Most people think financial literacy means knowing how to budget and save money. But what if the real power lies in understanding why you make the financial decisions you do in the first place? Your brain works against you in predictable ways when it comes to money, and recognizing these patterns can be the difference between financial struggle and financial success. The question isn’t whether you know basic financial concepts – it’s whether you can apply that knowledge strategically when emotions run high and stakes feel overwhelming. Understanding the benefits of financial literacy can enhance your financial decisions significantly.

Financial literacy becomes truly valuable when you move beyond memorizing definitions and start building systems that work automatically. This means understanding how different types of debt can actually accelerate your wealth building, why timing matters more than perfection in investing, and how to make financial institutions work for you rather than the other way around. The people who maximize these benefits don’t just learn once and move on – they adapt their knowledge as their lives change and economic conditions shift around them.

The Hidden Psychology of Financial Decision-Making

Recognizing the benefits of financial literacy allows for improved decision-making. By understanding the benefits of financial literacy, you can make better financial choices. Learning about the benefits of financial literacy helps in overcoming loss aversion. One of the key benefits of financial literacy is simplifying complex choices. The benefits of financial literacy include building resilience against peer pressure.

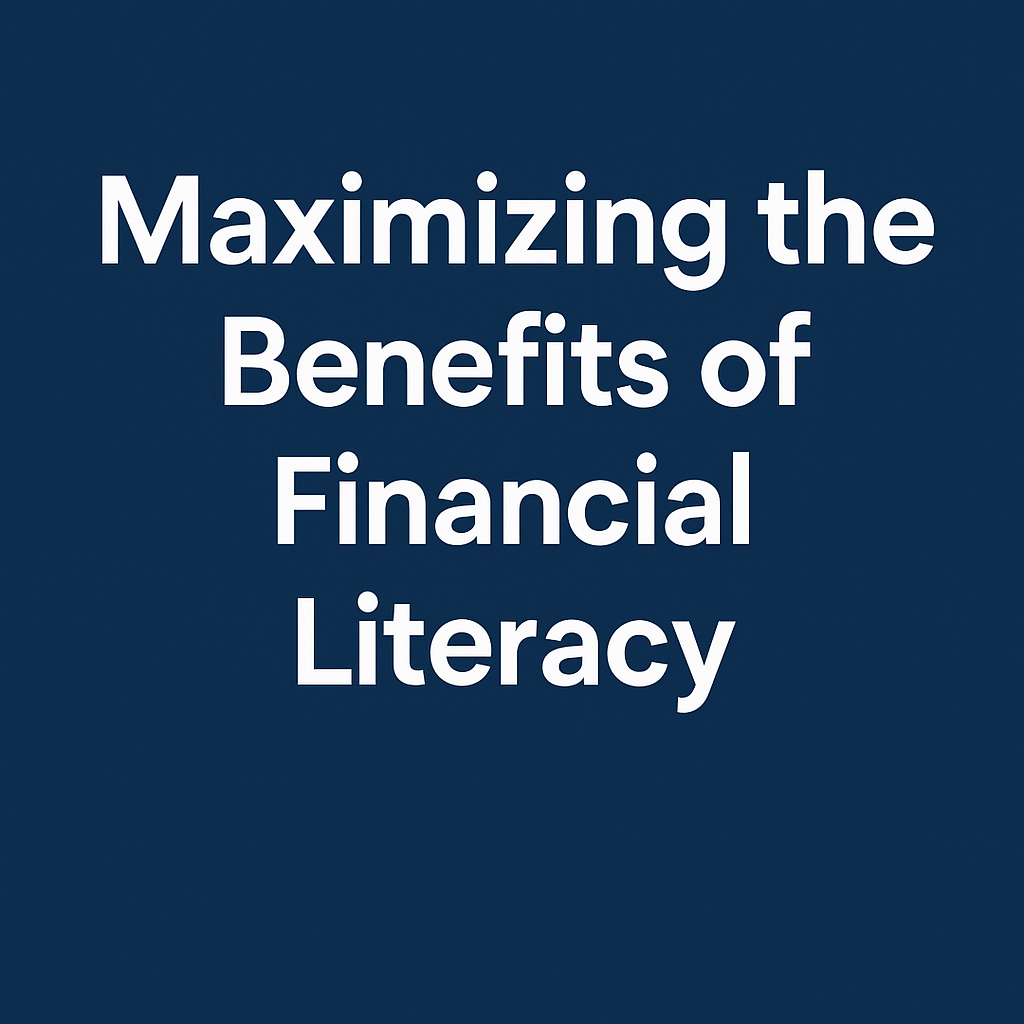

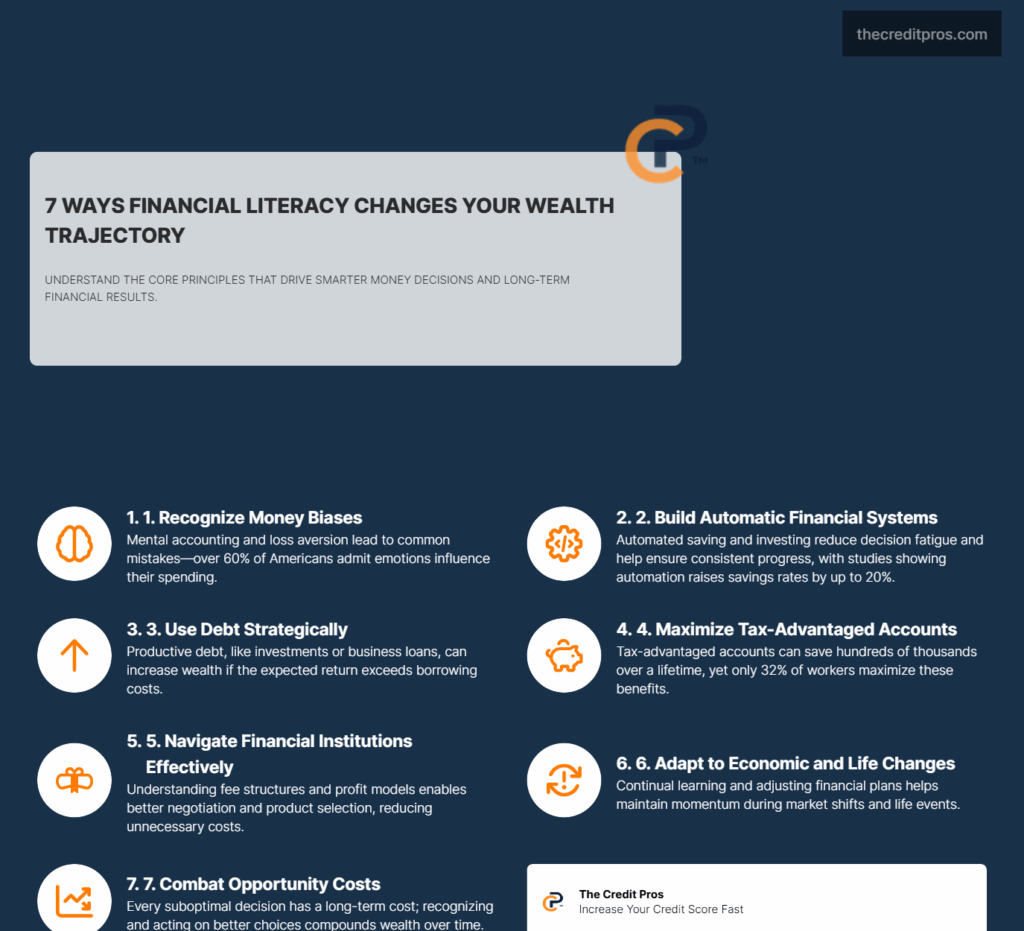

Your brain processes financial information through predictable patterns that often work against your best interests. Financial literacy provides the framework to recognize these cognitive shortcuts and override them when they lead to poor outcomes. Understanding behavioral economics becomes essential when you realize that most financial mistakes stem from psychological biases rather than lack of information.

Understanding debt’s role is among the benefits of financial literacy. Recognizing the benefits of financial literacy can lead to productive debt use. Evaluating the benefits of financial literacy can guide debt consolidation decisions. Mental accounting represents one of the most pervasive barriers to optimal financial decision-making. This cognitive bias causes people to treat money differently based on its source or intended use, leading to irrational spending patterns. For example, you might carefully budget your salary while carelessly spending a tax refund, even though both represent the same purchasing power. Financial literacy helps you recognize these artificial mental categories and make decisions based on your overall financial picture rather than arbitrary mental divisions. The benefits of financial literacy are evident in effective repayment strategies.

Loss aversion creates another significant obstacle to building wealth through investing. Research consistently shows that people feel the pain of losing money approximately twice as intensely as they feel the pleasure of gaining the same amount. This psychological tendency leads to overly conservative investment strategies and poor timing decisions. When you understand this bias through financial education, you can reframe investment volatility as a normal part of wealth building rather than a threat to be avoided. This knowledge enables you to maintain long-term investment strategies even during market downturns.

The paradox of choice becomes particularly problematic in financial product selection. When faced with numerous investment options, insurance policies, or loan products, many people either delay decisions indefinitely or make choices based on irrelevant factors. Financial literacy simplifies this complexity by providing evaluation frameworks that focus on the most important variables. You learn to compare products based on fees, terms, and alignment with your goals rather than marketing materials or superficial features.

Social proof and peer influence significantly impact financial behavior, often leading to decisions that serve others’ interests rather than your own. Financial literacy builds immunity to these external pressures by establishing clear personal financial principles. When you understand your own financial situation and goals, you become less susceptible to following investment trends or lifestyle inflation simply because others are doing the same.

Strategic Debt Architecture: Beyond Good vs. Bad Debt

The traditional classification of debt into “good” and “bad” categories oversimplifies the strategic role debt can play in wealth building. Financial literacy enables you to evaluate debt based on its impact on your overall financial trajectory rather than arbitrary moral judgments. This sophisticated approach recognizes that debt can serve as a tool for leveraging opportunities and optimizing cash flow when used strategically.

Productive debt extends beyond the typical examples of mortgages and student loans to include any borrowing that generates returns exceeding the cost of capital. This might include business loans that fund revenue-generating activities, investment property financing, or even strategic use of low-interest credit during periods of high inflation. The key lies in understanding the relationship between borrowing costs, expected returns, and your personal risk tolerance. Financial literacy provides the analytical framework to evaluate these trade-offs objectively.

Debt consolidation timing requires careful analysis of both immediate and long-term financial impacts. While consolidating high-interest debt into lower-interest options seems straightforward, the optimal timing depends on factors including credit score trends, interest rate environments, and cash flow projections. Financial literacy helps you recognize when consolidation serves your interests versus when it primarily benefits lenders through extended payment periods or additional fees.

Credit card utilization optimization represents a sophisticated application of debt management knowledge. Understanding how different types of credit accounts affect your credit score enables strategic decisions about payment timing and account management. This knowledge helps you maintain optimal credit utilization ratios across different account types while maximizing available credit for opportunities or emergencies.

The psychology of debt repayment strategies reveals important insights about matching financial approaches to personal motivation patterns. The debt avalanche method minimizes total interest paid by targeting highest-rate debts first, while the debt snowball approach builds momentum through quick wins on smaller balances. Financial literacy helps you assess which strategy aligns with your psychological profile and financial situation, recognizing that the best mathematical approach may not be the most effective for your specific circumstances.

The Compound Effect of Financial Literacy on Wealth Building

Financial literacy creates exponential improvements in wealth building through the compound effect of better decisions across multiple financial domains. Each improvement in financial knowledge enables better choices that build upon previous gains, creating acceleration rather than linear progress. This compounding effect becomes particularly powerful when applied to tax-advantaged accounts and investment strategies. Financial advisors can highlight the benefits of financial literacy in their guidance. Building relationships can enhance the benefits of financial literacy.

Tax-advantaged accounts represent one of the most powerful wealth-building tools available, yet many people underutilize them due to lack of understanding. Financial literacy reveals how different account types work together to create multiple layers of tax optimization. Understanding the interplay between traditional and Roth retirement accounts, Health Savings Accounts, and taxable investment accounts enables strategic tax planning that can save hundreds of thousands of dollars over a lifetime.

Adapting your knowledge highlights the benefits of financial literacy in changing times. The benefits of financial literacy include better evaluation of innovative solutions. Life transitions can be navigated more smoothly with the benefits of financial literacy. Understanding the benefits of financial literacy allows for intelligent technology use. Families can build wealth together by recognizing the benefits of financial literacy. Continuous learning emphasizes the benefits of financial literacy for resilience.

Investment timing becomes more sophisticated when you understand market inefficiencies and behavioral patterns. While market timing is generally discouraged, financial literacy helps you recognize opportunities created by investor overreactions and systematic biases. This might include rebalancing portfolios during market volatility, taking advantage of tax-loss harvesting opportunities, or recognizing when asset classes become significantly undervalued relative to historical norms. Recognizing the benefits of financial literacy transforms your approach to decision-making. Ultimately, the benefits of financial literacy empower you to make informed choices.

Building automated financial systems reduces decision fatigue while maximizing growth potential. Financial literacy enables you to design systems that capture opportunities without requiring constant attention. This includes automatic rebalancing strategies, systematic investment plans that take advantage of dollar-cost averaging, and automated savings programs that adjust based on income changes. These systems work continuously in the background, compounding benefits over time.

The true cost of financial illiteracy becomes apparent through opportunity cost analysis. Every suboptimal financial decision represents not just the immediate cost but also the compound growth that money could have generated over time. Financial literacy helps you recognize these opportunity costs and make decisions that maximize long-term wealth accumulation rather than short-term convenience.

Understanding economic cycles enables you to position your finances to benefit from predictable patterns in markets and economic conditions. Financial literacy provides the knowledge to recognize when economic indicators suggest opportunities for strategic moves, such as refinancing debt during low-interest periods or adjusting investment allocations based on market cycles.

Navigating Financial Institutions: Maximizing Relationship Value

Financial institutions operate as businesses with specific profit models that influence their product offerings and customer relationships. Understanding these underlying economics enables you to approach financial institutions as an informed partner rather than a passive consumer. This knowledge helps you negotiate better terms, select appropriate products, and build relationships that serve your long-term financial interests.

Evaluating and negotiating with financial institutions requires understanding their revenue sources and competitive pressures. Banks profit from interest rate spreads, fees, and cross-selling additional products. Credit unions operate under different models, returning profits to members through better rates and lower fees. This knowledge enables strategic negotiations where you can present proposals that benefit both parties while maximizing your own outcomes.

The profit models of different financial institutions create distinct advantages for different financial goals. Traditional banks often provide extensive branch networks and sophisticated technology platforms, making them suitable for complex financial needs. Credit unions typically offer better rates on loans and savings accounts due to their member-owned structure. Financial literacy helps you match institutional strengths with your specific requirements.

Understanding fee structures and potential conflicts of interest becomes crucial when working with financial advisors. Fee-only advisors charge transparent fees for advice, while commission-based advisors earn money from product sales. Financial literacy enables you to evaluate these different compensation models and choose advisors whose incentives align with your goals. This knowledge also helps you ask informed questions about investment recommendations and fee structures.

Building strategic relationships with financial institutions involves understanding when to deepen existing relationships versus when to seek new providers. Long-term relationships can provide access to better rates, waived fees, and priority service. However, financial literacy helps you recognize when loyalty becomes counterproductive and when shopping for better options serves your interests. This balance requires ongoing evaluation of your financial institution relationships against available alternatives.

Future-Proofing Your Financial Knowledge

Financial literacy must evolve continuously to remain relevant in changing economic landscapes and personal circumstances. The financial products, regulations, and economic conditions that shape optimal financial strategies change regularly. Developing adaptive financial literacy ensures your knowledge remains current and applicable to new situations.

Staying current with financial innovations requires developing frameworks for evaluating new products and services. The rise of fintech solutions, cryptocurrency, and alternative investment platforms creates both opportunities and risks. Financial literacy provides the analytical tools to assess these innovations based on their fundamental characteristics rather than marketing claims or popular trends. This evaluation process helps you identify genuinely beneficial innovations while avoiding products that serve providers’ interests more than your own.

Major life transitions require adjusting financial strategies based on changing circumstances and priorities. Marriage, career changes, parenthood, and retirement each create new financial challenges and opportunities. Financial literacy enables you to anticipate these transitions and adjust your strategies proactively rather than reactively. This forward-thinking approach helps you maintain financial momentum through life changes that often derail less prepared individuals.

Technology continues to reshape personal finance through automated investing, digital banking, and sophisticated financial planning tools. Financial literacy helps you evaluate these technological solutions based on their ability to improve your financial outcomes rather than their convenience or novelty. Understanding the underlying principles of sound financial management enables you to use technology as a tool while maintaining control over your financial decisions.

Developing financial literacy within your family system creates intergenerational wealth-building opportunities. Teaching financial concepts to children and involving family members in financial planning discussions builds shared knowledge and aligned goals. This approach helps prevent common family financial conflicts while creating opportunities for collaborative wealth building through shared investments, family businesses, or coordinated tax planning strategies.

Continuous learning becomes essential for maintaining financial resilience during economic uncertainty. Economic conditions, tax laws, and financial markets change regularly, requiring ongoing education to maintain optimal strategies. Financial literacy includes developing reliable sources of financial information and maintaining the critical thinking skills necessary to evaluate new information and adjust strategies accordingly.

Conclusion: The True Power of Financial Literacy

Financial literacy’s real value isn’t found in memorizing definitions or following generic advice – it’s in developing the psychological awareness and strategic thinking that transforms how you approach money decisions. When you understand why your brain works against you financially and build systems that account for these biases, you gain the power to make choices that compound over time. This deeper knowledge enables you to use debt strategically, maximize institutional relationships, and adapt your approach as circumstances change.

The people who achieve lasting financial success don’t just learn financial concepts once; they develop adaptive frameworks that evolve with their lives and economic conditions. They recognize that financial literacy is an ongoing process of understanding both the technical aspects of money management and the psychological forces that drive decision-making. Your financial future depends less on perfect knowledge and more on your ability to apply what you know when emotions run high and stakes feel overwhelming.