When you apply for new credit, you’re not just adding another account to your wallet—you’re triggering a complex chain reaction that affects multiple components of your credit score. While most people know that new credit accounts for 10% of their FICO score, the reality involves intricate timing windows, mathematical calculations, and strategic considerations that can make the difference between a minor temporary dip and a significant score reduction.

Understanding the impact of new credit is essential for anyone seeking to improve their financial health. The impact of new credit can vary significantly based on individual circumstances. The impact of new credit is often misunderstood by consumers. Ultimately, the impact of new credit hinges on several critical factors. The impact of new credit can be particularly significant for individuals with shorter credit histories. Understanding the specific impact of new credit on your overall financial situation is crucial. The direct impact of new credit applications can lead to varying outcomes based on profile thickness. The impact of new credit choices is compounded by multiple factors. Each new account can change the overall impact of new credit on your score. The overall impact of new credit on scores can fluctuate widely.

The impact of new credit extends far beyond the simple “hard inquiry equals points lost” equation that many assume. Your credit profile‘s thickness, the timing of your applications, and even the types of accounts you’re opening all play crucial roles in determining how new credit will affect your score both immediately and over time. What happens when you open multiple accounts within weeks of each other, and why does the same inquiry have different impacts on different people’s scores?

The Dual Nature of Credit Inquiries: Why Timing and Type Matter More Than Frequency

The impact of new credit on your credit mix should not be underestimated. Credit inquiries operate within two distinct timeframes that create confusion for many consumers attempting to understand their score impact. While inquiries remain visible on your credit report for 24 months, FICO scoring models only consider inquiries from the past 12 months when calculating your score. This dual timeline means that an inquiry from 18 months ago still appears on your report but carries zero weight in your current score calculation.

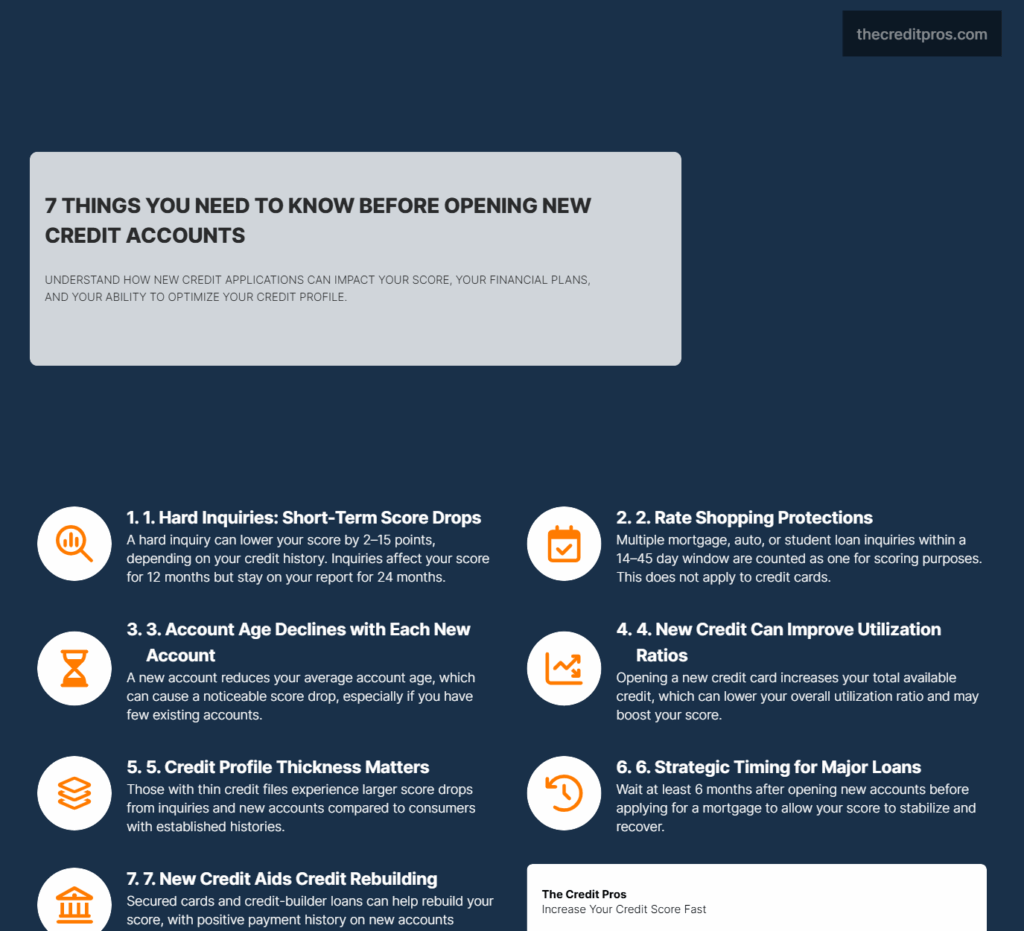

The distinction between hard and soft inquiries represents one of the most misunderstood aspects of new credit scoring. Hard inquiries occur when you actively apply for credit, triggering a lender’s request to review your full credit report for lending decisions. These inquiries can temporarily reduce your score by a few points, with the impact typically lasting less than 12 months. Soft inquiries, generated by pre-qualification checks, account monitoring, or your own credit report requests, never affect your credit score regardless of frequency.

Rate shopping protections built into FICO scoring algorithms acknowledge that consumers need to compare offers for major purchases like homes, vehicles, or student loans. Multiple inquiries for the same type of loan within a 14-45 day window count as a single inquiry in score calculations. This protection recognizes that responsible borrowers shop for the best rates rather than accepting the first offer they receive. However, this protection doesn’t extend to credit card applications, where each inquiry counts separately regardless of timing.

The inquiry impact varies dramatically based on your existing credit profile’s thickness and overall health. For someone with a robust credit history spanning decades with multiple accounts, a single inquiry might reduce their score by 2-3 points temporarily. Conversely, someone with a thin credit file containing only one or two accounts might experience a 10-15 point reduction from the same inquiry. This disparity occurs because the inquiry represents a larger percentage of the total credit information available for scoring in thinner profiles.

The Account Age Paradox: How New Credit Disrupts Your Credit History Timeline

Average account age calculations create mathematical realities that many consumers don’t anticipate when opening new accounts. Your credit score considers both the age of your oldest account and the average age of all your accounts, with new accounts immediately reducing this average. For someone with five accounts averaging 10 years old, adding a new account drops the average to approximately 8.3 years, representing a significant shift in this scoring factor.

The impact of new accounts on credit history length becomes particularly pronounced for consumers with thin credit files. Someone with only two existing accounts, each five years old, sees their average account age drop to 3.3 years when adding a new account. This dramatic reduction explains why financial advisors often recommend that young adults avoid opening multiple accounts rapidly, as each new account compounds the average age reduction effect. Evaluating the impact of new credit on your accounts requires careful analysis.

Authorized user accounts can provide strategic buffering against new account age effects, though this strategy requires careful consideration. When you’re added as an authorized user to someone else’s established account, that account’s age typically contributes to your credit history length calculations. However, opening new accounts in your own name while maintaining authorized user status allows you to build independent credit history while benefiting from the age buffer of the authorized user account.

The recovery timeline for account age disruption follows a predictable pattern, though patience remains essential. New accounts begin contributing positively to your credit mix and payment history immediately, but their age-related negative impact diminishes gradually over months and years. After six months, the new account impact typically lessens, and after 12 months, the account begins contributing more positively to your overall profile as it ages.

Credit Utilization Dynamics: The Hidden Consequences of New Credit Limits

The speed at which the impact of new credit fades varies by individual. New credit limits create immediate changes to your overall utilization calculations that can work either for or against your credit score depending on how you manage them. When you open a new credit card with a $5,000 limit while maintaining the same balances on existing cards, your overall utilization ratio decreases automatically. This mathematical improvement can boost your score even before you make your first payment on the new account. Recognizing the impact of new credit on your overall financial goals is vital. The cumulative impact of new credit decisions can shape your financial future.

The temporary utilization spike from new account spending represents a critical consideration that many consumers overlook. Even if you plan to pay off new purchases immediately, credit card companies report balances to credit bureaus on specific dates that might not align with your payment schedule. A large purchase on a new card might appear as high utilization for a full reporting cycle, temporarily impacting your score despite your intention to pay the balance quickly.

Per-card utilization considerations become increasingly complex as you add new accounts to your credit mix. FICO scoring models evaluate both your overall utilization across all cards and individual card utilization ratios. Keeping individual cards below 30% utilization, and ideally below 10%, becomes more challenging to track as your account portfolio grows. Many consumers benefit from setting up alerts or using apps to monitor utilization across multiple accounts. Unused new credit cards can improve your score over time through several mechanisms. The influence of each new credit line on your overall score is substantial.

Ultimately, the impact of new credit can serve as both a risk and a benefit.

- Increased available credit reduces overall utilization ratios•

- Account aging gradually improves average account age calculations•

- Credit mix diversification can boost the credit mix scoring factor•

- Payment history opportunities allow you to demonstrate consistent on-time payments•

- Emergency credit availability prevents future high-utilization situations•

The relationship between new credit and credit mix diversification creates opportunities for strategic score improvement. Adding an installment loan to a credit profile dominated by revolving credit, or vice versa, can boost the credit mix factor that accounts for 10% of your FICO score. However, this benefit must be weighed against the temporary negative impacts of the new account and inquiry.

Strategic New Credit Management: Timing, Sequencing, and Recovery Tactics

Pre-planning major credit applications around significant life events requires understanding the timeline for score recovery and the relative importance of different credit decisions. Mortgage applications demand the highest credit scores for optimal rates, making them the priority around which other credit decisions should be planned. Auto loans typically offer more flexibility in credit score requirements, while credit card applications have the least stringent standards but the most frequent opportunities.

The six-month rule for major loan applications after opening new accounts reflects the typical timeline for inquiry impact reduction and new account stabilization. While inquiries continue affecting your score for up to 12 months, their impact diminishes significantly after the first few months. New accounts begin contributing more positively to your credit mix and payment history, while their negative age impact lessens as they mature past the newest account threshold.

Sequencing different types of credit applications requires understanding how each affects your credit profile differently. Mortgage shopping should occur first due to rate shopping protections and the high stakes involved in securing optimal rates. Auto loan applications can follow, benefiting from similar rate shopping protections. Credit card applications should generally come last, as they don’t benefit from rate shopping protections and offer ongoing opportunities rather than time-sensitive purchases.

Emergency credit needs versus planned credit expansion strategies demand different approaches to new credit management. Emergency situations might require accepting temporary score impacts to secure necessary credit access, while planned expansions allow for strategic timing and preparation. Building emergency credit access before you need it prevents forced decisions during financial stress when you might not qualify for optimal terms.

Monitoring and measuring recovery from the impact of new credit involves tracking multiple metrics beyond just your credit score. Average account age, total available credit, utilization ratios, and inquiry counts all provide insights into how new credit affects your profile. Many consumers benefit from monthly monitoring during the first year after opening new accounts to understand their personal recovery patterns and optimize future credit decisions.

The Rebuilding Advantage: When New Credit Becomes Your Credit Repair Tool

New credit serves as an essential tool for consumers rebuilding their credit profiles after financial setbacks, despite the temporary score impacts that accompany new account openings. The paradox of credit rebuilding requires accepting short-term score reductions to create long-term scoring improvements through diversified account types, increased payment history opportunities, and improved utilization ratios.

Secured credit cards and credit-builder loans provide structured pathways for establishing new credit during rebuilding phases. Secured cards require deposits that become credit limits, eliminating lender risk while providing cardholders with opportunities to demonstrate responsible credit management. Credit-builder loans hold loan proceeds in savings accounts while borrowers make payments, creating payment history while building savings simultaneously.

The graduation timeline from secured to unsecured credit products typically spans 6-12 months of consistent payment history and responsible utilization management. Many secured card issuers review accounts for unsecured conversion after six months, while others require annual reviews. This graduation process allows consumers to recover their security deposits while maintaining the positive account history established during the secured phase.

New payment history accelerates recovery from past delinquencies by diluting negative information with fresh positive data. Each new account provides additional opportunities to demonstrate current responsible credit management, which carries more weight in scoring algorithms than older negative information. The mathematical impact of new credit adding positive payment history becomes particularly pronounced for consumers with limited credit histories where each new data point carries significant weight.

Balancing new credit needs with existing account rehabilitation requires strategic prioritization of financial resources and attention. Consumers rebuilding credit must maintain perfect payment histories on existing accounts while establishing new positive relationships. This balance often requires strict budgeting and automated payment systems to ensure no accounts fall behind during the rebuilding process.

Bringing It All Together: The Strategic Reality of New Credit Management

The complex interplay between inquiries, account age, and utilization reveals that the impact of new credit isn’t simply a 10% scoring factor—it’s a multifaceted force that ripples through every component of your credit profile.

Understanding these dynamics transforms the impact of new credit from a feared score killer into a powerful tool for credit optimization.