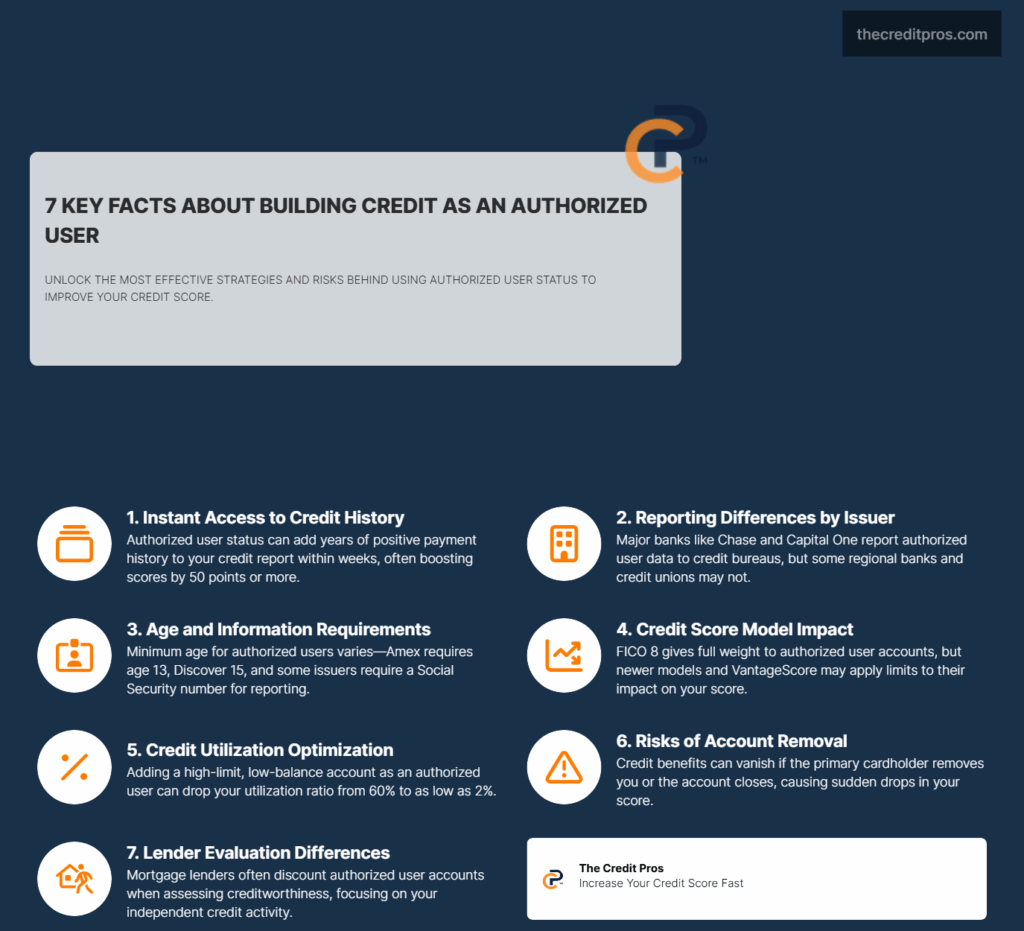

Getting added as an authorized user on someone else’s credit card might seem like a simple favor, but it’s actually one of the most powerful authorized users credit building strategies available. When done correctly, this arrangement can add years of positive payment history to your credit report almost instantly, potentially boosting your credit score by 50 points or more within weeks. The process works because most major credit card companies report authorized user activity to credit bureaus, allowing you to benefit from the primary cardholder’s established credit history and available credit limits. Understanding the role of authorized users credit building is essential for maximizing your credit potential.

However, the mechanics behind authorized user relationships are far more complex than most people realize. Not all credit card issuers report authorized user data the same way, and the timing of when these benefits appear on your credit report varies significantly. What happens when the primary cardholder runs into financial trouble? How do mortgage lenders actually view these accounts when you’re applying for a home loan? Understanding these nuances can mean the difference between a temporary credit score boost and a sustainable foundation for long-term financial success.

For many individuals, authorized users credit building becomes a stepping stone toward achieving their own financial independence. By leveraging the credit history of a primary cardholder, authorized users can significantly enhance their credit profiles. Authorized users credit building is a critical component for many looking to break into the world of credit. Understanding the nuances of authorized users credit building can empower individuals to make informed decisions regarding their credit management. Effective authorized users credit building requires strategic planning and awareness of potential pitfalls to ensure long-term success.

How Authorized User Credit Reporting Actually Works

The various age requirements for participating in authorized users credit building can impact how quickly a young person can start building credit. Many people find that authorized users credit building is particularly beneficial during major life transitions, such as starting college or a first job. Understanding how credit scores are affected by authorized users credit building relationships can lead to better financial decision-making. Authorized users credit building strategies can be particularly effective for those with limited credit histories. Careful consideration of authorized users credit building can also help mitigate risks associated with fluctuations in credit scores. For many, the journey of authorized users credit building involves learning crucial financial management skills. Engaging in authorized users credit building can open doors to future financial opportunities.

Ultimately, authorized users credit building strategies should complement the formation of independent credit management habits. By balancing authorized users credit building with personal accountability, individuals can achieve lasting financial health. A strong foundation of authorized users credit building can support individuals through various financial challenges. Furthermore, authorized users credit building presents opportunities for collaborative financial planning between parties.

With a solid understanding of authorized users credit building, individuals can navigate the complexities of credit more effectively. The principles of authorized users credit building can often be applied to broader financial strategies. Consequently, individuals practicing authorized users credit building should remain vigilant about their overall credit health. Ultimately, understanding authorized users credit building can empower individuals to take control of their financial futures. The knowledge gained from authorized users credit building strategies can influence credit decisions for years to come. Moreover, the benefits of authorized users credit building extend beyond just credit scores; they can influence overall financial literacy.

The infrastructure behind authorized user credit reporting represents one of the most complex aspects of the credit industry, with significant variations in how different credit card companies handle this process. Major issuers like Chase, Bank of America, and Capital One maintain sophisticated systems that automatically report authorized user activity to all three credit bureaus within 30-60 days of account setup. However, smaller regional banks and credit unions often lack these automated reporting capabilities, meaning authorized user accounts may never appear on credit reports despite the cardholder’s expectations.

As such, authorized users credit building can serve as an educational journey for many consumers. In summary, authorized users credit building can be an invaluable tool when approached with awareness and responsibility. By embracing the principles of authorized users credit building, individuals can secure a better financial future. Incorporating authorized users credit building strategies can significantly enhance credit scores and overall financial health.

Finally, the journey of authorized users credit building is one of growth and learning that many successfully navigate. Age requirements for authorized user reporting create another layer of complexity that varies dramatically across the industry. American Express requires authorized users to be at least 13 years old before reporting their activity to credit bureaus, while Chase sets the minimum at 15 years. Discover Card takes a more restrictive approach, requiring authorized users to be 15 years old and mandating that they provide their Social Security number for reporting purposes. These age thresholds stem from credit bureau policies designed to prevent premature credit file creation for minors, but they also create strategic timing considerations for parents planning long-term credit building for their children.

The transfer of account history from primary cardholders to authorized users follows specific protocols that can dramatically impact credit scores. When you become an authorized user on an account that has been open for seven years with perfect payment history, that entire seven-year track record typically appears on your credit report as if you had been managing the account yourself. This historical transfer explains why authorized user status can produce such dramatic credit score improvements, particularly for individuals with thin credit files who suddenly gain access to years of positive payment history.

Credit scoring models treat authorized user accounts differently than primary accounts, but the specific mechanisms vary between FICO and VantageScore systems. FICO 8, the most widely used scoring model, generally gives full weight to authorized user payment history and credit utilization, while newer FICO versions like FICO 9 have implemented algorithms designed to detect and discount certain types of authorized user relationships. VantageScore models take a more nuanced approach, considering factors like the authorized user’s age and the length of their relationship with the primary cardholder when determining how much weight to give these accounts.

Strategic Timing and Relationship Dynamics

The timing of authorized user additions can significantly impact the effectiveness of this credit building strategy, with optimal windows often coinciding with the primary cardholder’s statement closing dates and payment cycles. Adding an authorized user immediately after a primary cardholder has paid down a high balance and before the next statement closes maximizes the positive utilization impact on the authorized user’s credit report. This timing strategy requires coordination between both parties and an understanding of how credit utilization calculations work across different reporting periods.

Communication strategies between primary cardholders and authorized users often determine the success or failure of these arrangements. Establishing clear ground rules about card usage, payment responsibilities, and monitoring procedures prevents many common conflicts that arise in authorized user relationships. Primary cardholders should maintain complete control over account access and spending limits, while authorized users need to understand that their credit building benefits depend entirely on the primary cardholder’s financial discipline and payment habits.

The psychological aspects of authorized user relationships frequently create unexpected challenges, particularly in family situations where financial boundaries become blurred. Adult children who become authorized users on their parents’ accounts may develop a false sense of financial security, believing they have established independent credit when they have actually created a dependency relationship. This dynamic can delay the development of personal financial management skills and create complications when the authorized user eventually needs to qualify for credit based on their own financial profile.

Exit strategies for authorized user relationships require careful planning to minimize credit score disruption and maintain personal relationships. The most effective approaches involve gradual transitions where authorized users establish their own credit accounts before being removed from the primary cardholder’s account. This overlap period allows for credit score stabilization and ensures that the authorized user maintains access to credit during the transition. Primary cardholders should provide adequate notice before removing authorized users, typically 30-60 days, to allow for alternative credit arrangements.

Setting spending limits and monitoring capabilities represents a critical component of successful authorized user management. Most major credit card companies now offer sophisticated controls that allow primary cardholders to set specific spending limits for authorized users, receive real-time transaction alerts, and temporarily freeze authorized user cards if necessary. These technological tools have made authorized user arrangements more viable by giving primary cardholders greater control over their financial exposure while still providing credit building benefits to authorized users.

Credit Utilization Optimization Through Authorized User Status

The mathematical impact of authorized user status on credit utilization ratios can be profound, particularly for individuals with limited existing credit. When someone with a single credit card carrying a $500 limit and $300 balance becomes an authorized user on an account with a $15,000 limit and minimal balance, their overall utilization ratio drops from 60% to approximately 2%. This dramatic reduction in utilization typically produces immediate credit score improvements, often within one to two billing cycles.

Individual account utilization versus aggregate utilization calculations create strategic opportunities for authorized user optimization. Credit scoring models evaluate both the utilization ratio on each individual account and the overall utilization across all accounts. Authorized user status can improve both metrics simultaneously, but the impact varies depending on the existing credit profile. Individuals with multiple high-utilization accounts may see greater benefits from authorized user status than those who already maintain low utilization ratios across their existing credit.

The timing of utilization reporting creates opportunities for strategic optimization that many authorized users overlook. Credit card companies typically report account balances to credit bureaus on statement closing dates, not payment due dates. This means that authorized users can benefit from primary cardholders who pay down balances before statement closing, even if those balances are carried and paid after the due date. Understanding this timing allows for coordination between primary cardholders and authorized users to maximize credit score benefits.

Multiple authorized user relationships can create compounding benefits, but they also introduce complexity and risk. Individuals who become authorized users on several accounts with different primary cardholders may see dramatic credit score improvements, but they also become vulnerable to the financial decisions of multiple parties. Each additional authorized user relationship increases the potential for negative impacts if any primary cardholder experiences financial difficulties or makes poor payment decisions.

The interaction between authorized user accounts and existing credit limits in scoring calculations follows specific algorithms that vary between credit scoring models. FICO scores typically treat authorized user credit limits as part of the overall available credit calculation, while some alternative scoring models apply different weightings to authorized user versus primary account limits. These technical differences can create variations in credit score improvements depending on which scoring model lenders use for evaluation.

Limitations and Risk Management in Authorized User Strategies

Mortgage lenders and other major creditors often apply different evaluation criteria to authorized user accounts compared to primary credit accounts, creating potential obstacles for borrowers who rely heavily on authorized user benefits. Many underwriters will exclude authorized user accounts from debt-to-income calculations and available credit assessments, focusing instead on the borrower’s independently managed credit history. This practice stems from the recognition that authorized user status doesn’t demonstrate independent credit management capability or financial responsibility.

The temporary nature of authorized user benefits creates a fundamental limitation that many users fail to recognize until it’s too late. Unlike primary credit accounts that remain under the account holder’s control, authorized user benefits can disappear instantly if the primary cardholder decides to remove the authorized user or if the primary account is closed. This vulnerability means that credit scores built primarily on authorized user benefits may experience sudden and dramatic drops, potentially affecting loan applications, employment opportunities, or other credit-dependent decisions.

Financial difficulties experienced by primary cardholders can have immediate and severe impacts on authorized users’ credit reports. Late payments, over-limit fees, or account closures on the primary account will typically appear on authorized users’ credit reports within 30 days of the negative event. This shared responsibility for account performance means that authorized users must carefully evaluate the financial stability and payment history of potential primary cardholders before entering these arrangements.

The removal process for authorized users varies significantly between credit card companies and can affect credit scores differently depending on the timing and method used. Some issuers allow primary cardholders to remove authorized users online with immediate effect, while others require phone calls or written requests that may take several billing cycles to process. The credit reporting implications of authorized user removal can persist for months, as credit bureaus may take time to update records and recalculate credit scores based on the revised credit profile.

Risk mitigation strategies for primary cardholders include maintaining separate emergency funds to cover potential authorized user spending, setting up automatic payment systems to prevent missed payments that could affect both parties, and establishing clear communication protocols for monitoring account activity. Primary cardholders should also consider the potential impact on their own credit utilization ratios if authorized users make large purchases, as these transactions will affect the primary cardholder’s credit profile as well.

- Primary Cardholder Risks: Liability for all authorized user charges, potential credit utilization increases, responsibility for payment regardless of authorized user behavior

- Authorized User Risks: Dependence on primary cardholder’s financial decisions, potential for sudden credit score drops upon removal, limited control over account management

- Shared Risks: Impact of late payments or account closure on both parties’ credit reports, potential relationship strain from financial disagreements

Advanced Strategies and Alternative Approaches

Combining authorized user status with secured credit cards and credit builder loans creates a comprehensive approach that addresses both immediate credit score improvement and long-term credit building capability. This strategy involves using authorized user benefits to qualify for better terms on secured cards or credit builder loans, then using those independent credit products to establish a track record of personal credit management. The timing of this approach requires careful coordination to ensure that new credit applications occur while authorized user benefits are active but before any potential removal from the primary account.

Professional authorized user services operate in a legal gray area that requires careful evaluation by consumers considering these options. Legitimate services typically involve adding clients as authorized users on accounts belonging to individuals with excellent credit histories, often for fees ranging from $200 to $800 per account. However, these services carry significant risks, including potential account closure by credit card companies, removal without notice, and possible violations of credit card terms of service that could affect the client’s credit standing.

The transition from authorized user dependency to independent credit management requires strategic planning that begins while the authorized user benefits are still active. This process typically involves applying for secured credit cards or credit builder loans while credit scores are elevated from authorized user status, then using these new accounts to establish independent payment history. The goal is to create a bridge that maintains credit access and scores even after authorized user accounts are removed.

Credit recovery and rehabilitation through authorized user relationships can be particularly effective for individuals recovering from bankruptcy, foreclosure, or other major credit events. The rapid credit score improvement possible through authorized user status can help these individuals qualify for secured credit products and begin rebuilding their credit profiles more quickly than traditional methods alone. However, this approach requires careful timing to ensure that authorized user benefits don’t interfere with the natural credit recovery process or create unrealistic expectations about credit rebuilding timelines.

The ethics of paid authorized user services continue to evolve as credit scoring companies and regulators develop new approaches to detecting and potentially discounting these relationships. While not explicitly illegal, these services often operate in ways that credit card companies prohibit in their terms of service, creating potential risks for both the service providers and their clients. Consumers considering these services should carefully evaluate the potential benefits against the risks of account closure, credit score volatility, and possible negative impacts on their credit profiles.

Creating sustainable credit building habits while benefiting from authorized user status requires a disciplined approach that treats the authorized user benefits as a temporary boost rather than a permanent solution. This involves establishing budgeting systems, payment schedules, and monitoring routines that will support independent credit management once the authorized user relationship ends. The goal is to use the improved credit access that comes with higher scores to establish independent credit relationships that can sustain credit health over the long term.

Wrapping Up: The True Power and Responsibility of Authorized Users Relationships

Becoming an authorized users credit building represents far more than a simple credit hack – it’s a sophisticated financial strategy that can transform your credit profile when executed thoughtfully. The potential for rapid score improvements of 50+ points exists, but only when you understand the complex reporting mechanisms, timing strategies, and relationship dynamics that determine success. The infrastructure behind authorized user benefits varies dramatically across lenders, and what works with one credit card company may fail entirely with another.

The most successful authorized users credit building arrangements treat this strategy as a bridge to independent credit management, not a permanent solution. Whether you’re helping a family member build credit or seeking to improve your own profile, the key lies in understanding both the immediate benefits and long-term limitations of these relationships. Remember that your credit score built on someone else’s financial discipline can disappear as quickly as it appeared – but the knowledge and strategic approach you develop in the process can serve as the foundation for lasting financial success.