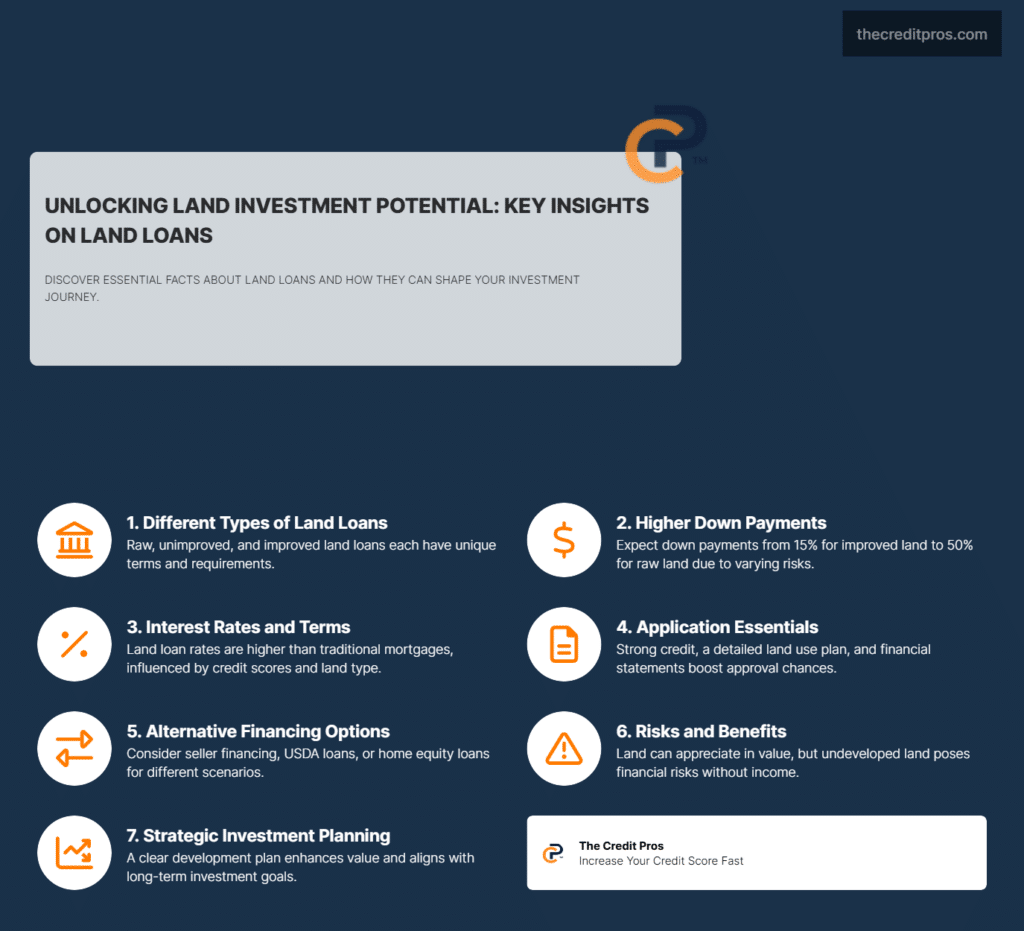

Understanding land loans can unlock opportunities for those looking to invest in property. These loans have their own set of rules and complexities, making it crucial to grasp how they differ from traditional home loans. Land loans are unique and might require more upfront investment. Knowing the ins and outs can help you make informed decisions and potentially secure a valuable asset.

In this guide, we’ll explore the different types of land loans—raw, unimproved, and improved—and what each entails. You’ll learn about the application process, including what lenders look for and how to improve your approval chances. We’ll also touch on alternative financing options and the financial benefits and risks involved. Whether you’re eyeing a piece of rural land or a plot in a bustling area, understanding these aspects can empower you to take the next steps confidently. Let’s explore the potential of land loans together.

Understanding Types of Land Loans

When exploring land loans, it’s important to recognize the distinctions between the various types available. These loans cater to different stages of land development and carry unique terms and requirements.

Raw Land Loans: These loans are tailored for undeveloped parcels with no infrastructure, such as utilities, roads, or buildings. Due to the speculative nature of these investments, lenders typically require higher down payments, often ranging from 30% to 50%, and higher interest rates compared to traditional mortgages. The significant risk associated with raw land loans stems from the absence of immediate income generation potential. Borrowers must present a compelling development plan and demonstrate strong creditworthiness to secure such loans. For more details, you can refer to Investopedia’s article on land loans.

Unimproved Land Loans: These loans are for properties that may have some basic improvements, like access roads, but still lack essential utilities or infrastructure. Unimproved land loans generally offer slightly more favorable terms. The down payment requirement typically falls between 20% and 30%, reflecting the reduced risk compared to raw land. Borrowers should be prepared to provide detailed plans for future improvements and development, as lenders assess the potential for value appreciation and income generation. For more information, visit Investopedia’s financial product reviews.

Improved Land Loans: Improved land loans are designed for parcels that are ready for immediate development, with utilities and infrastructure already in place. These loans are considered less risky by lenders, resulting in terms that closely resemble traditional mortgages. Down payments range from 15% to 25%, with interest rates typically lower than those for raw or unimproved land loans. The presence of infrastructure reduces the lender’s risk, making these loans more accessible to borrowers with standard credit requirements. Further insights can be found at Investopedia’s real estate investing section.

Navigating the Land Loan Application Process

Securing a land loan requires a thorough understanding of the application process and the expectations set by lenders. Becoming familiar with these requirements can significantly enhance your chances of approval.

Key Requirements: Lenders assess several factors when evaluating land loan applications. A strong credit score, generally 700 or higher, is crucial for demonstrating your financial reliability. Down payments vary based on the type of land loan, with raw land loans demanding higher percentages due to their speculative nature. Additionally, borrowers must provide comprehensive documentation, including a detailed land use plan, zoning information, and financial statements.

Lender Perspectives: Lenders approach land loans with caution due to the inherent risks associated with undeveloped properties. They prioritize a well-outlined land use plan, as it provides insight into the potential for value appreciation and income generation. Lenders also assess the land’s location, accessibility, and proximity to essential services, which can influence their perception of risk. Demonstrating a clear plan for development and a strong financial standing can help improve approval chances.

Overcoming Common Hurdles: To enhance approval odds, consider selecting land with existing utilities and infrastructure, as this reduces perceived risks for lenders. Additionally, improving your credit score through responsible financial practices can strengthen your application. If necessary, consider enlisting a co-signer to bolster your creditworthiness. Preparing a thorough land use plan that outlines your intentions and potential for development is essential for gaining lender confidence.

Financial Implications and Benefits of Land Loans

Understanding the financial aspects of land loans is vital for making informed decisions and maximizing the benefits of your investment.

Interest Rates and Terms: Land loan interest rates are generally higher than those for traditional mortgages due to the increased risk associated with undeveloped properties. However, these rates can vary based on factors such as the type of land loan, your credit score, and the lender’s assessment of risk. Loan terms may also differ, with raw land loans typically offering shorter durations compared to improved land loans. It’s crucial to compare offers from multiple lenders to secure the most favorable terms. For more insights, you can explore Investopedia’s section on mortgages.

Potential Benefits: Investing in land can offer long-term financial benefits, including the potential for appreciation and income generation through development. Additionally, owning land provides an opportunity to leverage equity for future investments or construction projects. By strategically planning your land use and development, you can enhance the value of your investment over time.

Risks Involved: While land loans present attractive opportunities, they also come with inherent risks. The absence of immediate income generation from undeveloped land can strain your finances if not managed carefully. Market fluctuations and changes in zoning regulations can impact the value and usability of your property. To mitigate these risks, conduct thorough research, maintain a strong financial position, and develop a clear plan for development.

Alternative Financing Options for Land Purchases

For those exploring alternative avenues for financing land purchases, several options exist beyond traditional land loans.

Seller Financing: In cases where traditional lending may be challenging, seller financing can offer a viable alternative. This arrangement involves the seller acting as the lender, allowing for potentially more flexible terms. While this option can provide favorable conditions, it’s essential to have a legal professional review the agreement to protect both parties’ interests.

USDA Loans: For individuals considering rural land purchases, USDA loans provide attractive benefits, including low or no down payment requirements. To qualify, the property must be located in an eligible rural area, and the borrower must meet specific income criteria. USDA loans offer competitive rates and terms, making them a valuable option for those looking to invest in rural land.

Home Equity Loans: If you own an existing property with substantial equity, leveraging a home equity loan can be a cost-effective way to finance a land purchase. This option typically offers lower interest rates and favorable terms compared to traditional land loans. However, it’s crucial to assess your financial situation carefully, as using your home as collateral carries inherent risks.

Wrapping It Up: Navigating the Terrain of Land Loans

Understanding land loans opens doors to real estate opportunities that can shape your financial future. From raw to improved land loans, each type presents its own set of challenges and benefits, requiring a strategic approach to secure favorable terms. Grasping the intricacies of the application process, knowing what lenders prioritize, and exploring alternative financing options are all crucial steps in this journey.

The financial implications of land loans can be significant, offering potential rewards through appreciation and development but also carrying risks that require careful management. By equipping yourself with knowledge and preparing a solid plan, you position yourself to make informed decisions that align with your investment goals. Remember, the land you invest in today could be the foundation of your wealth tomorrow. Are you ready to seize the opportunity and transform a piece of earth into a basis for your financial success?