Most creditors report account information monthly, typically around the same date each month, which means the timing of your payments relative to these reporting cycles can influence how your account appears on your credit report. Making payments before the reporting date ensures that lower balances and current payment status are reflected in your credit report, potentially improving your credit utilization ratios and payment history presentation.

Account Information Architecture: The Complex Ecosystem of Credit Relationships

The distinction between satisfactory accounts and accounts with adverse information extends beyond simple payment status to encompass the overall management and performance of each credit relationship. Satisfactory accounts demonstrate consistent payment behavior, appropriate credit utilization, and responsible account management over time. These accounts serve as positive references that strengthen your credit profile and provide evidence of your creditworthiness to potential lenders.

Account responsibility types carry significant implications for credit decisions, particularly in situations involving joint accounts, authorized users, or co-signers. Individual accounts demonstrate your personal credit management capabilities, while joint accounts show your ability to manage shared financial responsibilities. Understanding these distinctions helps you recognize how different account types contribute to your overall credit profile and how potential lenders evaluate your individual creditworthiness.

The lifecycle of accounts from opening to closure creates ongoing credit impact that extends well beyond the active use period. Closed accounts in good standing continue to contribute positively to your credit history for up to ten years, maintaining their positive influence on your credit age and payment history. However, the closure of accounts also affects your available credit and credit utilization calculations, potentially impacting your credit score if not managed strategically.

Buy Now, Pay Later integration represents an emerging element in credit assessment that reflects changing consumer payment preferences and lending practices. While these accounts may not currently impact traditional credit scores, their presence on your credit report provides lenders with additional insights into your payment behavior and financial management approaches. The integration of BNPL data into credit reporting systems signals a broader evolution in how alternative credit data influences traditional credit assessment methods.

Key Account Management Strategies: • Maintain older accounts open to preserve credit history length • Monitor account responsibility designations for accuracy • Understand how account closures affect credit utilization ratios • Track emerging alternative credit data integration • Regularly review account status updates and reporting accuracy

The Inquiry Ecosystem: Understanding Credit Access Patterns and Their Strategic Implications

Hard inquiries, promotional inquiries, and account review inquiries serve distinctly different purposes in the credit ecosystem, each providing unique insights into your credit-seeking behavior and market interest. Hard inquiries result from your direct applications for credit and can temporarily impact your credit score, while promotional inquiries indicate market interest from potential lenders who view you as a qualified prospect. Account review inquiries demonstrate ongoing relationship management by existing creditors who periodically assess your creditworthiness for account management purposes.

Inquiry patterns reveal financial behavior patterns that extend beyond individual credit applications, providing lenders with insights into your credit-seeking frequency and financial decision-making processes. Multiple inquiries within short timeframes may suggest financial distress or aggressive credit seeking, while strategic inquiry timing demonstrates thoughtful financial planning. Lenders analyze these patterns to assess risk and determine appropriate credit terms based on your apparent financial behavior.

The rate shopping exception provides a strategic advantage for major purchases by allowing multiple inquiries for the same type of credit within a specific timeframe to be treated as a single inquiry for scoring purposes. This exception recognizes that responsible consumers compare offers when making significant financial decisions like purchasing a home or car. Understanding and leveraging this exception allows you to shop for the best rates without unnecessarily damaging your credit score through multiple inquiries.

Promotional inquiries indicate market interest and potential pre-qualification opportunities that may not be immediately apparent to consumers. These inquiries suggest that creditors have identified you as meeting their preliminary qualification criteria based on your credit profile. While promotional inquiries don’t impact your credit score, they provide valuable insights into your market positioning and potential credit opportunities that align with your current credit profile.

Public Records and Collections: Navigating the Most Damaging Credit Report Elements

Bankruptcy types create differentiated impacts on credit recovery timelines and strategies, with Chapter 7 and Chapter 13 bankruptcies following distinct reporting and recovery patterns. Chapter 7 bankruptcies remain on credit reports for ten years but may allow for faster credit rebuilding due to the immediate discharge of debts. Chapter 13 bankruptcies remain for seven years and involve structured repayment plans that can demonstrate ongoing financial responsibility during the bankruptcy period.

Collection account lifecycle management requires understanding the complex timeline from initial delinquency through potential removal from your credit report. The seven-year reporting period begins with the original delinquency date, not when the account was placed for collection or sold to a collection agency. This distinction is crucial for understanding when negative items will naturally age off your credit report and for developing strategies to address collection accounts effectively.

Medical debt reporting changes have created significant improvements in credit report accuracy and fairness, particularly for consumers dealing with healthcare-related financial challenges. Paid medical collections no longer appear on credit reports, and unpaid medical collections under $500 are excluded from reporting. Additionally, unpaid medical collections now have a one-year waiting period before appearing on credit reports, providing time for insurance processing and payment arrangements.

Consumer statement strategies offer opportunities to provide context for financial hardships without disputing factual information on your credit report. These statements allow you to explain circumstances that led to negative credit events, such as job loss, medical emergencies, or natural disasters. While consumer statements don’t directly impact credit scores, they provide valuable context that may influence lender decisions during manual underwriting processes.

“Understanding your credit report sections helps you identify areas for improvement and take control of your financial future.”

The strategic approach to addressing negative public records involves understanding both the immediate and long-term implications of different resolution strategies. Bankruptcy dismissal versus discharge creates different credit report presentations, with dismissals potentially allowing for refiling while discharges provide final resolution. Understanding these distinctions helps you make informed decisions about bankruptcy proceedings and their impact on your credit recovery timeline.

Taking Control of Your Financial Narrative

Your credit report isn’t just a financial document—it’s the story of your financial life told through data points that determine your access to opportunities. Understanding the intricate layers within each section transforms you from a passive observer of your credit score into an active architect of your financial future. The subtle patterns in inquiry timing, the strategic implications of account management, and the complex interplay between different credit elements all work together to create a comprehensive picture that lenders use to make decisions about your creditworthiness.

The difference between simply monitoring your credit and truly understanding it lies in recognizing that every element of your credit report serves a specific purpose in the lending decision process. From the personal information that verifies your identity to the payment history matrix that predicts your future behavior, each section provides lenders with crucial insights into your financial character. When you understand how lenders interpret these data points, you gain the power to shape your credit narrative strategically, making informed decisions that strengthen your position over time rather than simply reacting to credit score fluctuations.

The question isn’t whether you can afford to ignore the complexities of your credit report—it’s whether you can afford to remain financially invisible to the opportunities that comprehensive credit mastery can unlock.