Millions of Americans find themselves trapped in a frustrating cycle: they need credit to build credit, but without existing credit history, traditional lenders won’t give them a chance. What if your consistent utility payments, on-time rent, and responsible banking habits could actually count toward your credit score? They can, and this shift is quietly changing how creditworthiness gets measured. By utilizing these methods, you can boost credit alternative data to new heights and unlock access to credit opportunities.

Alternative data sources are opening doors that traditional credit reports keep locked. Your electricity bill, streaming subscriptions, and even how you manage your checking account are now being recognized as valid indicators of financial responsibility. But which data sources pack the biggest punch for your credit score, and how do you avoid the common mistakes that could backfire? Understanding how to strategically leverage these non-traditional credit factors could be the key to finally breaking through credit barriers that have held you back for years.

Embracing the power of alternative data can significantly boost credit alternative data and improve your credit score. This includes understanding how your utility payments, rental history, and digital financial behaviors can work together to enhance your credit profile.

The Hidden Credit Universe: Understanding Alternative Data Sources

Utilizing various forms of alternative data effectively allows you to boost credit alternative data, providing lenders a fuller picture of your creditworthiness. By focusing on your consistent utility payments, you can dramatically boost credit alternative data and influence your credit score positively. Traditional credit scoring has long relied on a narrow band of financial behaviors, primarily focusing on credit card usage, loan repayment history, and length of credit accounts. However, your daily financial habits extend far beyond these conventional metrics, creating a rich tapestry of creditworthy behavior that remains largely untapped by traditional scoring models. This is where the concept of using alternative data to boost credit alternative data comes into play.

With rental history as a cornerstone, you can also boost credit alternative data, showcasing your reliability as a tenant to potential lenders. Recognizing the potential to boost credit alternative data through innovative reporting practices can be a game changer for your financial future. By ensuring your rental payment data is accurately reported, you can effectively boost credit alternative data and enhance your credit profile. Your banking behavior can also significantly boost credit alternative data, demonstrating your financial habits to lenders. Managing subscription services efficiently can boost credit alternative data and reflect your ongoing commitment to financial responsibility. Mobile payment platforms can also contribute to boosting credit alternative data by providing additional data points that reflect your spending behavior.

Incorporating unconventional data points can additionally boost credit alternative data, enhancing your financial profile for credit assessments. Understanding the predictive power of various alternative data types helps you boost credit alternative data effectively. Data aggregation platforms can also support your efforts to boost credit alternative data through accurate and reliable reporting. Leveraging advanced scoring models can significantly boost credit alternative data, allowing for a more accurate assessment of your creditworthiness. Integrating traditional and alternative data can boost credit alternative data and enhance the overall evaluation of your financial health. The science behind alternative data scoring is all about how we can boost credit alternative data through innovative methodologies. Psychometric analysis can also help boost credit alternative data, providing insights into behavioral indicators of creditworthiness.

Utilizing these behavioral indicators enables you to boost credit alternative data and improve your credit scores significantly. Understanding social media behaviors can further boost credit alternative data, shedding light on lifestyles that reflect financial responsibility. The balance between real-time and historical data can boost credit alternative data by providing a comprehensive view of your financial behaviors. Ensuring data accuracy through validation processes is essential to boost credit alternative data effectively. Geographic and demographic factors also play a role in how you can boost credit alternative data and influence credit scoring outcomes. Through seasonal adjustments, you can boost credit alternative data by ensuring your scoring reflects genuine financial behavior.

The ensemble modeling approach is vital in how we boost credit alternative data by integrating multiple sources for higher accuracy. Understanding regulatory navigation can also boost credit alternative data by ensuring compliance while optimizing your credit profile. Consumer rights in alternative credit are crucial to boost credit alternative data effectively while protecting your interests. Understanding permissioned versus inferred data is essential in knowing how to boost credit alternative data in compliance with regulations. Modern frameworks for consumer consent can help boost credit alternative data while ensuring you maintain control over your information. Discrimination concerns in alternative data usage highlight the importance of balancing fairness while seeking to boost credit alternative data.

Understanding state-level regulations can also influence how you boost credit alternative data appropriately within legal frameworks. Dispute resolution for alternative data needs to be navigated carefully to ensure you can effectively boost credit alternative data. Understanding privacy protocols helps boost credit alternative data while securing your financial information against potential breaches. Notification requirements for adverse actions based on alternative data are critical to boost credit alternative data and consumer awareness.

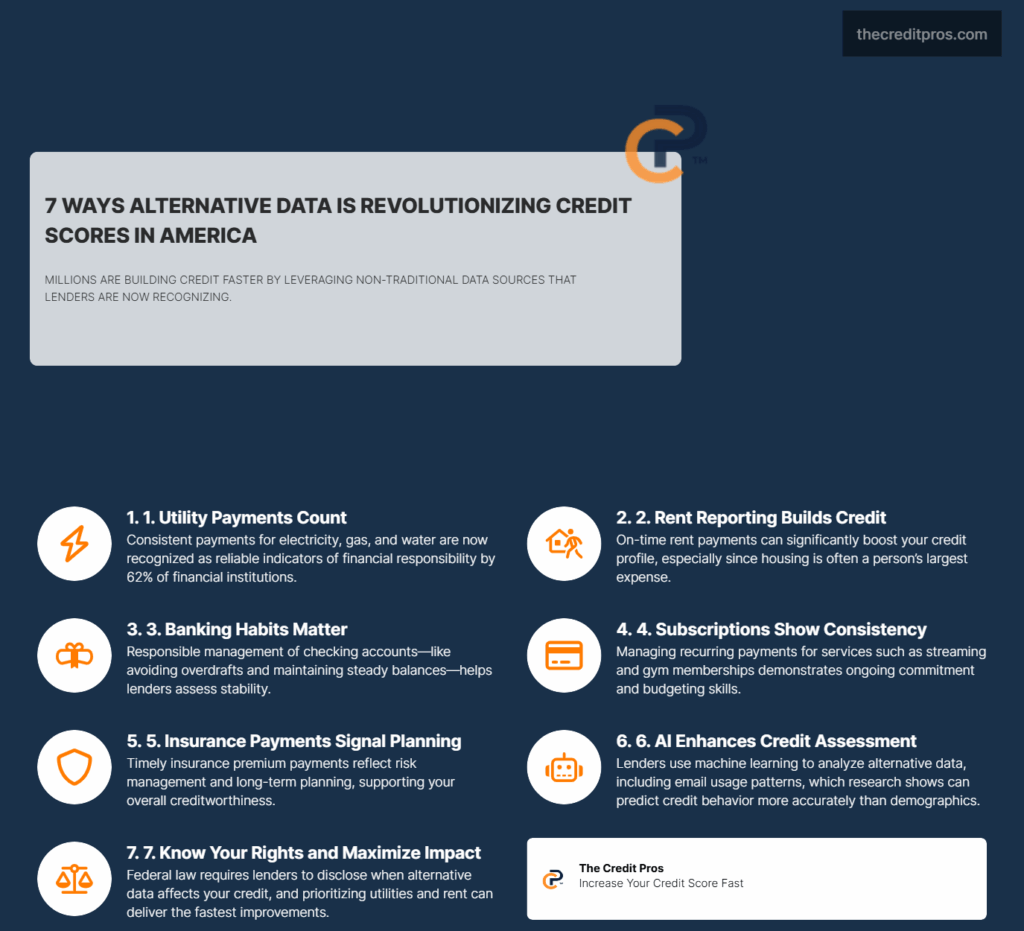

Utility payment patterns represent one of the most reliable indicators of financial responsibility in the alternative data landscape. Your consistent payment of electricity, gas, water, and internet bills demonstrates a fundamental understanding of recurring financial obligations and your ability to prioritize essential services. Research indicates that 62% of financial institutions are now using alternative data to improve risk profiling and credit decisioning capabilities, with utility payments serving as a cornerstone of these assessments. The predictive power of utility payments stems from their non-discretionary nature – unlike credit cards or personal loans, utilities represent essential services that responsible consumers prioritize regardless of financial stress.

Engaging with the evolving regulatory landscape can help you boost credit alternative data and stay ahead of future changes. Strategically implementing alternative data sources can provide a significant boost credit alternative data that enhances your credit profile. Timing your alternative data integration can effectively boost credit alternative data and demonstrate reliability to lenders. Understanding the 90-day rule can also help you strategically boost credit alternative data and improve your credit score over time. Prioritizing high-impact alternative data sources allows you to quickly boost credit alternative data and enhance your overall creditworthiness. Maintaining stable alternative data reporting is essential to consistently boost credit alternative data and achieve your credit goals.

The mechanics of utility reporting involve sophisticated data aggregation systems that capture payment timing, consistency, and account management behaviors. These systems analyze patterns such as seasonal payment variations, early payment tendencies, and account maintenance practices. For instance, consumers who consistently pay utility bills before due dates demonstrate proactive financial management, while those who maintain stable utility accounts over extended periods show residential stability and long-term planning capabilities.

Rental history has emerged as perhaps the most transformative alternative data source for credit building. Your monthly rent payments often represent your largest recurring expense, yet traditional credit scoring models have historically ignored this substantial demonstration of financial responsibility. Rent reporting services now bridge this gap by translating housing payments into credit-building opportunities through direct reporting to major credit bureaus.

As we explore these innovative methods, it’s essential to recognize how they can help boost credit alternative data in ways that traditional methods may overlook. The integration of rental payment data requires careful validation processes to ensure accuracy and prevent manipulation. Property management companies and rent reporting platforms employ verification systems that confirm payment amounts, dates, and account standing. These systems also track additional housing-related behaviors such as lease renewal patterns, security deposit management, and tenant communication responsiveness. The correlation between consistent rent payments and overall creditworthiness has proven remarkably strong, with studies showing that consumers with positive rental histories demonstrate lower default rates across all credit products.

Digital financial footprints provide an increasingly sophisticated view of your financial behavior through bank account transaction patterns and mobile payment histories. Your checking account activity reveals spending patterns, income stability, and cash flow management skills that traditional credit reports cannot capture. Modern alternative scoring models analyze transaction categorization, account balance trends, and overdraft frequency to assess financial stability and responsibility.

Subscription service management has become an unexpected indicator of creditworthiness in the digital age. Your ability to maintain and appropriately manage recurring subscriptions – from streaming services to gym memberships – demonstrates ongoing financial commitment and budgeting skills. The data reveals not just payment consistency but also decision-making patterns around service cancellations, upgrades, and account modifications.

Mobile payment platforms contribute additional layers of financial behavior data through peer-to-peer transactions, merchant payments, and account funding patterns. These platforms capture real-time financial interactions that provide immediate insights into spending habits and payment preferences. The frequency and consistency of mobile payment usage often correlate with broader financial engagement and technological adaptability.

Beyond conventional financial data, alternative scoring models increasingly incorporate unconventional data points that reflect broader life stability and responsibility. Insurance premium payments demonstrate risk awareness and long-term financial planning, while professional licensing records indicate career stability and regulatory compliance. Property ownership documentation, including tax payment histories and maintenance records, provides evidence of asset management capabilities and long-term financial commitment.

The predictive power differential between various alternative data types varies significantly based on consistency, verification methods, and correlation with traditional credit performance. Utility and rental payments typically carry the highest predictive value due to their essential nature and regular occurrence. Insurance payments and subscription services provide moderate predictive power, while professional licensing and property records offer supplementary validation of overall financial stability.

Evaluating industry-specific data opportunities is critical to boost credit alternative data effectively based on your unique circumstances. Considering the cost-benefit of alternative data services can help you boost credit alternative data within your budget constraints. Coordinating multiple alternative data sources is essential to boost credit alternative data and prevent potential conflicts. Urban consumers typically have more opportunities to boost credit alternative data, leveraging diverse resources available in their areas. Regular monitoring helps you boost credit alternative data by evaluating how your reported data affects your credit scores over time.

Data aggregation platforms have developed sophisticated validation and standardization processes to ensure alternative information maintains accuracy and reliability. These platforms employ multiple verification methods, including direct data feeds from service providers, consumer-permissioned account access, and third-party validation services. The standardization process converts diverse data formats into consistent reporting structures that credit scoring algorithms can effectively process and weight.

The Science Behind Alternative Credit Scoring Models

Machine learning algorithms have revolutionized how lenders integrate traditional bureau data with alternative sources to create comprehensive risk profiles. These sophisticated models employ ensemble techniques that weight different data types based on their predictive power and reliability. The algorithmic integration process involves complex mathematical relationships that account for data freshness, consistency, and correlation with known credit performance indicators.

Creating a balanced approach to credit building helps boost credit alternative data and enhance your financial outcomes. The mathematical foundation of alternative credit scoring relies on ensemble modeling techniques that combine multiple data streams into unified risk assessments. These models employ weighted averaging systems where traditional credit data typically receives higher initial weighting, but alternative data can significantly influence final scores when traditional data is limited or absent. Advanced algorithms use gradient boosting and random forest techniques to identify optimal combinations of traditional and alternative data points.

Psychometric and behavioral analysis has emerged as a particularly nuanced aspect of alternative credit scoring. Email usage patterns provide insights into digital engagement and communication consistency that correlate with financial responsibility. Consumers who maintain organized email practices, respond promptly to financial communications, and demonstrate consistent digital engagement patterns typically exhibit higher creditworthiness scores.

Research shows that psychometric variables and email usage predictors can effectively separate good and bad payers, with models containing email usage and psychometric variables achieving greater predictive accuracy than demographic data alone. The analysis extends beyond simple usage metrics to include communication patterns, response times to financial notifications, and digital organization behaviors. These behavioral indicators reflect underlying personality traits such as conscientiousness and reliability that directly translate to credit performance.

Social media financial behavior indicators represent an emerging frontier in alternative credit assessment, though their implementation requires careful privacy consideration and regulatory compliance. The analysis focuses on publicly available information that suggests financial stability, such as employment updates, educational achievements, and lifestyle consistency indicators. However, the use of social media data remains controversial and faces increasing regulatory scrutiny.

The balance between real-time and historical data represents a critical consideration in modern scoring models. Real-time data provides immediate insights into current financial behavior and can quickly reflect changes in financial circumstances. However, historical data offers stability and trend analysis that helps predict long-term credit performance. Advanced models employ time-decay functions that give greater weight to recent behavior while maintaining consideration for historical patterns.

Cross-validation methodologies ensure alternative data accuracy and prevent manipulation through multiple verification layers. These systems employ triangulation techniques that compare alternative data against multiple sources and flag inconsistencies for manual review. Machine learning algorithms identify unusual patterns that might indicate data manipulation or reporting errors, while blockchain-based verification systems provide immutable records of data authenticity.

Geographic and demographic variations significantly impact alternative data effectiveness, with urban consumers typically generating more diverse alternative data streams than rural consumers. The scoring models employ regional adjustment factors that account for these variations and prevent geographic bias in credit assessments. Demographic considerations include age-related technology adoption patterns, income-level variations in service usage, and cultural differences in financial behavior.

Seasonal adjustment factors play a crucial role in alternative credit models, particularly for utility payments and subscription services. Winter heating costs, summer cooling expenses, and holiday spending patterns create predictable variations that sophisticated models account for through seasonal normalization techniques. These adjustments prevent temporary seasonal variations from unfairly impacting credit scores while maintaining sensitivity to genuine financial distress indicators.

The ensemble modeling approach combines multiple alternative data streams through sophisticated weighting systems that optimize predictive accuracy. These models employ techniques such as stacking and blending that create meta-models from individual data source predictions. The ensemble approach provides robustness against individual data source failures while maximizing the predictive power of combined alternative data streams.

Regulatory Navigation and Consumer Rights in Alternative Credit

El Fair Credit Reporting Act (FCRA) establishes the regulatory framework governing alternative data usage in credit decisions, requiring lenders to provide specific disclosures when alternative data influences credit determinations. Under FCRA guidelines, consumers must receive notification when alternative data contributes to adverse credit decisions, including identification of the specific data sources and their impact on the decision. These regulations ensure transparency in alternative data usage while protecting consumer rights to understand and challenge credit decisions.

The legal distinction between permissioned and inferred alternative data creates important compliance considerations for both lenders and consumers. Permissioned data requires explicit consumer consent for collection and usage, typically obtained through opt-in agreements with specific data sharing terms. Inferred data, derived from publicly available sources or existing business relationships, operates under different regulatory frameworks but still requires compliance with privacy protection standards.

Consumer consent frameworks for alternative data sharing have evolved to provide granular control over data usage permissions. Modern consent systems allow consumers to specify which alternative data types they authorize for credit assessment, with options to revoke permissions or modify sharing preferences. These frameworks include detailed explanations of how alternative data will be used, the potential impact on credit decisions, and the duration of data sharing agreements.

El Equal Credit Opportunity Act (ECOA) prohibits discrimination based on race, color, religion, national origin, sex, marital status, age, or public assistance status, extending these protections to alternative data usage. Lenders must ensure that alternative data models do not create disparate impact on protected classes, requiring ongoing monitoring and adjustment of scoring algorithms. The challenge lies in balancing the predictive power of alternative data with fair lending requirements.

State-level variations in alternative credit data regulations create a complex compliance landscape that varies significantly across jurisdictions. California’s Consumer Privacy Act (CCPA) imposes strict requirements on alternative data collection and usage, while other states maintain more permissive regulatory environments. Lenders operating across multiple states must navigate these varying requirements while maintaining consistent credit assessment practices.

Dispute resolution processes for alternative data require specialized procedures that differ from traditional credit report disputes. Consumers challenging utility, rental, or banking data used in credit decisions must work through both the original data source and the credit reporting agency. The dispute process involves verification of payment records, account standing confirmation, and correction of any reporting errors that may impact credit scores.

The complexity of alternative data disputes stems from the involvement of multiple parties in the data chain. A utility payment dispute might involve the utility company, a data aggregation service, a credit reporting agency, and the lender using the information. Each entity has specific responsibilities for data accuracy and correction, creating potential delays in dispute resolution.

Privacy protection protocols for alternative data collection have evolved to address consumer concerns about financial surveillance and data security. These protocols include encryption requirements for data transmission, access controls for data storage, and audit trails for data usage. The General Data Protection Regulation (GDPR) has influenced global privacy standards, even affecting alternative credit data practices in non-European jurisdictions.

Consumer notification requirements for adverse actions based on alternative data extend beyond traditional credit report disclosures. Lenders must specify which alternative data sources influenced negative decisions and provide consumers with information about accessing and correcting these data sources. The notifications must include contact information for data providers and detailed explanations of dispute procedures.

The evolving regulatory landscape continues to address emerging alternative data sources and their appropriate usage in credit decisions. Recent regulatory guidance has focused on artificial intelligence transparency requirements, algorithmic fairness standards, and consumer control over automated decision-making processes. These developments will likely expand consumer rights while potentially limiting certain alternative data applications.

Strategic Implementation: Maximizing Alternative Data Benefits

Timing optimization for alternative data integration requires strategic planning to maximize credit score impact while avoiding potential reporting conflicts. The most effective approach involves establishing consistent payment patterns for at least 90 days before beginning alternative data reporting, ensuring that your financial behavior demonstrates stability and reliability. This preparation period allows you to identify and correct any payment inconsistencies that might negatively impact your credit profile once reporting begins.

The 90-day rule for alternative data impact visibility reflects the time required for credit scoring algorithms to incorporate new information and adjust risk assessments accordingly. During this period, credit bureaus validate alternative data sources, establish baseline payment patterns, and integrate the information into existing credit profiles. Understanding this timeline helps you set realistic expectations for credit score improvements and plan other credit-building activities accordingly.

Data source prioritization should focus on high-impact alternative data types that provide the most substantial credit improvements. Utility payments typically offer the fastest and most reliable credit benefits due to their essential nature and consistent reporting standards. Rent reporting follows closely, particularly for consumers whose housing costs represent a significant portion of their income. Bank account data and subscription services provide supplementary benefits but require longer periods to demonstrate meaningful impact.

Priority ranking for alternative data sources:

- Utility payments (electricity, gas, water) – Highest impact, fastest results

- Rent payments – High impact, moderate timeline

- Telecommunications (phone, internet) – Moderate impact, consistent reporting

- Insurance premiums – Moderate impact, demonstrates risk management

- Subscription services – Lower impact, shows financial engagement

- Banking data – Variable impact, requires comprehensive analysis

Avoiding alternative data pitfalls requires careful attention to reporting consistency and data accuracy. Common mistakes include starting alternative data reporting during periods of financial instability, failing to verify data accuracy before reporting begins, and creating conflicts between different alternative data sources. For example, reporting utility payments from multiple residences without proper explanation can create confusion in credit profiles and potentially harm scores.

The portfolio approach to credit building combines traditional credit products with alternative data strategies for accelerated improvement. This comprehensive strategy involves maintaining existing credit accounts in good standing while systematically adding alternative data sources to enhance your credit profile. The key lies in balancing multiple data streams without overwhelming credit algorithms or creating reporting inconsistencies.

Industry-specific alternative data opportunities vary significantly based on employment type and income sources. Gig economy workers benefit most from banking data analysis that demonstrates consistent income patterns despite irregular payment schedules. Freelancers can leverage professional licensing records and business insurance payments to establish credibility. Retirees often find success with utility and insurance payment reporting, as these represent their most consistent financial obligations.

The cost-benefit analysis of paid versus free alternative data reporting services reveals important considerations for strategic implementation. Free services typically offer basic utility and rent reporting with limited customization options, while paid services provide comprehensive data integration, credit monitoring, and optimization recommendations. The decision should be based on your current credit profile, improvement goals, and available financial resources.

Balancing multiple alternative data sources requires careful coordination to prevent reporting conflicts or data inconsistencies. The most effective approach involves staggered implementation, adding one alternative data source at a time and monitoring its impact before introducing additional sources. This methodical approach allows you to identify which data sources provide the greatest benefit for your specific credit profile and financial situation.

Geographic considerations play a crucial role in alternative data effectiveness, with urban consumers typically having access to more diverse alternative data opportunities than rural consumers. Urban areas offer greater utility provider diversity, more comprehensive rental reporting infrastructure, and broader acceptance of alternative data by local lenders. Rural consumers may need to focus on fewer, more reliable alternative data sources while ensuring consistent reporting standards.

The integration of alternative data with traditional credit building requires ongoing monitoring and adjustment to optimize results. Regular credit report reviews help identify how alternative data impacts your credit scores and whether adjustments to reporting strategies are necessary. This monitoring process should include tracking score changes, identifying reporting errors, and adjusting alternative data sources based on their effectiveness.

Future-Proofing Your Credit Profile Through Emerging Data Trends

Cryptocurrency transaction histories represent the next frontier in alternative credit data, with early adopters already exploring how blockchain-based financial behaviors can demonstrate creditworthiness. Digital asset management patterns, including consistent investment contributions, responsible trading behaviors, and security protocol adherence, provide new indicators of financial sophistication and risk management capabilities. However, the volatile nature of cryptocurrency markets requires careful analysis to separate speculative behavior from genuine financial responsibility indicators.

Investment app behaviors offer increasingly sophisticated insights into long-term financial planning and risk tolerance that traditional credit models cannot capture. Your investment account activity reveals portfolio diversification strategies, consistent contribution patterns, and market volatility responses that indicate financial maturity. These platforms track behaviors such as automatic investment scheduling, rebalancing frequency, and withdrawal patterns that demonstrate financial discipline and planning capabilities.

The integration timeline for emerging alternative data sources into mainstream lending varies significantly based on regulatory approval, data standardization, and lender adoption rates. Cryptocurrency data faces the longest integration timeline due to regulatory uncertainty and market volatility concerns. Investment app data shows more promising near-term adoption prospects, with several major lenders already piloting programs that incorporate investment behaviors into credit assessments.

Artificial intelligence is fundamentally expanding the definition of creditworthy behavior beyond traditional metrics through sophisticated pattern recognition and predictive modeling. AI-driven systems can identify subtle behavioral patterns in financial data that human analysts might miss, such as micro-payment consistency, account management efficiency, and digital engagement optimization. These systems continuously learn from new data patterns, adapting their assessment criteria as financial behaviors evolve.

Machine learning algorithms now analyze communication patterns, device usage behaviors, and digital interaction preferences to assess financial responsibility. The technology examines factors such as financial app engagement frequency, payment scheduling preferences, and account security practices that reflect underlying financial management capabilities. However, the implementation of AI-driven assessment requires careful balance between predictive accuracy and consumer privacy protection.

Global alternative data integration addresses the growing need for cross-border financial behavior recognition in an increasingly mobile society. International payment histories, foreign banking relationships, and cross-currency transaction patterns provide valuable insights for consumers with global financial footprints. The challenge lies in standardizing diverse international financial systems and regulatory frameworks into coherent credit assessment models.

Open banking initiatives worldwide are creating new opportunities for comprehensive financial data integration that will revolutionize alternative credit scoring. These frameworks allow consumers to share detailed banking data directly with lenders, providing unprecedented insights into income patterns, spending behaviors, and financial management practices. The preparation for open banking integration involves understanding data sharing permissions, privacy implications, and optimization strategies for comprehensive financial profiles.

Blockchain verification systems are emerging as solutions for alternative credit data authenticity challenges, providing immutable records of financial behaviors and payment histories. These systems create tamper-proof documentation of utility payments, rent histories, and other alternative data sources that eliminate concerns about data manipulation or reporting errors. The technology also enables direct peer-to-peer verification of financial behaviors without requiring intermediary data aggregation services.

Breaking Free from Credit Limitations: Your Alternative Data Advantage

The credit landscape is experiencing a fundamental transformation that’s quietly dismantling the barriers that have kept millions of Americans trapped in a frustrating catch-22. By leveraging alternative data sources, including utility payments and subscription services, individuals have the opportunity to boost credit alternative data and improve their overall creditworthiness. The strategic integration of these data points can accelerate your credit journey by months or even years compared to conventional methods alone.

Understanding and leveraging these alternative data opportunities requires careful planning, regulatory awareness, and strategic timing to maximize their impact. The most successful approach combines traditional credit building with thoughtfully selected alternative data sources, creating a comprehensive credit profile that demonstrates financial responsibility. As consumer behaviors evolve, those who master the art of utilizing alternative data today will be best positioned to boost credit alternative data and navigate future credit innovations.