Bankruptcy offers genuine financial relief when debt becomes overwhelming, but the credit consequences extend far beyond what most people expect. While you might understand that filing bankruptcy will hurt your credit score, the reality involves a complex web of financial barriers that can affect everything from your ability to rent an apartment to the insurance premiums you’ll pay for years to come. Understanding the effect of bankruptcy credit is crucial for navigating these challenges.

Understanding the effect of bankruptcy credit is essential for anyone facing financial distress, as it influences long-term financial decisions. Many underestimate the effect of bankruptcy credit on their ability to secure future loans. The overall effect of bankruptcy credit can be mitigated with proper planning and awareness of available resources. Hence, understanding the effect of bankruptcy credit is crucial for making informed decisions about financial recovery. This understanding helps to manage expectations surrounding the effect of bankruptcy credit on future lending opportunities. Recognizing the long-term effect of bankruptcy credit can also influence how quickly one can rebuild their financial standing.

Understanding this effect of bankruptcy credit can guide individuals towards better post-bankruptcy strategies. The effect of bankruptcy credit is not just about numbers; it affects emotional and psychological recovery as well. What makes bankruptcy’s credit impact particularly challenging is that standard credit repair advice often falls short during recovery. The typical strategies you’ll find online assume you’re working with damaged but existing credit accounts, not starting from scratch after a legal discharge. Why do some people bounce back from bankruptcy in two years while others struggle for nearly a decade? The answer lies in understanding the hidden timeline differences between bankruptcy chapters, recognizing the invisible barriers beyond credit scores, and knowing when traditional rebuilding methods need to be completely reimagined for post-bankruptcy success. These factors contribute significantly to the overall effect of bankruptcy credit.

The Hidden Timeline: How Different Bankruptcy Chapters Create Distinct Credit Footprints

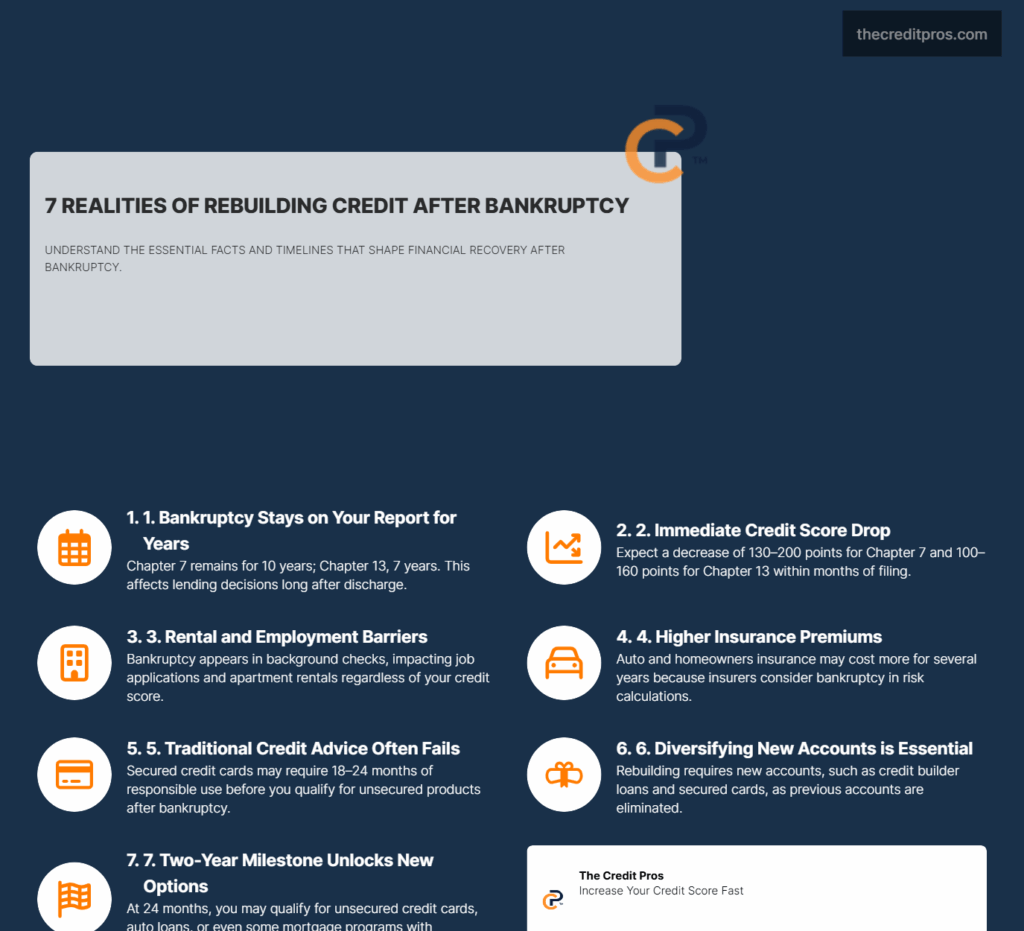

The distinction between Chapter 7 and Chapter 13 bankruptcies extends far beyond their basic legal structures, creating fundamentally different credit recovery trajectories that most debtors don’t fully understand until years after filing. Chapter 7 bankruptcy, which involves liquidating non-exempt assets to pay creditors, remains on your credit report for 10 years from the filing date, while Chapter 13 bankruptcy, structured as a court-supervised repayment plan, is removed after seven years. This three-year difference represents more than just a timeline variation—it reflects how credit reporting agencies and future lenders perceive the nature of each bankruptcy type and your demonstrated commitment to debt resolution, ultimately influencing the effect of bankruptcy credit.

The immediate credit score impact varies significantly between these bankruptcy chapters, with Chapter 7 typically causing a more severe initial drop due to its association with complete debt discharge rather than partial repayment. Your credit score may plummet by 130 to 200 points following a Chapter 7 filing, particularly if you maintained relatively good credit before the bankruptcy. Chapter 13 filings often result in a slightly less dramatic initial score reduction, typically ranging from 100 to 160 points, because the court-approved repayment plan demonstrates ongoing financial responsibility even amid financial distress.

Knowing the effect of bankruptcy credit enables individuals to prepare better for future financial engagements. It is essential to recognize the effect of bankruptcy credit on your overall financial health. Chapter 13’s “partial payment” perception creates a paradox in credit recovery that many bankruptcy filers fail to anticipate. While both bankruptcy types appear prominently on your credit report, successful completion of a Chapter 13 repayment plan signals to future lenders that you honored your commitment to pay back at least a portion of your debts under court supervision. This demonstration of follow-through can accelerate your access to new credit products, even though the bankruptcy notation itself carries similar weight to a Chapter 7 discharge. Lenders often view Chapter 13 completion as evidence of financial discipline and improved money management skills.

The automatic stay that takes effect immediately upon filing either bankruptcy chapter creates temporary credit utilization improvements that can be misleading for your overall credit recovery planning. When collection activities cease and creditors can no longer pursue payment, your credit utilization ratios may improve artificially as existing balances are frozen or discharged. However, this immediate improvement doesn’t translate to sustainable credit score gains because the underlying bankruptcy filing overwhelms any positive utilization changes in most credit scoring models.

Beyond the Credit Score: The Invisible Barriers to Financial Recovery

Employment and housing screening challenges represent some of the most overlooked consequences of bankruptcy filing, extending far beyond traditional credit score considerations. Many employers, particularly in financial services, healthcare, and government sectors, conduct background checks that reveal bankruptcy filings even when credit scores aren’t directly evaluated. Professional licensing boards in fields such as accounting, real estate, and financial planning may require disclosure of bankruptcy history and could impose additional scrutiny or requirements for license renewal or initial certification.

Rental applications present another significant hurdle, as property managers and landlords frequently use specialized tenant screening services that flag bankruptcy filings regardless of your current credit score or income level. These screening services often maintain their own databases and scoring systems that weight bankruptcy history heavily, potentially requiring larger security deposits, co-signers, or outright rental denials even years after your credit score has recovered to acceptable levels. Awareness of the effect of bankruptcy credit can lead to more effective budgeting and financial planning.

Insurance premium penalties create an ongoing financial burden that many bankruptcy filers discover only when their policies come up for renewal. Auto insurance companies in most states can legally factor bankruptcy history into their risk assessment calculations, often resulting in premium increases that persist for several years after filing. Homeowners insurance and life insurance policies may also carry higher premiums or require additional underwriting scrutiny when bankruptcy appears in your financial background, creating compound financial pressure during an already challenging recovery period.

Banking relationship complications extend beyond simple credit applications to fundamental financial services that many people take for granted. ChexSystems, the primary checking account screening service used by most banks and credit unions, maintains records of banking-related issues that can arise during bankruptcy proceedings, particularly if you had overdrawn accounts or unpaid bank fees that were included in your bankruptcy filing. Opening new checking accounts, obtaining cashier’s checks, or accessing business banking services may require specialized second-chance banking programs that often carry higher fees and more restrictive terms.

The reaffirmation agreement trap represents one of the most complex credit complications that emerges during bankruptcy proceedings. When you choose to reaffirm secured debts like auto loans or mortgages to retain the underlying property, these agreements create ongoing payment obligations that survive the bankruptcy discharge. While maintaining these payments can provide some positive credit history, reaffirmed debts also limit your financial flexibility and can create future credit complications if your circumstances change and you struggle to maintain the agreed-upon payment terms.

The Rebuilding Paradox: Why Traditional Credit Advice Fails Post-Bankruptcy

The secured credit card graduation timeline that works for most credit-building situations requires significant extension and modification for post-bankruptcy recovery. Standard advice suggests that secured cardholders can expect to graduate to unsecured products within six to twelve months of responsible use, but bankruptcy filers typically need eighteen to twenty-four months of consistent secured card activity before major issuers consider them for unsecured credit products. This extended timeline reflects the additional risk assessment period that lenders require when evaluating applicants with bankruptcy history, regardless of their demonstrated payment behavior on secured products.

The impact of the effect of bankruptcy credit can linger, thus requiring strategic actions to mitigate its long-term consequences. Understanding the effect of bankruptcy credit helps individuals navigate the complexities of securing loans after discharge. Strategies that address the effect of bankruptcy credit can significantly improve one’s chances of financial recovery.

Credit mix complications arise because bankruptcy discharge eliminates your existing credit accounts, creating an artificially thin credit profile that requires strategic diversification to rebuild effectively. Traditional credit advice emphasizes maintaining existing accounts with long payment histories, but bankruptcy filers must start from scratch with new accounts that have no payment history. Building an optimal credit mix requires carefully timing applications for different credit types—secured cards, credit-builder loans, and eventually unsecured products—while managing the hard inquiries that each application generates.

The “clean slate illusion” represents one of the most misunderstood aspects of post-bankruptcy credit recovery. While bankruptcy discharge eliminates your legal obligation to pay discharged debts, your credit utilization ratios and payment history factors don’t immediately reset to optimal levels. New credit accounts start with zero payment history, and your available credit limits are typically much lower than before bankruptcy, making it challenging to maintain the low utilization ratios that credit scoring models favor. This creates a situation where you may have eliminated debt burdens but still struggle with credit score improvement in the short term.

Timing credit applications strategically becomes crucial for post-bankruptcy recovery, as the difference between applying too early and waiting too long can significantly impact your rebuilding success. Applying for multiple credit products too soon after discharge often results in multiple rejections that create additional negative marks on your credit report and signal desperation to potential lenders. Conversely, waiting too long to begin rebuilding can result in missed opportunities to establish positive payment history and may signal to lenders that you’re not actively working to restore your creditworthiness.

Strategic Credit Rehabilitation: Advanced Techniques for Accelerated Recovery

The authorized user strategy requires careful modification when bankruptcy history is involved, as traditional approaches may not work effectively with your compromised credit profile. Family members or trusted friends who agree to add you as an authorized user on their established accounts can provide significant credit score benefits, but the primary account holder must understand that your bankruptcy history could potentially impact their ability to obtain credit increases or new accounts with certain lenders. The most effective authorized user arrangements involve accounts with long payment histories, low utilization ratios, and primary users who commit to maintaining these positive characteristics throughout your recovery period.

Experian Boost and alternative credit data sources become particularly valuable for bankruptcy filers because traditional credit rebuilding methods are limited during the early recovery phase. These services allow you to receive credit score benefits for utility payments, rent payments, and subscription services that you’re already making, providing score improvements without requiring new credit applications or approvals. The impact may be modest—typically 10 to 20 points—but these improvements can be crucial for reaching minimum score thresholds required for secured credit products or rental applications.

Credit builder loan timing and structure require careful coordination with your overall rebuilding strategy to maximize their effectiveness without creating unnecessary financial strain. These specialized loan products, offered by credit unions and online lenders, work by holding your loan proceeds in a savings account while you make monthly payments that are reported to credit bureaus. The optimal timing for credit builder loans is typically six to twelve months after bankruptcy discharge, allowing you to establish initial secured card payment history while adding installment loan diversity to your credit profile.

The two-year milestone strategy represents a critical transition point in post-bankruptcy credit recovery when many lenders begin considering applications from bankruptcy filers under more favorable terms. At the 24-month post-discharge mark, you become eligible for certain credit products that were previously unavailable, including some unsecured credit cards, auto loans with competitive rates, and specialized mortgage programs. This milestone requires careful preparation, including maintaining perfect payment history on existing accounts, keeping credit utilization below 10%, and having a stable income history to support new credit applications.

Future-Proofing Your Financial Recovery: Long-Term Credit Health Strategies

Emergency fund integration with credit building requires balancing competing financial priorities during a period when resources are typically limited. Building an emergency fund while simultaneously rebuilding credit may seem contradictory, as both goals require disciplined saving and spending habits. However, maintaining a modest emergency fund—even $500 to $1,000—can prevent future credit damage by avoiding late payments or credit utilization spikes when unexpected expenses arise. This financial cushion becomes particularly important during credit rebuilding because any payment delays or credit limit overages carry disproportionate weight when your credit profile is still recovering.

The five to seven-year credit profile evolution demonstrates how your post-bankruptcy credit opportunities expand significantly as time passes and positive payment history accumulates. During years three through five after bankruptcy discharge, you typically become eligible for mainstream credit products with competitive rates, including unsecured credit cards from major issuers, auto loans with preferred pricing, and personal loans for debt consolidation or major purchases. By years six and seven, your credit profile may be strong enough to qualify for premium credit products, business credit lines, and conventional mortgage loans, provided you’ve maintained consistent positive payment behavior throughout the recovery period.

Mortgage readiness timeline varies significantly based on the type of bankruptcy filed and the specific loan program you’re pursuing. FHA loans become available three years after Chapter 7 discharge and one year after Chapter 13 discharge, but these waiting periods assume you’ve maintained perfect payment history and stable employment during the recovery period. VA loans require a two-year waiting period after Chapter 7 discharge, while conventional loans typically require a four-year waiting period. Preparing for homeownership during these waiting periods involves more than just credit score improvement—you’ll need to demonstrate stable income, maintain low debt-to-income ratios, and accumulate sufficient savings for down payments and closing costs.

Credit monitoring versus credit management represents a fundamental shift in approach that should occur as your financial stability improves during the recovery process. Early post-bankruptcy recovery requires intensive credit monitoring to catch errors, track score improvements, and identify opportunities for credit limit increases or new account approvals. As your credit profile matures and stabilizes, your focus should shift toward proactive credit management strategies that optimize your long-term creditworthiness, including strategic account management, periodic credit limit increase requests, and maintaining optimal credit utilization patterns across multiple accounts.

Conclusion: Mastering Your Post-Bankruptcy Credit Journey

The effect of bankruptcy credit extends far beyond the initial score drop, creating a complex web of financial barriers that can persist for years without proper strategic planning. The key difference between those who recover in two years versus those who struggle for a decade lies in understanding that Chapter 7 and Chapter 13 create distinct recovery timelines. It also requires recognizing that traditional credit advice often falls short post-bankruptcy and implementing specialized rebuilding strategies tailored to the unique challenges of starting over with a clean slate.

Overcoming the effect of bankruptcy credit requires patience, strategic thinking, and a willingness to abandon conventional credit wisdom in favor of methods tailored to post-bankruptcy recovery. The invisible barriers—from employment screening to increased insurance premiums—will test your resolve, but the two-year milestone and beyond offer real opportunities for financial redemption. Success isn’t just about rebuilding your credit score; it’s about establishing a solid financial foundation that prevents future crises and supports long-term prosperity. The question isn’t whether you can recover from bankruptcy—it’s whether you’re ready to embrace the disciplined, strategic approach that turns a financial setback into your greatest comeback story.