Graduating with student loans means entering a complex financial system where one misstep can cost you thousands of dollars or valuable benefits. The difference between federal and private loans isn’t just paperwork – it determines which safety nets you have access to, what happens when your income drops, and whether you qualify for forgiveness programs that could eliminate your debt entirely. Many graduates discover too late that their loan servicer changed, their repayment strategy no longer fits their career path, or they missed opportunities for employer assistance programs. Understanding the nuances of managing student loan debt is essential for successful financial navigation.

For many graduates, managing student loan debt starts with understanding how different types of loans affect their future financial health. Effective strategies for managing student loan debt can make a significant impact. Making informed choices about managing student loan debt in the initial repayment phase is crucial for long-term financial success. Your approach to managing student debt affects far more than your monthly budget. The choices you make in your first few months of repayment can determine whether you’ll pay an extra $20,000 in interest over the life of your loans, qualify for forgiveness programs worth tens of thousands of dollars, or maintain the financial flexibility to pursue graduate school or buy a home. Understanding how to balance aggressive repayment with building wealth, navigate career transitions without losing federal protections, and structure your payments around your long-term goals requires a strategic approach to managing student loan debt that most graduates never receive guidance on.

Strategies for managing student loan debt effectively can help graduates navigate their financial futures with confidence. Students should consider how managing student loan debt can influence their graduate school decisions. Understanding the aggregate limits on student loans is an integral part of managing student loan debt to avoid complications in the future. Being proactive in managing student loan debt can alleviate stress during transitions between servicers. Effective management strategies for managing student loan debt will vary depending on individual circumstances and goals. When considering income-driven repayment, focus on how managing student loan debt aligns with your career choices. The potential for loan forgiveness is a key aspect of managing student loan debt that requires careful planning.

Understanding Federal vs. Private Student Loan Distinctions

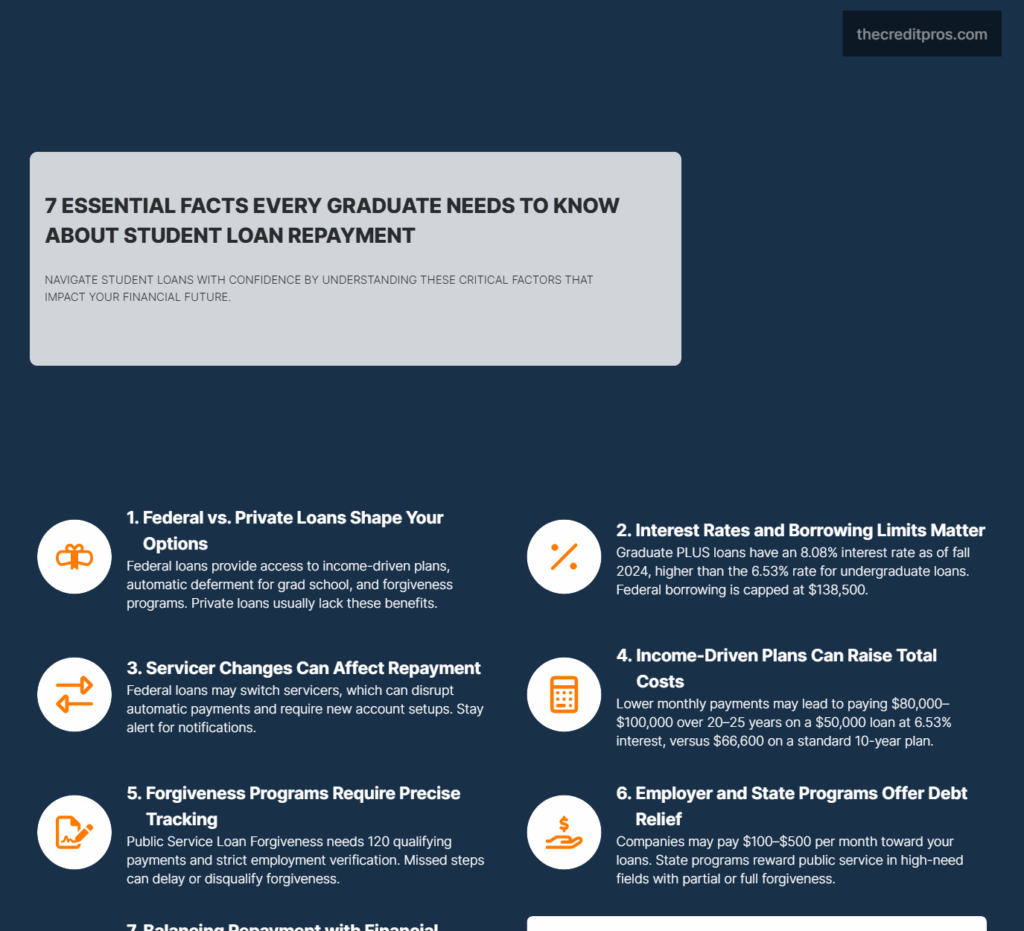

Federal and private student loans operate under fundamentally different rules that directly impact your financial flexibility and long-term repayment options. Federal loans provide automatic access to income-driven repayment plans, deferment options, and forgiveness programs, while private loans typically offer fewer protections but may feature lower interest rates for borrowers with strong credit profiles. Understanding these distinctions becomes critical when developing a comprehensive debt management strategy that aligns with your career trajectory and financial goals.

The automatic deferment feature for federal loans represents one of the most significant advantages for borrowers pursuing continuing education. When you enroll in graduate school at least half-time, your undergraduate federal loans automatically enter in-school deferment without requiring additional paperwork or servicer communication. Ellie Bruecker, director of research at The Institute for College Access & Success, explains the seamless nature of this process: “A school’s registrar’s office reports to the National Student Clearinghouse once somebody is enrolled. So once you are enrolled in graduate school, your undergraduate loans are placed in deferment automatically.” This automatic protection contrasts sharply with private loan deferment policies, which typically require individual negotiation with lenders and may not be available at all.

Aggregate borrowing limits create another layer of complexity that affects your future borrowing capacity and repayment strategy. The $138,500 federal loan limit for graduate students includes all undergraduate borrowing, with no more than $65,500 in subsidized loans across your entire academic career. Once you reach these limits, additional federal borrowing must occur through the Grad PLUS program, which carries significantly higher interest rates. As of fall 2024, Grad PLUS loans feature an 8.08% interest rate compared to the 6.53% rate for undergraduate loans, creating a substantial cost differential that compounds over time.

Loan servicer changes represent an often-overlooked factor that can disrupt your repayment strategy and access to benefits. Federal loan servicing contracts are periodically reassigned, meaning your loans may transfer to a new servicer without your input or choice. These transitions can temporarily interrupt automatic payments, delay processing of applications for income-driven repayment plans, and require you to establish new online accounts and communication channels. Private loan servicers may also change due to portfolio sales or business restructuring, but these changes typically occur less frequently and with different notification requirements. Overall, managing student loan debt effectively can lead to a brighter financial future. Students must remain diligent about managing student loan debt to ensure success in qualifying for loan forgiveness. Employers can play a significant role in managing student loan debt through sponsored repayment benefits.

Strategic Repayment Planning Beyond Standard Schedules

Participating in state-specific loan forgiveness programs is another smart strategy for managing student loan debt. Tax implications can influence the overall impact of managing student loan debt and require careful consideration. During career transitions, maintaining a proactive approach to managing student loan debt can help mitigate financial risks. Graduate students must understand how managing student loan debt affects their financial future and borrowing capacity. Scholarships and fellowships can contribute to a strategy for managing student loan debt, minimizing overall borrowing needs. Every borrower’s journey includes unique challenges in managing student loan debt, making personalized strategies essential.

Income-driven repayment plans offer federal borrowers the flexibility to align monthly payments with their earning capacity, but each plan carries distinct long-term cost implications that require careful analysis. The four primary options – Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) – calculate payments differently and offer varying forgiveness timelines. REPAYE, for example, caps payments at 10% of discretionary income for undergraduate loans but extends to 25 years before forgiveness, while PAYE offers the same payment calculation but forgives remaining debt after 20 years for undergraduate borrowers.

The true cost calculation for extended repayment periods reveals a complex tradeoff between monthly affordability and total interest paid over the loan’s lifetime. A borrower with $50,000 in federal loans at 6.53% interest would pay approximately $555 monthly under the standard 10-year plan, totaling $66,600 in payments. The same borrower on an income-driven plan might pay $200-300 monthly initially, but could end up paying $80,000-100,000 over 20-25 years due to extended repayment periods and interest capitalization. This analysis becomes more nuanced when factoring in potential loan forgiveness, career progression that increases income over time, and the opportunity cost of higher monthly payments.

Understanding the relationship between managing student loan debt and credit scores is vital for future financial planning.

“Graduate school is not something you take lightly. It is born out of passion. It is born out of need. It is born out of wanting to contribute to the public good.”

Investing in financial education can significantly enhance your ability to manage student loan debt effectively. Overall awareness of financial priorities is essential for managing student loan debt while saving for future goals. Comprehensive management of student loan debt is essential for high-achieving graduates seeking financial stability.

Loan consolidation through the federal Direct Consolidation program allows borrowers to combine multiple federal loans into a single new loan with a weighted average interest rate. This strategy can simplify repayment by creating one monthly payment and may make certain loans eligible for forgiveness programs they previously couldn’t access. However, consolidation resets the clock on forgiveness programs, meaning borrowers who have already made qualifying payments toward PSLF would lose that progress. The timing of consolidation becomes crucial for borrowers balancing simplification benefits against forgiveness program eligibility. Ultimately, balancing accessibility to resources while managing student loan debt is key to long-term success.

Refinancing federal loans into private loans represents a permanent decision that eliminates access to federal protections in exchange for potentially lower interest rates. Private refinancing makes sense for high-income borrowers with excellent credit who can secure rates significantly below their current federal loan rates and who don’t anticipate needing income-driven repayment options or forgiveness programs. The decision requires evaluating your career stability, income trajectory, and risk tolerance, as refinanced loans cannot be converted back to federal status. With a solid understanding of their options, borrowers can approach managing student loan debt with confidence and clarity.

Maximizing Forgiveness and Assistance Programs

Public Service Loan Forgiveness represents the most substantial debt relief opportunity for qualifying borrowers, but success requires meticulous attention to employment verification, payment counting, and loan type requirements. PSLF forgives the remaining balance on Direct Loans after 120 qualifying payments while working full-time for qualifying employers, including government organizations, 501(c)(3) nonprofits, and other organizations providing qualifying public services. The program’s complexity lies in its specific requirements: only payments made on Direct Loans under income-driven repayment plans while employed by qualifying employers count toward the 120-payment requirement.

Employment certification represents a critical but often overlooked aspect of PSLF success. Borrowers should submit Employment Certification Forms annually and whenever changing employers to ensure their employment qualifies and their payments are being counted correctly. The Department of Education’s PSLF servicer, MOHELA, maintains records of qualifying payments, but borrowers bear responsibility for ensuring accurate tracking. Documentation requirements extend beyond simple employment verification to include proof of full-time status, which typically means working at least 30 hours per week or meeting the employer’s definition of full-time, whichever is greater.

Employer-sponsored loan repayment benefits have expanded significantly in recent years, with many companies offering monthly contributions toward employee student loan balances as a recruitment and retention tool. These benefits typically range from $100-500 monthly and may be structured as direct payments to loan servicers or as taxable income additions that employees can use for loan repayment. Alex Ricci, vice president of government affairs and communications at the Education Finance Council, notes the variety of available options: “Many (grad students) may use personal savings they have earned between undergraduate and graduate studies, so that’s always an option. Other options include scholarships, fellowships and assistantships, which are usually merit-based.”

State-specific loan forgiveness programs offer targeted relief for professionals in high-need fields or underserved geographic areas. These programs typically require service commitments of 2-5 years in exchange for partial or complete loan forgiveness. Healthcare professionals, teachers, lawyers working in public interest, and other essential service providers may qualify for multiple programs simultaneously, creating opportunities to layer benefits for maximum debt relief. However, these programs often have limited funding and competitive application processes, requiring early career planning to maximize eligibility.

Tax implications of loan forgiveness vary significantly depending on the program and timing of forgiveness. PSLF forgiveness is not considered taxable income, making it particularly valuable for borrowers with large loan balances. However, forgiveness under income-driven repayment plans typically generates taxable income equal to the forgiven amount, creating potential tax liabilities that borrowers should plan for throughout their repayment period. Some borrowers may owe thousands of dollars in taxes on forgiven debt, requiring advance planning and savings to manage this obligation.

Managing Debt During Career Transitions

Existing undergraduate debt significantly impacts graduate school financing options and requires strategic planning to avoid overwhelming debt burdens. Graduate students face higher borrowing costs through the Grad PLUS program once they exhaust standard federal loan limits, with interest rates reaching 8.08% compared to 6.53% for undergraduate loans. This rate differential compounds over time, making graduate school financing particularly expensive for students who have already borrowed substantial amounts for undergraduate education.

The mechanics of in-school deferment create both opportunities and risks for borrowers pursuing graduate education. While subsidized undergraduate loans don’t accrue interest during deferment, unsubsidized loans and any new graduate loans continue accumulating interest throughout the program. Ashley Herndon, a graduate personnel and finance coordinator at the University of Oklahoma Graduate College, experienced this challenge firsthand: “The (undergraduate) student loan debt I incurred was more because I went out of state, even if I had some tuition help. It was this dark cloud looming over me after I graduated college.” Her experience illustrates how undergraduate debt can create psychological and financial pressure that influences graduate school decisions.

Alternative funding strategies can significantly reduce reliance on loans during graduate studies. Assistantships, fellowships, and work-study positions provide both income and valuable professional experience while minimizing additional borrowing. Employer tuition assistance programs offer another avenue, particularly for working professionals pursuing graduate degrees part-time. Herndon leveraged her university’s staff tuition waiver program, which covers half her tuition for up to six credits per semester: “The waiver covers half her tuition for up to six credits a semester. The rest is paid through federal student loans.”

Career transition planning requires careful consideration of how changing employment affects loan repayment capacity and program eligibility. Borrowers on income-driven repayment plans must recertify their income annually, and significant income changes can dramatically alter monthly payment amounts. Career changes that involve temporary income reduction, such as transitioning from private sector to public service work, require advance planning to ensure continued affordability of loan payments while maintaining eligibility for forgiveness programs.

The intersection of multiple loan types during graduate school creates complex repayment scenarios that require ongoing management. Borrowers may simultaneously hold subsidized and unsubsidized undergraduate loans, graduate unsubsidized loans, and Grad PLUS loans, each with different interest rates and terms. When deferment ends, these loans may be consolidated or managed separately, depending on the borrower’s strategy for repayment and forgiveness program participation.

Building Long-Term Financial Resilience

Student loan repayment must be balanced against other critical financial priorities, including emergency fund building, retirement savings, and major life goals like homeownership. The conventional wisdom of eliminating all debt before investing doesn’t always apply to student loans, particularly federal loans with relatively low interest rates and tax-deductible interest payments. Borrowers with federal loans at 4-6% interest rates may benefit more from contributing to employer 401(k) matches and building emergency funds rather than aggressively paying down debt.

The opportunity cost analysis of aggressive loan repayment versus investing requires consideration of multiple factors including loan interest rates, potential investment returns, tax implications, and personal risk tolerance. A borrower with $40,000 in federal loans at 5% interest who chooses to make minimum payments while investing an additional $200 monthly in diversified index funds may accumulate more wealth over 20 years than someone who uses that money for accelerated loan repayment. This calculation becomes more complex when factoring in the psychological benefits of debt elimination and the guaranteed return of avoided interest payments.

Credit score implications of student loan management extend far beyond the loans themselves, affecting future borrowing capacity for mortgages, auto loans, and other credit products. Consistent on-time student loan payments contribute positively to payment history, which represents 35% of your credit score calculation. However, high debt-to-income ratios from large student loan balances can impact mortgage qualification and other lending decisions. Strategic loan repayment that reduces debt-to-income ratios while maintaining positive payment history optimizes credit profiles for future borrowing needs.

The psychological aspects of debt management often receive insufficient attention despite their crucial role in long-term success. Large student loan balances can create feelings of overwhelm and hopelessness that lead to avoidance behaviors and missed opportunities for optimization. Breaking large debt amounts into smaller, manageable goals and celebrating progress milestones helps maintain motivation over extended repayment periods. Regular review and adjustment of repayment strategies ensures that your approach evolves with changing financial circumstances and life priorities.

Financial flexibility becomes increasingly important as borrowers navigate career changes, family formation, and other major life transitions. Maintaining some liquid savings while paying down student loans provides a buffer against unexpected expenses and income disruptions. This approach may result in slightly higher total interest payments but offers valuable protection against financial emergencies that could otherwise derail your debt management strategy. Building this flexibility requires ongoing evaluation of your debt management approach and willingness to adjust strategies as circumstances change.

Conclusion: Your Strategic Roadmap to Student Loan Success

The complexity of managing student loan debt extends far beyond monthly payments – it’s about creating a strategic framework that adapts to your evolving career and financial landscape. The distinction between federal and private loans determines your access to safety nets and forgiveness opportunities, while your repayment strategy affects everything from your credit profile to your ability to pursue major life goals. Understanding these interconnected elements empowers you to make informed decisions that can save thousands in interest while maintaining the flexibility to navigate career transitions and unexpected challenges.

Your approach to managing student loan debt in those crucial first months of repayment sets the trajectory for years to come. Whether you’re optimizing for loan forgiveness through public service, balancing aggressive repayment with wealth building, or navigating the complexities of graduate school financing, success requires ongoing attention and strategic adjustment. The borrowers who thrive aren’t necessarily those with the lowest balances – they’re the ones who understand their options, stay engaged with their repayment strategy, and recognize that effective managing student loan debt is ultimately about creating financial freedom rather than simply eliminating debt.