Filing for bankruptcy might seem like the end of your credit journey, but here’s something surprising: many people see their credit scores increase by 69-80 points shortly after filing. This initial boost happens because your debt-to-income ratio improves dramatically when debts are discharged. What most people don’t know is that the real work begins after bankruptcy – rebuilding your creditworthiness requires strategy, patience, and consistent financial habits. How quickly can you recover your credit score after bankruptcy? What specific steps should you take in those critical first 90 days to improve your credit score after bankruptcy?

The path to credit recovery follows a predictable timeline, typically spanning from one month to two years depending on your approach. During this period, you’ll need to carefully select the right secured credit products, establish perfect payment patterns, and gradually diversify your credit mix. Your bankruptcy will remain on your credit report for 7-10 years, but its negative impact diminishes significantly over time when you implement proper rebuilding techniques. With the right strategy, many people achieve prime credit scores long before the bankruptcy notation disappears, improving their credit score after bankruptcy.

Understanding the Post-Bankruptcy Credit Landscape

Bankruptcy creates a unique financial phenomenon that most filers don’t anticipate. While conventional wisdom suggests bankruptcy devastates credit scores, the reality presents a more nuanced picture. Credit scores often experience an immediate upward trajectory following bankruptcy filing, with data showing an average increase of 69 points—moving from 533 to 602 within just one month after filing. This counterintuitive improvement occurs primarily because bankruptcy eliminates or significantly reduces the debt burden that previously suppressed credit scores, setting the stage for a better credit score after bankruptcy.

The mathematical mechanics behind this improvement stem from how credit scoring algorithms calculate risk. Prior to bankruptcy, most filers struggle with maxed-out credit cards, multiple missed payments, and potentially collections or charge-offs. These negative factors heavily impact credit utilization ratios y payment history—two components that together constitute approximately 65% of credit score calculations. When bankruptcy discharges these debts, the algorithms no longer factor those high utilization ratios into scoring models, resulting in the paradoxical score increase and ultimately improving your credit score after bankruptcy.

The psychological component of post-bankruptcy credit recovery cannot be overstated. Many filers report experiencing significant stress relief once their debts are discharged, allowing them to approach financial decisions with greater clarity and discipline. This psychological fresh start often translates into improved financial behaviors, including more careful budgeting and spending habits. The removal of overwhelming debt burdens enables individuals to focus on rebuilding rather than constantly struggling to keep up with unmanageable payment schedules.

Understanding your credit score after bankruptcy is crucial for effective recovery strategies. Monitor your progress regularly and adjust your financial habits to ensure continuous improvement of your credit score after bankruptcy.

The impact of different bankruptcy chapters on your credit score after bankruptcy cannot be understated. Chapter 7 bankruptcy results in a faster recovery compared to Chapter 13, which offers a structured repayment plan. Both paths require strategic management to effectively improve your credit score after bankruptcy.

It’s essential to recognize that the first 90 days can set the tone for your credit score after bankruptcy. This period is critical for establishing habits that will positively influence your credit score after bankruptcy.

Using credit monitoring services can help track your credit score after bankruptcy, allowing you to see the effects of your rebuilding efforts in real-time.

Different bankruptcy chapters produce varying impacts on credit recovery timelines. Chapter 7 bankruptcy, which typically discharges most unsecured debts within 3-6 months, creates a more immediate fresh start but remains on credit reports for 10 years. Chapter 13 bankruptcy involves a structured repayment plan over 3-5 years and stays on credit reports for 7 years from filing date. Chapter 13 filers may see more gradual credit score improvements as they demonstrate consistent repayment behavior through their court-approved payment plans. Understanding these distinctions helps set realistic expectations for recovery timelines based on the specific bankruptcy path chosen.

Additionally, establishing a financial plan that includes saving for emergencies is vital for anyone looking to improve their credit score after bankruptcy.

The Critical First 90 Days After Filing

To maximize the benefits of your post-bankruptcy actions, it’s essential to create a timeline that aligns with improving your credit score after bankruptcy. Choosing secured cards that advertise improvement of your credit score after bankruptcy can provide quicker access to better credit products. Incorporating authorized user strategies can also assist in enhancing your credit score after bankruptcy, offering additional credit history to your profile.

The foundation for successful credit rebuilding begins with obtaining and thoroughly analyzing your post-bankruptcy credit reports from all three major bureaus—Equifax, Experian, and TransUnion. This crucial first step reveals your true starting position and helps identify any inaccuracies requiring correction. Approximately 20% of bankruptcy filers discover accounts incorrectly reported as still open or past-due rather than included in bankruptcy. These errors can significantly hinder recovery efforts if left unaddressed. Set calendar reminders to review your reports every 30 days during this initial period to ensure all discharged debts properly reflect their bankruptcy status.

Identifying which accounts survived bankruptcy provides critical insights for rebuilding efforts. Most secured loans like mortgages or auto loans that you choose to keep through reaffirmation agreements remain on your credit report and continue reporting payment activity. These accounts become especially valuable rebuilding tools since they represent established credit lines with payment history. Similarly, federal student loans, which typically cannot be discharged in bankruptcy, continue reporting to credit bureaus. Creating a comprehensive inventory of these remaining accounts helps formulate a strategic approach to rebuilding based on your specific post-bankruptcy credit profile.

Establishing financial stability before pursuing new credit represents the most overlooked yet critical element of post-bankruptcy recovery. During these first 90 days, prioritize creating a sustainable budget that accommodates all necessary expenses while allocating funds toward emergency savings. Financial experts recommend accumulating at least $1,000 in emergency funds before applying for new credit products. This buffer prevents reliance on credit for unexpected expenses—a common pattern that leads many back into financial difficulty. Implementing a zero-based budgeting approach, where every dollar of income receives a specific assignment, helps maintain the financial discipline necessary for long-term credit recovery.

Setting up automated payment systems for all remaining obligations creates the foundation for perfect payment history going forward. Late payments impact post-bankruptcy credit scores more severely than they would otherwise, as credit scoring models apply stricter penalties to those with recent bankruptcy. Configure automatic payments to process several days before actual due dates, providing a buffer against processing delays. Additionally, establish account alerts for low balances, payment confirmations, and unusual activity. These technological guardrails help prevent the payment oversights that could significantly delay credit recovery during this sensitive rebuilding phase.

Strategic Credit Rebuilding Techniques

Secured credit cards serve as the cornerstone of most successful post-bankruptcy credit rebuilding strategies, but choosing the right product significantly impacts recovery speed. Focus on secured cards that explicitly offer graduation paths to unsecured products, typically after 6-12 months of responsible usage. These cards should report to all three major credit bureaus and ideally carry no annual fee. The initial security deposit amount matters less than establishing perfect payment patterns, so starting with a modest $200-$500 deposit proves sufficient. Avoid secured cards that charge monthly maintenance fees in addition to annual fees, as these unnecessary costs reduce the capital available for rebuilding other areas of your financial life.

Credit builder loans provide an excellent complement to secured credit cards by adding installment credit to your profile. These specialized products, offered by credit unions and online lenders, place loan proceeds into a locked savings account while you make monthly payments. Once you complete all payments, the funds become available—effectively creating forced savings while building positive payment history. The ideal approach involves taking a small credit builder loan ($500-$1,000) with a 12-month term concurrent with secured card usage. This strategy establishes both revolving and installment credit simultaneously, addressing two major credit scoring categories while minimizing the risk of overextension.

El authorized user strategy offers a potential shortcut in the rebuilding process when implemented correctly. Becoming an authorized user on a family member’s or close friend’s well-established credit card can import that account’s positive payment history to your credit profile. For maximum benefit, select accounts that:

- Have been open for 2+ years

- Maintain utilization below 30%

- Have perfect payment history

- Report authorized user activity to all three bureaus

- Have credit limits exceeding $2,000

Not all credit card issuers report authorized user accounts equally. Capital One and Discover typically report the account’s complete history to authorized users, while American Express only reports from the date you’re added. Chase, Bank of America, and Citi fall somewhere in between, generally reporting the account but with varying history inclusion policies.

Self-reporting of recurring payments represents an underutilized yet powerful rebuilding technique that can positively affect your credit score after bankruptcy. Services like Experian Boost, eCredable Lift, and Perch allow reporting of on-time payments for utilities, streaming services, rent, and phone bills to certain credit bureaus.

As you approach the later stages of recovery, understanding how your credit score after bankruptcy might evolve can help you leverage it for future financial opportunities.

Credit utilization management requires strategic precision during rebuilding. Maintaining utilization between 1% and 9% on revolving accounts is crucial for an optimal scoring impact and is especially important for your credit score after bankruptcy.

Navigating the 6-24 Month Recovery Period

Adopting a milestone-based approach to credit diversification creates a structured path through the critical 6-24 month recovery period. Rather than focusing exclusively on time elapsed since bankruptcy, base credit application decisions on specific achievement markers. Begin applying for traditional unsecured credit only after establishing six consecutive months of perfect payment history on existing accounts and achieving at least a 630 FICO score. Start with retailer credit cards, which typically maintain more lenient approval standards for post-bankruptcy applicants, before progressing to general-purpose unsecured cards. This incremental approach reduces rejection risk while methodically diversifying your credit mix—a factor accounting for approximately 10% of most credit scoring models.

Strategic management of credit inquiries becomes increasingly important as your rebuilding efforts progress. Each hard inquiry typically causes a temporary 5-10 point score reduction, with greater impact on those with limited credit history or recent bankruptcy. Implement a targeted application strategy by researching pre-qualification options that use soft inquiries before submitting formal applications. When pursuing new credit, submit applications within a focused 14-day window, as most modern scoring models count multiple inquiries for the same credit type within this timeframe as a single inquiry. This rate-shopping approach allows you to pursue the best possible terms without multiplying the scoring impact of necessary credit applications.

Addressing lingering bankruptcy notations with potential creditors requires thoughtful preparation, especially in relation to your credit score after bankruptcy. Prepare a brief letter of explanation that acknowledges the bankruptcy while emphasizing your positive financial behaviors since filing.

Leveraging improved scores to refinance remaining obligations creates substantial financial benefits, particularly when your credit score after bankruptcy exceeds 660-680. Explore refinancing options for any secured debts reaffirmed during bankruptcy.

Maintaining Long-Term Credit Health

Creating sustainable financial habits requires systematic approaches rather than willpower alone. Implement automated savings systems that transfer predetermined amounts to separate accounts immediately after receiving income. This “pay yourself first” approach ensures consistent progress toward financial goals without requiring constant decision-making. Establish spending guidelines using the 50/30/20 framework—allocating 50% of take-home pay toward needs, 30% toward wants, and 20% toward savings and debt reduction. This balanced approach prevents the extreme austerity that often leads to abandonment of financial improvement efforts while maintaining sufficient discipline for continued progress.

Monitoring techniques should evolve as your credit recovery advances. During the initial rebuilding phase, utilize weekly credit score updates through services like Credit Karma, Experian, or credit card issuer portals to maintain motivation through visible progress. As your recovery stabilizes, transition to monthly comprehensive reviews using a credit monitoring service that provides alerts for changes across all three bureaus. Pay particular attention to credit utilization trends, recently opened accounts, and inquiry activity—early indicators of potential financial stress before payment delinquencies occur. This proactive monitoring approach helps identify and address minor issues before they develop into significant setbacks.

Addressing inevitable setbacks requires predetermined response strategies rather than emotional reactions. Establish a financial contingency plan that outlines specific actions for common scenarios like income reduction, unexpected expenses, or credit application denials. For example, if facing a temporary income reduction, your plan might include suspending discretionary spending, contacting creditors for hardship programs, and using emergency funds in a specific sequence. Having these decisions predetermined removes the emotional decision-making that often exacerbates financial challenges. Remember that recovery rarely follows a linear path—temporary score decreases of 10-20 points represent normal fluctuations rather than failures in your rebuilding strategy.

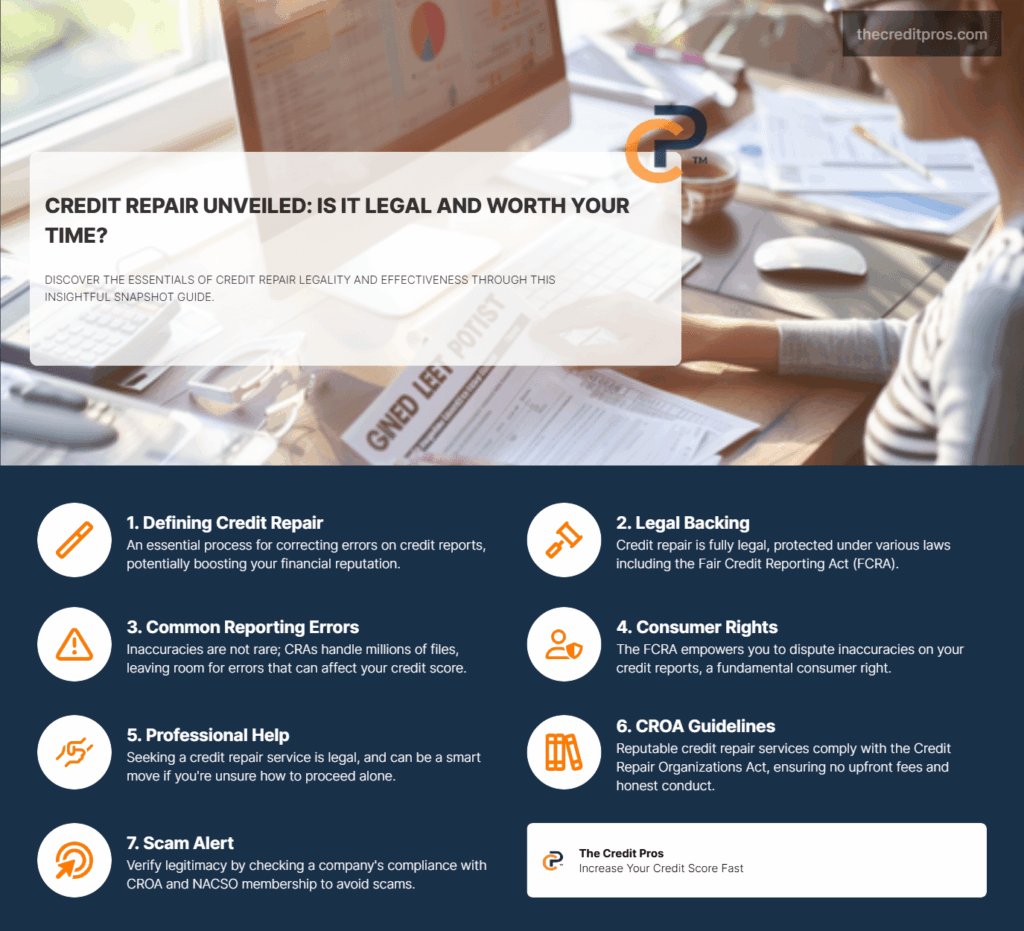

Professional credit repair assistance becomes a consideration once you’ve implemented fundamental rebuilding techniques for at least six months with limited results. Legitimate credit repair organizations can provide specialized assistance with complex situations like mixed credit files, identity theft recovery, or persistent reporting errors that standard dispute processes haven’t resolved. Approach this option with careful research, selecting only firms charging reasonable monthly fees rather than large upfront payments, and maintaining realistic expectations about results. The most reputable services provide education and empowerment rather than promising specific point increases or quick fixes. Their primary value comes from managing the administrative burden of complex disputes rather than accessing special techniques unavailable to individuals.

Planning for major post-bankruptcy purchases requires strategic timing and preparation, particularly for mortgage applications. Conventional mortgage lenders typically enforce waiting periods of 2-4 years after bankruptcy discharge before considering applications, though FHA and VA loans may offer shorter waiting periods of 1-2 years with documented extenuating circumstances. Rather than focusing exclusively on waiting period expiration, prepare methodically by establishing at least 12 consecutive months of housing payments at or above the expected mortgage payment amount. This payment history, combined with a down payment exceeding minimum requirements, substantially increases approval odds when timing aligns with lender waiting periods. This patient, preparation-focused approach transforms bankruptcy from a permanent obstacle into a temporary detour on your financial journey.

Conclusion: Your Bankruptcy Recovery Blueprint

Bankruptcy isn’t the financial death sentence many fear—it’s often the first step toward genuine financial rebirth and a better credit score after bankruptcy. The most successful rebuilders combine traditional credit products with alternative data reporting, maintaining unwavering payment discipline to ensure continuous improvement in their credit score after bankruptcy.

The journey from bankruptcy to prime credit status isn’t about waiting for time to pass—it’s about actively creating a new financial identity through consistent, strategic actions. Your bankruptcy represents just one chapter in your financial story, not the entire narrative. With proper technique and patience, many achieve credit scores in the 700s within 24 months of discharge, qualifying for prime lending rates and opportunities once thought impossible. Remember, those who emerge strongest from bankruptcy aren’t those who simply survived it, but those who used it as a catalyst to master financial principles they’ll benefit from for life.