A single late payment can drop your credit score by 60 to 110 points, but here’s what most people don’t realize: the real damage often happens before that payment even shows up on your credit report. While you’re focused on catching up on bills, hidden consequences are already working against you – from interest rate penalties that compound your debt to account reviews that can trigger closures on your other credit lines. Understanding how late payments impact credit is crucial to managing your financial health. Furthermore, understanding how late payments impact credit can help you develop better financial habits.

The path to recovery isn’t just about making payments on time going forward. Your credit score might bounce back within months, but will lenders actually approve you for that mortgage or car loan? The timeline for real credit opportunities often extends far beyond what scoring models suggest. Understanding which late payments to tackle first, how to communicate with creditors effectively, and when to time your next major credit application can mean the difference between a quick recovery and years of limited financial options. Knowing how late payments impact credit can help you navigate recovery strategies more effectively and ensure you don’t repeat past mistakes.

The 30-Day Rule: Why Most Late Payments Don’t Immediately Appear on Credit Reports

It is essential to remember that late payments impact credit not just in the short term, but can have long-lasting effects on your overall financial health. This makes it imperative to stay on top of your payment schedules. Moreover, consumer awareness about how late payments impact credit can empower individuals to take proactive measures before their situations escalate into delinquencies. Financial education about how late payments impact credit is essential for consumers to avoid potential pitfalls and safeguard their credit scores. Many don’t realize that understanding how late payments impact credit can also inform their decisions about seeking new credit lines responsibly. Therefore, knowing how late payments impact credit can guide you in prioritizing your financial obligations effectively. Understanding the severe ramifications on credit scores is vital, as late payments impact credit scores disproportionately based on prior credit history.

Being cognizant of how late payments impact credit could save consumers from incurring high-interest rates and additional fees. In conclusion, knowing how late payments impact credit is essential for anyone aiming to maintain a healthy financial status. Ultimately, a thorough understanding of how late payments impact credit will equip consumers to avoid unnecessary pitfalls. Continued education on how late payments impact credit can empower individuals to manage their finances better. Finally, recognizing how late payments impact credit is crucial for developing sound financial strategies moving forward. A proactive approach to understanding how late payments impact credit can lead to improved financial stability. Therefore, focusing on how late payments impact credit can significantly influence one’s financial future.

The 30-day threshold represents a critical buffer zone that most consumers don’t fully understand or leverage effectively. While creditors typically wait until payments reach 30 days past due before reporting to credit bureaus, this grace period creates strategic opportunities for damage control that extend far beyond simply avoiding immediate credit score drops. The reporting timeline varies significantly across creditor types, with credit card companies often adhering strictly to the 30-day standard while utility companies and landlords may report earlier or follow entirely different protocols.

Understanding these reporting nuances becomes crucial when managing multiple late payments simultaneously. Credit card issuers generally maintain consistent 30-day reporting schedules, but they may implement internal penalties immediately after your due date passes. These penalties include late fees, interest rate increases, and account status changes that affect your relationship with the creditor even before credit bureau reporting occurs. Auto lenders and mortgage servicers typically follow similar 30-day patterns, though they may have different internal escalation procedures that trigger account reviews or modification considerations.

The strategic advantage of the pre-30-day window lies in your ability to negotiate from a position where credit damage hasn’t yet occurred. During this period, you maintain leverage with creditors who prefer to resolve delinquencies internally rather than report them to credit bureaus. Successful navigation of this window requires immediate action and clear communication about your payment intentions, as creditors often show more flexibility when approached proactively rather than reactively.

How Late Payment Severity Compounds Over Time

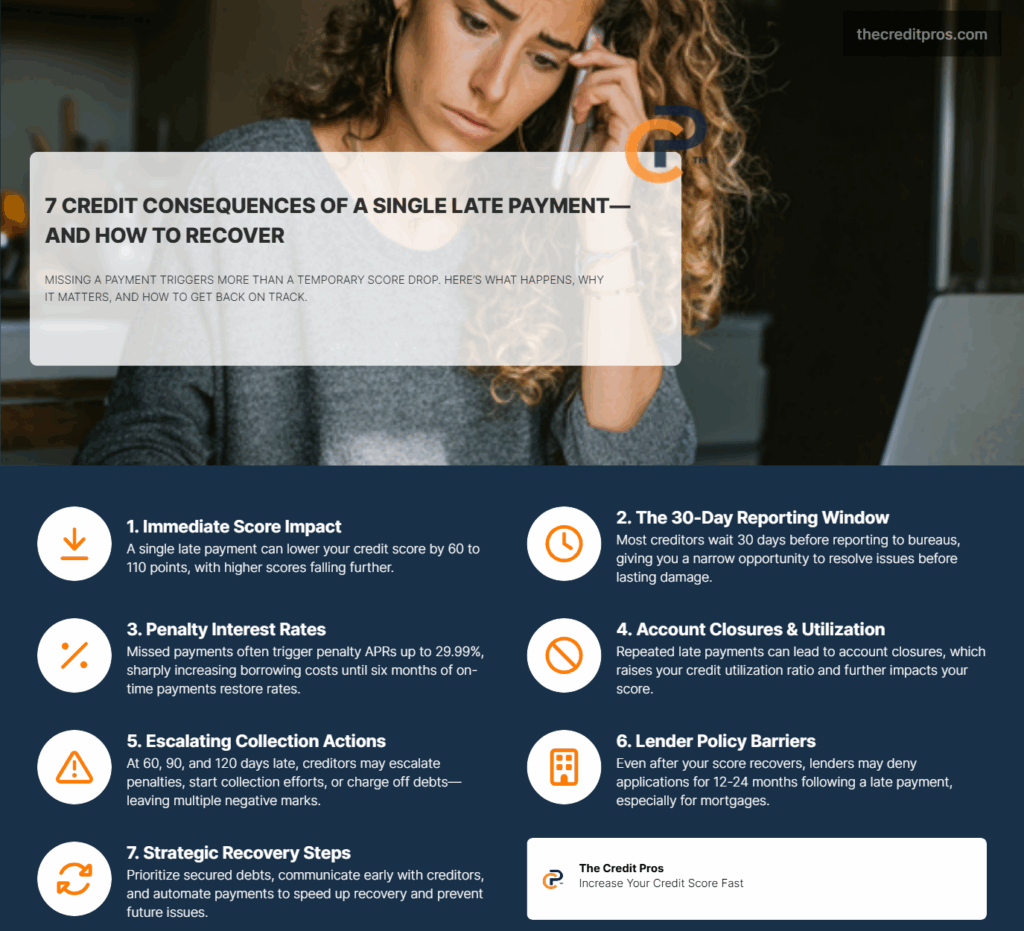

Payment delinquencies follow a progressive damage model that intensifies at each milestone, creating exponential rather than linear credit deterioration. The initial 30-day mark triggers the first credit bureau reporting, typically resulting in a score drop ranging from 60 to 110 points depending on your baseline credit profile. Higher credit scores experience more dramatic declines because payment history represents 35% of FICO scoring models and 40% of VantageScore calculations, making previously pristine payment records more vulnerable to significant disruption.

The 60-day threshold marks a critical escalation point where creditors often implement additional penalties beyond standard late fees. Interest rates may increase to penalty levels, sometimes reaching 29.99% APR, while account privileges such as balance transfer options or credit line increases become suspended. At 90 days past due, many creditors initiate more aggressive collection efforts and begin documenting accounts for potential charge-off consideration, creating internal flags that affect future credit decisions even after the delinquency resolves.

Equipped with knowledge about how late payments impact credit, consumers can make informed choices regarding their debts. Ultimately, understanding how late payments impact credit will alleviate anxiety surrounding credit management. It’s imperative that individuals recognize how late payments impact credit to safeguard their financial stability. Above all, an awareness of how late payments impact credit should drive responsible financial behavior. Knowing how late payments impact credit can help individuals avoid pitfalls that could hinder financial progress.

Finally, recognizing how late payments impact credit will empower consumers to be proactive in managing their finances. In summary, understanding how late payments impact credit is essential for achieving financial well-being. As we navigate the complexities of credit management, let us never forget how late payments impact credit. Ultimately, how late payments impact credit remains a key consideration for consumers looking to maintain strong financial health. Understanding the implications of how late payments impact credit will enhance consumers’ ability to manage their finances effectively. In conclusion, being aware of how late payments impact credit will help individuals make informed financial decisions.

Finally, understanding how late payments impact credit will ensure consumers are equipped to navigate their financial futures. Ultimately, how late payments impact credit is a vital topic for anyone invested in their financial health. The 120-day mark represents the “charge-off cliff” where most unsecured debts transition from delinquent to charged-off status. This transition creates lasting credit damage that extends beyond the immediate score impact, as charged-off accounts signal to future creditors that you’ve previously defaulted on financial obligations. The compounding effect becomes particularly severe when multiple accounts reach advanced delinquency stages simultaneously, as scoring algorithms interpret this pattern as systematic financial distress rather than isolated payment difficulties.

Hidden Consequences Beyond Credit Score Drops

Late payments trigger cascading financial consequences that extend far beyond visible credit score reductions. Interest rate penalties activate immediately upon missed payments, often increasing your APR to penalty rates that can double or triple your borrowing costs. These penalty rates typically remain in effect for six months of consecutive on-time payments, creating long-term financial strain that compounds the original payment difficulty. The mathematical impact becomes particularly severe on high-balance accounts where penalty rates can add hundreds of dollars in monthly interest charges.

Account closure triggers represent another hidden consequence that many consumers discover too late. Creditors may close accounts after repeated late payments, even if the account eventually becomes current. This closure immediately affects your credit utilization ratios by reducing available credit limits while maintaining existing balances, potentially pushing utilization percentages into damaging territory. The timing of account closures often correlates with credit limit reviews across your entire credit profile, as creditors share information about payment patterns through industry databases.

The collections pipeline acceleration creates additional layers of credit deterioration that operate independently of your original creditor relationship. Once accounts enter collections, typically after 120-180 days of delinquency, collection agencies may report separate tradelines to credit bureaus while the original creditor maintains their charge-off reporting. This dual reporting creates multiple negative entries for a single debt, amplifying credit score damage and extending recovery timelines significantly beyond the original delinquency period.

Universal default clauses in credit agreements enable creditors to review and modify terms based on payment performance with other creditors, creating these potential consequences:

- Interest rate increases on accounts that were never late

- Credit limit reductions across multiple products with the same issuer

- Suspension of promotional rates or reward program benefits

- Acceleration of payment terms on installment loans

- Termination of pre-approved credit offers and marketing relationships

Strategic Recovery Tactics: Immediate Damage Control and Long-Term Rehabilitation

Effective recovery requires prioritizing late payments based on their potential for ongoing damage rather than simply addressing them chronologically. Mortgage and auto loan delinquencies typically warrant immediate attention due to their secured nature and foreclosure or repossession risks, while credit card late payments may offer more negotiation flexibility despite their credit score impact. The prioritization strategy should also consider account relationships, as creditors holding multiple products often link payment performance across all accounts through cross-default provisions.

Goodwill letter effectiveness depends heavily on timing, relationship history, and communication approach. The optimal timing for goodwill requests occurs after establishing 3-6 months of consistent on-time payments, demonstrating renewed financial stability rather than requesting forgiveness during ongoing payment difficulties. Your letter should acknowledge responsibility while providing specific context about the circumstances that led to late payments, avoiding generic explanations that creditors receive repeatedly. Documentation of hardship circumstances, such as medical bills or employment disruption, strengthens goodwill requests when accompanied by evidence of resolution.

Building redundant payment systems prevents future late payments while maintaining cash flow flexibility for irregular income patterns. Automated payment scheduling should include buffer periods that account for weekend and holiday processing delays, with backup funding sources designated for months when primary accounts experience insufficient funds. The redundancy extends beyond automation to include manual oversight systems that verify payment processing and provide early warning for potential payment failures before they reach critical deadlines.

Hardship program navigation requires understanding each creditor’s specific qualification criteria and documentation requirements. Most programs require formal application processes that include income verification, expense documentation, and hardship explanation letters. The strategic timing of hardship program enrollment can prevent late payment reporting while providing temporary payment relief, but programs often include restrictions on account usage and credit line access that may limit financial flexibility during recovery periods.

Timeline Expectations: The Reality of Credit Recovery After Late Payments

Credit score recovery follows predictable patterns that vary based on payment recency, frequency, and your overall credit profile composition. Single late payments on otherwise strong credit profiles typically show measurable improvement within 3-4 months of resumed on-time payments, with substantial recovery occurring within 12-18 months as the late payment ages. However, multiple late payments or late payments combined with other negative factors can extend meaningful recovery to 24-36 months, particularly when delinquencies reach 90+ day severity levels.

The seven-year reporting period creates a declining impact curve where late payment influence diminishes progressively over time. Recent late payments carry maximum weight in scoring algorithms, while late payments older than two years contribute minimal negative impact to most credit scores. This aging process accelerates recovery for consumers who maintain perfect payment patterns following their delinquencies, as positive payment history accumulates to offset historical negative marks.

Recovery expectations must distinguish between credit score improvement and actual credit opportunity restoration. Lenders often maintain internal policies that extend beyond credit score thresholds, potentially declining applications from consumers with recent late payments regardless of current score levels. Prime lending opportunities typically require 12-24 months of clean payment history following late payments, while subprime lenders may approve applications with more recent delinquencies at higher interest rates and more restrictive terms.

The strategic timing for major credit applications during recovery requires balancing score improvement with lender-specific policies regarding recent late payments. Mortgage applications generally require longer clean payment histories than auto loans or credit cards, with conventional loans often requiring 12 months of on-time payments following any late payment reporting. Credit card applications may approve with shorter clean payment periods but often at reduced credit limits or higher interest rates until payment patterns demonstrate sustained improvement.

Conclusion: Mastering Credit Recovery Through Strategic Action

Late payment recovery isn’t just about waiting for time to heal your credit wounds – it’s about understanding the complex web of consequences that extend far beyond your credit score. The hidden penalties, account reviews, and lender policies that activate immediately after missed payments create challenges that persist long after your score rebounds. Your path forward requires strategic prioritization of which debts to address first, proactive communication with creditors during that crucial 30-day window, and building systems that prevent future delinquencies while you rebuild trust with lenders.

The timeline for real credit opportunities often stretches years beyond what scoring models suggest, but armed with the right knowledge, you can navigate this recovery more effectively. Understanding that your credit score recovery and actual lending approval are separate processes allows you to set realistic expectations and make informed decisions about when to pursue major credit applications. The question isn’t whether you’ll recover from late payments – it’s whether you’ll recover strategically or spend years wondering why your improved credit score still isn’t opening the doors you expected.