The Impact of Credit Card Utilization Ratio on Your Credit Score

Credit card utilization ratio is a very important calculation for your credit score. It’s often forgotten by people when they’re using their credit card, and you might be guilty of this too! But why credit card utilization ratio matters? How does it affect your credit score?

A Complete Explanation on Credit Card Utilization Ratio:

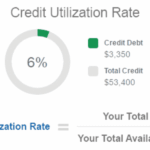

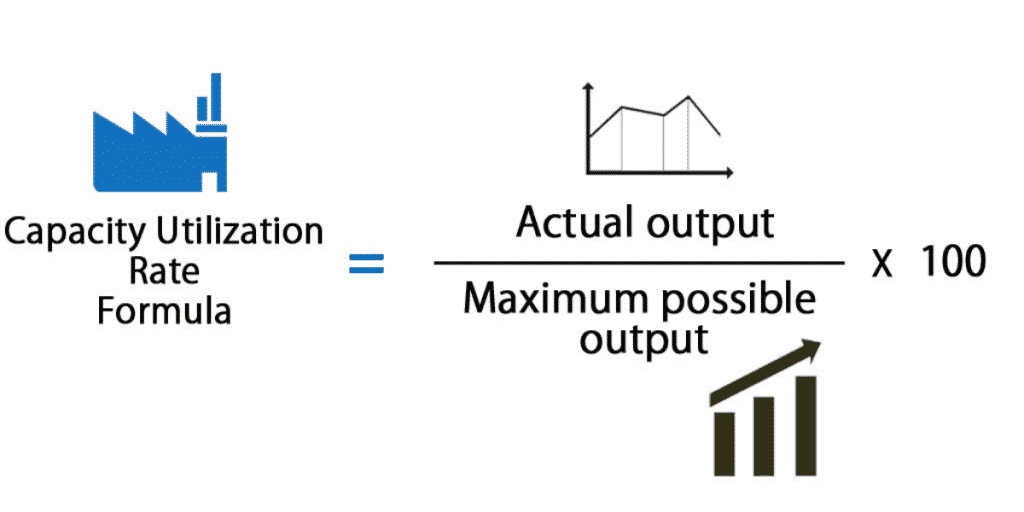

Your credit card utilization ratio is calculated by taking the percentage of the available credit on your card that is currently used by the credit card balance.

Relacionado: The Right Time to Pay off Your Credit Card Balances

In short, (credit card balance / credit card limit) * 100% = your credit card utilization ratio.

If you have a credit card balance of $10,000, and your current balance is $2,000, your credit card utilization ratio is 20%.

This ratio can be taken per card, and it can be taken on the sum of all credit cards. So you can see the following table:

| Tarjeta de crédito | Credit Balance | Límite de crédito | Ratio |

|---|---|---|---|

| Card #1 | $2,000 | $10,000 | 20% |

| Card #2 | $3,500 | $15,000 | 23.33% |

| Card #3 | $1,000 | $1,500 | 66.67% |

| Card #4 | $0 | $2,000 | 0% |

| Card #5 | $300 | $2,000 | 15% |

Your total utilization ratio would be 22.30%.

These balances do not depend on what you carry over month to month, but what is shown on your credit card statements. That is, if you regularly have large balances on your credit cards but you pay them off every month, you are not benefiting from having a low credit card utilization ratio.

So this is a fair bit of information about how the ratio is calculated, but why is it so important? Keep reading, why credit card utilization ratio matters?

We wrote an entire article on: How to Reduce Your Credit Utilization Rate

Why Credit Card Utilization Ratio Is Important?

Amounts owed is 30% of your total puntuación crediticia. Credit card utilization ratio indicates how much you owe, and is thus calculated as part of this score along with your mortgage balance, préstamo de coche balance, and balances on other loans you may have.

Tarjetas de crédito are weighted differently than other kinds of debt. Credit card balances are treated differently in the credit score calculation, and are actually worth a bit more per dollar used. The reason is because it’s expected that people have large balances on certain types of loans, such as mortgages or car loans; however, carrying a large saldo de la tarjeta de crédito indicates a general irresponsibility with money.

Another reason is because amounts owed depends not only on the total balance of all debt owed, but also on how much of your available credit you’re using up. Credit card utilization ratio represents this number relatively clearly.

Lea también: ¿Valen la pena los servicios gratuitos de verificación de puntaje de crédito?

What Can You Do About It?

If you have a balance that you’re carrying month to month, concentrate on paying down your credit cards. Not only does this help with a good payment history, but it also tackles your amounts owed in multiple ways. It lowers total amount owed while also lowering credit card utilization ratio.

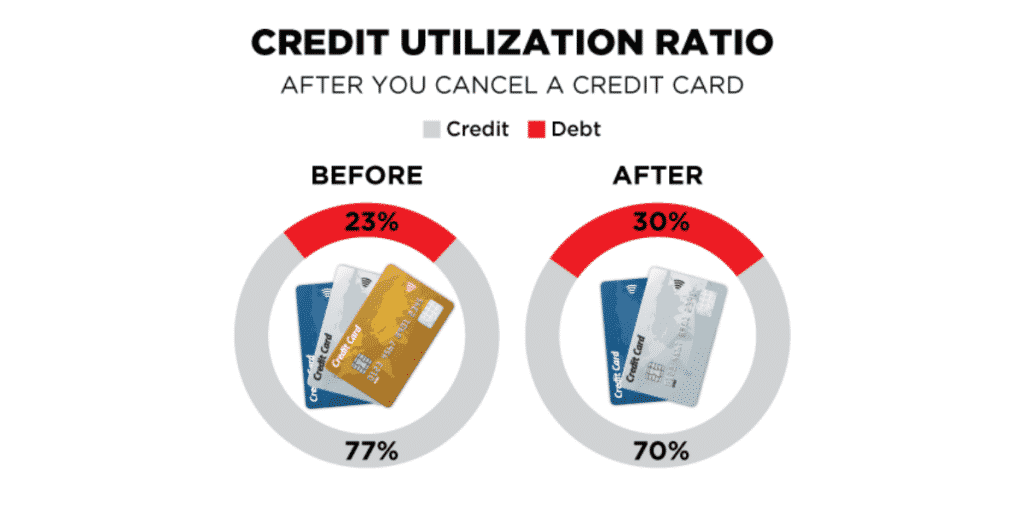

Having a higher credit limit is extremely useful, and you should aim to increase your credit card limits every year or so. The higher your credit limit is, the lower your credit utilization ratio will be if you keep your balances about the same!