Tiny homes have captured the imagination of many seeking simpler, more affordable living options. But while these compact dwellings offer freedom from traditional housing costs, financing them presents unique challenges. Most banks don’t offer standard mortgages for tiny homes because they fall below minimum loan amounts or lack permanent foundations. This leaves many prospective tiny home owners—especially those with credit challenges—wondering how to turn their small-space dreams into reality.

Secured loans for tiny homes offer a promising solution tailored to the distinctive needs of tiny home buyers. Unlike conventional mortgages, loans for tiny homes can accommodate the lower price points and unique characteristics of alternative housing. Whether you’re considering a tiny home on wheels or a stationary mini-dwelling, understanding your secured loans for tiny homes options could be the key to making your tiny home aspirations possible. What specific types of secured loans for tiny homes work best for different tiny home scenarios, and how might your credit score affect your options? The answers might surprise you.

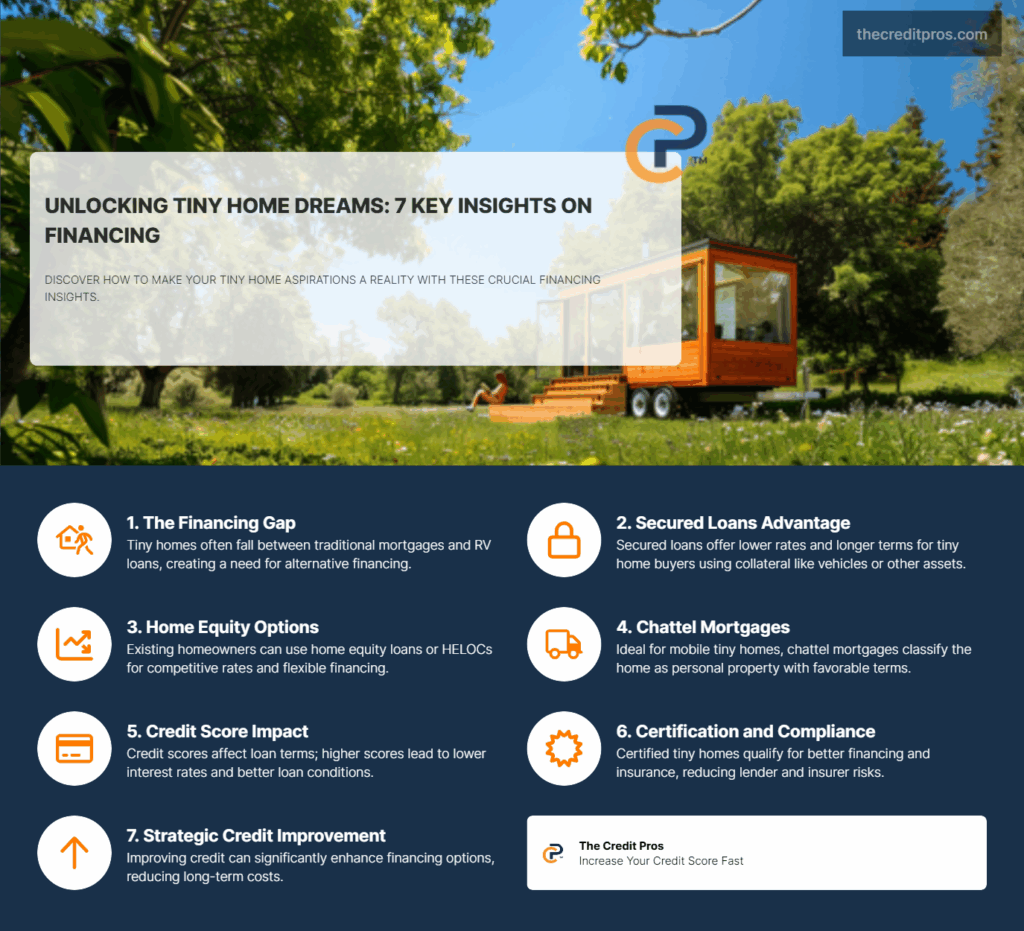

Understanding Tiny Home Financing Challenges

The tiny home movement has gained significant momentum, but financing these compact dwellings presents unique obstacles that traditional housing markets don’t encounter. When prospective tiny homeowners approach conventional lenders, they’re often met with confusion or outright rejection due to financial systems designed around standard housing models.

Most traditional mortgage lenders enforce minimum loan amounts ranging from $50,000 to $100,000, placing them well above the cost of many tiny homes, which typically range from $30,000 to $70,000. This creates an immediate mismatch between the product and conventional financing options. Even when tiny homes fall within mortgage lending ranges, they frequently fail to meet other critical requirements. Traditional mortgages typically require properties to have permanent foundations, meet minimum square footage requirements (often 400+ square feet), and comply with local building codes designed for conventional homes.

The financing landscape creates an awkward gap between RV loans and traditional mortgages. Tiny homes often fall into this gray area – too small and sometimes too mobile for traditional home financing, yet too customized and permanent for standard RV loans. This leaves many prospective tiny homeowners searching for secured loans for tiny homes that acknowledge the unique nature of these dwellings.

Mobility represents another significant factor affecting financing options. Tiny homes on wheels face different challenges than foundation-based structures. Mobile tiny homes may qualify for RV loans if they’re certified by the Recreation Vehicle Industry Association (RVIA), but these loans typically come with shorter terms (10-15 years) and higher interest rates than traditional mortgages. Additionally, RV loans generally aren’t intended for primary residences, creating another hurdle for those planning to live in their tiny home full-time.

Land ownership plays a crucial role in securing secured loans for tiny homes. Lenders view tiny homes on owned land more favorably than those placed on rented or borrowed property. When a borrower owns the land where the tiny home will be situated, it provides additional collateral and security for the lender. Some financing options, particularly those resembling traditional mortgages, may require land ownership as a prerequisite for loan approval. For those without land, this creates another layer of financial planning – securing secured loans for tiny homes not just for the structure but for the property beneath it.

Secured Loans: A Tailored Solution for Tiny Homes

Secured loans for tiny homes offer a promising pathway for tiny home enthusiasts facing the financing challenges of alternative housing. Unlike traditional mortgages with rigid requirements, secured loans provide flexibility while offering more favorable terms than many unsecured alternatives. These loans use collateral to reduce lender risk, resulting in better rates and terms that align well with the unique nature of tiny home investments.

Personal loans secured by other assets represent one of the most accessible options in the world of secured loans for homes. These loans allow borrowers to use existing assets – such as vehicles, investments, or other property – as collateral. This approach typically yields lower interest rates than unsecured personal loans, with rates ranging from 6% to 12%. These secured loans for tiny homes also often feature longer repayment terms, sometimes extending to 7-10 years.

For existing homeowners, home equity loans and HELOCs are excellent secured loans. They leverage the equity built in a current home to finance a tiny home purchase. Whether you’re buying a primary residence or a rental, these secured loans offer the most competitive rates—just 1-2 points above prime.

Chattel mortgages are another specialized form of secured loans, ideal for mobile models. These treat the home as personal property, making them excellent options for wheels-based or leased-land homes. With terms of 15–20 years and rates between 5% and 9%, these secured loans are an effective middle ground between traditional mortgages and RV loans.

The benefits of secured loans include:

- Higher borrowing limits to cover quality builds

- Longer repayment terms

- Flexible qualification criteria

- Tax benefits (especially for home equity options)

- Greater lender willingness to support alternative housing models

Lenders providing secured loans understand the tangible value of both the property and the lifestyle, making them ideal for buyers needing smart, tailored financing.

Credit Score Considerations for Tiny Home Financing

Credit scores play a pivotal role in qualifying for secured loans. The thresholds differ based on loan type: HELOCs and home equity loans often require 680+, while chattel loans expect 640+. Some secured personal loans, are available with scores as low as 580.

Better scores unlock better terms on secured loans. High scorers can access longer terms, higher loan-to-value ratios, and lower fees. For example, a borrower with a score of 740 may receive a 7% rate on secured loans, while someone with 600 may face 15%—a massive cost difference over time.

Lenders offering secured loans for tiny homes also examine DTI ratios. Keeping it below 43% is ideal, but tiny homes often reduce housing expenses, which can work in the borrower’s favor.

Other credit-related factors influencing secured loans include:

- Consistent income and job history

- Asset reserves

- Prior rent/mortgage performance

- Build quality and certifications

- Down payment size

Improving your score before applying for secured loans—even by 20–40 points—can drastically improve your loan terms and long-term affordability.

Navigating Insurance and Legal Requirements

Getting insurance is essential when using secured loans. RV insurance works for mobile models, especially RVIA-certified homes. Lenders require proof of this coverage for most mobile secured loans for tiny homes.

Stationary homes need manufactured home policies, which cover the smaller builds and foundation-based structures. Most secured loans require this insurance and it typically costs $600–$1,200 per year.

Certification is vital. Homes built to RVIA, ANSI A119.5, or IRC Appendix Q standards qualify for better secured loans for tiny homes and insurance plans. Certification confirms quality and reduces risk for both lender and insurer.

Zoning and building codes also influence approval of secured loans for tiny homes. Lenders need confirmation of compliance with local laws before releasing funds. Always confirm zoning regulations before committing to secured loans for tiny homes.