VantageScore 4.0 – 3 Unique Features

VantageScore 4.0 – 3 Unique FeaturesTable of Contents VantageScore 4.0 – 3 Unique Features You may not have realized it before now, but the truth

VantageScore 4.0 – 3 Unique FeaturesTable of Contents VantageScore 4.0 – 3 Unique Features You may not have realized it before now, but the truth

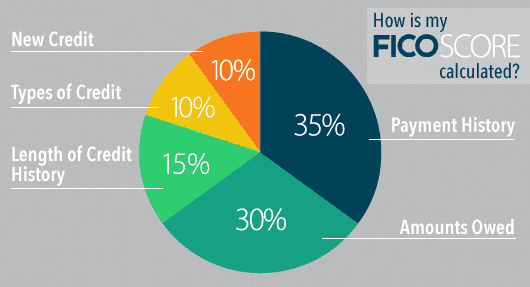

The Most Important Things To Know About Your Credit Score – Part Two This is the 2nd in a 5-part series where we explain all

Prescreened Credit Card Offers and Your Credit Your credit reports and scores are probably used for a lot more purposes than you even realize. Sure,

“I’m trying to fix my credit so I just closed several of my credit card accounts.” This is one of the last statements which any

Privacy and Cookies

We use cookies on our website. Your interactions and personal data may be collected on our websites by us and our partners in accordance with our Privacy Policy and Terms & Conditions