Save money and stop missing out on important opportunities.

By clicking 'Get Started' I agree by electronic signature to: (1) be contacted by The Credit Pros by a live agent, artificial or prerecorded voice, and SMS text at my residential or cellular number, dialed manually or by autodialer even if my phone number is on a do-not-call registry (consent to be contacted is not a condition to purchase services); and (2) the Privacy Policy and Terms of Use.

The Credit Pros has been helping people like you repair their credit score by updating or removing inaccurate items on credit reports for over a decade.

Our commitment is to making sure that everyone has a fair shot at good credit. Founded by a team of credit law experts, The Credit Pros wants to make sure that everyone has access to the same information and can learn what it takes to build good credit for a lifetime.

Not only do we offer credit repair, but we also provide financial and credit education tools and resources to help our clients understand what’s on their report and how their credit score works. With this education and our AI-based credit management tools, our clients can work to take control of their financial future and live a life without credit worries.

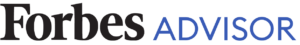

Your credit score determines how much you pay to borrow money to cover modern day essentials including housing, cars, credit cards and loan interest rates.

Use the slider below to see how your credit score range impacts how much you pay for the same items over time. Then ask yourself, can you afford NOT to fix your credit?

Home Loan

Car Loan

Loan

Credit card

Loan Type

30 Year Fixed Mortgage

60 Month New Auto

Personal Loan (2yrs)

Revolving Credit

Loan Amount

$0

$35,000

$5,000

$2,500

APR

No Approval

17.54%

21.14%

30.02%

Monthly Payment

$0

$880

$257

$2,562.43

Total Interest

$0

$17,802

$1,175

$62.43

Loan Type

30 Year Fixed Mortgage

60 Month New Auto

Personal Loan (2yrs)

Revolving Credit

Loan Amount

$250,000

$35,000

$5,000

$2,500

APR

7.5-8.0%

12.632%

18.93%

26.64%

Monthly Payment

$1,799

$790

$252

$2,555.32

Total Interest

$397, 593

$12,387

$1,045

$55.32

Loan Type

30 Year Fixed Mortgage

60 Month New Auto

Personal Loan (2yrs)

Revolving Credit

Loan Amount

$250,000

$35,000

$5,000

$2,500

APR

6.8-7.0%

10.42%

17.41%

24.15%

Monthly Payment

$1,661

$751

$248

$2,550.10

Total Interest

$348,650

$10,054

$957

$50.10

Loan Type

30 Year Fixed Mortgage

60 Month New Auto

Personal Loan (2yrs)

Revolving Credit

Loan Amount

$250,000

$35,000

$5,000

$2,500

APR

6.70%

8.66%

15.86%

22.95%

Monthly Payment

$1,613

$721

$244

$2,547.59

Total Interest

$330,750

$8,249

$868

$47.59

Loan Type

30 Year Fixed Mortgage

60 Month New Auto

Personal Loan (2yrs)

Revolving Credit

Loan Amount

$250,000

$35,000

$5,000

$2,500

APR

6.40%

7.55%

13.40%

18.09%

Monthly Payment

$1,577

$702

$239

$2,537.44

Total Interest

$317,560

$7,125

$728

$37.44

The Credit Pros offers affordable plans to help you increase your credit score so you pay less for the essentials (and the extras) in life.

Easy-to-read credit reports and personalized score insights

Tools & tips to help you understand your score and take the next step.

Credit Monitoring is Included at No Additional Charge which can help you spot potential identity theft.

A credit report is a track record of both your personal and financial credit information. It includes information taken from public records, personal identification and debt information. Your report will show things like your payment history, your debt balances, items in default, items in collections, and who you owe money to.

Your credit score is a 3-digit number between 300 and 850 that shows how creditworthy you are. Lenders use your credit score to decide whether or not you qualify for loans. They also use your credit score to determine your interest rate.

Credit scores are calculated using a 5-part formula, calculated based on the following factors: payment history, amounts owed, length of credit history, mix of types of credit, and amount of new credit.

It only takes 90 seconds to sign up. Start fixing errors on your credit report and get help to increase your credit score. Your information is safe with us. We treat your data as if it were our own.

Privacy and Cookies

We use cookies on our website. Your interactions and personal data may be collected on our websites by us and our partners in accordance with our Privacy Policy and Terms & Conditions