For years, your monthly rent check has been one of your largest expenses with zero credit benefit. While you’ve been building equity for your landlord, those consistent payments haven’t been helping you build the credit score you need for your next car loan or mortgage application. That reality is finally changing as the credit industry recognizes what tenants have long known – paying rent on time every month demonstrates the same financial responsibility as any other loan payment. Understanding the impact of rent payments and credit score is essential for renters.

The shift toward including rental payment history in credit reports isn’t just a nice-to-have feature anymore. Major mortgage lenders and credit scoring companies are actively incorporating this data into their decision-making processes, creating new opportunities for millions of renters to strengthen their credit profiles. But the process isn’t automatic, and not all rent reporting methods deliver the same results. Understanding how to make your rental payments work for your credit score requires knowing which reporting systems actually move the needle and when the timing makes sense for your specific financial goals. Rent payments and credit score are being factored in by lenders more than ever before.

The Hidden Credit Building Opportunity in Your Monthly Rent

Your rental payments represent one of the largest untapped resources for credit building in the American financial system. For decades, the credit reporting infrastructure treated rent payments as fundamentally different from traditional loan obligations, despite representing the same underlying financial commitment and payment discipline. This exclusion stemmed from practical challenges rather than logical credit assessment principles – landlords and property management companies lacked standardized systems to report payment data to credit bureaus, while the credit reporting agencies had no streamlined mechanisms to verify and process rental payment information. When considering rent payments and credit score, be sure to understand your options.

The technological barriers that historically prevented rent reporting have largely dissolved through advances in financial technology and data verification systems. Modern rent reporting platforms can now authenticate rental agreements, verify payment histories through bank account analysis, and transmit data to credit bureaus in standardized formats that integrate seamlessly with existing credit report structures. This technological evolution has enabled both prospective reporting of ongoing rental payments and retroactive reporting of past payment history, though the latter requires more extensive documentation and verification processes. Many people do not realize how rent payments and credit score can influence future borrowing.

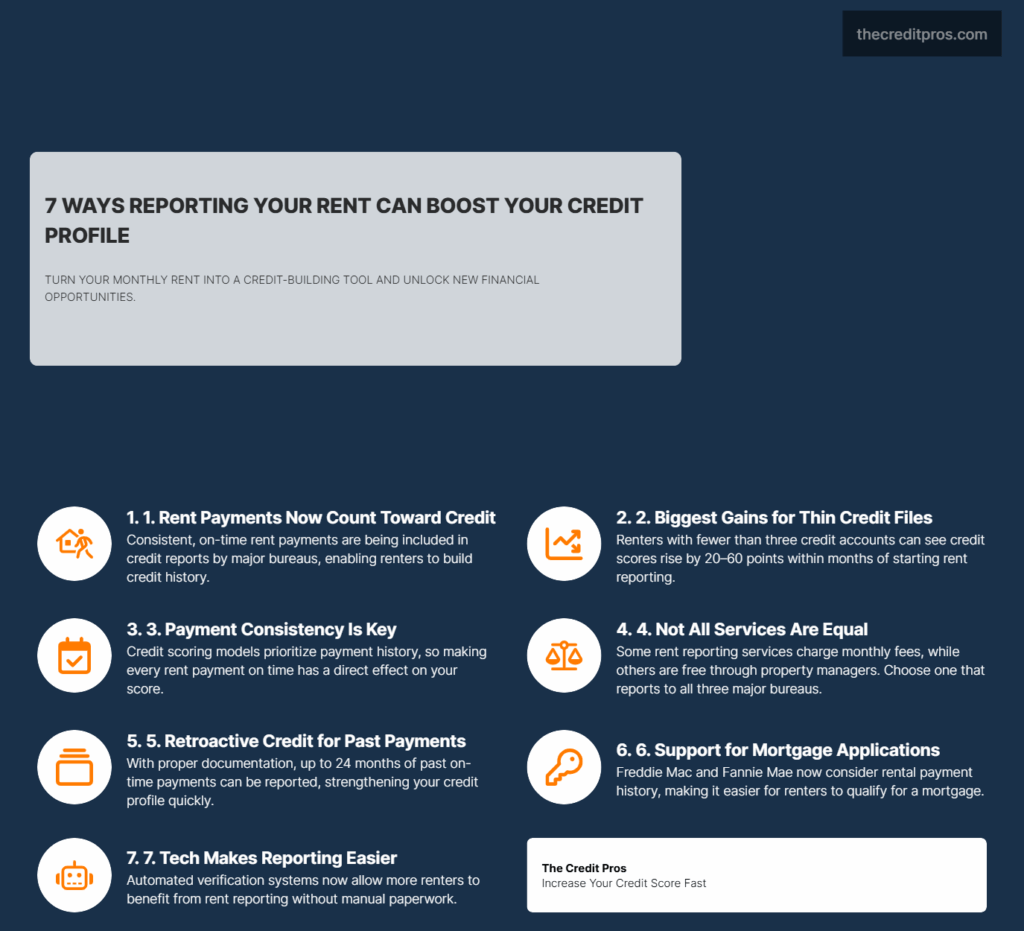

The distinction between voluntary and automatic rent reporting systems creates significantly different outcomes for renters seeking to build credit. Voluntary systems require active participation from either the tenant or landlord, often involving third-party services that charge fees for reporting rental payment data to credit bureaus. These systems typically offer more comprehensive reporting options, including the ability to report multiple years of payment history, but depend on consistent engagement from all parties involved. Automatic reporting systems, implemented by larger property management companies or built into rental payment platforms, provide seamless credit reporting without ongoing tenant involvement but may offer less historical depth or customization options. Tracking your rent payments and credit score can be a game-changer.

The mechanics of how rental payments translate into credit score improvements differ substantially from traditional credit accounts. Unlike installment loans or credit cards that factor in utilization rates, payment amounts, and account age, rental payment history primarily contributes to payment history calculations – the most heavily weighted component of credit scoring models. This focus on payment consistency rather than payment amounts means that a renter paying $800 monthly receives similar credit benefits to someone paying $2,500 monthly, provided both maintain consistent on-time payment patterns. It’s important to evaluate how rent payments and credit score interplay in your financial life.

How Rent Reporting Actually Impacts Your Credit Score: Beyond the Basics

The credit score improvements from rent reporting vary dramatically based on your existing credit profile, with consumers possessing thin credit files experiencing the most substantial benefits. Individuals with fewer than three active credit accounts often see score increases of 20-60 points within the first few months of rent reporting, while those with established credit histories typically observe more modest improvements of 5-15 points. This disparity occurs because rental payment data fills critical gaps in sparse credit profiles, providing the payment history foundation that credit scoring algorithms require for accurate risk assessment. By understanding the relationship between rent payments and credit score, you can improve your financial health.

Different credit scoring models assign varying weights to rental payment data, creating inconsistencies in how rent reporting affects your credit across different lenders and credit monitoring services. VantageScore models have historically incorporated rental payment data more readily than FICO scores, leading to situations where consumers see significant improvements in their VantageScore while experiencing minimal changes in their FICO score. However, recent FICO model updates have begun incorporating alternative data sources more comprehensively, gradually aligning the treatment of rental payment history across major scoring systems. Utilize tools to track rent payments and credit score for better management. Monitoring how your rent payments and credit score evolve is crucial for achieving financial goals.

The timeline for observing rent reporting benefits extends beyond the initial score improvement, with the most significant long-term value emerging from consistent reporting over extended periods. Initial score boosts typically appear within 30-60 days of rent reporting initiation, as credit bureaus process and integrate the new payment data. However, the sustained credit building value develops over 12-24 months of consistent reporting, as the rental payment history demonstrates ongoing financial responsibility and reduces the volatility often associated with thin credit files.

Negative rent reporting presents unique challenges that differ substantially from traditional credit account delinquencies. While late payments on credit cards or loans typically affect credit scores for seven years, negative rental reporting can include eviction records that appear in specialized tenant screening databases separate from standard credit reports. These eviction records can impact future rental applications and housing opportunities beyond their effect on credit scores, creating compounding consequences that extend well beyond traditional credit implications. Make sure to pay attention to how rent payments and credit score affect your applications.

“After decades of discussion, progress is finally being made in incorporating alternative data—particularly rental payment history—into credit scoring and mortgage underwriting.”

To maximize your financial potential, focus on the connection between rent payments and credit score. The interaction between rent reporting and other alternative data sources creates a comprehensive alternative credit profile that many lenders now consider alongside traditional credit metrics. When combined with utility payment history, bank account activity analysis, and employment verification data, rental payment reporting contributes to a holistic financial picture that can compensate for limited traditional credit history. This comprehensive approach particularly benefits first-time credit users, recent immigrants, and individuals recovering from past financial difficulties who may have strong alternative payment histories despite limited traditional credit accounts.

Navigating the Complex Landscape of Rent Reporting Services

The rent reporting ecosystem encompasses a diverse array of service providers, each offering different approaches to collecting, verifying, and transmitting rental payment data to credit bureaus. Third-party platforms like RentTrack, Rental Kharma, and LevelCredit typically charge monthly fees ranging from $6.95 to $24.95 for their services, while some property management companies have integrated rent reporting into their standard operations at no additional cost to tenants. The cost-benefit analysis of these services depends heavily on your credit goals, current credit profile, and the specific features offered by each platform. Understanding the nuances of rent payments and credit score can lead to better financial decisions.

Verification processes for retroactive rent payment reporting require extensive documentation that many renters struggle to compile comprehensively. Most services require 12-24 months of bank statements showing rental payment withdrawals, lease agreements covering the reporting period, and sometimes additional verification from landlords or property management companies. The complexity of this verification process often limits retroactive reporting to 12-24 months of payment history, even when renters have longer tenancy periods they wish to report.

Multi-tenant situations and roommate arrangements present particular challenges for rent reporting services, as most platforms struggle to attribute partial rent payments to individual tenants accurately. When multiple tenants share responsibility for a single rental payment, determining individual payment responsibility and timing becomes complex, often requiring detailed roommate agreements and separate payment tracking systems. Some services address this by requiring each roommate to register separately and report their portion of the total rent, while others decline to report payments in shared housing situations entirely. The relationship between rent payments and credit score can open doors for renters.

The emerging role of financial technology companies has streamlined many aspects of rent-to-credit reporting through automated bank account analysis and payment verification systems. Companies like Plaid and Yodlee provide the underlying infrastructure that enables rent reporting services to verify payment histories without requiring extensive manual documentation from tenants. This technological integration has reduced the barrier to entry for rent reporting while improving the accuracy and comprehensiveness of reported data.

Potential conflicts between tenant-initiated and landlord-initiated reporting systems can create complications for renters who attempt to report their rental payments through multiple channels simultaneously. When both tenants and property management companies report the same rental payments, credit bureaus may receive duplicate data that requires reconciliation to prevent double-counting of payment history. This situation most commonly occurs when tenants begin using third-party reporting services without realizing their landlord already reports rental payments, or when property management companies implement rent reporting after tenants have established their own reporting arrangements. Data on rent payments and credit score should be monitored closely for optimal results.

Strategic Implementation: Maximizing Your Rent’s Credit Building Potential

The optimal timing for initiating rent reporting depends significantly on your specific credit goals and current financial situation. For individuals planning to apply for mortgages within 12-18 months, beginning rent reporting immediately provides the maximum opportunity for credit score improvement before the loan application process. However, those with immediate credit needs may benefit more from focusing on traditional credit building methods that produce faster results, such as secured credit cards or credit builder loans, before implementing rent reporting as a supplementary strategy. Being proactive about rent payments and credit score is essential for long-term stability.

Coordinating rent reporting with other credit building strategies requires careful consideration of how multiple credit activities interact within your overall credit profile. Adding rent reporting while simultaneously opening new credit accounts or paying down existing balances can create compounding positive effects, but the timing and sequence of these activities can influence the magnitude of credit score improvements. The most effective approach typically involves stabilizing existing credit accounts before adding rent reporting, allowing each credit building activity to contribute distinctly to your overall credit profile improvement. Many renters overlook the importance of rent payments and credit score in their financial planning.

For mortgage applications, documented rental payment history provides particularly valuable supporting evidence for borrowers with limited traditional credit history. Government-sponsored enterprises like Freddie Mac and Fannie Mae have developed specific guidelines for incorporating rental payment history into mortgage underwriting decisions, particularly for first-time homebuyers who may lack extensive credit card or loan payment histories. The key to leveraging rent reporting for mortgage applications lies in ensuring consistent, documented reporting for at least 12 months before the loan application, as shorter reporting periods provide limited underwriting value.

Maintaining consistent rent reporting once initiated requires ongoing attention to payment timing, reporting service functionality, and potential changes in housing arrangements. Gaps in rent reporting can reduce its credit building effectiveness and may raise questions during future credit applications about payment consistency or housing stability. The most successful rent reporting strategies involve setting up automatic payment systems that ensure consistent on-time payments and regularly monitoring credit reports to verify that rental payment data appears accurately and completely. Rent payments and credit score are two sides of the same coin when it comes to financial health.

Essential steps for maximizing rent reporting effectiveness: • Verify your landlord’s current reporting practices before selecting a third-party service • Document all rental payments through bank statements and receipts for potential retroactive reporting

- Choose reporting services that report to all three major credit bureaus (Experian, Equifax, TransUnion) • Monitor your credit reports monthly to ensure rental payment data appears correctly • Coordinate rent reporting timing with other major credit activities to avoid overwhelming your credit profile

Strategies for renters in informal housing arrangements or those with landlords resistant to rent reporting require creative approaches to documentation and verification. Month-to-month tenants, those in subletting situations, or renters with informal lease agreements may need to establish paper trails through consistent payment methods, written payment receipts, and detailed record-keeping that can support future rent reporting efforts. Building relationships with landlords and explaining the mutual benefits of rent reporting can sometimes overcome initial resistance, particularly when framed as a tool for attracting and retaining responsible tenants. Consult with experts about the implications of rent payments and credit score.

Future-Proofing Your Credit Through Rental Payment Documentation

The integration of rental payment history into mainstream lending decisions represents a fundamental shift in how financial institutions assess creditworthiness, with implications extending far beyond individual credit scores. Government-sponsored enterprises have begun incorporating rental payment data into their automated underwriting systems, recognizing that consistent rental payments often predict mortgage payment reliability more accurately than traditional credit metrics alone. This integration particularly benefits potential homebuyers who have demonstrated housing payment responsibility through rental history but lack extensive traditional credit profiles. Establish routines around your rent payments and credit score to maximize benefits.

Every payment can influence rent payments and credit score in your favor. The potential for rent reporting to address historical disparities in credit access stems from its ability to recognize payment discipline that traditional credit systems have overlooked. Communities with limited access to traditional banking services or those who have historically relied on cash-based transactions can demonstrate creditworthiness through consistent rental payments, even when they lack credit card or loan payment histories. This democratization of credit assessment has the potential to expand homeownership opportunities and reduce lending disparities that have persisted under traditional credit-only evaluation systems. For those with limited credit history, rent payments and credit score represent an opportunity.

Preparing for a future where rental payment history becomes standard in lending decisions requires proactive documentation and reporting strategies that begin before you need credit access. The most forward-thinking approach involves treating rental payments with the same attention and consistency as traditional loan payments, maintaining detailed payment records, and establishing rent reporting relationships early in tenancy periods. This preparation ensures that when lenders increasingly rely on comprehensive payment histories, your rental payment data contributes positively to credit decisions rather than representing a missed opportunity. Be aware of how your rent payments and credit score can affect your future borrowing.

The intersection of rent reporting with other emerging credit factors creates a comprehensive alternative credit ecosystem that may eventually supplement or partially replace traditional credit scoring methods. Utility payment histories, subscription service payments, and even mobile phone bill payments are beginning to appear in specialized credit reports designed for lenders serving consumers with limited traditional credit. Understanding how these various data sources interact and complement each other enables more strategic credit building approaches that leverage multiple payment relationships simultaneously. Rent payments and credit score can be intertwined with your overall financial picture.

The evolution of rent reporting technology continues to expand accessibility and reduce barriers to participation, with new platforms emerging that require minimal documentation while providing comprehensive reporting services. These technological advances suggest that rent reporting will become increasingly automated and integrated into standard rental payment processes, making the credit building benefits of rental payments available to more renters without requiring active participation or additional fees. The connection between rent payments and credit score should not be underestimated.

Conclusion: Transforming Your Largest Monthly Expense into a Credit Building Asset

Your monthly rent payment no longer has to represent a financial dead end that builds equity only for your landlord. Understanding the dynamics of rent payments and credit score can empower you financially. The technological infrastructure and industry acceptance now exist to transform these consistent payments into powerful credit building opportunities, particularly for those with limited traditional credit histories. While the process isn’t automatic and requires strategic implementation, the potential benefits extend far beyond simple score improvements to include enhanced mortgage qualification prospects and expanded access to future lending opportunities. Remember, understanding rent payments and credit score can change your financial future. Your rent payments and credit score journey is only beginning.

The future of rent payments and credit score is bright for informed consumers. The shift toward comprehensive payment history evaluation represents a fundamental change in how creditworthiness is assessed, moving beyond traditional credit products to recognize the financial discipline demonstrated through housing payments. Success in leveraging this opportunity requires understanding the nuances of different reporting systems, timing your implementation strategically, and maintaining consistent documentation practices. The question isn’t whether rent reporting will become standard practice in lending decisions – it’s whether you’ll position yourself to benefit from this evolution before your next major credit application. To conclude, knowing about rent payments and credit score is vital for financial success.