Your credit application gets denied, and you’re left wondering what went wrong. Maybe you checked your credit score beforehand, shopped around for the best rates, and thought you had everything covered. Yet somehow, the approval you expected never came through, or the terms offered were far worse than anticipated. Understanding common credit application mistakes can help you avoid denial.

The reality is that most people make predictable mistakes during the credit application process – mistakes that seem minor but can cost thousands of dollars or derail major financial goals entirely. From misunderstanding how rate shopping actually affects your credit profile to overlooking critical timing issues with payment patterns, these oversights happen because the credit system operates differently than most people assume. What if the very steps you’re taking to improve your chances are actually working against you?

The Pre-Application Trap: Neglecting Your Credit Foundation

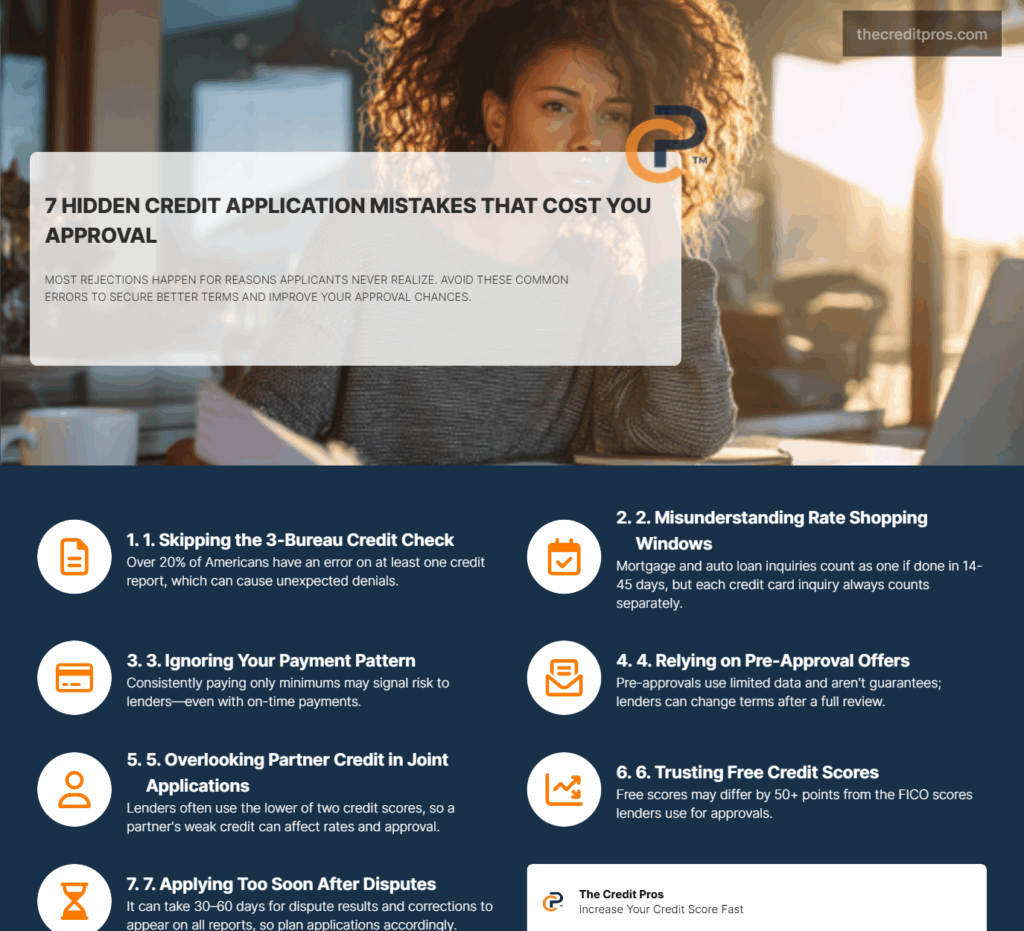

Common credit application mistakes are often simple to fix. Understanding your credit profile requires examining all three credit reports from Equifax, TransUnion, and Experian well before submitting any credit application. Each credit reporting company maintains separate databases and may contain different information about your financial history, creating variations that directly impact lender decisions. Your payment history serves as the primary driver of your credit score, making it essential to identify and address any discrepancies across all three reports before they influence approval outcomes. Identifying common credit application mistakes can lead to better outcomes.

The distinction between credit reports and credit scores becomes critical during the application process, as lenders often use proprietary scoring models that differ from consumer-facing versions. Credit reports provide the raw data foundation that generates your scores, including payment history, account balances, credit limits, and inquiry records. Lenders frequently access multiple scoring models simultaneously, weighing factors like industry-specific scores for auto loans or mortgage applications that emphasize different aspects of your credit profile. Many people overlook common credit application mistakes in their preparation.

Strategic timing of your credit report review should occur 3-6 months before any major credit application to allow sufficient time for dispute resolution and score improvement. Credit reporting companies typically require 30-45 days to investigate disputes, and positive changes may take additional billing cycles to reflect across all three bureaus. This extended timeframe becomes particularly important when addressing complex issues like identity theft, mixed files, or accounts incorrectly marked as delinquent. Awareness of common credit application mistakes can improve your chances.

The impact of different credit scoring models extends beyond simple numerical variations, as some lenders prioritize specific scoring versions for particular loan types. FICO scores remain the industry standard for most lending decisions, but VantageScore models are increasingly used by credit monitoring services and some financial institutions. Understanding which scoring model your target lender uses allows you to focus improvement efforts on the factors most likely to influence their approval decision. Let’s take a closer look at common credit application mistakes.

The Shopping Paradox: When Rate Comparison Backfires

Awareness of common credit application mistakes can lead to success. Credit inquiry clustering rules vary significantly by credit type, creating a complex landscape where rate shopping can either benefit or harm your credit profile depending on your approach. Mortgage and auto loan inquiries receive special treatment under credit scoring algorithms, allowing multiple inquiries within a specific timeframe to count as a single inquiry for scoring purposes. This protection recognizes that consumers naturally shop for the best rates on major purchases and prevents penalizing responsible comparison shopping. Strategies to overcome common credit application mistakes are essential.

The 14-45 day window strategy for mortgage and auto loan shopping represents a critical but often misunderstood aspect of credit management. Different credit scoring models use varying timeframes within this range, with older FICO models using 14-day windows while newer versions extend to 45 days. However, this protection only applies when all inquiries fall within the same category and timeframe, making it essential to concentrate your shopping activities rather than spreading them across months. Avoiding common credit application mistakes is key to financial success.

Credit card applications operate under entirely different rules, with each inquiry typically counted separately regardless of timing. This fundamental difference means that applying for multiple credit cards within a short period can significantly impact your credit scores and signal financial distress to future lenders. The absence of inquiry clustering for credit cards reflects the different risk profile these applications represent compared to secured lending like mortgages and auto loans. Recognizing common credit application mistakes is the first step.

Pre-approved offers from lenders often create false confidence in approval odds, as these marketing tools typically use limited credit data that may not reflect your complete financial picture. These offers frequently include terms and conditions that allow lenders to modify or withdraw offers after conducting full credit reviews. Understanding that pre-approval represents marketing interest rather than guaranteed approval helps set realistic expectations and prevents disappointment when final terms differ from initial offers. There are numerous common credit application mistakes to be aware of.

Payment History Blind Spots: Beyond Late Payments

Consistently making only minimum payments creates a pattern that sophisticated lending algorithms interpret as a sign of financial stress, even when all payments arrive on time. This behavior suggests limited cash flow and increased default risk, as borrowers operating at minimum payment levels have little financial cushion for unexpected expenses. Lenders increasingly use payment behavior analysis to assess risk beyond simple delinquency records, examining payment amounts relative to balances and available credit. Addressing common credit application mistakes can prevent rejections.

Payment timing within billing cycles affects credit utilization calculations in ways that many consumers overlook during the application preparation process. Credit card companies typically report balances to credit bureaus on specific dates each month, often coinciding with statement closing dates rather than payment due dates. Making payments before statement closing can reduce reported utilization ratios, while payments made after closing but before due dates may not improve utilization until the following month’s reporting cycle. Learn from common credit application mistakes to enhance your strategy.

Automatic payment systems can sometimes work against you during critical application periods if they’re set to minimum amounts or if timing conflicts with your utilization management strategy. While autopay prevents late payments, it may not optimize your credit profile for applications if you’re carrying balances that could be paid down strategically before statement closing dates. Additionally, automatic payments can mask changes in your financial situation that might require payment adjustments to maintain optimal credit profiles. Recognizing common credit application mistakes can help mitigate risks.

Modern loan approval algorithms analyze payment patterns to predict future financial behavior, looking beyond simple on-time payment records to examine consistency, amounts, and trends over time. These systems evaluate whether your payment behavior demonstrates financial stability or suggests underlying cash flow problems that might affect your ability to handle additional credit obligations. Understanding these analytical approaches helps you recognize why payment history encompasses more than avoiding late fees. Common credit application mistakes often go unnoticed until it’s too late.

The Communication Gap: Financial Transparency in Relationships

Joint credit applications undergo complex evaluation processes that don’t simply average individual credit scores, but instead examine both applicants’ complete financial profiles to assess combined risk. Lenders may focus on the lower credit score for qualification purposes while considering combined income for capacity calculations. This approach means that one partner’s credit issues can significantly impact approval odds and terms, even when the other partner maintains excellent credit.

Undisclosed financial behaviors between partners can create unexpected obstacles during application processes, particularly when lenders discover debts, inquiries, or credit report errors that weren’t factored into application strategies. These surprises often emerge during verification processes and can delay approvals or result in modified terms that neither partner anticipated. Financial transparency becomes especially critical for major purchases where timing matters, such as home purchases with closing deadlines. It’s crucial to understand common credit application mistakes that can arise.

Strategic credit goal alignment requires ongoing communication about individual financial decisions that might affect joint applications in the future. This includes discussing major purchases, credit applications, employment changes, or debt management strategies that could influence combined creditworthiness. Partners who maintain separate credit profiles while planning joint applications need to coordinate their individual credit activities to optimize their combined application strength. Take steps to correct common credit application mistakes before applying.

Essential financial discussions before major applications:

- Complete disclosure of all existing debts and credit obligations

- Review of recent credit inquiries and planned future applications

- Discussion of employment stability and income documentation

- Agreement on debt paydown strategies and timing

- Coordination of individual credit improvement activities

The timing of financial discussions relative to major credit applications affects your ability to address issues and optimize your combined credit profile. Conversations held months before applications allow time to implement improvement strategies, while last-minute discussions may reveal problems that can’t be resolved quickly enough to benefit the application. Emergency credit applications often suffer when couples haven’t established clear communication patterns about their individual financial activities and combined credit goals. Being aware of common credit application mistakes can save you time.

The Monitoring Misconception: Free Scores vs. Application Reality

Free credit scores provided by financial institutions and monitoring services often use different scoring models than those employed by lenders during actual credit applications, creating gaps between consumer expectations and approval reality. Many free services use VantageScore models, while most lenders still rely primarily on various FICO score versions. These differences can result in score variations of 50 points or more, leading to surprise rejections or terms that differ significantly from what consumers expected based on their monitored scores. Understanding common credit application mistakes helps in planning ahead.

FICO versus VantageScore differences matter significantly for specific lenders and loan types, as each model weighs credit factors differently and may produce substantially different results from the same credit data. FICO models typically place greater emphasis on payment history and amounts owed, while VantageScore models may be more sensitive to recent credit behavior and account for trended data. Understanding which scoring model your target lender uses allows you to focus on the metrics that will actually influence their decision. Evaluating common credit application mistakes leads to better applications.

Credit score timing affects application strategy because scores fluctuate based on reporting cycles, account updates, and utilization changes that may not align with your application timeline. Monitoring services typically update scores monthly, but the timing of these updates may not coincide with optimal application windows. Additionally, improvements in your credit profile may take 30-60 days to fully reflect in scoring models, making it important to plan application timing around expected score improvements rather than current monitored scores. Knowing common credit application mistakes is vital for new applicants.

Each applicant should learn about common credit application mistakes. Free monitoring services provide limited insight into approval odds because they typically don’t access the same data sources or use the same evaluation criteria as actual lenders. These services focus on credit scores and basic credit report information, while lenders examine additional factors like debt-to-income ratios, employment history, and bank account information that monitoring services can’t access. Using monitoring services as one component of credit management rather than relying on them for approval predictions helps set more realistic expectations for credit applications. Let’s explore some common credit application mistakes to avoid.

Wrapping Up: The Path to Credit Application Success

Successful credit applications aren’t just about having a good credit score – they’re about understanding the intricate system that evaluates your creditworthiness from multiple angles. The seemingly straightforward process of applying for credit actually involves complex algorithms, timing considerations, and evaluation criteria that most consumers don’t fully grasp. From recognizing that free credit scores don’t reflect what lenders actually see to understanding how payment patterns beyond simple on-time payments influence approval decisions, these insights reveal why preparation matters far more than most people realize. Let’s summarize common credit application mistakes to keep in mind.

Avoid these common credit application mistakes for a better outcome. The credit application process rewards those who approach it strategically rather than reactively. Your success depends on coordinating multiple factors – from timing your rate shopping correctly to ensuring financial transparency with partners to understanding how different scoring models affect your approval odds. These aren’t just minor details that might slightly improve your chances; they’re fundamental aspects of how modern lending decisions are made that can mean the difference between approval and rejection, or between favorable terms and expensive alternatives. Learning from common credit application mistakes can enhance your profile. The question isn’t whether you’ll need credit in the future – it’s whether you’ll be ready to navigate the system that determines your financial opportunities. Ultimately, avoiding common credit application mistakes is your best strategy.