Pursuing homeownership with a less-than-stellar credit score can feel like an uphill battle. Many potential buyers assume that home loans poor credit automatically disqualify them from mortgage approval, but the reality is more nuanced. While credit challenges certainly impact your options and terms, various pathways to homeownership remain open even with poor credit scores. Specifically, home loans poor credit can provide alternative routes to financing. Ensuring that you understand home loans poor credit will help you navigate the lending landscape. What specific credit issues matter most to lenders? And which mortgage programs might overlook certain credit problems while focusing on other financial strengths? Understanding home loans poor credit options can be your key to success.

The good news is that with proper preparation and strategy, securing a home loan with poor credit becomes a realistic goal rather than an impossible dream. This process requires understanding exactly where you stand credit-wise, exploring specialized loan programs designed for credit-challenged borrowers, including options specifically for home loans for poor credit, and learning how to strengthen other aspects of your application. By working with the right professionals and implementing both short and long-term credit improvement tactics, you can navigate the mortgage landscape successfully despite credit limitations that might initially seem insurmountable.

As you explore home loans poor credit options, keep in mind that working with professionals familiar with home loans poor credit can greatly enhance your chances of approval.

Understanding home loans poor credit options is essential for success. With proper preparation and strategy, securing a home loan with poor credit becomes a realistic goal rather than an impossible dream. This process requires understanding exactly where you stand credit-wise, exploring specialized loan programs designed for credit-challenged borrowers, including options specifically for home loans for poor credit, and learning how to strengthen other aspects of your application.

Home loans poor credit: understanding your options is essential in overcoming barriers that may seem daunting at first. When approaching mortgage lenders, exploring home loans poor credit options thoroughly will empower you in the decision-making process. For those considering home loans poor credit, understanding the components of your score is crucial for securing favorable terms. Moreover, being aware of the specific home loans poor credit programs available can guide you to the best choices for your situation.

Understanding how home loans poor credit can be structured is vital for navigating this process effectively.

Home Loans Poor Credit: Overcoming the Barriers

Additionally, examining how home loans poor credit work can provide insights into your financial future. If you qualify, home loans poor credit options such as FHA loans might be more accessible than you think. For eligible applicants, home loans poor credit programs like VA and USDA loans can also present attractive alternatives. Home loans poor credit options available through portfolio lenders may be worth exploring as well.

With home loans poor credit, non-QM loans offer flexibility that might suit your needs. Utilizing home loans poor credit for consolidating debts can significantly improve your financial situation. Refinancing options with home loans poor credit can also facilitate better terms as you improve your financial standing. Strategically approaching home loans poor credit will yield benefits for your future financial health.

In addition, home loans poor credit provide a pathway to financial stability when managed correctly. Recognizing the significance of home loans poor credit helps you navigate your financial journey.

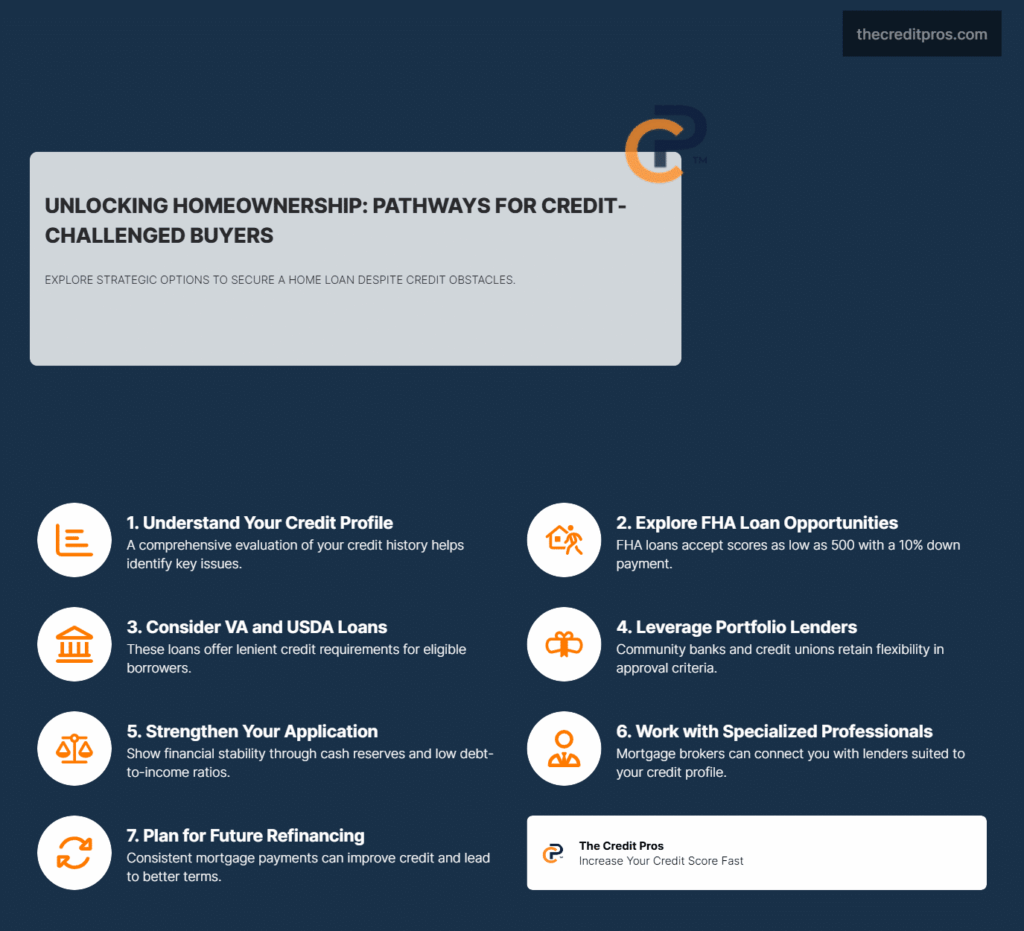

When approaching mortgage lenders with less-than-perfect credit, knowledge becomes your greatest asset. Understanding exactly where you stand credit-wise requires more than simply knowing your numeric score. Mortgage lenders conduct a comprehensive evaluation of your credit profile, examining patterns, specific events, and the timeline of your credit history.

Credit scores for mortgage purposes typically fall into several tiers. Conventional loans generally prefer scores above 620, while FHA loans may accept scores as low as 500 with a larger down payment. However, these numbers only tell part of the story. Lenders scrutinize the specific components that comprise your score, giving particular weight to payment history y credit utilization. Late payments on existing mortgages or rent carry significantly more negative weight than late payments on retail accounts, as they directly demonstrate your approach to housing obligations.

The recency of credit issues plays a crucial role in lender assessment. Credit events that occurred within the past 12-24 months generally create the most significant obstacles. Many lenders implement “seasoning periods” after major credit events—typically two years for Chapter 13 bankruptcies, four years for Chapter 7 bankruptcies, and three years for foreclosures. However, these timeframes aren’t absolute barriers; they often represent the point at which the negative impact begins to diminish substantially. Understanding these timelines allows you to strategically time your mortgage application for optimal results.

Credit report errors can significantly impact your approval chances, and addressing them represents one of the fastest paths to score improvement. According to consumer protection studies, approximately 20% of credit reports contain material errors that could affect lending decisions. A thorough review should identify accounts that don’t belong to you, incorrectly reported late payments, or outdated negative information that should have aged off your report. Disputing these errors through both the credit bureaus and directly with creditors can yield improvements within 30-45 days—potentially making the difference between rejection and approval.

Beyond the standard credit score factors, mortgage lenders evaluate your credit behavior patterns. They examine whether credit problems stem from a single catastrophic event (medical emergency, job loss) or demonstrate a pattern of financial mismanagement. Providing context for past credit challenges through a well-crafted letter of explanation can significantly influence how lenders interpret negative items. This document should concisely explain the circumstances, demonstrate how the situation was resolved, and highlight the steps taken to prevent recurrence.

Exploring Specialized Mortgage Options for Credit-Challenged Borrowers

Federal Housing Administration (FHA) loans represent the most accessible path to homeownership for credit-challenged borrowers. With minimum credit score requirements starting at 500 (with a 10% down payment) or 580 (with 3.5% down), these government-backed loans provide significant flexibility. The FHA’s manual underwriting process allows consideration of compensating factors that automated systems might overlook. However, FHA loans carry mandatory mortgage insurance premiums (MIP) for the life of the loan in most cases, adding to your monthly payment costs. These loans also implement stricter property standards, requiring the home to meet specific safety and structural criteria.

Veterans Affairs (VA) and U.S. Department of Agriculture (USDA) loans offer even more lenient credit requirements for qualifying borrowers. VA loans, available to service members, veterans, and eligible spouses, technically have no minimum credit score requirement, though most lenders impose their own minimums (typically around 580-620). These loans offer 100% financing with no down payment requirement and no mortgage insurance. Similarly, USDA loans for rural and some suburban properties focus more on income eligibility than credit scores, with many approved applicants having scores in the 580-640 range. Both programs evaluate applications holistically, considering residual income and overall financial stability beyond credit scores.

Portfolio lenders provide a crucial alternative for borrowers who don’t fit conventional or government-backed loan parameters. Unlike standard mortgage lenders who sell loans to investors, portfolio lenders retain loans on their own books, giving them greater flexibility in setting approval criteria. Community banks, credit unions, and specialized mortgage companies often function as portfolio lenders, evaluating applications on a case-by-case basis. These institutions may offer “non-warrantable” mortgages that consider alternative credit data like rent payment history, utility payments, and even cell phone bills. While these loans typically carry higher interest rates (usually 1-2.5% above conventional rates), they provide a viable pathway to homeownership with the potential to refinance later.

Non-Qualified Mortgage (Non-QM) loans have emerged as an important option for credit-challenged borrowers, particularly those with complex income situations. These loans don’t meet the “qualified mortgage” standards set by the Consumer Financial Protection Bureau, allowing lenders more flexibility in approval criteria. Non-QM products often feature alternative income verification methods, accepting bank statements rather than traditional W-2s or tax returns—ideal for self-employed borrowers or those with irregular income. Interest rates typically range from 1-4% higher than conventional loans, with down payment requirements starting at 10-20%. While more accessible, these loans require careful evaluation to ensure the terms remain manageable long-term.

With home loans poor credit, you can strategically consolidate debt and potentially improve your credit standing. This approach allows you to replace your existing mortgage with a larger loan, taking the difference in cash to pay off high-interest debts. By consolidating credit card balances and other unsecured debts into your mortgage, you can reduce your overall debt-to-income ratio and potentially improve your credit score through lower utilization ratios.

For current homeowners with equity, cash-out refinancing presents a strategic option to consolidate debt and potentially improve credit standing. This approach allows you to replace your existing mortgage with a larger loan, taking the difference in cash to pay off high-interest debts. By consolidating credit card balances and other unsecured debts into your mortgage, you can reduce your overall debt-to-income ratio and potentially improve your credit score through lower utilization ratios. This strategy works best when you’ve built substantial equity (at least 20-30%) and when the interest rate differential between your credit cards and the refinanced mortgage creates meaningful savings. Unsecured loans typically require excellent or good credit scores since the lender is appraising risk primarily on the borrower’s creditworthiness, making this a challenging option for those with poor credit.

Strengthening Your Application Beyond Credit Scores

When navigating mortgage applications with credit challenges, compensating factors become essential tools for demonstrating creditworthiness beyond the traditional score. Lenders recognize that credit scores represent only one dimension of financial responsibility, and they’re increasingly willing to consider alternative indicators of reliability. Substantial cash reserves, typically defined as having 3-6 months of mortgage payments (including taxes and insurance) in savings after closing, demonstrate financial stability and emergency preparedness. Similarly, a low overall debt-to-income ratio can offset credit concerns by showing that despite past issues, your current financial situation allows comfortable management of a mortgage payment.

A substantial down payment serves as perhaps the most powerful compensating factor when applying with poor credit. While conventional loans typically require 20% down, credit-challenged borrowers should aim for 25-30% when possible. This larger equity position significantly reduces lender risk and often translates to more favorable interest rates and terms. Beyond improving approval odds, larger down payments create immediate equity, potentially eliminating the need for private mortgage insurance and reducing monthly payments. Consider these down payment strategies:

- Leverage gift funds from family members (properly documented with gift letters)

- Explore down payment assistance programs offered by state and local housing authorities

- Utilize retirement account loans (though carefully weighing the implications)

- Combine savings strategies, including automatic transfers to dedicated accounts

- Investigate employer-assisted housing benefits, increasingly offered as workplace perks

By considering home loans poor credit, you are taking the first step toward achieving homeownership.

Optimizing your debt-to-income (DTI) ratio provides another powerful strategy for strengthening your application. Lenders typically prefer a back-end DTI (including the proposed mortgage payment) below 43%, though FHA and some portfolio lenders may accept ratios up to 50% with strong compensating factors. Temporarily reducing work hours or taking on a second job can strategically improve this ratio during the application process. Consider paying down revolving accounts to 30% of their limits rather than closing them entirely, as this approach improves both your credit utilization ratio and preserves credit history length. For maximum impact, focus debt reduction efforts on accounts with the highest interest rates and those reporting the highest utilization to credit bureaus.

Employment stability carries significant weight in mortgage underwriting, particularly for applicants with credit challenges. Lenders typically look for two years of consistent employment in the same field, though not necessarily with the same employer. Career advancement changes are viewed positively, while frequent job-hopping or unexplained employment gaps raise concerns. Self-employed applicants face additional scrutiny, generally needing to demonstrate two years of stable or increasing income through tax returns. If your employment history contains gaps or changes, be prepared to provide detailed explanations and documentation of any periods of education, family leave, or other reasonable interruptions. Maintaining your current employment situation throughout the application process is crucial, as lenders typically verify employment again just before closing.

Creating a compelling financial narrative through thorough documentation can significantly influence lending decisions. Beyond the standard required documents (tax returns, pay stubs, bank statements), credit-challenged applicants should proactively provide supplementary materials that demonstrate financial responsibility. Compile 12-24 months of on-time rent payment history, preferably from a management company rather than a private landlord. Document consistent payments for utilities, insurance, and other obligations not typically reported to credit bureaus. Include explanatory letters for any credit issues, focusing on specific events rather than general financial difficulties, and emphasizing the corrective actions taken. This comprehensive documentation package allows underwriters to look beyond automated scoring systems and evaluate your application holistically.

Working with the Right Professionals and Institutions

Finding mortgage lenders who specialize in working with credit-challenged borrowers requires strategic research beyond mainstream banking institutions. These specialized lenders typically advertise their focus on “non-prime” or “flexible credit” lending and have established processes for evaluating applications that don’t meet conventional guidelines. Start by identifying lenders who offer government-backed programs like FHA, VA, and USDA loans, as these inherently accommodate lower credit scores. Online mortgage marketplaces can facilitate comparisons between multiple lenders’ credit requirements, while industry publications often highlight lenders focused on underserved borrowers. When evaluating potential lenders, look beyond their advertised minimum credit scores to understand their actual approval patterns, as many institutions approve loans below their published minimums when compensating factors exist.

Consequently, understanding home loans poor credit will prepare you for the challenges ahead. Acquiring knowledge about home loans poor credit enables you to make informed decisions for your future. Ultimately, leveraging home loans poor credit can lead to beneficial financial outcomes over time. Hence, embracing home loans poor credit as a viable option will empower your financial recovery.

Mortgage brokers provide particularly valuable services for credit-challenged applicants. Unlike loan officers who work for specific institutions with limited product offerings, brokers maintain relationships with dozens of lenders across various specialties. This network allows them to match your specific situation with the most appropriate lending programs, often including portfolio lenders not directly accessible to consumers. Experienced brokers understand the nuanced differences between underwriting guidelines and can strategically position your application to highlight strengths while addressing weaknesses. When selecting a broker, prioritize those with specific experience handling credit challenges similar to yours, verified through client testimonials and professional references.

Therefore, home loans poor credit should not deter you from pursuing your homeownership goals. Ultimately, home loans poor credit represent a beginning, not an end, in your journey toward financial empowerment.

When interviewing potential lenders or brokers, asking targeted questions about their poor credit policies reveals crucial information about their suitability for your situation. Inquire about their manual underwriting capabilities, as automated systems typically apply stricter credit standards with less flexibility for compensating factors. Determine whether they consider alternative credit data beyond traditional credit reports, such as rent, utilities, and insurance payments. Ask about their experience with borrowers who have specific credit issues similar to yours, requesting anonymous case studies that demonstrate successful outcomes. Discuss their pre-approval process, particularly whether they conduct comprehensive reviews before submission rather than simple pre-qualifications based on limited information.

Finding mortgage lenders who specialize in home loans poor credit requires strategic research beyond mainstream banking institutions. These specialized lenders typically advertise their focus on “non-prime” or “flexible credit” lending and have established processes for evaluating applications that don’t meet conventional guidelines.

Recognizing warning signs of predatory lending becomes particularly important when seeking mortgages with credit challenges. Be wary of lenders who don’t require income verification or who pressure you to borrow more than requested. Legitimate lenders always verify your ability to repay through documented income and assets. Excessive fees represent another red flag—while credit-challenged loans legitimately carry higher costs, application fees exceeding $1,000 or origination fees above 5% generally indicate predatory practices. Avoid lenders who discourage comparison shopping or create artificial urgency through “limited-time offers.” Prepayment penalties that extend beyond three years or balloon payments that require refinancing typically signal unfavorable loan structures designed to maximize lender profit rather than facilitate sustainable homeownership.

Building relationships with smaller financial institutions often yields better results for credit-challenged applicants than approaching large national banks. Community banks and credit unions frequently implement more flexible underwriting standards, considering local market knowledge and individual circumstances in their decisions. These institutions typically retain loans in their own portfolios rather than selling them to secondary market investors, allowing greater flexibility in approval criteria. Credit unions, in particular, operate as member-owned cooperatives with a mission to serve their communities, often resulting in more accommodating policies for members with credit challenges. Establishing accounts with these institutions before applying for mortgages demonstrates commitment and provides opportunities to explain past credit issues directly to decision-makers who may consider factors beyond automated scoring models.

When interviewing potential lenders or brokers about home loans poor credit, asking targeted questions reveals crucial information about their suitability for your situation. Inquire about their manual underwriting capabilities, as automated systems typically apply stricter credit standards with less flexibility for compensating factors.

Long-term Strategies: From Approval to Refinancing

When planning for home loans poor credit, creating a compelling financial narrative through thorough documentation can significantly influence lending decisions.

Accepting initial mortgage terms while planning for future refinancing represents a strategic approach to homeownership with credit challenges. Your first mortgage may come with compromises—higher interest rates, larger down payment requirements, or mortgage insurance—but these terms need not be permanent. Viewing this initial loan as a stepping stone allows you to establish property ownership while simultaneously rebuilding credit. The current mortgage market offers multiple refinancing pathways as your credit improves, including rate-and-term refinancing to lower interest costs, FHA-to-conventional refinancing to eliminate mortgage insurance, and eventually cash-out refinancing to access equity for other financial goals.

Understanding the timeline for credit improvement helps establish realistic refinancing expectations. Most negative credit items impact your score most significantly in the first 24 months, with diminishing effects thereafter. Late payments, collections, and charge-offs generally influence credit scores for seven years, while bankruptcies may remain for up to ten years. However, the impact of these items decreases substantially after the first two years, particularly when counterbalanced by positive payment history. With consistent mortgage payments and responsible credit management, many borrowers qualify for significantly better terms within 18-36 months of their initial purchase. This improvement timeline accelerates when combining mortgage payment history with strategic use of other credit products.

Accepting initial mortgage terms while planning for future refinancing with home loans poor credit represents a strategic approach to homeownership. Your first mortgage may come with compromises—higher interest rates or larger down payment requirements—but these terms need not be permanent.

Secured credit products offer powerful tools for rebuilding credit while in your new home. Unlike unsecured credit cards that may remain inaccessible with poor credit, secured cards require cash deposits that serve as collateral, making them available to most consumers regardless of credit history. Starting with a secured card with a $300-500 limit, making small purchases, and paying the balance in full each month establishes positive payment patterns reported to all three major credit bureaus. Similarly, credit-builder loans (sometimes called share-secured loans at credit unions) allow you to make deposits into an account while simultaneously making payments on a “loan” against those funds. These structured products create positive payment history while minimizing the risk of additional debt, complementing your mortgage payments in rebuilding your credit profile.

Implementing automated payment systems for all financial obligations provides essential protection for your improving credit profile. Late payments on any account, not just your mortgage, can significantly impede your progress toward better credit and refinancing eligibility. Setting up automatic payments for at least the minimum due on all accounts ensures consistent on-time payment history, the most heavily weighted factor in credit scoring models. For maximum benefit, schedule these automatic payments 3-5 days before actual due dates to allow for processing time and weekend/holiday adjustments. Maintain sufficient balance buffers in payment accounts, and implement account alerts to notify you of low balances, payment processing, and any unusual activity that could disrupt your payment schedule.

Homeownership itself provides unique opportunities to strengthen your credit profile beyond what’s possible as a renter. Property appreciation combined with regular mortgage payments builds equity that can be strategically leveraged for credit improvement. As your home equity increases, you gain access to home equity lines of credit (HELOCs) or home equity loans, which typically offer lower interest rates than unsecured debt. These secured products allow for debt consolidation under more favorable terms while demonstrating responsible management of multiple credit types—a positive factor in credit scoring models. Additionally, mortgage payments typically receive greater weight in credit algorithms than other types of installment loans, accelerating score improvements compared to other forms of credit rehabilitation. By maintaining perfect payment history on your mortgage while strategically utilizing other credit products, you create a comprehensive credit improvement strategy that maximizes your refinancing options for borrowers with challenging credit histories.

Conclusion: Your Path Forward

Homeownership remains attainable even with credit challenges when you approach the process strategically. By understanding exactly how lenders evaluate your credit profile, exploring specialized mortgage programs designed for credit-challenged borrowers, and strengthening compensating factors like down payment and employment stability, you can overcome obstacles that initially seem insurmountable. Working with the right professionals—particularly those specializing in non-prime lending—while avoiding predatory practices creates a viable pathway to approval despite less-than-perfect credit.

Homeownership remains attainable even with credit challenges when you approach the process strategically. By understanding home loans poor credit and how lenders evaluate your credit profile, exploring specialized mortgage programs designed for credit-challenged borrowers, and strengthening compensating factors like down payment and employment stability, you can overcome obstacles that initially seem insurmountable.

Remember that home loans poor credit represent just the beginning of your homeownership journey, not the final destination. With consistent on-time payments, strategic credit rebuilding tactics, and patience, you’ll position yourself for refinancing under significantly better terms within 18-36 months.

Remember that your first mortgage represents just the beginning of your homeownership journey, not the final destination. With consistent on-time payments, strategic credit rebuilding tactics, and patience, you’ll position yourself for refinancing under significantly better terms within 18-36 months. The mortgage that seems challenging today becomes the foundation for tomorrow’s financial strength—proving that credit history doesn’t have to dictate your financial future, but rather serves as just one chapter in your ongoing story of homeownership and financial recovery.