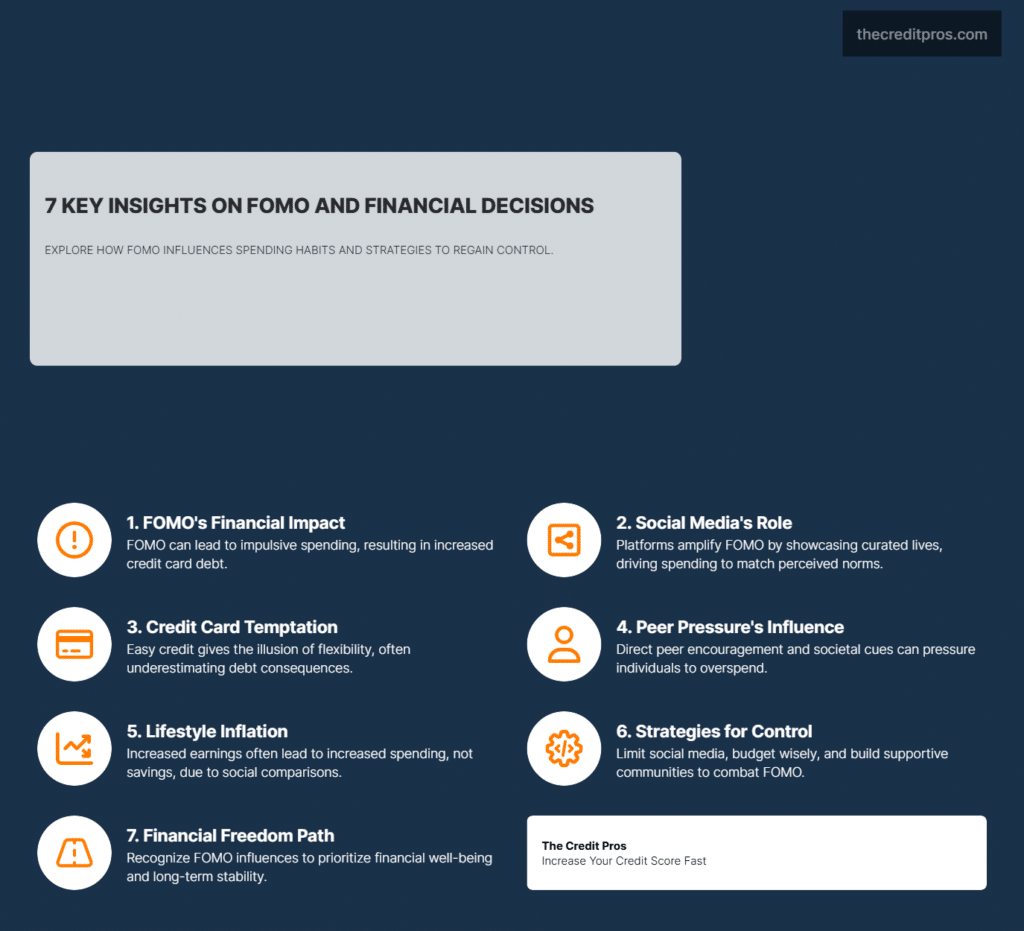

The fear of missing out (FOMO) is deeply rooted in human behavior. It originates from the desire to belong and partake in collective experiences, often leading to anxiety over being excluded from rewarding events or possessions. This anxiety can significantly influence financial choices, driving individuals toward FOMO & deuda de tarjetas de crédito as they make purchases they might otherwise avoid. Social media platforms amplify this effect by constantly showcasing curated highlights of others’ lives, promoting a sense of inadequacy or exclusion that can lead to impulsive spending and increased reliance on credit cards.

FOMO & credit card debt are closely linked, as the instant gratification offered by credit cards makes it easier for individuals to give in to FOMO-driven urges. This often leads to purchases beyond their financial means. The psychological pressure to “keep up with the Joneses” further fuels this spending, pushing individuals to match their peers’ lifestyles despite financial limitations. This cycle of spending to fit in, driven by FOMO & credit card debt, frequently results in mounting balances and increased financial stress.

The role of social media in FOMO & credit card debt cannot be understated. Platforms like Instagram y Facebook showcase curated versions of others’ successes and possessions, intensifying feelings of inadequacy. This often drives individuals to rely on credit to maintain a comparable lifestyle. The psychological impact of FOMO & credit card debt highlights the need for awareness and financial discipline. Understanding these influences is crucial for developing strategies to curb impulsive spending and foster healthier financial habits.

Peer Pressure and Lifestyle Inflation

Peer pressure and social comparison are significant factors in lifestyle inflation and increased credit card debt. As individuals strive to align with perceived social standards, they often find themselves spending beyond their means. This pressure can manifest in various forms, from direct encouragement by peers to subtle societal cues suggesting a particular lifestyle is necessary for acceptance and success.

The concept of upward social comparison further complicates financial behavior. When individuals compare themselves to those who appear more successful or affluent, they may feel compelled to elevate their own status through spending. This often leads to lifestyle inflation, where increased earnings are matched by increased expenditures instead of savings. The financial implications of this behavior are significant, as individuals may find themselves accumulating debt in an attempt to project an image that aligns with societal expectations.

Social dynamics play a key role in FOMO & credit card debt, influencing spending through cultural norms and peer pressure. Some social circles prioritize luxury dining or the latest gadgets, making members feel compelled to keep up. These subtle cues can lead to financial decisions that exceed personal budgets, fueling reliance on credit. Recognizing these influences is crucial for breaking free from lifestyle inflation and fostering healthier financial habits. Awareness and mindful spending can help individuals resist FOMO & credit card debt traps.

- Key influences of peer pressure on spending:

- Direct encouragement from peers

- Societal cues suggesting necessary lifestyles

- Upward social comparison

The Double-Edged Sword of Easy Credit

The widespread availability of credit cards has created a double-edged sword for consumers. They offer convenience and the ability to manage cash flow effectively, but they also exacerbate FOMO-driven spending by providing the illusion of financial flexibility. This perceived flexibility often leads individuals to spend beyond their means, underestimating the long-term consequences of accumulating debt.

Psychologically, the availability of credit can create a sense of security, encouraging individuals to make purchases they might otherwise avoid. This sense of security is often misleading, as it overlooks the reality of interest rates and minimum payments, which can extend the debt repayment period significantly. The illusion of financial freedom provided by credit cards can lead to a cycle of debt that’s difficult to escape.

The long-term effects of FOMO & credit card debt can be severe, as high-interest rates and mounting balances erode financial stability. Relying on credit for FOMO-driven expenses creates a debt cycle that restricts savings and limits financial flexibility. Over time, this can lead to stress and reduced options for managing future expenses. Recognizing the real cost of credit is crucial for making informed financial decisions and avoiding excessive debt. Developing mindful spending habits can help break free from the FOMO & credit card debt trap.

- Consequences of excessive credit reliance:

- Increased debt and financial instability

- Limitations on future financial options

- Difficulty in managing unexpected expenses

Strategies to Combat FOMO and Financial Pressure

Addressing FOMO and its impact on financial behavior requires a multifaceted approach that includes setting boundaries, budgeting, and building supportive communities. One effective strategy is to limit exposure to social media, which often amplifies feelings of inadequacy and exclusion. By setting boundaries around social media use, individuals can reduce the impact of FOMO and make more conscious financial decisions.

Practical budgeting and financial planning are also crucial in managing and mitigating debt. Developing a clear budget that prioritizes needs over wants can help individuals resist the urge to make impulsive purchases driven by FOMO. Additionally, financial planning can provide a roadmap for achieving long-term financial goals, reducing the temptation to seek instant gratification through spending.

Building a supportive community focused on financial health is another effective strategy. Surrounding oneself with individuals who prioritize financial well-being can provide encouragement and accountability, making it easier to resist peer pressure and make informed financial decisions. By fostering an environment that values financial education and responsible spending, individuals can combat the pressures of FOMO and develop healthier financial habits.

Conclusion: Wrapping Up FOMO & Financial Well-being

FOMO & deuda de tarjetas de crédito are closely linked, as social media amplifies impulsive spending habits. The ease of credit card use encourages instant gratification, leading to mounting debt and financial stress. Social pressures and lifestyle inflation push individuals to overspend to maintain appearances, often jeopardizing long-term financial stability. Understanding these influences is key to breaking free from unhealthy spending patterns and fostering financial well-being.

FOMO & credit card debt can derail financial stability if left unchecked. Recognizing how social pressure influences spending is key to breaking the cycle of debt. By prioritizing needs over trends and focusing on long-term financial health, individuals can resist impulsive spending and build a secure financial future. Taking control starts with mindful budgeting and redefining financial priorities.