Improve Your Credit Score

Ahorre dinero y deje de perder oportunidades importantes.

Presentado En

Empezar Hoy

Presentado En

Awards & Reconocimiento

Porqué el ¿Ventajas del crédito?

The Credit Pros has been helping people like you repair their credit score by updating or removing inaccurate items (especially debt collection brands) on credit reports for over a decade.

Nuestro compromiso es asegurarnos de que todos tengan una oportunidad justa de obtener un buen crédito. Fundada por un equipo de expertos en derecho crediticio, The Credit Pros quiere asegurarse de que todos tengan acceso a la misma información y puedan aprender lo que se necesita para generar un buen crédito de por vida.

Not only do we offer credit repair and improvement services, we also provide financial and credit building tools and education resources to help our clients understand what’s on their report (e.g. like specific negative items, etc.) and how their credit score works. With this education and our AI-based credit management tools, our clients can work to take control of their financial future and live a life without credit worries.

Nuestro compromiso es asegurarnos de que todos tengan una oportunidad justa de obtener un buen crédito. Fundada por un equipo de expertos en derecho crediticio, The Credit Pros quiere asegurarse de que todos tengan acceso a la misma información y puedan aprender lo que se necesita para generar un buen crédito de por vida.

Not only do we offer credit repair and improvement services, we also provide financial and credit building tools and education resources to help our clients understand what’s on their report (e.g. like specific negative items, etc.) and how their credit score works. With this education and our AI-based credit management tools, our clients can work to take control of their financial future and live a life without credit worries.

The Impact of Good Credit

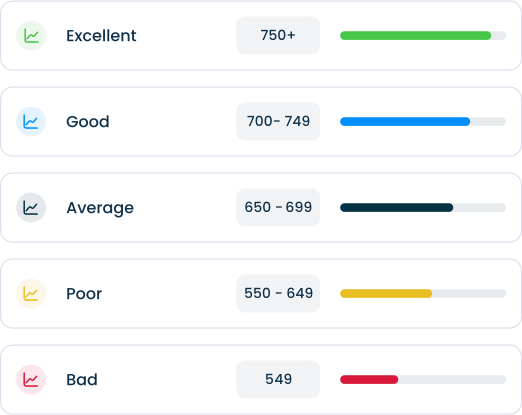

Your credit score determines how much you pay to borrow money to cover modern day essentials including housing, cars, credit cards and loan interest rates.

Use the slider below to see how your credit score range impacts how much you pay for the same items over time. Then ask yourself, can you afford NOT to fix your credit?

300

Credit Rating

Home Loan

Car Loan

Loan

Credit card

Loan Type

30 Year Fixed Mortgage

60 Month New Auto

Personal Loan (2yrs)

Revolving Credit

Loan Amount

$0

$35,000

$5,000

$2,500

APR

No Approval

17.54%

21.14%

30.02%

Monthly Payment

$0

$880

$257

$2,562.43

Total Interest

$0

$17,802

$1,175

$62.43

The Credit Pros offers affordable plans to help you increase your credit score so you pay less for the essentials (and the extras) in life.

Con los profesionales del crédito, usted obtiene

Uno a uno con un

NACSOⒸ Especialista Certificado

Restauración por robo de identidad y seguro incluidos

Cartas de cese y desistimiento a agencias de cobranza

24/7 Access to Your Client Portal

Debt Validation Letters to Creditors

Goodwill Letters to Creditors

Registered and Bonded

Monthly Plan with Unlimited Dispute Letters Available

¿Qué es un ¿Reporte de crédito?

A credit report contains information about an individual’s credit history and financial background. Your credit report will include your full name, any aliases, current and previous addresses, date of birth, Social Security number, phone numbers, and employment.

It will list all types of credit accounts, such as credit cards, loans, and mortgages. Also included are public records (such as tax liens, legal judgements, bankruptcy and foreclosures), credit inquiries from credit applications and soft inquiries for pre-approved offers, and accounts sent to collections for overdue debts.

Credit reports do not include checking or savings account details, income, investments, or criminal records. Credit reports are essential for lenders and others assessing creditworthiness and are used to calculate credit scores.

It will list all types of credit accounts, such as credit cards, loans, and mortgages. Also included are public records (such as tax liens, legal judgements, bankruptcy and foreclosures), credit inquiries from credit applications and soft inquiries for pre-approved offers, and accounts sent to collections for overdue debts.

Credit reports do not include checking or savings account details, income, investments, or criminal records. Credit reports are essential for lenders and others assessing creditworthiness and are used to calculate credit scores.

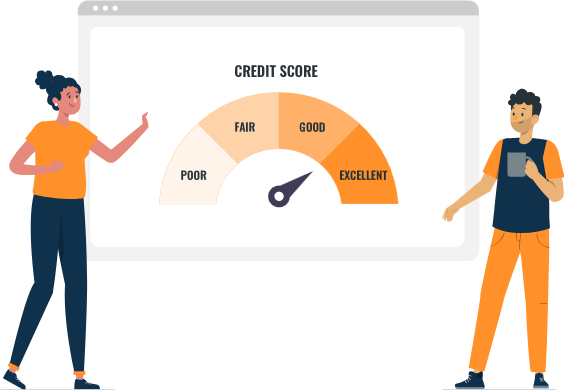

¿Qué es un ¿Puntuación de crédito?

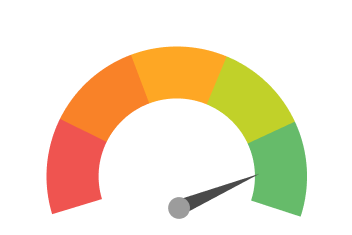

Su puntaje crediticio es un número de 3 dígitos entre 300 y 850 que muestra su solvencia crediticia. Los prestamistas utilizan su puntaje crediticio para decidir si califica o no para préstamos. También utilizan su puntaje crediticio para determinar su tasa de interés.

Los puntajes crediticios se calculan utilizando una fórmula de 5 partes, calculada en función de los siguientes factores: historial de pagos, montos adeudados, duración del historial crediticio, combinación de tipos de crédito y monto de crédito nuevo.

Los puntajes crediticios se calculan utilizando una fórmula de 5 partes, calculada en función de los siguientes factores: historial de pagos, montos adeudados, duración del historial crediticio, combinación de tipos de crédito y monto de crédito nuevo.

Good Credit Runs in the Family

Good credit is crucial for family members living in the same household as it directly influences financial opportunities and stability for everyone involved.

Enrolling a partner or spouse in a credit-building program while building your own credit can be beneficial for several reasons. First, having strong credit scores for both partners is crucial when applying for joint financial products like mortgages or car loans, as lenders often consider the lower credit score to determine eligibility and interest rates. This means that even if one partner has an excellent credit score, a lower score from the other can result in less favorable loan terms.

When you join The Credit Pros, you will have the option to enroll a ‘family member’ for free ($0 enrollment fee) and get 50% off their monthly plan rate!

Enrolling a partner or spouse in a credit-building program while building your own credit can be beneficial for several reasons. First, having strong credit scores for both partners is crucial when applying for joint financial products like mortgages or car loans, as lenders often consider the lower credit score to determine eligibility and interest rates. This means that even if one partner has an excellent credit score, a lower score from the other can result in less favorable loan terms.

When you join The Credit Pros, you will have the option to enroll a ‘family member’ for free ($0 enrollment fee) and get 50% off their monthly plan rate!

lo que nuestro Los clientes dicen

¿Alguna pregunta?

Te tenemos.

¿Por qué esperar? Empiece hoy

Sólo toma 90 segundos registrarse. Comience a corregir errores en su informe crediticio y obtenga ayuda para aumentar su puntaje crediticio. Su información está segura con nosotros. Tratamos tus datos como si fueran propios.