Your credit card information is surprisingly vulnerable when you travel, and most people don’t realize it until it’s too late. While you might think your bank’s standard fraud protection has you covered, international transactions create unique blind spots that criminals know how to exploit. The financial headaches that follow can turn your dream vacation into a nightmare of frozen accounts, disputed charges, and limited access to funds when you need them most. To protect credit during travel, it’s essential to be proactive about your financial security. Additionally, implementing measures to protect credit during travel can significantly enhance your safety.

What makes travel-related credit fraud so dangerous isn’t just the theft itself—it’s how quickly it can spiral out of control when you’re thousands of miles from home. The usual 24-hour fraud detection systems that work domestically often fail to catch sophisticated international schemes, leaving you scrambling to resolve issues across multiple time zones while managing currency conversions and foreign banking regulations. But here’s what most travelers don’t know: there are specific strategies and timing protocols that can dramatically reduce your risk, starting with actions you need to take exactly 72 hours before departure.

Taking steps to protect credit during travel ensures that your finances remain secure. Always remember to protect credit during travel by notifying your bank. Using multiple accounts can help protect credit during travel when one card is lost or stolen. Moreover, a pre-authorized spending limit can further protect credit during travel. When using advanced card techniques, always keep in mind to protect credit during travel. To prevent losses, remember to protect credit during travel through strategic placement of cards. RFID-blocking wallets are essential to protect credit during travel against electronic theft. Ensuring your cards are divided can also help protect credit during travel. Utilizing waterproof solutions is another method to protect credit during travel. Being aware of your surroundings can significantly protect credit during travel from pickpockets. Setting up alerts can help protect credit during travel by notifying you of suspicious activity.

Customizing alerts is crucial to protect credit during travel and address potential fraud quickly. Your immediate response can protect credit during travel if you act within the critical time frame. Creating a trusted contact can help protect credit during travel in case of emergencies. Documenting your transactions carefully can protect credit during travel and simplify disputes. Understanding fees is important to protect credit during travel and avoid unnecessary disputes. Using secure WiFi networks can help protect credit during travel from potential hackers. Be cautious with two-factor authentication to protect credit during travel from unauthorized access.

Strategic Pre-Travel Credit Preparation

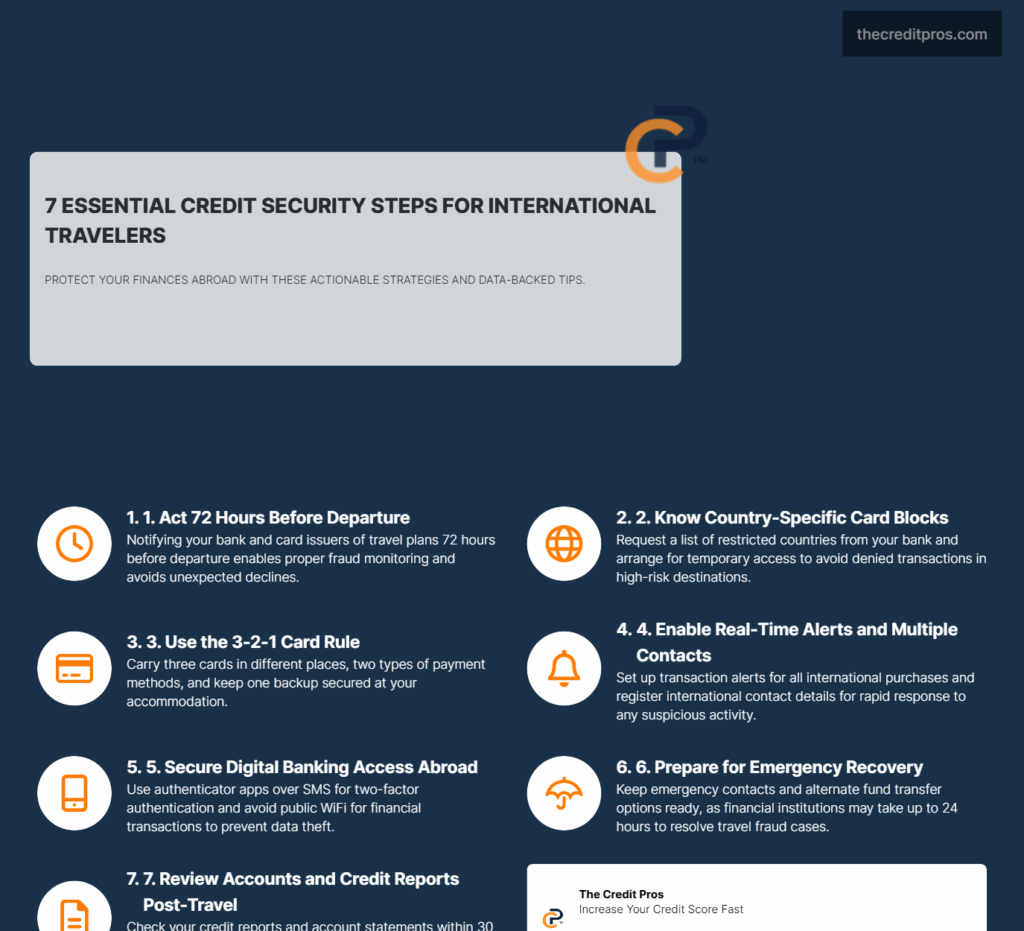

Managing time zones can help protect credit during travel by ensuring timely payments. Adjusting app settings can protect credit during travel and enhance your overall banking security. Secure channels with banks can help protect credit during travel and maintain communication. The 72-hour window before departure represents the optimal timeframe for implementing comprehensive credit protection measures. Financial institutions require this lead time to properly configure international transaction monitoring systems and establish location-specific fraud detection parameters. During this critical period, you must contact each credit card issuer and bank to provide detailed travel itineraries, including specific cities, dates, and expected spending patterns.

In case of fraud, knowing how to respond can protect credit during travel and minimize losses. Embassies can also assist in protecting credit during travel by facilitating communication with banks. Understanding alternative transfer methods can protect credit during travel when traditional methods fail. Regular credit monitoring helps protect credit during travel and detect identity theft early. Finally, remember that a post-travel credit review is vital to protect credit during travel and address any issues.

Country-specific credit blocking policies vary dramatically between financial institutions and can create unexpected barriers to legitimate transactions. Many banks automatically block transactions from countries with elevated fraud risk, including popular tourist destinations like Thailand, Turkey, and certain Caribbean islands. Before traveling, request a complete list of restricted countries from each financial institution and formally request temporary removal of these blocks for your travel dates. This proactive approach prevents the frustration of declined transactions at foreign merchants who may not accept alternative payment methods. Ultimately, to protect credit during travel is to prioritize your financial security each step of the way. Your strategies must always include ways to protect credit during travel for a worry-free adventure.

Creating redundant access points for credit monitoring requires establishing multiple communication channels with your financial institutions. Set up international roaming on your primary phone, but also configure account access through secondary devices and email addresses. Enable push notifications for all transaction alerts and ensure your contact information includes both domestic and international phone numbers. This redundancy becomes critical when your primary communication method fails or becomes compromised during travel.

Pre-authorizing international merchant categories prevents legitimate transactions from triggering fraud alerts. Request authorization for specific merchant types you anticipate using, such as foreign ATMs, international car rental agencies, hotel chains, and restaurant categories. This granular approach to transaction pre-approval reduces false positive fraud alerts while maintaining security against genuine threats.

Advanced Card Security Techniques for International Use

Physical security extends far beyond traditional money belts to encompass sophisticated concealment and protection strategies. The 3-2-1 rule provides a framework for strategic card distribution: keep three cards in separate locations, maintain two different payment methods (credit and debit), and ensure one backup payment source remains secured at your accommodation. This distribution strategy prevents total financial isolation if one location becomes compromised.

RFID-blocking technology serves a specific purpose in high-risk environments but requires careful consideration. Electronic pickpocketing through RFID skimming primarily occurs in crowded urban areas with sophisticated criminal networks. Destinations with documented RFID skimming activity include major European cities, busy Asian transportation hubs, and popular tourist areas in South America. In these locations, RFID-blocking wallets or sleeves provide genuine protection against contactless card theft.

Hotel room security presents unique challenges that standard safes don’t adequately address. Many hotel safes use default manufacturer codes or can be easily bypassed by housekeeping staff. Instead, consider portable travel safes that attach to fixed objects or utilize multiple hiding spots throughout your room. Divide your cards between your person, locked luggage, and a concealed location within your accommodation. Never leave all payment methods in a single location, regardless of perceived security.

Waterproof storage solutions become essential for beach and adventure destinations where traditional wallets offer inadequate protection. Waterproof pouches with lanyard attachments allow you to maintain card access during water activities while preventing theft or loss. These specialized storage solutions should accommodate both cards and backup cash, ensuring you maintain payment capabilities even in challenging environments.

The psychology of pickpocketing relies on predictable tourist behavior patterns. Professional pickpockets target individuals who display obvious signs of carrying valuables, such as frequently checking pockets, using external wallet chains, or wearing obvious money belts. Counter-surveillance techniques include varying your routine, avoiding predictable tourist areas during peak hours, and maintaining awareness of individuals who appear in multiple locations throughout your day.

Real-Time Fraud Detection and Response Protocols

Intelligent alert systems require customization based on your specific travel patterns and spending habits. Configure transaction alerts for amounts significantly below your normal spending threshold to catch small test transactions that precede larger fraudulent purchases. Set alerts for any international transaction, regardless of amount, and establish separate alert parameters for different types of merchants. This granular approach ensures you receive immediate notification of potentially fraudulent activity while minimizing false alarms.

The 15-minute response window represents the critical timeframe for preventing escalation of fraudulent activity. Once criminals confirm a stolen card works through small test transactions, they typically attempt larger purchases within minutes. Your immediate response during this window can prevent thousands of dollars in fraudulent charges. Establish multiple communication channels with your financial institutions, including international phone numbers, secure messaging systems, and emergency contact protocols that function across time zones.

Emergency contact protocols become crucial when your primary communication device is compromised or unavailable. Memorize international customer service numbers for each financial institution and maintain written backup contact information in multiple locations. Establish a trusted contact person in your home country who can communicate with financial institutions on your behalf if necessary. This person should have written authorization to discuss your accounts and understand your travel itinerary.

Documentation strategies for disputed international transactions require meticulous record-keeping from the moment suspicious activity is detected. Photograph all transaction receipts, maintain detailed logs of legitimate purchases with timestamps and locations, and document all communication with financial institutions. International transaction disputes often require additional documentation compared to domestic cases, including proof of location, currency conversion records, and merchant verification information.

Understanding the distinction between foreign transaction fees and fraudulent charges prevents unnecessary disputes and maintains positive relationships with financial institutions. Foreign transaction fees typically range from 1-3% of purchase amounts and appear as separate line items on statements. These fees are legitimate charges for currency conversion services, while fraudulent charges represent unauthorized transactions. Disputing legitimate foreign transaction fees can damage your credibility with financial institutions and delay resolution of genuine fraud cases.

Digital Banking Security in Foreign Networks

Hotel and airport WiFi networks present significant security risks for banking activities due to their open nature and potential for criminal monitoring. These networks often lack encryption protocols and may be operated by third parties with questionable security practices. Criminals frequently establish fake WiFi hotspots in these locations, using names similar to legitimate networks to capture financial information from unsuspecting travelers.

Two-factor authentication challenges multiply in international roaming scenarios where SMS messages may be delayed, blocked, or subject to additional charges. Configure authentication methods that don’t rely solely on SMS, such as authenticator apps, hardware tokens, or biometric verification. Test all authentication methods before departure and ensure backup options remain accessible if your primary method fails. Some financial institutions offer international-specific authentication protocols that bypass common roaming issues.

Time zone management becomes critical for scheduled payments and account monitoring when traveling across multiple time zones. Automatic payments may process at unexpected times relative to your local schedule, potentially creating overdraft situations or missed payment opportunities. Configure account monitoring to display both local and home time zones, and adjust automatic payment schedules to account for time differences. This proactive approach prevents payment delays that could impact your credit score.

Mobile banking app security settings require adjustment for international use to balance security with accessibility. Enable additional security layers such as biometric authentication, device registration, and location-based verification. However, ensure these settings don’t create barriers to legitimate access when you’re in foreign countries. Test all security features before departure and understand how to modify settings if they prevent necessary access to your accounts.

Creating secure communication channels with financial institutions involves establishing multiple verified contact methods that function internationally. Register international phone numbers with your financial institutions and verify that secure messaging systems work from foreign IP addresses. Some institutions block access from certain countries or require additional verification for international logins. Establish these protocols before departure to prevent access issues during critical moments.

Recovery and Damage Control Strategies

The 24-hour fraud response timeline requires immediate action across multiple fronts to minimize damage and restore access to funds. Within the first hour of detecting fraud, contact all affected financial institutions to report suspicious activity and request immediate card cancellation. During hours 2-6, document all fraudulent transactions and begin the formal dispute process. Hours 6-24 should focus on establishing alternative payment methods and monitoring for additional unauthorized activity across all accounts.

Embassy and consulate resources provide crucial support during financial emergencies, but their capabilities are often misunderstood by travelers. While embassies cannot provide direct financial assistance or guarantee resolution of banking disputes, they can facilitate communication with domestic financial institutions and provide documentation for insurance claims. Consular services can also assist with emergency money transfers from family or friends when traditional banking channels are compromised.

International wire transfer alternatives become essential when cards are compromised and traditional payment methods are unavailable. Services like Western Union, MoneyGram, and digital transfer platforms offer emergency fund access, but each has specific requirements and limitations. Establish accounts with multiple transfer services before departure and ensure trusted contacts at home understand how to send emergency funds through these channels.

Credit report monitoring during extended international travel requires proactive scheduling to account for time zone differences and limited internet access. Configure automated credit monitoring alerts to send notifications through multiple channels and establish a schedule for manual credit report reviews. Extended international travel can delay detection of identity theft or credit fraud, making consistent monitoring even more critical than during domestic travel.

Post-travel credit health assessment should begin immediately upon return to identify any issues that may have developed during your absence. Request credit reports from all three major bureaus and carefully review all accounts for unauthorized changes or new accounts. International travel creates opportunities for identity theft through document exposure, data breaches at foreign merchants, and compromised communication channels. A comprehensive credit review within 30 days of return ensures any issues are detected and addressed promptly.

Wrapping Up: Your Financial Security Starts Before You Pack

The nightmare scenarios that open this discussion—frozen accounts, disputed charges, and financial isolation thousands of miles from home—aren’t inevitable consequences of international travel. They’re preventable outcomes that result from inadequate preparation and misunderstanding of how credit fraud operates in foreign environments. The 72-hour preparation window, strategic card distribution, and real-time monitoring protocols outlined here transform you from a vulnerable tourist into a prepared traveler who’s anticipated the most common threats.

Your credit’s vulnerability during travel isn’t just about the cards in your wallet—it’s about the systematic approach you take to protect your entire financial ecosystem before, during, and after your journey. The sophisticated international fraud schemes that criminals deploy rely on travelers who haven’t implemented these protective measures, who haven’t established redundant communication channels, and who don’t understand the critical response timelines that can prevent thousands in fraudulent charges. The question isn’t whether you can afford to implement these strategies—it’s whether you can afford not to when your financial security hangs in the balance during your next international adventure.