When you’re drowning in multiple debt payments each month, the question isn’t whether you should tackle that debt—it’s how. You’ve probably heard about the debt snowball and avalanche methods, but here’s what most people don’t realize: the mathematically “correct” choice isn’t always the one that works in real life. Your personality, income stability, and even how your brain processes wins and losses can make one approach significantly more effective than the other for your specific situation. Understanding the differences between debt snowball vs avalanche can help clarify your path to financial freedom.

When considering debt repayment strategies, the debate often centers on debt snowball vs avalanche. Both methods have their advocates, but understanding how they differ is crucial. To navigate this decision, it’s essential to analyze both debt snowball vs avalanche methods and see which aligns better with your mindset. The stakes are higher than you might think. Choose the wrong method for your psychological makeup, and you could end up abandoning your debt payoff plan entirely, costing you thousands more in the long run. But get it right, and you’ll not only save money—you’ll build the momentum and confidence needed to stay debt-free for good. The key lies in understanding not just the mechanics of each approach, but the hidden psychological and financial factors that determine whether you’ll actually stick with your plan when life gets complicated, especially when comparing debt snowball vs avalanche.

Each approach, whether debt snowball vs avalanche, has unique benefits that cater to different psychological profiles. Understanding how debt snowball vs avalanche works can significantly affect your financial decisions. For many, the choice between debt snowball vs avalanche isn’t just mathematical; it’s emotional as well. Analyzing your personal finance style can help determine whether debt snowball vs avalanche will suit you better. In discussions about debt repayment, the comparison of debt snowball vs avalanche is inevitable. Many find that the clear-cut decisions in debt snowball vs avalanche enhance their ability to stick to their strategy.

As we explore debt snowball vs avalanche methodologies, it’s vital to assess which method brings you more satisfaction and success. When choosing between debt snowball vs avalanche, many factors come into play that affect your emotional and financial journey. Ultimately, the decision of debt snowball vs avalanche can shape your repayment success. When the conversation shifts to debt snowball vs avalanche, the nuances of each strategy become apparent. Comparing the two—debt snowball vs avalanche—can provide clarity on which option is best for you. In financial circles, debt snowball vs avalanche is a common debate that shapes many people’s repayment strategies.

As you weigh your options, consider how debt snowball vs avalanche aligns with your personal values and goals. Each strategy presents distinct advantages, making the debt snowball vs avalanche discussion critical for effective debt management. Ultimately, understanding the nuances of debt snowball vs avalanche can guide you toward financial success. It’s crucial to evaluate the merits of debt snowball vs avalanche based on your unique situation. Deciding between debt snowball vs avalanche ultimately hinges on your personal preferences and financial goals. In summary, the discussion around debt snowball vs avalanche remains relevant as more individuals seek effective debt repayment strategies. Ultimately, the choice between debt snowball vs avalanche reflects your financial philosophy and personal circumstances.

The Psychology Behind Debt Repayment Success

Many individuals struggle to choose between the debt snowball vs avalanche methods, making it crucial to analyze which one aligns better with your personal financial situation. Your brain processes debt differently than other financial obligations, creating unique psychological barriers that can derail even the most mathematically sound repayment plans. The stress of carrying multiple debts triggers what researchers call “cognitive load,” where your mental resources become consumed by managing complex financial decisions rather than executing them effectively. This mental burden often leads to decision paralysis, where people avoid making any debt payments beyond minimums simply because the complexity feels overwhelming.

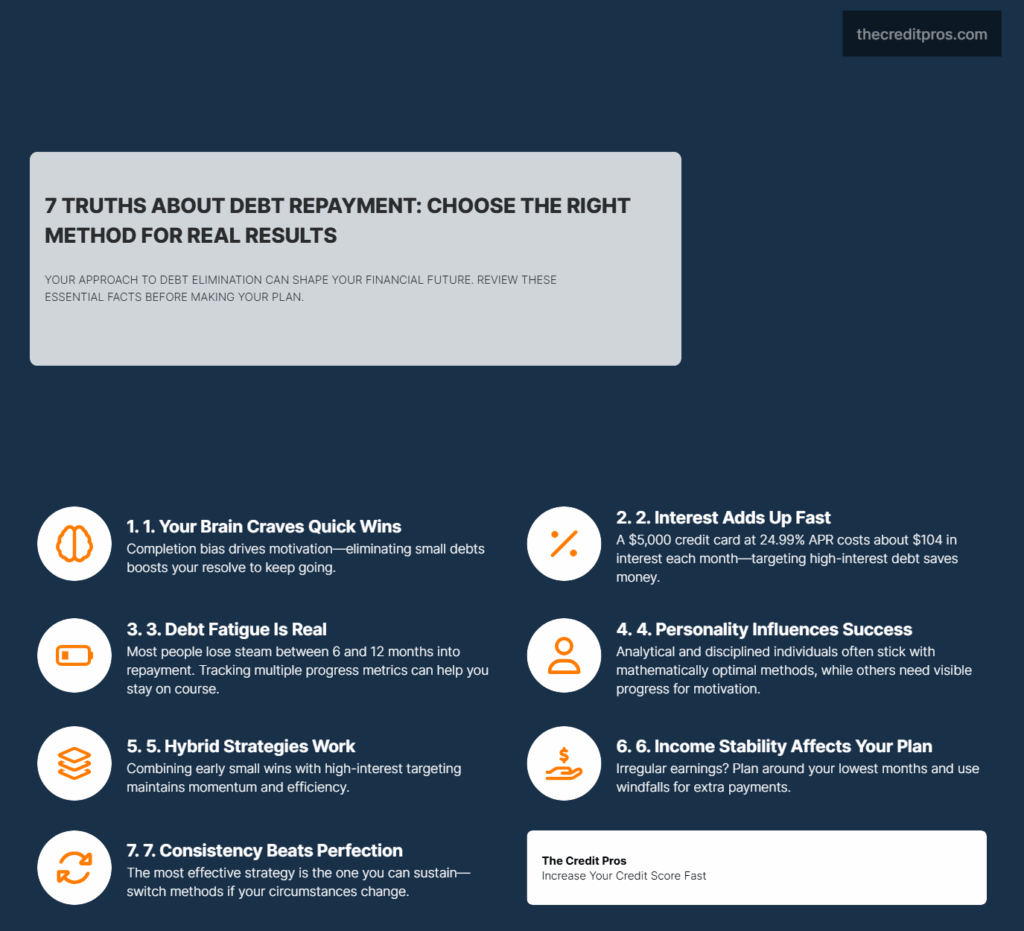

Behavioral economics reveals why traditional financial advice often fails in practice. The human brain prioritizes immediate rewards over long-term benefits, making it difficult to maintain motivation when results aren’t immediately visible. This tendency becomes particularly problematic with debt repayment, where the “reward” is often just a smaller balance rather than something tangible you can enjoy. The debt avalanche method, while mathematically superior, can feel psychologically punishing when you’re making large payments toward high-interest debts without seeing accounts disappear from your list.

The concept of “debt fatigue” emerges when people lose momentum in their repayment journey, typically occurring around the six to twelve-month mark. This phenomenon affects both methods but manifests differently. With the snowball approach, fatigue often hits when you reach larger balances that take longer to eliminate. With the avalanche method, fatigue can set in much earlier if your highest-interest debt has a substantial balance, creating a sense that you’re not making meaningful progress despite consistent payments.

Different personality types respond distinctly to delayed gratification scenarios. People with high conscientiousness and strong analytical skills often thrive with the avalanche method because they can maintain motivation through mathematical logic rather than emotional rewards. Conversely, individuals who struggle with executive function or have attention-related challenges may find the snowball method’s frequent victories essential for maintaining long-term commitment to their debt payoff plan.

Debt Snowball Method: The Power of Psychological Momentum

The snowball method leverages a fundamental principle of human psychology called “completion bias,” where people experience disproportionate satisfaction from finishing tasks completely rather than making partial progress on multiple tasks. When you eliminate a debt entirely, your brain releases dopamine, the same neurotransmitter associated with other rewarding experiences. This biochemical response creates positive reinforcement that makes you more likely to continue with your debt payoff plan, even when motivation wanes.

Neuroscience research demonstrates that small, frequent wins create stronger behavioral patterns than larger, infrequent rewards. Each debt elimination in the snowball method provides a concrete milestone that your brain interprets as success, building confidence and reinforcing the financial behaviors that led to that achievement. This psychological momentum often proves more valuable than the mathematical optimization offered by other methods, particularly for people who have previously failed at debt repayment attempts.

The snowball method provides those little wins that serve as motivation to keep going. Many high-income earners benefit significantly from this approach despite its higher interest costs. These individuals often carry multiple debts across various categories—credit cards, personal loans, student loans, and car payments—creating mental complexity that their busy schedules can’t accommodate. The simplification that comes from eliminating debt accounts entirely reduces their cognitive load more effectively than optimizing interest savings, leading to better long-term adherence to their repayment plan.

The snowball method proves particularly effective for individuals with ADHD or executive function challenges, who often struggle with complex financial management systems. The clear, simple priority system—smallest balance first—eliminates decision-making complexity while providing frequent positive reinforcement. These individuals typically need more immediate feedback to maintain motivation, making the avalanche method’s delayed gratification structure counterproductive to their success.

When minimum payments vary significantly across your debts, the snowball method requires strategic optimization to maintain its psychological benefits. You should consider grouping debts with similar balances and prioritizing those with higher minimum payments within each group. This approach preserves the momentum-building aspect while maximizing the monthly cash flow relief that comes from eliminating payment obligations entirely.

Debt Avalanche Method: Maximizing Mathematical Efficiency

The avalanche method’s mathematical advantage compounds significantly over time, particularly when dealing with high-interest debt like credit cards or personal loans. Interest calculations work against you daily, meaning that every month you carry a balance on a high-interest account, you’re essentially paying a premium for the privilege of owing money. By targeting these expensive debts first, you reduce the total interest burden more aggressively than any other systematic approach.

Strategic implementation of the avalanche method requires understanding how interest rates interact with balance sizes to determine your true cost savings. A $5,000 credit card debt at 24.99% APR costs you approximately $104 monthly in interest charges alone, while a $15,000 student loan at 4.5% generates only about $56 monthly in interest. The avalanche method’s focus on the credit card debt eliminates the higher interest generation rate, creating more available money for debt repayment in subsequent months.

People with stable income and strong self-discipline often find the avalanche method more satisfying because it aligns with their analytical approach to problem-solving. These individuals typically prefer strategies that optimize outcomes rather than optimize feelings, making them more tolerant of the delayed gratification inherent in the avalanche approach. Their consistent income allows them to maintain motivation through mathematical progress rather than requiring the emotional reinforcement of completed debt eliminations.

The avalanche method may be better suited for analytical and patient individuals who can maintain focus on long-term financial benefits. This method demonstrates superior effectiveness for larger debt loads because the interest savings become more substantial in absolute dollar terms. When you’re dealing with total debts exceeding $50,000, the difference between methods can amount to thousands of dollars and several months of payments. The psychological challenge of the avalanche method becomes more manageable when the financial stakes are high enough to provide their own motivation for persistence.

Interest rate changes and promotional periods significantly impact avalanche strategy effectiveness. Credit cards frequently offer 0% promotional rates for balance transfers, temporarily making them lower priority than other debts. Similarly, variable rate loans can shift in priority as market conditions change. Successful avalanche implementation requires periodic reassessment of your debt hierarchy to ensure you’re always targeting the most expensive debt currently on your list.

The avalanche method often produces faster credit score improvements because it reduces credit utilization ratios more efficiently. High-interest debts are typically credit cards, and paying these down quickly decreases your credit utilization percentage—a major factor in credit score calculations. This improvement can create a positive feedback loop where your improving credit score provides access to better refinancing options, further accelerating your debt payoff progress.

Hybrid Approaches and Personalized Strategies

The modified avalanche approach addresses one of the primary weaknesses of the traditional avalanche method by incorporating psychological momentum while maintaining mathematical efficiency. This strategy involves targeting any high-interest debts with balances under a specific threshold—typically $1,000 to $2,000—before focusing on the highest interest rate debt regardless of balance. This modification provides early wins to maintain motivation while still prioritizing expensive debt elimination. The final takeaway from the debt snowball vs avalanche analysis is that your unique situation dictates the best choice.

Your financial circumstances will inevitably change during your debt payoff journey, requiring flexibility in your chosen method. Job changes, medical expenses, or family obligations may temporarily reduce your available payment amounts or create new financial priorities. Successful debt management requires building adaptability into your strategy, allowing you to switch between methods or modify your approach based on current circumstances rather than abandoning your debt payoff efforts entirely. To conclude, whether you lean toward debt snowball vs avalanche, understanding your motivation will influence your success.

In this journey, knowing the differences between debt snowball vs avalanche can empower you to make informed decisions.

“If you prefer to see progress quickly and work your way up, then the ‘snowball method’ may be a better fit for your debt management goals.”

Balance transfer strategies can enhance either the snowball or avalanche method when implemented thoughtfully. Moving high-interest debt to promotional 0% offers effectively transforms avalanche prioritization by temporarily making those debts the lowest priority. Similarly, consolidating several small debts through a personal loan can create a single, larger balance that fits better into an avalanche strategy while maintaining some psychological benefits of the snowball approach.

Emergency fund considerations create tension in both debt payoff methods because building savings while carrying high-interest debt seems mathematically counterproductive. However, attempting debt payoff without any emergency buffer often leads to taking on new debt when unexpected expenses arise, undermining your progress. A balanced approach typically involves building a minimal emergency fund—$1,000 to $2,000—before aggressively pursuing debt payoff, then completing your emergency fund after becoming debt-free.

The distinction between secured and unsecured debt adds complexity to both methods because secured debts carry additional consequences beyond interest costs. Mortgage and car loan payments maintain your access to essential assets, while credit card and personal loan defaults primarily affect your credit score and create collection issues. Your debt payoff strategy should generally prioritize unsecured debts within your chosen method while maintaining current payments on secured obligations.

Tax considerations can influence your debt prioritization, particularly with student loans and mortgages that offer interest deductions. The after-tax cost of deductible debt may be lower than the stated interest rate, potentially changing the avalanche method’s priority order. However, these tax benefits typically apply only if you itemize deductions, and the benefit decreases as your income rises, making this consideration more complex than simple interest rate comparisons.

Implementation Strategies and Common Pitfalls

The “messy middle” of debt payoff—typically occurring between months six and eighteen—presents the greatest risk for abandoning your chosen method. During this period, initial enthusiasm has worn off, but significant progress isn’t yet visible, creating a motivation valley that derails many debt payoff attempts. Successful navigation requires establishing systems that maintain momentum regardless of your emotional state, such as automated payments and regular progress reviews that highlight improvements beyond just balance reduction.

Progress tracking should encompass multiple metrics beyond simple balance reduction to maintain motivation during difficult periods. Monthly interest savings, credit score improvements, and increased available credit limits all represent meaningful progress that may not be immediately obvious from balance statements alone. Creating a comprehensive progress dashboard helps you recognize advancement even when individual debt balances seem to decrease slowly.

Lifestyle inflation poses a significant threat to debt payoff success because increased income often leads to increased spending rather than accelerated debt reduction. This phenomenon occurs gradually, making it difficult to recognize until it has significantly impacted your debt payoff timeline. Successful debt elimination requires deliberately directing income increases toward debt payments rather than allowing them to disappear into general lifestyle improvements.

Key strategies for handling irregular income within structured debt payoff methods:

- Calculate average monthly income over the previous 12 months for baseline planning

- Create a minimum debt payment plan based on your lowest income months

- Apply windfall income—bonuses, tax refunds, overtime pay—directly to debt reduction

- Build a small income smoothing fund to handle monthly payment variations

- Consider seasonal payment adjustments for predictable income fluctuations

Accountability systems and social support significantly improve debt payoff success rates, but they must be structured appropriately to provide motivation rather than shame. Sharing specific debt amounts or financial details often creates embarrassment rather than support, while focusing on behavioral goals—making extra payments, avoiding new debt, tracking expenses—provides positive reinforcement without privacy concerns. Regular check-ins with a trusted friend or family member about your debt payoff progress can provide external motivation during challenging periods.

Reassessing your chosen method becomes necessary when your financial situation changes significantly or when you consistently struggle to maintain your payment plan. Signs that indicate a method change might be beneficial include consistently missing extra payments, feeling overwhelmed by your debt situation, or experiencing major life changes that affect your income or expenses. The key is recognizing that switching methods represents strategic adaptation rather than failure, and that maintaining some debt payoff momentum is always better than abandoning your efforts entirely.

The Bottom Line: Your Success Depends on Self-Knowledge

The choice between debt snowball and avalanche methods isn’t really about mathematics versus psychology—it’s about understanding which approach aligns with your unique combination of personality, circumstances, and financial goals. While the avalanche method will always save you more money on paper, the snowball method’s psychological advantages often translate into real-world success for people who need frequent motivation to stay committed. Your income stability, stress tolerance, and past experiences with financial goals all play crucial roles in determining which method you’ll actually stick with long enough to become debt-free.

The most successful debt payoff journeys often involve strategic adaptation rather than rigid adherence to one method. Whether you choose the mathematical optimization of the avalanche approach or the momentum-building power of the snowball method, your ability to maintain consistency over months or years will ultimately determine your results. The “wrong” method that you follow faithfully will always outperform the “right” method that you abandon halfway through—making self-awareness your most valuable tool in choosing a debt elimination strategy like debt snowball vs avalanche that transforms your financial future rather than becoming another abandoned resolution.