Most of us have thought about or written down our New Year’s resolutions back in January of this past year… but usually have forgotten them or given up on them by mid-March. Although 2020 was a strange year (gyms were closed, many people were laid off, and a lot of us had to cancel our wedding plans) there was still room for our resolutions. No sense dwelling on the past though: 2021 is almost here! Check out this blog on new year resolutions for personal finance.

If you’re wondering how you could get started on improving your financial situation in 2021, here’s our guide to new year’s resolutions for personal finance.

New Year’s Resolutions for Personal Finance in 2021

Getting Back to Work (Or Getting a New Job)

2020 really messed things up for a lot of people. Millions of Americans were either laid off, furloughed, or found themselves temporarily out of work due to the pandemic. If you’re one of them, it might be time to take back your life and start getting back to work.

This is important, especially now, because it won’t be long until the moratorium on evictions is lifted on December 31. Worse yet, COVID-19 economic relief will end soon. If you’re currently out of work or are unsatisfied with your current job, consider adding “Get A New Job” onto your resolution list.

There are a few things you can do to get started on achieving this resolution.

- Get your resume updated or redone. This includes your LinkedIn profile. You may be able to find free resume clinics by searching on Google, Eventbrite, or LinkedIn.

- Set a goal to send in a certain number of applications every day. Remember: if you’re open to remote work, feel free to apply to remote postings from places outside your area!

- Practice interviews regularly. Have someone you trust (preferably someone who has actually hired or interviewed people before) take you through a mock interview. Research questions that people are likely to ask in your field. Doing this will help increase your confidence in interviewing.

Pay Off Credit Card Debt

Credit card debt can be a serious hindrance for those trying to get themselves back on their feet financially. If you’ve dealt with an extended period of unemployment, you may have racked up some of your bills on your credit card. The interest can add up significantly!

Set a resolution to pay off a certain amount of credit card debt. Depending on your income and your current balance, you might be able to set a resolution to pay off the entire thing!

Paying off your credit card debt is an important step to take for both improving your credit score AND eliminating your debt altogether. Credit card debt is typically the most expensive long-held debt that people have, and at rates as high as 24% APR, it’s easy to see why.

One way you can get started on clearing out your credit card debt is to use a technique that Dave Ramsey calls “snowballing your debt”. We wrote an article about snowballing your credit card debt: check it out!

Build Up Savings

If 2020 has taught us anything, it’s that savings could mean the difference between financial security and financial ruin in tough times. One great resolution for 2021 is to build up your savings to a comfortable amount.

A good barometer for savings is to have at least six month’s rent saved up for a rainy day. After all, 2020 was the longest rainy day that we’ve had to live through, and it’s possible that 2021 might be no different (especially as the economic relief stops and evictions start up again!)

We understand that you might not be able to build up your savings due to your situation. If that’s you, then you might want to look at your income and your expenses to see where you could improve.

To start building up your savings, you will want to do a few things. First, look at your expenses and see what you can eliminate. Second, look at your income and see what you could do to increase it (a higher-paying job, a 2nd job, side hustles, starting a business). Third, commit to a specific amount that you want to save every month. To make this easy, you can set up your online banking to send a certain amount of money to your savings every single month.

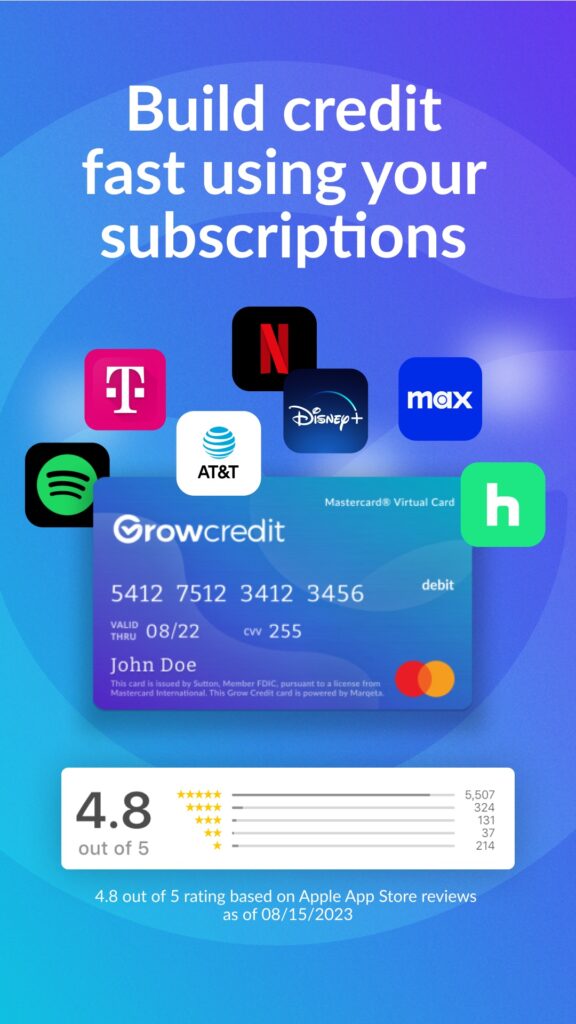

Improve Your Credit Score

Your credit score is an important part of your overall financial well-being. Without a good credit score, you won’t be able to get the best rates on loans or qualify for a mortgage for your dream home.

To start working on your credit score, take the following steps. First, use one of many credit score tools to get an estimate of your credit score. Then, get your free credit report from https://annualcreditreport.com (this is an official US government website).

Once you’ve done this, you can start working on steps to improve your credit score.

- Remove fraudulent or erroneous entries on your credit report by disputing them. We wrote an article explaining the dispute process here.

- Settle delinquent accounts. These will stay on your credit report for up to 10 years (7 in most cases), however your outstanding balance on these and your payment history will be reflected in your credit score.

- Resume or renegotiate payments on accounts that are past due.

- Pay down credit card debt. Credit card debt (and your credit utilization ratio) is a big part of your credit score.

We wrote several guides on how to improve your credit score: here’s one that explains what your credit score is made of!

The Credit Pros offers comprehensive credit repair and credit monitoring tools to help you improve your credit score in 2021. Learn more about credit repair here!