Table of Contents

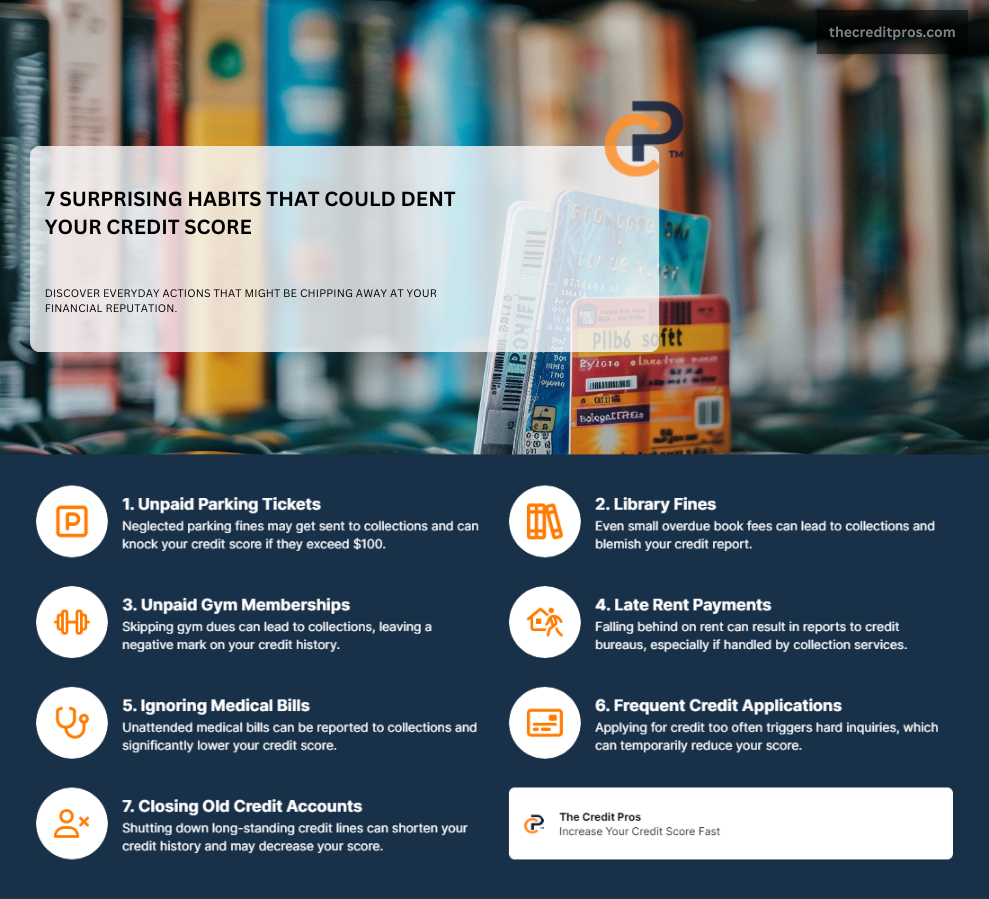

When it comes to credit scores, most of us are aware of the usual red flags: late payments, maxed-out credit cards, defaults, and bankruptcies. However, some less obvious lifestyle factors can also impact your credit score. This article will explore five surprising ways your everyday habits may be affecting your financial health.

Unpaid Parking Tickets

Let’s start with something as common as parking tickets. Seemingly insignificant, these fines can have a profound effect on your credit score if left unpaid. The unpaid ticket might be sent to a collection agency, which is a major negative mark on your credit report. If the amount in collections exceeds $100, it could even be reported to the credit bureaus, affecting your score. The lesson here? Don’t ignore those parking tickets; pay them off promptly to avoid potential credit score damage.

Library Fines

Another unlikely culprit of credit score damage is library fines. Yes, those small fines for overdue books can snowball into significant credit issues if ignored. Libraries, like any other service provider, have the right to report delinquent accounts to collection agencies, and this information can end up on your credit report. So, the next time you borrow a book, make sure to return it on time to avoid fines and potential credit score impacts.

Unpaid Gym Memberships

Next on the list are unpaid gym memberships. When you sign up for a gym membership, you enter into a contractual agreement. If you stop paying your membership fees, the gym can send your account to collections, resulting in a negative mark on your credit report. Therefore, if you’re not using your gym membership, it’s better to cancel it properly rather than just stop paying the dues.

Late Rent Payments

Rent payments, too, can affect your credit score. While timely rent payments aren’t always reported to the credit bureaus, late payments can be – especially if your landlord uses a rent collection service that reports to the bureaus. If your unpaid rent ends up in collections, it will likely show up on your credit report and damage your credit score. The solution? Always pay your rent on time and in full.

This exploration of unexpected factors that can impact your credit score is a reminder that financial responsibility extends beyond the obvious. By being aware of these potential pitfalls and taking steps to avoid them, you can maintain and even improve your credit score. So, whether it’s returning that library book on time, paying off a parking ticket promptly, or keeping up with your rent and gym membership payments, every little bit helps when it comes to preserving your credit health.

Ignoring Medical Bills

The final unexpected factor that can affect your credit score is ignoring medical bills. Medical expenses can be daunting, and it’s not uncommon for people to put off dealing with them. However, similar to gym memberships, unpaid medical bills can be sent to collections and appear on your credit report. This negative mark can significantly lower your credit score. Therefore, it’s crucial to address medical bills promptly, set up payment plans if necessary, or seek financial assistance options to avoid damage to your credit health.

In conclusion, various aspects of your lifestyle can impact your credit score in ways you may not have previously considered. From parking tickets to library fines, gym memberships rent payments, and medical bills, these seemingly unrelated factors can all contribute to your overall credit health. Being aware of these potential pitfalls and taking proactive steps to avoid them is a significant part of maintaining and improving your credit score.

Remember, credit scores are not just numbers; they represent your financial responsibility and can significantly impact various areas of your life, from getting a loan to renting an apartment, and even potential job opportunities. Therefore, it’s essential to understand all the factors that can affect your credit score, including these unexpected ones, to better manage your financial health.

By paying attention to these details in your everyday life, you can not only avoid unnecessary financial stress but also build a strong credit history that will serve you well in the future. It’s about being mindful of your financial obligations, no matter how small they may seem, as they all contribute to your overall credit profile.

So, the next time you receive a parking ticket, library fine, or gym membership bill, remember that these are not just minor inconveniences. They’re opportunities for financial responsibility that, when handled correctly, can contribute positively to your credit health. And that’s a habit worth cultivating for a secure financial future.