Millions of Americans pay rent reliably every month, yet many remain invisible to traditional credit scoring systems. You could have five years of perfect rental payments totaling tens of thousands of dollars, but if you don’t have credit cards or loans, lenders might still see you as a risky borrower. This disconnect between actual payment behavior and credit scores creates a significant barrier for people trying to build credit from scratch. Understanding how to boost thin credit with rent can change the financial trajectory for many individuals.

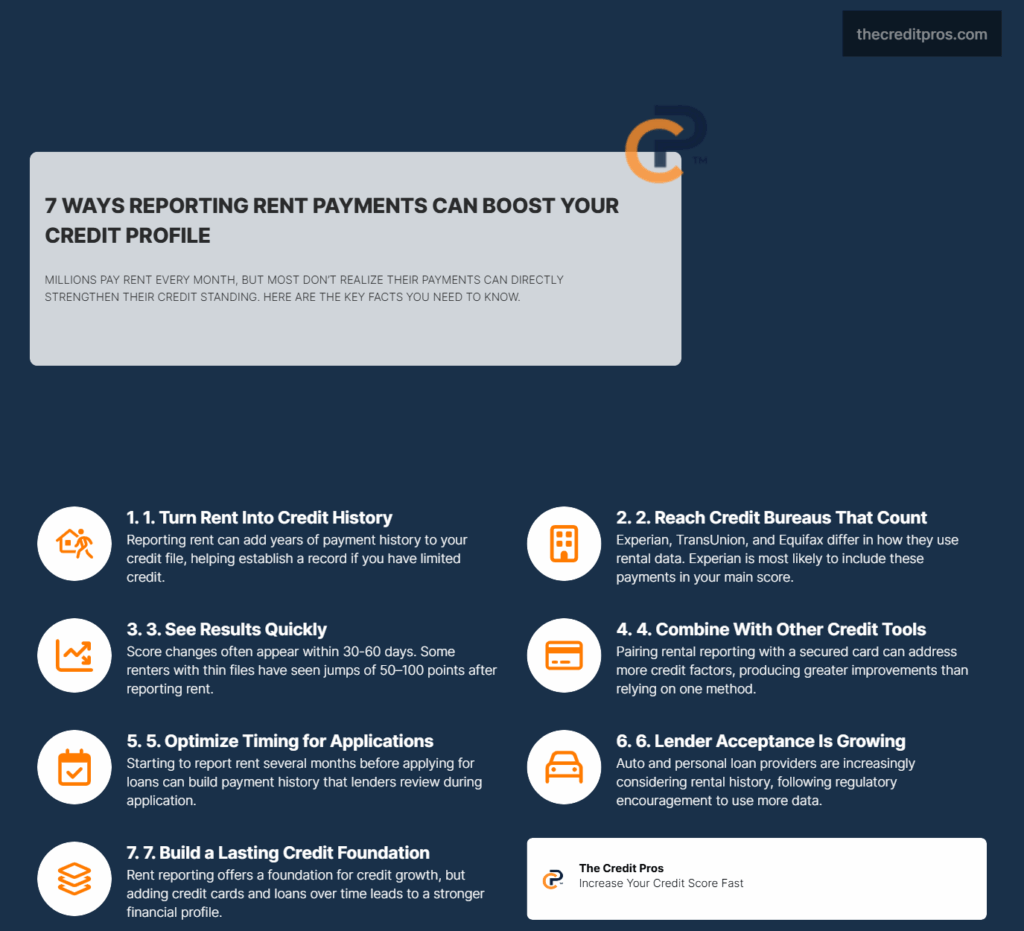

By utilizing rental payments effectively, you can boost thin credit with rent and create a stronger financial profile. The good news is that rental payment history can now be reported to credit bureaus, offering a legitimate path to strengthen thin credit files. But here’s what most people don’t know: simply reporting your rent payments isn’t enough to maximize their impact. The timing of when you start reporting, which bureaus receive the data, and how you combine rental reporting with other credit-building strategies can mean the difference between a modest score bump and meaningful credit improvement. Understanding these nuances could be the key to unlocking credit opportunities you’ve been missing.

The Hidden Credit Opportunity in Monthly Rent Payments

The fundamental disconnect between rental payment reliability and credit recognition creates one of the most significant missed opportunities in personal finance today. Traditional credit scoring models prioritize revolving credit accounts and installment loans, effectively ignoring the largest monthly payment most Americans make consistently. This oversight particularly impacts individuals with thin credit files, who may demonstrate excellent payment discipline through rent but remain invisible to conventional credit assessment systems. Many people are unaware that they can boost thin credit with rent through consistent reporting.

Rental payment history represents a vastly underutilized credit-building resource that differs fundamentally from traditional credit products. Unlike credit cards or loans that require approval and often involve interest charges, rental payments reflect actual living expenses that consumers prioritize above discretionary spending. This priority creates a payment pattern that often exceeds the reliability of credit card payments, yet receives no recognition in standard credit evaluations. The psychological framework surrounding rent payments also differs significantly – tenants view rent as a non-negotiable obligation rather than optional credit utilization, leading to more consistent payment behaviors. Utilizing rent payments to boost thin credit with rent is an innovative approach many are beginning to embrace.

The timing considerations for rental payment reporting reveal sophisticated strategic opportunities that most consumers overlook. Enrolling in rental payment reporting during periods of credit application activity can provide immediate benefits, while starting the process during stable housing situations allows for longer payment history accumulation. Geographic variations in rental payment reporting effectiveness also play a crucial role, as different regions show varying levels of lender acceptance and credit bureau integration. Urban markets with higher rental costs often see more substantial score improvements, while rural areas may experience slower adoption among local lenders. It’s crucial to understand how to boost thin credit with rent in different housing markets.

The compound effect of rental payment integration becomes most apparent when analyzing payment consistency patterns over extended periods. Monthly rent payments typically show less volatility than credit card usage, creating steady positive payment history that credit scoring algorithms increasingly value. This consistency factor becomes particularly powerful for individuals transitioning from cash-based financial management to credit-building strategies, as it provides a bridge between their existing responsible payment behaviors and formal credit recognition. Strategies to boost thin credit with rent can provide a unique advantage in your financial journey.

Understanding the Technical Infrastructure Behind Rental Payment Credit Integration

The opportunity to boost thin credit with rent is more accessible than ever. The infrastructure supporting rental payment credit reporting operates through sophisticated verification systems that authenticate payment history before transmitting data to credit bureaus. This verification process involves multiple data points, including lease agreements, bank transaction records, and landlord confirmations, creating a comprehensive authentication framework that ensures accuracy. The technical complexity of this system explains why rental payment reporting has only recently become widely accessible, as the technology required to process and verify millions of rental transactions represents a significant technological advancement. To truly benefit, one must know how to boost thin credit with rent effectively.

Credit bureau acceptance of rental payment data varies significantly across the three major reporting agencies, with each maintaining different standards for data integration and scoring algorithm incorporation. Experian has historically shown the most aggressive adoption of alternative credit data, including rental payments, while TransUnion and Equifax have implemented more conservative approaches. This variation creates strategic considerations for consumers, as the choice of rental payment reporting service can influence which credit scores receive the most substantial improvements. Understanding these bureau-specific differences allows for more targeted credit-building strategies. Boosting thin credit with rent is a step many are now exploring as part of their credit strategy.

The algorithmic weighting of rental payment data represents a fundamental shift in credit scoring methodology that reflects evolving understanding of payment behavior predictability. Traditional credit factors like credit utilization and account age receive established weightings within scoring models, while rental payments are incorporated through newer algorithms that account for payment consistency and amount stability. This technical integration means rental payments may have different impacts depending on the specific credit scoring model used, with newer models like VantageScore 4.0 showing greater sensitivity to rental payment history than older FICO models. Many individuals are learning how to boost thin credit with rent by understanding the process.

Third-party verification services play a crucial role in the rental payment reporting ecosystem, acting as intermediaries between tenants, landlords, and credit bureaus. These services must navigate complex data privacy requirements while maintaining the accuracy standards demanded by credit reporting agencies. The verification timeline typically spans several weeks for historical data integration, during which payment records undergo multiple authentication checks to prevent fraudulent reporting. This thorough verification process, while time-consuming, ensures the integrity of rental payment data within credit files. The ability to boost thin credit with rent opens new doors for those with limited credit history.

Strategic Timing and Optimization for Maximum Credit Impact

The optimal timing for initiating rental payment reporting depends heavily on individual credit goals and existing credit profile characteristics. For individuals with completely thin credit files, beginning rental payment reporting immediately provides the fastest path to establishing any credit history, as the absence of other credit factors means rental payments receive maximum algorithmic weight. However, consumers with existing negative credit items may benefit from delaying rental payment reporting until after addressing derogatory marks, allowing the positive rental history to have greater relative impact on overall credit scores. Understanding how to boost thin credit with rent may soon become essential knowledge for renters.

The compound effect of combining rental payments with secured credit cards creates a synergistic credit-building approach that maximizes score improvements across multiple credit factors. Rental payments establish payment history, while secured cards contribute to credit mix and utilization factors, creating a comprehensive credit profile that demonstrates responsible financial management across different account types. This strategic combination typically produces faster score improvements than either approach alone, as it addresses multiple credit scoring factors simultaneously. To effectively boost thin credit with rent, one must engage with the right reporting services.

Seasonal considerations for rental payment reporting enrollment reveal strategic opportunities that align with natural credit application cycles. Beginning rental payment reporting in late fall or early winter allows for several months of payment history accumulation before peak lending seasons in spring and summer. This timing strategy proves particularly valuable for individuals planning major credit applications like auto loans or mortgages, as the established rental payment history provides additional positive credit factors during application review processes. The strategy to boost thin credit with rent can significantly impact your financial future.

Managing expectations for score improvement timelines requires understanding the complex interaction between rental payment integration and existing credit factors. Initial score improvements from rental payment reporting typically appear within 30-60 days of data integration, but the magnitude of improvement varies significantly based on existing credit profile strength. Individuals with completely thin files may see dramatic improvements of 50-100 points, while those with established credit histories might experience more modest gains of 10-30 points. The key lies in understanding that rental payment reporting provides consistent, long-term credit building rather than immediate dramatic changes. Innovative ways to boost thin credit with rent are emerging in today’s financial landscape.

Overcoming Institutional Barriers and Maximizing Lender Acceptance

Lender variations in recognizing rental payment credit data create a complex landscape that requires strategic navigation for maximum benefit. Traditional banks and credit unions often maintain conservative approaches to alternative credit data, preferring established credit factors over newer reporting mechanisms like rental payments. However, fintech lenders and online financial institutions frequently embrace rental payment history as valid credit assessment criteria, creating opportunities for consumers to access credit products that might otherwise be unavailable through traditional channels. Those who learn to boost thin credit with rent will find themselves ahead in building credit.

Industry-specific differences in rental payment credit evaluation reveal important strategic considerations for targeted credit applications. Auto lenders increasingly recognize rental payment history as evidence of payment reliability, particularly for borrowers with limited traditional credit history. Mortgage lenders show more conservative approaches, often requiring rental payment history to supplement rather than replace traditional credit factors. Personal loan providers demonstrate the most variation, with some embracing rental payments as primary credit assessment criteria while others maintain traditional underwriting standards. Effective strategies to boost thin credit with rent will lead to better lending opportunities.

The evolving landscape of rental payment acceptance among major lenders reflects broader industry trends toward inclusive credit assessment practices. Recent regulatory guidance encouraging alternative credit data consideration has accelerated lender adoption of rental payment recognition. This shift creates opportunities for consumers to leverage rental payment history more effectively, but also requires staying informed about which lenders actively consider this data in their underwriting processes. Lenders now recognize the need to boost thin credit with rent in their assessments.

Different loan types evaluate rental payment history through distinct analytical frameworks that reflect their specific risk assessment priorities:

- Auto loans: Focus on payment consistency and amount stability as indicators of ability to handle fixed monthly obligations

- Mortgages: Emphasize long-term payment history and housing payment reliability as predictors of mortgage payment capability

- Personal loans: Vary widely in approach, with some lenders using rental payments as primary qualification criteria

- Credit cards: Generally show less emphasis on rental payments, preferring traditional credit utilization patterns

Success in boosting thin credit with rent requires a proactive approach to credit building. Understanding when rental payments may not significantly impact approval odds requires recognizing the limitations of alternative credit data in traditional lending environments. High-value loans like mortgages often require multiple credit factors beyond rental payments, while premium credit cards may prioritize income and existing credit relationships over rental payment history. This reality necessitates realistic expectations about rental payment reporting benefits within specific lending contexts. Establishing a routine to boost thin credit with rent will yield long-term benefits.

Building Long-term Credit Portfolio Development Beyond Rental Payments

The natural progression from thin file to established credit profile requires strategic planning that extends beyond rental payment reliance into diversified credit building approaches. Rental payments provide an excellent foundation for credit establishment, but long-term credit health depends on developing multiple credit relationships that demonstrate various types of financial responsibility. This transition involves gradually introducing traditional credit products while maintaining the positive rental payment history that initiated the credit-building process. When considering credit options, think about ways to boost thin credit with rent.

Understanding the limitations of rental payment reliance becomes crucial as credit profiles mature and lending requirements become more sophisticated. While rental payments establish payment history effectively, they do not contribute to credit mix diversity or demonstrate revolving credit management capabilities that many lenders value. This limitation means rental payments should be viewed as a credit-building foundation rather than a complete credit strategy, requiring supplementation with traditional credit products for optimal long-term results. Utilizing the potential to boost thin credit with rent can transform your credit score.

The influence of rental payment history on future credit product eligibility extends beyond immediate score improvements to create opportunities for accessing better credit terms and higher credit limits. Established rental payment history demonstrates financial stability to lenders, potentially qualifying consumers for premium credit products that might otherwise be unavailable. This progression effect means early investment in rental payment reporting can yield compounding benefits as credit profiles develop and mature over time. Strategies that boost thin credit with rent can build a stronger financial profile over time.

Creating sustainable credit growth strategies involves balancing rental payment reporting with traditional credit account development to achieve optimal credit portfolio composition. The most effective approach combines consistent rental payment reporting with strategic credit card usage, occasional installment loans, and careful credit utilization management. This balanced approach ensures credit profiles demonstrate comprehensive financial responsibility while avoiding over-reliance on any single credit factor. It’s crucial to implement a plan that helps boost thin credit with rent.

Exit strategies for rental payment reporting become relevant as credit profiles mature and traditional credit factors provide sufficient credit strength. Some consumers choose to discontinue rental payment reporting once they achieve target credit scores through other means, while others maintain it as ongoing credit support. The decision depends on individual credit goals, existing credit strength, and the cost-benefit analysis of continued rental payment reporting services. For many consumers, maintaining rental payment reporting provides ongoing credit stability and protection against future credit challenges. To maximize benefits, understanding how to boost thin credit with rent is essential.

Conclusion: Transforming Your Financial Future Through Strategic Rental Payment Reporting

By actively seeking ways to boost thin credit with rent, you can enhance your financial future. The disconnect between reliable rental payments and traditional credit recognition represents more than just an oversight—it’s a massive opportunity waiting to be unlocked. By understanding the technical infrastructure behind rental payment reporting, timing your enrollment strategically, and combining it with other credit-building tools, you can transform years of responsible rent payments into meaningful credit improvement. The key lies not just in reporting your payments, but in optimizing when, where, and how you integrate this data into your broader credit strategy. Finally, remember that effective methods to boost thin credit with rent are essential to your financial health.

Your monthly rent payments have been building an invisible credit history that traditional lenders couldn’t see—until now. The strategic implementation of rental payment reporting, combined with realistic expectations and proper timing, can bridge the gap between your actual financial responsibility and your credit score. While rental payments alone won’t solve every credit challenge, they provide a legitimate foundation for building the diversified credit profile that opens doors to better financial opportunities. The question isn’t whether you can afford to start reporting your rental payments—it’s whether you can afford to keep letting this powerful credit-building tool go unused. In conclusion, using rental payment history is a powerful way to boost thin credit with rent.