Weddings are joyous occasions, but wedding debt can bring financial challenges that linger long after the vows are exchanged. As couples in the United States plan their big day, it’s crucial to consider the impact of wedding debt on their financial health and credit scores. Celebrating without sacrificing your financial future requires strategic financial planning, allowing you to enjoy a memorable wedding while keeping your credit intact.

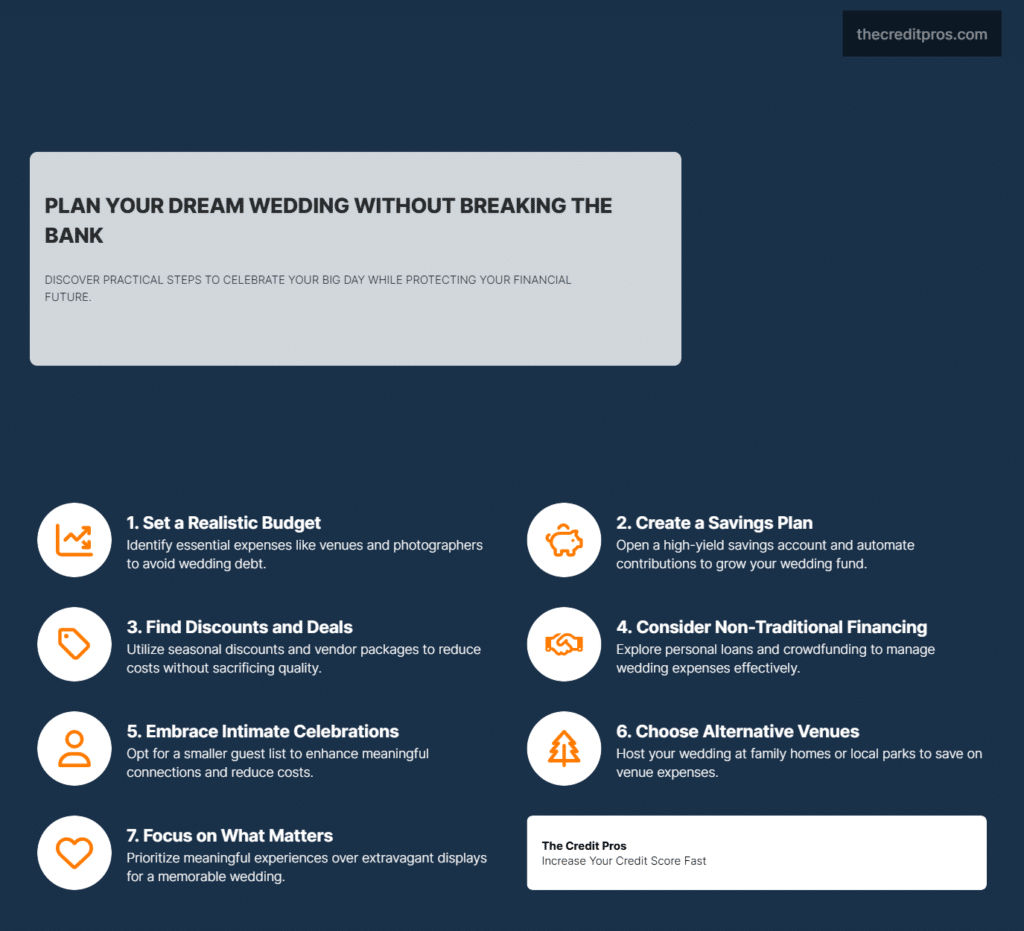

Planning starts with a realistic budget and a dedicated savings plan to avoid wedding debt. Consider often-overlooked opportunities for saving, like seasonal discounts or creative financing options. A more intimate celebration could offer both emotional and financial benefits. This guide will explore these questions, offering practical advice for couples looking to say “I do” without wedding debt. By the time you’re done reading, you’ll be equipped to plan a beautiful wedding and step into married life with confidence in your financial stability.

Building a Realistic Wedding Budget

Creating a realistic wedding budget is essential for avoiding wedding debt. Start by identifying all potential expenses, from the venue and catering to smaller items like invitations and party favors. A detailed budget should cover both essential and non-essential items, helping couples distinguish between what’s necessary and what might be considered a luxury. Using budgeting tools and apps can greatly enhance the tracking and management of wedding expenses. These digital tools provide real-time updates and alerts, ensuring you stay on track and make informed financial decisions.

Prioritizing expenses is crucial to avoiding wedding debt. Begin by categorizing expenses into essential and non-essential. Essential items might include the venue, catering, and photographer, while non-essentials could be extravagant decor or custom party favors. By clearly distinguishing these categories, couples can allocate their budget effectively, ensuring that funds are directed toward what truly matters. Budgeting apps can offer insights into spending patterns, identify potential savings, and adjust plans to prevent wedding debt.

- Essential Expenses:

- Venue

- Catering

- Photographer

- Non-Essential Expenses:

- Extravagant decor

- Custom party favors

Establishing a Dedicated Wedding Savings Plan

A dedicated wedding savings plan can significantly ease financial stress. Opening a high-yield savings account is an effective way to grow your wedding fund over time. With higher interest rates compared to standard savings accounts, these accounts offer a strategic advantage in accumulating funds. Consistent savings are key, and setting up automated transfers from your primary account to the wedding fund can ensure regular contributions without constant oversight.

Creative saving strategies can also help prevent wedding debt. Consider reallocating funds from non-essential monthly expenses, like dining out or entertainment, towards your wedding savings. Additionally, exploring side gigs or freelance opportunities can provide an extra income stream dedicated solely to wedding expenses. By diversifying your savings strategies, you can ensure steady growth of your wedding fund without compromising your daily living expenses or accumulating wedding debt.

Navigating Wedding Discounts and Deals

Taking advantage of wedding discounts and deals can result in significant savings. Seasonal discounts are a great place to start. Many venues offer reduced rates during off-peak months or weekdays, translating to substantial savings. Vendors often provide package deals that bundle services like photography, videography, and floral arrangements, offering cost efficiency without sacrificing quality.

Exploring second-hand and rental options for attire and decor is another effective strategy. Gently used wedding dresses, tuxedos, and decorations can be found at a fraction of the cost of new items, allowing couples to maintain elegance without financial strain. By being open to these alternatives, couples can allocate their budget more effectively, ensuring that funds are available for other essential aspects of the wedding.

Exploring Non-Traditional Financing Options

Considering non-traditional financing options can provide financial flexibility. Personal loans often carry lower interest rates compared to credit cards, making them a more affordable option for wedding expenses. It’s important to understand the terms and conditions of these loans, as well as their impact on your credit score. A well-researched loan can offer manageable repayment terms, easing the financial burden post-wedding.

Crowdfunding has emerged as a popular alternative for financing weddings. Platforms like GoFundMe allow friends and family to contribute towards specific wedding expenses. While this approach can be effective, it’s crucial to approach it with sensitivity and transparency. Not everyone may be comfortable contributing, so it’s important to convey gratitude and ensure that contributors understand their support is appreciated but not expected.

Embracing Intimate and Meaningful Celebrations

Choosing a smaller, more intimate wedding can benefit both your financial and emotional health. A reduced guest list means fewer expenses related to catering, invitations, and venue size. This approach not only alleviates financial pressure but also allows for a more personal and meaningful celebration with those who matter most.

Alternative venues present another opportunity for savings. Consider hosting the wedding at a family home, local park, or small restaurant. These venues can offer charm and intimacy without the hefty price tag associated with traditional wedding venues. Emphasizing meaningful experiences over extravagant displays ensures that the day remains memorable for all the right reasons. By focusing on what truly matters, couples can create a beautiful wedding that reflects their values and commitment without compromising their financial future.

Conclusion: Celebrating Love Without Financial Regret

Planning a wedding without accumulating wedding debt is entirely achievable with strategic preparation and thoughtful decision-making. By building a realistic budget, establishing a dedicated savings plan, and exploring discounts, deals, and non-traditional financing options, couples can enjoy a memorable day that aligns with their financial goals. Embracing intimate celebrations highlights the importance of meaningful connections over extravagant expenses, helping to avoid unnecessary wedding debt.

As you begin this journey, remember that a beautiful wedding doesn’t have to lead to wedding debt. It calls for a focus on what truly matters—celebrating love and commitment with those closest to you. By prioritizing financial stability alongside your wedding plans, you ensure a strong start to married life. The choices you make today lay the groundwork for a secure future, helping you avoid unnecessary wedding debt. Isn’t it time to rethink what truly creates joy and fulfillment on your wedding day?