Most people think budgeting is about restricting spending, but the real challenge lies in understanding why we reach for credit cards in the first place. The psychology behind our financial decisions often sabotages even the most well-intentioned budgets, creating a cycle where small, seemingly harmless purchases compound into overwhelming debt. What if the solution isn’t about spending less, but about spending differently? Understanding how to avoid overwhelming credit card debt is crucial in today’s financial landscape. By implementing these strategies, you can effectively avoid overwhelming credit card debt and take control of your finances.

The strategies you’ll discover here go beyond traditional budgeting advice. They address both the mathematical realities of debt accumulation and the behavioral patterns that drive us toward credit card dependency. From creating digital systems that mirror cash limitations to building psychological barriers against impulsive spending, these approaches recognize that successful debt prevention requires more than willpower—it requires strategic design. You’ll learn how to structure your finances so that staying debt-free becomes the natural outcome, not a constant struggle against your own spending impulses.

Creating a financial cushion will help you avoid overwhelming credit card debt in unexpected situations. Make sure you have a plan in place to avoid overwhelming credit card debt. Adjust your budget proactively to avoid overwhelming credit card debt during high-spending seasons. This will greatly assist in your journey to avoid overwhelming credit card debt.

The Preemptive Strike: Building Anti-Debt Buffers Into Your Budget

The most effective defense against credit card debt begins long before you ever reach for plastic. Traditional budgeting approaches often fail because they focus on managing money after spending decisions have already been made, rather than creating structural barriers that prevent problematic spending patterns from developing in the first place.

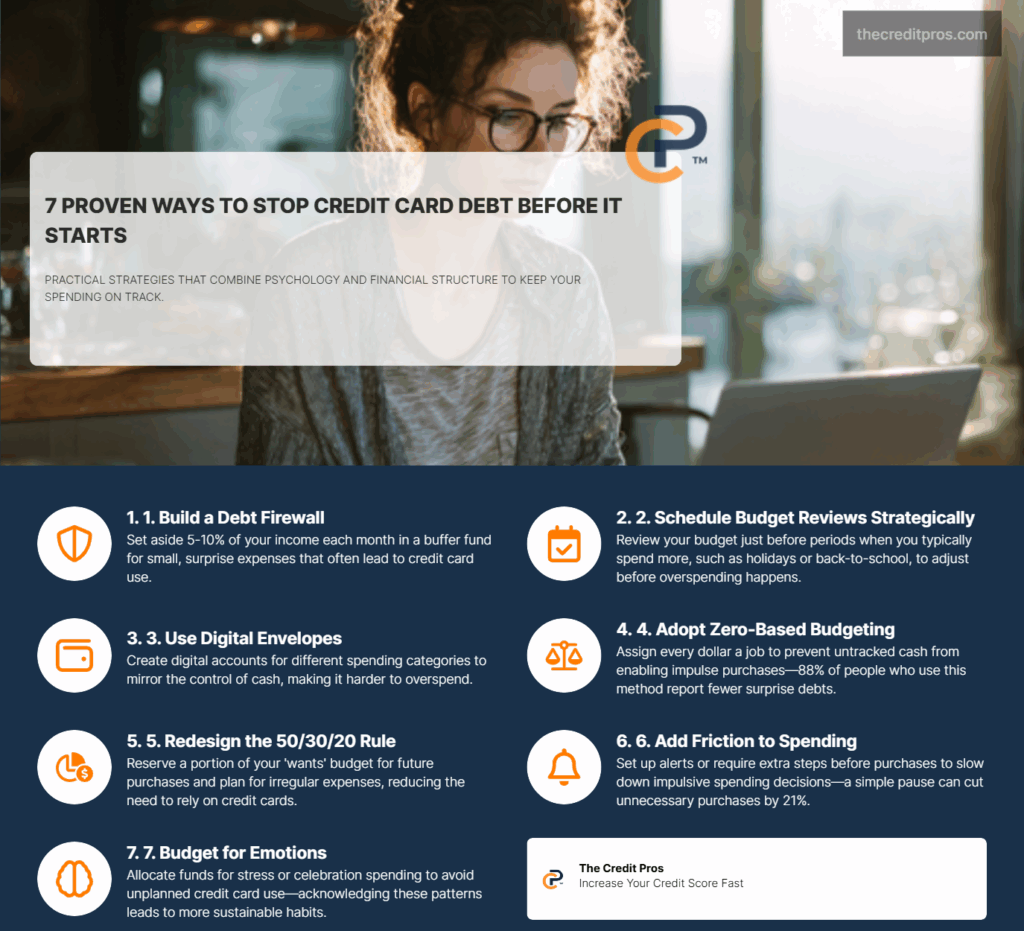

Adapting your strategy will help you avoid overwhelming credit card debt. This distinction can help you avoid overwhelming credit card debt. By preparing a fund, you can avoid overwhelming credit card debt in the long run. The “Debt Firewall” concept represents a fundamental shift in budgeting philosophy, where you allocate 5-10% of your monthly income specifically for unexpected expenses that typically trigger credit card use. This buffer fund operates differently from an emergency fund because it’s designed for smaller, more frequent disruptions to your budget. When your car needs a minor repair, your child requires school supplies, or a friend invites you to an unexpected dinner, this firewall prevents these common scenarios from derailing your financial stability.

Strategic timing of budget reviews creates another layer of protection against debt accumulation. Most people review their budgets monthly, but this schedule often misses the seasonal patterns that lead to overspending. By aligning your budget reviews with your personal financial cycles—such as the weeks before major holidays, the start of school seasons, or periods when you historically overspend—you can proactively adjust your allocations before problematic spending occurs. This approach recognizes that your financial needs aren’t static throughout the year and builds flexibility into your system.

The psychological principle of “pre-commitment” transforms budgeting from a willpower-based exercise into a structural solution. When you set up automatic payments for your credit card bills ensures you never miss a payment, avoiding late fees and additional interest charges. This might involve automatically moving money designated for entertainment into a separate account that requires a deliberate transfer back to your checking account, creating a natural pause before spending.

The Envelope Evolution: Modern Cash Management for Credit Card Users

The traditional envelope system, while psychologically sound, often fails in today’s digital economy where cash transactions have become increasingly rare. However, the underlying principles of the envelope method—physical limitations on spending and category-specific allocation—can be adapted for modern financial management through digital envelope systems.

Digital envelope systems using separate checking accounts or specialized apps create virtual barriers that mirror the physical limitations of cash. Instead of carrying cash in labeled envelopes, you can establish multiple checking accounts for different spending categories, each with its own debit card. This approach maintains the psychological benefit of seeing finite resources while accommodating the digital payment preferences of modern commerce. When your “dining out” account reaches zero, you’re forced to wait until the next budget cycle, just as you would with an empty cash envelope.

These adjustments can further help you avoid overwhelming credit card debt. Addressing these factors is crucial to avoid overwhelming credit card debt. Understanding your spending personality will help you avoid overwhelming credit card debt. Creating these friction points will assist you in avoiding overwhelming credit card debt. Budgeting for these scenarios can help you avoid overwhelming credit card debt. By automating your finances, you can avoid overwhelming credit card debt. This mindset will help you avoid overwhelming credit card debt.

The “Credit Card Quarantine” method represents a sophisticated approach to credit card management that allows you to capture rewards benefits while maintaining strict spending controls. This strategy involves using credit cards only for predetermined categories with automatic payment setups that immediately transfer money from your designated envelope accounts. For example, you might use a rewards credit card exclusively for groceries, with an automatic payment system that transfers the exact amount from your grocery envelope account to pay the credit card balance daily. Ultimately, the goal is to avoid overwhelming credit card debt through these methods. It’s essential to implement these strategies to avoid overwhelming credit card debt in the future.

Behavioral triggers that lead to envelope system failures often stem from the disconnect between digital transactions and physical money. The solution lies in creating artificial friction points that force conscious decision-making. This might involve setting up account alerts that notify you when envelope balances drop below certain thresholds, or using banking apps that require additional authentication for certain types of purchases. The key is designing your system around your specific spending weaknesses rather than adopting a one-size-fits-all approach.

The Zero-Sum Game: Advanced Zero-Based Budgeting for Debt Prevention

Zero-based budgeting, when properly implemented, eliminates the “leftover money trap” that often leads to credit card debt. This trap occurs when unallocated funds create a false sense of financial security, leading to impulsive purchases that exceed your actual discretionary income. By ensuring every dollar has a predetermined purpose, zero-based budgeting creates a complete financial ecosystem where credit card use becomes an intentional deviation from your plan rather than an unconscious default.

Creating dynamic zero-based budgets that adjust monthly based on income fluctuations and seasonal expenses requires a more sophisticated approach than static budgeting methods. This involves establishing percentage-based allocations rather than fixed dollar amounts, allowing your budget to scale appropriately with income changes. For irregular income earners, this might mean creating multiple budget scenarios based on different income levels, with predetermined rules for which scenario to implement based on actual earnings.

The concept of “budget insurance” involves building small buffer amounts into each spending category to prevent category overspending that typically leads to credit card use. Rather than creating one large emergency fund, this approach distributes small cushions throughout your budget categories. Your grocery budget might include an extra $50 for unexpected price increases, while your transportation budget includes padding for fluctuating gas prices. This distributed approach prevents the domino effect where overspending in one category triggers credit card use to cover other planned expenses.

Using zero-based budgeting to identify and eliminate “lifestyle inflation” before it requires credit card financing involves regular analysis of spending patterns and conscious decision-making about increased expenses. This process requires categorizing spending increases as either temporary adjustments or permanent lifestyle changes, with different budgeting strategies for each. Temporary increases might be funded through category reallocation, while permanent changes require corresponding increases in income or decreases in other categories.

Utilizing digital tracking can help you avoid overwhelming credit card debt effectively. Using a digital envelope system can help you avoid overwhelming credit card debt. This method is designed specifically to avoid overwhelming credit card debt. Identifying these triggers is essential to avoid overwhelming credit card debt. By maintaining this discipline, you can avoid overwhelming credit card debt. Implementing zero-based budgeting is a great way to avoid overwhelming credit card debt. This will ultimately help you avoid overwhelming credit card debt. Such an approach can significantly aid in your efforts to avoid overwhelming credit card debt. Monitoring this will help you avoid overwhelming credit card debt.

The 50/30/20 Debt-Proofing Method: Rebalancing Traditional Ratios

The traditional 50/30/20 rule, while popular for its simplicity, can inadvertently encourage credit card reliance by creating artificial boundaries that don’t align with real-world spending patterns. The rigid categorization of expenses into “needs,” “wants,” and “savings” often fails to account for the gray areas where most credit card debt originates. A more effective approach involves modifying these ratios to prioritize debt prevention over conventional savings strategies.

The “Wants vs. Delayed Wants” distinction requires a fundamental shift in how you categorize and budget for discretionary spending. Instead of simply allocating 30% of income to “wants,” this approach involves creating subcategories for immediate wants and future wants, with specific savings goals for larger purchases that might otherwise be financed through credit cards. This might involve reducing the immediate wants category to 20% while allocating 10% to a “future wants” fund that prevents impulsive credit card purchases for items like electronics, vacation, or home improvements.

Creating a “Credit Card Replacement Fund” within the 20% savings portion specifically addresses the most common scenarios that lead to debt accumulation. This fund operates differently from traditional emergency savings because it’s designed for planned but unpredictable expenses—the category of spending that most frequently triggers credit card use. Examples include:

- Annual insurance premiums that you forget to budget for monthly

- Seasonal expenses like holiday gifts or summer vacation costs

- Maintenance and replacement costs for appliances and vehicles

- Professional development expenses like conferences or certification fees

- Social obligations like weddings or baby showers

Strategic reallocation during different life phases ensures that your debt-prevention strategy evolves with your changing financial needs and responsibilities. Young professionals might allocate a larger percentage to the future wants fund to prevent lifestyle inflation debt, while parents might increase the buffer funds to accommodate the unpredictable expenses associated with children. Pre-retirees might shift more resources toward debt elimination to enter retirement with a clean financial slate.

The Behavioral Budget: Psychological Strategies for Sustainable Spending Control

The “Spending Personality Assessment” recognizes that effective budgeting must align with your individual psychological patterns and behavioral tendencies. Some people are natural savers who need permission to spend, while others are natural spenders who need structural barriers to prevent overspending. Understanding your spending personality allows you to design budgeting systems that work with your natural tendencies rather than against them.

Creating “Friction Points” in your budget involves deliberately introducing obstacles that force conscious decision-making before credit card use. This might involve storing your credit cards in a separate location that requires deliberate retrieval, setting up account alerts that notify you before making purchases above certain thresholds, or implementing waiting periods for non-essential purchases. The goal is to create enough inconvenience to prevent impulsive spending while maintaining accessibility for legitimate needs.

The concept of “Emotional Spending Accounts” acknowledges that stress, celebration, boredom, and other emotional states often trigger spending behaviors that lead to debt accumulation. Rather than trying to eliminate emotional spending entirely, this approach involves budgeting for these predictable human behaviors. You might allocate a specific amount monthly for stress-relief purchases, celebration expenses, or impulse buys, treating these as legitimate budget categories rather than budget failures.

Using automation and timing strategies removes willpower from the budgeting equation by creating systems that function independently of your momentary emotional state or energy levels. This involves setting up automatic transfers that occur immediately after payday, before you have the opportunity to make spending decisions with that money. The timing of these transfers is crucial—they should occur when you’re most likely to make rational financial decisions rather than emotional ones.

The “Future Self” budgeting technique involves making financial decisions based on your long-term identity and goals rather than immediate desires. This approach requires regularly visualizing your future financial situation and making current spending decisions that align with that vision. Instead of asking “Can I afford this?” you ask “Does this purchase align with who I want to be financially in five years?” This perspective shift often reveals that many potential credit card purchases are inconsistent with your long-term financial identity and goals.

Breaking the Cycle: Your Path to Debt-Free Living

The journey from credit card dependency to financial freedom isn’t about restricting your spending—it’s about restructuring your relationship with money itself. These strategies work because they address the root causes of debt accumulation rather than just the symptoms. By implementing debt firewalls, modernizing envelope systems, and aligning your budget with your psychological patterns, you’re not just managing money; you’re designing a financial ecosystem that naturally prevents debt from taking hold.

The most powerful insight from these approaches is that successful debt prevention requires strategic design rather than constant willpower. When you create systems that make staying debt-free the natural outcome, you’re no longer fighting against your spending impulses—you’re channeling them through structures that protect your financial future. Your budget becomes a tool for financial empowerment rather than restriction, allowing you to spend confidently within parameters that support your long-term goals. The question isn’t whether you can afford to implement these strategies—it’s whether you can afford not to transform your financial habits before small purchases become overwhelming debt.